Current Report Filing (8-k)

August 20 2021 - 4:31PM

Edgar (US Regulatory)

0001130144false00011301442021-08-192021-08-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 19, 2021

SIERRA BANCORP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

California

|

000-33063

|

33-0937517

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

86 North Main Street, Porterville, CA 93257

|

|

(Address of principal executive offices)

|

(Zip code)

|

(559) 782-4900

(Registrant’s telephone number including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

|

BSRR

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of directors or certain officers; election of directors; appointment of certain officers; compensatory arrangements of certain officers.

(b) and (c)On August 19, 2021, Director Robb Evans announced his retirement and tendered his resignation as a director of Sierra Bancorp (the “Company”) (Nasdaq: BSRR) and the Company’s wholly owned subsidiary, Bank of the Sierra, effective immediately. The Company’s Board of Directors thanked Mr. Evans for his years of service, and wished him well in his retirement.

Additionally, effective on August 20, 2021, the Company, Bank of the Sierra, and Mr. Matthew Macia, the Company’s and Bank of the Sierra’s Executive Vice President and Chief Risk Officer, mutually agreed to the termination of his employment and employment agreement. In accordance with his employment agreement, Mr. Macia will receive one year of base salary as severance compensation upon the effectiveness of a general release agreement, the form of which was attached to his employment agreement.

Effective August 20, 2021, Mr. Hugh Boyle, the Company’s and Bank of the Sierra’s Executive Vice President and Chief Credit Officer was appointed Chief Risk Officer and will continue to serve as both Chief Credit Officer and Chief Risk Officer, a joint role he previously held at a prior financial institution. As disclosed when Mr. Boyle joined the Company and Bank of the Sierra in December 2020, Mr. Boyle, currently 61 years old, holds both a Master of Science and Bachelor of Science degree from Pennsylvania State University. Prior to serving the Company and Bank of the Sierra, Mr. Boyle was the Chief Risk Officer and Chief Credit Officer for Banc of California in Santa Ana, California, positions he held from 2013 to 2019. Prior to Banc of California, he spent 29 years primarily serving in a credit or risk position for a variety of financial institutions including Goldman Sachs & Co., Lehman Brothers, Inc., Washington Mutual, Inc., Canadian Imperial Bank of Commerce, and Flagstar Bank. With the addition of the Chief Risk Officer responsibilities, Mr. Boyle’s annual base salary will be increased $24,000, but no other changes to his compensation arrangement under his current employment agreement will be made. To memorialize the change in title and base salary, an amendment to Mr. Boyle’s employment agreement was entered into, a copy of which is attached hereto as Exhibit 10.1, and incorporated herein by reference.

ITEM 9.01FINANCIAL STATEMENTS AND EXHIBITS

(d)Exhibits. The information required to be furnished pursuant to this item is set forth in the Exhibit Index which appears below, immediately before the signatures.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Executive Vice President &

Chief Financial Officer

|

|

Dated: August 20, 2021

|

SIERRA BANCORP

By: /s/ Christopher G. Treece

Christopher G. Treece

Executive Vice President &

Chief Financial Officer

|

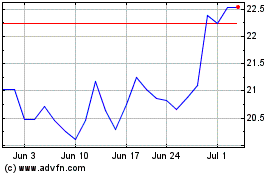

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

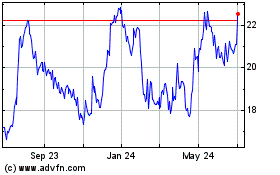

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Apr 2023 to Apr 2024