BioXcel Therapeutics, Inc. (“BTI” or “Company”) (Nasdaq: BTAI), a

clinical-stage biopharmaceutical company utilizing artificial

intelligence to identify improved therapies in neuroscience and

immuno-oncology, today announced its quarterly results for the

fourth quarter and full year ended December 31, 2019 and provided

an update on key strategic and operational initiatives.

“2019 has been a tremendous year for BTI. We have made

significant growth in our two programs – BXCL501 and BXCL701 –

laying the groundwork to achieve key milestones in the coming

years,” stated Vimal Mehta, Chief Executive Officer of

BTAI. “In neuroscience, we have made momentous advancements in

the clinical development of BXCL501 and look forward to announcing

topline results from our SERENITY program and our Phase 1b/2

TRANQUILITY trial in dementia-related agitation in mid-2020.

Additionally, we have been dedicated to expanding the potential

therapeutic use of BXCL501, announcing a fourth indication last

month as well as examining biomarkers that may have relevance for a

range of hyperarousal disorders. We believe these therapeutic

opportunities, along with our plans to investigate BXCL501 for the

treatment of all types of agitation, are crucial steps to building

out a leading neuroscience franchise.”

Dr. Mehta added, “In addition to our ongoing studies with

BXCL701 in prostate and pancreatic cancers, we are also evaluating

this immuno-oncology candidate, in combination with KEYTRUDA®, in

multiple advanced solid tumors with the goal of improving treatment

responses to this PD-1 inhibitor. We believe this basket trial, led

by researchers at MD Anderson, will help to accelerate the

evaluation of BXCL701 and help to explore its full potential.”

Fourth Quarter 2019 and Recent Highlights

BXCL501-Neuroscience Program BXCL501 is an

investigational sublingual thin film of dexmedetomidine, a

selective alpha-2A adrenergic receptor agonist, designed for the

treatment of acute agitation. The Company believes BXCL501 may

directly target a causal agitation mechanism.

- We initiated pivotal Phase 3 trials for the acute treatment of

agitation in patients with schizophrenia (SERENITY I) and bipolar

disorder (SERENITY II). Enrollment of patients is on track and

topline data readouts from both trials are expected mid-2020;

- In January, the first patient was enrolled in the TRANQUILITY

study, a Phase 1b/2 trial of BXCL501 for the acute treatment of

agitation associated with geriatric dementia, expanding potential

therapeutic use of BXCL501 beyond current neuropsychiatric

disorders. BTI expects to report data in mid-2020;

- We received clearance from the U.S. Food and Drug

Administration for an Investigational New Drug application for the

treatment of opioid withdrawal symptoms, a potential fourth

indication for BXCL501;

- A Phase 2 study designed to measure biomarkers associated with

agitation in patients with schizophrenia and their response to

treatment with BXCL501 was initiated by researchers at Yale

University earlier last month, with data expected in Q2 2020.

BXCL701-Immuno-Oncology

Program-BXCL701 is an orally-delivered small molecule,

innate immunity activator designed to inhibit dipeptidyl peptidase

(DPP) 8/9 and block immune evasion by targeting Fibroblast

Activation Protein (FAP). It has shown single agent activity in

melanoma and safety has been evaluated in more than 700 healthy

subjects and cancer patients.

- We advanced the clinical evaluation of BXCL701 via the

initiation of an open-label Phase 2 basket trial, which is being

conducted at MD Anderson. This study is evaluating the combination

of BXCL701 and Pembrolizumab (KEYTRUDA®) in patients with advanced

solid cancers;

- The Company recently presented additional safety and

tolerability data from the first and second patient cohorts of the

Phase 1b/2 trial of BXCL701 and KEYTRUDA® for tNEPC at the American

Society of Clinical Oncology Genitourinary Cancers Symposium (ASCO

GU). The trial is currently enrolling an expansion cohort to

explore the use of BID dosing. After the successful optimization of

BID dosing, the Company expects to advance to the efficacy stage of

the trial;

- The BXCL701 phase of the triple combination study of BXCL701,

bempegaldesleukin (NKTR-214, Nektar Therapeutics, Inc.) and

BAVENCIO® (avelumab, Merck KGaA, Darmstadt, Germany and Pfizer) in

pancreatic cancer is expected to be initiated following Nektar and

Pfizer’s safety run-in trial of a double combination of

bempegaldesleukin and avelumab and the outcome of that

trial.

Strengthened Balance Sheet

- In February 2020, the Company raised net proceeds of $60

million in connection with its common stock offering. We believe

that these proceeds, together with current reserves, provide BTI

cash runway to fund key clinical, regulatory and operational

milestones into 2021.

