Filed pursuant to Rule 424(B)(5)

Registration No. 333-230448

PROSPECTUS SUPPLEMENT

(To Prospectus Dated March 29, 2019)

2,187,500 Shares

Common Stock

We are offering 2,187,500 shares of our common stock, $0.001 par value per share.

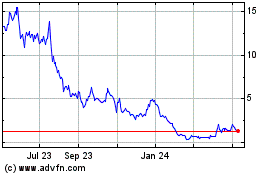

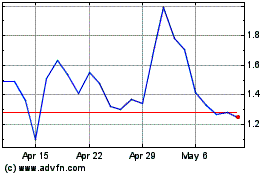

Our common stock is traded on the Nasdaq Capital Market under the symbol “BSGM.” On June 23, 2020, the last sale price of our common stock as reported on the Nasdaq Capital Market was $9.71 per share.

Investing in our securities involves a high degree of risk. You should read the “Risk Factors” section beginning on page S-5 of this prospectus supplement and page 4 of the accompanying prospectus and in the documents incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to invest in our common stock.

|

|

|

Per Share

|

|

|

Total

|

|

|

Offering price

|

|

$

|

8.00

|

|

|

$

|

17,500,000

|

|

|

Placement agent fees (1)

|

|

$

|

0.60

|

|

|

$

|

1,312,500

|

|

|

Proceeds, before expenses, to us

|

|

$

|

7.40

|

|

|

$

|

16,187,500

|

|

(1) See “Plan of Distribution” for additional disclosure regarding placement agent fees and estimated offering expenses.

We engaged The Special Equities Group, LLC, a division of Bradley Woods & Co., Ltd., as our placement agent to solicit offers to purchase the shares in this offering. The placement agent is not purchasing or selling any of the shares we are offering, and it is not required to arrange the purchase or sale of any specific number of shares or dollar amount, but has agreed to use reasonable best efforts to arrange for the sale of all of the shares. There is no required minimum number of shares that must be sold as a condition to completion of this offering. We have agreed to pay the placement agent fees set forth in the table above, which assumes that we sell all of the shares we are offering pursuant to this prospectus supplement and accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock to investors is expected to be made on or about June 26, 2020, subject to satisfaction of customary closing conditions.

The Special Equities Group, LLC

a division of Bradley Woods & Co., Ltd.

The date of this prospectus supplement is June 24, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the U.S. Securities and Exchange Commission utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the information contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein. We have not authorized, and the placement agent has not authorized, anyone to provide you with information that is different. The information contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein or therein is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our common stock. It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where you can find more information; Information incorporated by reference” in this prospectus supplement and in the accompanying prospectus, respectively.

We are offering to sell, and seeking offers to buy, the securities offered by this prospectus supplement only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the securities offered by this prospectus supplement in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

All references in this prospectus supplement and the accompanying prospectus to “BioSig,” the “Company,” “we,” “us,” “our,” or similar terms refer to BioSig Technologies, Inc. and its subsidiaries taken as a whole, except where the context otherwise requires or as otherwise indicated.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents incorporated by reference herein and therein. This summary is not complete and does not contain all the information you should consider before investing in our securities pursuant to this prospectus supplement and the accompanying prospectus. Before making an investment decision, to fully understand this offering and its consequences to you, you should carefully read this entire prospectus supplement and the accompanying prospectus, including “Risk Factors,” the financial statements, and related notes, and the other information incorporated by reference herein and therein.

Overview

BioSig Technologies, Inc.

We are a medical technology company commercializing a proprietary biomedical signal processing platform designed to improve signal fidelity and uncover the full range of ECG and intra-cardiac signals. Our initial emphasis is on providing intracardiac signal information to electrophysiologists during electrophysiology (“EP”) studies and cardiac catheter ablation procedures for atrial fibrillation (“AF”) and ventricular tachycardia (“VT”). Cardiac catheter ablation is a procedure that involves delivery of energy through the tip of a catheter that scars or destroys heart tissue in order to correct heart rhythm disturbances. In August 2018, we received 510(k) clearance from the U.S. Food and Drug Administration (the “FDA”) to market our PURE (Precise Uninterrupted Real-time evaluation of Electrograms) EP System.

