Revised Proxy Soliciting Materials (definitive) (defr14a)

June 18 2020 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x

|

|

|

|

Filed by a Party other than the Registrant o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

Broadway Financial Corporation

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

Broadway Financial Corporation

Supplement, dated June 15, 2020, to Proxy Statement for Annual Stockholders Meeting to be Held on June 24, 2020

Broadway Financial Corporation (the “Company”) has made available to its stockholders the definitive proxy statement of the Company’s board of directors for the Annual Meeting of Stockholders that will be held at 2 p.m. on June 24, 2020. The proxy statement contains information concerning the persons nominated by the Company’s board of directors for election to the board of directors, the other proposals to be presented for consideration and approval by stockholders and other important information relating to the Annual Meeting.

The definitive proxy statement was filed with the Securities and Exchange Commission (“SEC”), and first made available to stockholders, on May 20, 2020. On June 9, 2020, Commerce Home Mortgage, LLC (“Commerce”) filed a preliminary proxy statement with the SEC stating that Commerce and certain related entities and persons propose to nominate a candidate for election to the Company’s board of directors in opposition to the two existing directors nominated for reelection by the board of directors, to solicit stockholders to vote for the election of that candidate, to withhold votes for the two candidates proposed by the board of directors, and to vote against the proposal to approve the compensation of the Company’s executive officers on an advisory basis that is described in the Company’s proxy statement.

As acknowledged by Commerce and other persons and entities in their preliminary proxy statement, the Company’s bylaws provide that stockholder nominations for elections of persons to the board of directors may only be made by persons who were stockholders of record as of the record date for, and are entitled to vote at, the Annual Meeting. The Company has informed Commerce, most recently by letter dated June 15, 2020, that, according to the Company’s transfer agent, Commerce was not a stockholder of record of the Company as of the record date for the Annual Meeting. Accordingly, the Company has further informed Commerce that it is not eligible to nominate a person for election to the board of directors of the Company at the Annual Meeting and that any such purported nomination by Commerce at the Annual Meeting will not be accepted.

The other persons and entities who are identified as joining in Commerce’s preliminary proxy statement and participating in its solicitation are: The Capital Corps, LLC; TCC Manager, LLC; Sugarman Enterprises, Inc.; Steven A. Sugarman; Carlos Salas; and Antonio Villaraigosa. Descriptions of the relationships among such persons and entities, and other information concerning them and their proposed solicitation, are presented in their preliminary proxy statement. The Company has no responsibility for the accuracy or completeness of such descriptions and information.

2

IMPORTANT NOTE: The Annual Meeting will be conducted solely online by live webcast. You will be entitled to participate in the Annual Meeting only if you were a stockholder of record as of May 1, 2020, or if you hold a valid legal proxy for the Annual Meeting received from a stockholder of record on that date. Instructions for voting and for participating in the Annual Meeting are included in the Company’s proxy statement. Those voting instructions are not applicable to voting for the candidate Commerce has stated an intention to nominate for election at the Annual Meeting. The Company will not be responsible for the effectiveness of any internet, telephonic or other voting procedures described by Commerce in its preliminary proxy statement or any subsequent proxy statement or other communication.

Additional Important Information

The Company and the members of its board of directors are “participants” in the Company’s solicitation of proxies for the Annual Meeting as defined in the proxy rules of the SEC. Mr. Paul V. Hughes, who is a financial advisor to the Company, may also be deemed to be a participant in such solicitation. Mr. Hughes and his spouse are joint beneficial owners of 42,198 shares of the Company’s voting common stock. None of such persons has (1) any interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted upon at the Annual Meeting, other than the interest of the two existing directors who have been nominated for reelection to the board, (2) purchased or sold shares of the Company’s common stock during the past two years, or (3) any arrangement or understanding with any person with respect to any future employment with Broadway or any of its affiliates or with respect to any future transactions to which Broadway or any of its affiliates will be a party. The business address of each of such persons is c/o Broadway Financial Corporation, 5055 Wilshire Boulevard, Suite 500, Los Angeles, CA 90036. Additional information regarding the directors required pursuant the SEC proxy rules is set forth in the Company’s proxy statement under the captions “Security Ownership of Certain Beneficial Owners and Management,” “Proposal 1 Election of Directors — Information Concerning Nominees and Directors,” and “Certain Relations and Related Transactions.”

Mr. Hughes is an independent contractor who provides financial consulting services to the Company, including preparation of investor relations materials and assistance in the preparation of periodic and other filings with the SEC and bank regulatory authorities. Mr. Hughes has assisted the Company in contacting stockholders to solicit proxies from them for use in connection with the Annual Meeting. Mr. Hughes will not receive any compensation for such assistance.

The Company will bear the cost of the solicitation of proxies by the board of directors for use at the Annual Meeting. The Company estimates that such costs will aggregate approximately $65,000, of which approximately $50,000 has been incurred to date.

Based on the intention stated by Commerce in its preliminary proxy statement to conduct a proxy solicitation in opposition to that of the Company’s board of directors, the Company anticipates that the New York Stock Exchange may determine pursuant to the rules applicable to its member firms that none of the proposals described in the Company’s proxy statement may be considered a “routine” matter on which brokers have discretionary authority to vote shares they hold in a nominee capacity without instruction from the beneficial owners thereof. In that event, broker non-votes received may not be counted for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting.

3

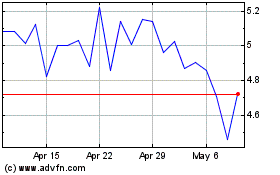

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

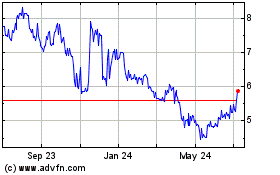

Broadway Financial (NASDAQ:BYFC)

Historical Stock Chart

From Apr 2023 to Apr 2024