Fourth Quarter and Full Year 2019 Financial

Results

BTI reported a net loss of $8.3 million for the fourth quarter

of 2019, compared to a net loss of $7.1 million for the same period

in 2018. The fourth quarter 2019 results include approximately $0.7

million in non-cash stock based compensation.

Research and development expenses were $6.5 million for the

fourth quarter of 2019, as compared to $6.0 million for the same

period in 2018. The increase was primarily due to an increase in

professional research and related project costs, salary, and

related payroll costs, manufacturing costs offset in part by a

decrease in clinical trial expenses.

General and administrative expenses were $1.9 million for the

fourth quarter of 2019, as compared to $1.3 million for the same

period in 2018. The increase was primarily due to increases in

salary, and related payroll costs and professional fees.

BTI reported a net loss of $33.0 million for the full year 2019,

compared to a net loss of $19.3 million for the same period in

2018.

Research and development expenses were $25.8 million for full

year 2019, as compared to $14.6 million for the same period in

2018. The increase was primarily due to clinical trial costs,

salary and related payroll costs, professional research and project

costs and manufacturing costs.

General and administrative expenses were $7.8 million for full

year 2019, as compared to $5.4 million for the same period in 2018.

The increase was primarily due to salary and related payroll costs

and professional fees.

As of December 31, 2019, cash and cash equivalents totaled

approximately $32.4 million.

Please note that these numbers do not include our recent

financing, which secured $60 million in net proceeds.

Conference Call:BTI will host a conference call

and webcast today at 8:30 a.m. ET. To access the call, please dial

877-407-2985 (domestic) and 201-378-4915 (international). A live

webcast of the call will be available on the Investors sections of

the BTI website at www.bioxceltherapeutics.com. The replay will be

available through March 23, 2020.

About BioXcel Therapeutics,

Inc.:

BioXcel Therapeutics, Inc. is a clinical stage

biopharmaceutical company focused on drug development that utilizes

artificial intelligence to identify improved therapies in

neuroscience and immuno-oncology. BTI's drug re-innovation approach

leverages existing approved drugs and/or clinically evaluated

product candidates together with big data and proprietary machine

learning algorithms to identify new therapeutic indices. BTI's two

most advanced clinical development programs are BXCL501, an

investigational sublingual thin film formulation in development for

acute treatment of agitation resulting from neuropsychiatric

disorders, and BXCL701, an investigational orally administered

systemic innate immunity activator in development for treatment of

a rare form of prostate cancer and for treatment of pancreatic

cancer in combination with other immuno-oncology agents. For more

information, please visit www.bioxceltherapeutics.com.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements in this press

release include but are not limited to the timing and data from

clinical development initiatives and trials for BXCL501 and

BXCL701, the Company’s cash runway and the Company’s future growth

and position to execute on key milestones. When used herein, words

including “anticipate,” “being,” “will,” “plan,” “may,” “continue,”

and similar expressions are intended to identify forward-looking

statements. In addition, any statements or information that refer

to expectations, beliefs, plans, projections, objectives,

performance or other characterizations of future events or

circumstances, including any underlying assumptions, are

forward-looking. All forward-looking statements are based upon

BTI's current expectations and various assumptions. BTI believes

there is a reasonable basis for its expectations and beliefs, but

they are inherently uncertain.

BTI may not realize its expectations, and its

beliefs may not prove correct. Actual results could differ

materially from those described or implied by such forward-looking

statements as a result of various important factors, including,

without limitation, its limited operating history; its incurrence

of significant losses; its need for substantial additional funding

and ability to raise capital when needed; its limited experience in

drug discovery and drug development; its dependence on the success

and commercialization of BXCL501 and BXCL701 and other product

candidates; the failure of preliminary data from its clinical

studies to predict final study results; failure of its early

clinical studies or preclinical studies to predict future clinical

studies; its ability to receive regulatory approval for its product

candidates; its ability to enroll patients in its clinical trials;

undesirable side effects caused by BTI’s product candidates; its

approach to the discovery and development of product candidates

based on EvolverAI is novel and unproven; its exposure to patent

infringement lawsuits; its ability to comply with the extensive

regulations applicable to it; its ability to commercialize its

product candidates; and the other important factors discussed under

the caption “Risk Factors” in its Annual Report on Form 10-K for

the fiscal year ended December 31, 2019 as such factors may be

updated from time to time in its other filings with the SEC, which

are accessible on the SEC’s website at www.sec.gov.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While BTI may elect to update such

forward-looking statements at some point in the future, except as

required by law, it disclaims any obligation to do so, even if

subsequent events cause our views to change. These forward-looking

statements should not be relied upon as representing BTI’s views as

of any date subsequent to the date of this press release.

BIOXCEL THERAPEUTICS, INC.

BALANCE SHEETS

(amounts in thousands, except share and

per share data)

| |

|

|

|

|

|

| |

December 31, |

|

December 31, |

| |

2019 |

|

2018 |

| |

|

|

|

| ASSETS |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

32,426 |

|

|

$ |

42,565 |

|

|

Prepaid expenses and other current assets |

|

1,681 |

|

|

|

491 |

|

|

Due from Parent |

|

— |

|

|

|

115 |

|

|

Total current assets |

|

34,107 |

|

|

|

43,171 |

|

| Property and equipment,

net |

|

1,041 |

|

|

|

327 |

|

| Operating lease right-of-use

asset |

|

1,193 |

|

|

|

— |

|

| Other assets |

|

51 |

|

|

|

51 |

|

|

Total assets |

$ |

36,392 |

|

|

$ |

43,549 |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

4,953 |

|

|

$ |

1,604 |

|

|

Accrued expenses |

|

3,120 |

|

|

|

3,056 |

|

|

Due to Parent |

|

64 |

|

|

|

— |

|

|

Other current liabilities |

|

331 |

|

|

|

— |

|

|

Total current liabilities |

|

8,468 |

|

|

|

4,660 |

|

|

|

|

|

|

|

|

| Operating lease liability |

|

1,029 |

|

|

|

— |

|

|

|

|

|

|

|

|

| Total

liabilities |

|

9,497 |

|

|

|

4,660 |

|

| |

|

|

|

|

|

| Stockholders'

equity |

|

|

|

|

|

| Preferred stock, $0.001 par

value, 10,000,000 shares authorized; no shares issued or

outstanding |

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value, 50,000,000 shares authorized; 18,087,382 and 15,663,221

shares issued and outstanding as of December 31, 2019 and

December 31, 2018, respectively |

|

18 |

|

|

|

16 |

|

| Additional

paid-in-capital |

|

83,565 |

|

|

|

62,593 |

|

| Accumulated deficit |

|

(56,688 |

) |

|

|

(23,720 |

) |

| Total stockholders'

equity |

|

26,895 |

|

|

|

38,889 |

|

| Total liabilities and

stockholders' equity |

$ |

36,392 |

|

|

$ |

43,549 |

|

BIOXCEL THERAPEUTICS, INC.

STATEMENTS OF OPERATIONS

(amounts in thousands, except share and

per share data)

| |

|

|

|

|

|

| |

2019 |

|

2018 |

|

Revenues |

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

| Operating costs and

expenses |

|

|

|

|

|

|

Research and development |

|

25,797 |

|

|

|

14,558 |

|

|

General and administrative |

|

7,804 |

|

|

|

5,404 |

|

|

Total operating expenses |

|

33,601 |

|

|

|

19,962 |

|

| Loss from operations |

|

(33,601 |

) |

|

|

(19,962 |

) |

| Other income |

|

|

|

|

|

|

Dividend and interest income, net |

|

633 |

|

|

|

692 |

|

| Net loss |

$ |

(32,968 |

) |

|

$ |

(19,270 |

) |

| |

|

|

|

|

|

| Net loss per share

attributable to common stockholders/ Parent basic and diluted |

$ |

(2.02 |

) |

|

$ |

(1.32 |

) |

| |

|

|

|

|

|

| Weighted average shares

outstanding - basic and diluted |

|

16,289,175 |

|

|

|

14,571,553 |

|

BIOXCEL THERAPEUTICS, INC.

STATEMENTS OF CHANGES IN STOCKHOLDERS’

EQUITY (DEFICIT)

(amounts in thousands, except share and

per share data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

| |

|

Common Stock |

|

Paid in |

|

Accumulated |

|

|

|

| |

|

Shares |

|

Amount |

|

Capital |

|

Deficit |

|

Total |

|

Balance as of January 1, 2018 |

|

9,907,548 |

|

$ |

10 |

|

$ |

3,458 |

|

$ |

(4,450 |

) |

|

$ |

(982 |

) |

|

Issuance of common stock |

|

283,452 |

|

|

1 |

|

|

1,949 |

|

|

— |

|

|

|

1,950 |

|

|

Issuance of common stock, upon completion of Initial Public

Offering, net of issuance costs of $5,898 |

|

5,454,545 |

|

|

5 |

|

|

54,097 |

|

|

— |

|

|

|

54,102 |

|

|

Stock-based compensation |

|

— |

|

|

— |

|

|

3,082 |

|

|

— |

|

|

|

3,082 |

|

|

Exercise of stock options |

|

17,676 |

|

|

— |

|

|

7 |

|

|

— |

|

|

|

7 |

|

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

(19,270 |

) |

|

|

(19,270 |

) |

| Balance as of December 31,

2018 |

|

15,663,221 |

|

$ |

16 |

|

$ |

62,593 |

|

$ |

(23,720 |

) |

|

$ |

38,889 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock, net of issuance costs of $1,991 |

|

2,369,223 |

|

$ |

2 |

|

$ |

17,808 |

|

$ |

— |

|

|

$ |

17,810 |

|

|

Stock-based compensation |

|

|

|

|

— |

|

|

3,142 |

|

|

— |

|

|

|

3,142 |

|

|

Exercise of stock options |

|

54,938 |

|

|

— |

|

|

22 |

|

|

— |

|

|

|

22 |

|

|

Net loss |

|

|

|

|

— |

|

|

— |

|

|

(32,968 |

) |

|

|

(32,968 |

) |

| Balance as of December 31,

2019 |

|

18,087,382 |

|

$ |

18 |

|

$ |

83,565 |

|

$ |

(56,688 |

) |

|

$ |

26,895 |

|

BIOXCEL THERAPEUTICS, INC.

STATEMENTS OF CASH FLOWS

(amounts in thousands, except share and

per share data)

| |

|

|

|

|

|

| |

Year ended December 31, |

| |

2019 |

|

2018 |

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

$ |

(32,968 |

) |

|

$ |

(19,270 |

) |

| Reconciliation of net loss to

net cash used in operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

156 |

|

|

|

17 |

|

|

Stock-based compensation expense |

|

3,142 |

|

|

|

3,082 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Prepaid expenses and other assets |

|

(1,190 |

) |

|

|

(539 |

) |

|

Accounts payable, accrued expenses and other liabilities |

|

3,580 |

|

|

|

3,201 |

|

| Net cash used in operating

activities |

|

(27,280 |

) |

|

|

(13,509 |

) |

| |

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

| Purchase of equipment |

|

(870 |

) |

|

|

(340 |

) |

| Net cash used in investing

activities |

|

(870 |

) |

|

|

(340 |

) |

| |

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

| Proceeds from issuance of

common stock, net |

|

17,810 |

|

|

|

56,513 |

|

| Exercise of options |

|

22 |

|

|

|

7 |

|

| Payable to Parent for

services |

|

— |

|

|

|

(67 |

) |

| Due to Parent |

|

179 |

|

|

|

(555 |

) |

| Note Payable — Parent |

|

— |

|

|

|

(371 |

) |

| Net cash provided by financing

activities |

|

18,011 |

|

|

|

55,527 |

|

| |

|

|

|

|

|

| Net (decrease) increase in

cash and cash equivalents |

|

(10,139 |

) |

|

|

41,678 |

|

| |

|

|

|

|

|

| Cash and cash equivalents,

beginning of the period |

|

42,565 |

|

|

|

887 |

|

| Cash and cash equivalents, end

of the period |

$ |

32,426 |

|

|

$ |

42,565 |

|

| |

|

|

|

|

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

Interest paid |

$ |

62 |

|

|

$ |

1 |

|

|

|

|

|

|

|

|

| Supplemental disclosure of

non-cash Operating, Investing and Financing Activities: |

|

|

|

|

|

|

Deferred issuance costs reclassified to additional paid-in-capital

upon completion of initial public offering |

$ |

— |

|

|

$ |

461 |

|

|

Right-of-use asset obtained in exchange for new operating lease

liability |

$ |

1,308 |

|

|

|

— |

|

Contact Information:

BioXcel Therapeutics,

Inc.www.bioxceltherapeutics.com

Investor Relations: John Graziano jgraziano@troutgroup.com

1.646.378.2942

Media: Julia Deutsch jdeutsch@troutgroup.com

1.646.378.2967

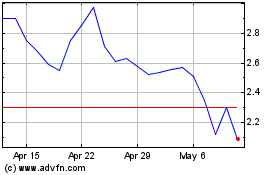

BioXcel Therapeutics (NASDAQ:BTAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

BioXcel Therapeutics (NASDAQ:BTAI)

Historical Stock Chart

From Apr 2023 to Apr 2024