The PURE EP™ System is a proprietary signal acquisition and processing technology. The device is a computerized system intended for acquiring, digitizing, amplifying, filtering, measuring and calculating, displaying, recording and storing of electrocardiographic and intracardiac signals for patients undergoing EP procedures in an EP laboratory under the supervision of licensed healthcare practitioners who are responsible for interpreting the data. The device aims to minimize noise and artifacts from cardiac recordings and acquire high-fidelity cardiac signals. Improving fidelity of acquired cardiac signals may potentially increase the diagnostic value of these signals, thereby possibly improving accuracy and efficiency of the EP studies and related procedures.

Our initial focus is on improving intracardiac signal acquisition and enhancing diagnostic information for catheter ablation procedures for complex and potentially life-threatening arrhythmias like AF, the most common cardiac arrhythmia, and VT, an arrhythmia evidenced by a fast heart rhythm originating from the lower chambers of the heart.

In November 2019, we commenced our first clinical study for the PURE EP System titled, “Novel Cardiac Signal Processing System for Electrophysiology Procedures (PURE EP 2.0 Study).” Texas Cardiac Arrhythmia Research Foundation (TCARF) in Austin, Texas, is the first institution to conduct patient cases under the clinical study. On January 16, 2020, we announced that we installed a PURE EP System at Mayo Clinic Jacksonville, Fl. Mayo Clinic is the second institution to conduct patient cases under the same clinical study. To date, 54 patients have been enrolled in the study. We have also conducted a total of twenty-four pre-clinical studies with the PURE EP System, twenty-one of which were conducted at Mayo Clinic in Rochester, Minnesota. We also conducted a pre-clinical study at the Mount Sinai Hospital in New York, NY with an emphasis on the VT model; and two pre-clinical studies at the University of Pennsylvania in preparation for clinical studies to be conducted there. We intend to continue to conduct additional clinical external evaluation at a select number of centers. We also intend to continue additional research studies with our technology at Mayo Clinic.

Leading up to a new Medical Device Regulation that entered into full force in 2020, the European Notified Bodies were reporting delays in accepting and processing new applications throughout 2019. Given the potential issues or further delays as a result of the ongoing global COVID-19 pandemic and our focus and priority on commercialization activities in the United States, we plan to commence audit preparation for the International Organization for Standardization (“ISO”) 13485 and Medical Device Single Audit Program certification. We expect to proceed with the audit to obtain the ISO 13485 Certification and CE Mark in first half of 2021, and the Medical Device Single Audit Program certification in the second half of 2021.

While we presently do not have any paying customers, we are making all preparations we believe are needed to commence sales of our initial product in the immediate future. We anticipate that our initial customers will be medical centers of excellence and other health care facilities that operate EP labs.

ViralClear Pharmaceuticals, Inc.

ViralClear Pharmaceuticals, Inc. (“ViralClear”) is a majority-owned subsidiary of the Company formerly known as NeuroClear Technologies, Inc. which was formed in November 2018 initially as our wholly-owned subsidiary for the purpose to pursue additional applications of the PURE EP™ signal processing technology outside of EP. In March 2020, NeuroClear Technologies, Inc. was renamed to ViralClear and repurposed to bring a broad-spectrum anti-viral agent against the SARS-COV-2 (COVID-19) virus to market. As of June 24, 2020, the Company had a majority interest in ViralClear of 69.38%.

Currently ViralClear is developing merimepodib (MMPD), a broad-spectrum, antiviral candidate acquired from Trek Therapeutics, PBC (“Trek”) in March 2020, which has demonstrated strong activity against COVID-19 in cell cultures in in-vitro laboratory testing. MMPD targets RNA-dependent polymerases. The molecule has shown activity against a broad spectrum of RNA viruses and has demonstrated satisfactory safety data from over 300 patients treated for hepatitis C. In April 2020, ViralClear published first pre-clinical data generated under contract with Galveston National Laboratory at The University of Texas Medical Branch. A manuscript titled, “The IMPDH inhibitor merimepodib suppresses SARS-COV-2 replication in vitro” was authored by Natalya Bukreyeva, Emily K. Mantlo, Rachel A. Sattler, Cheng Huang, Slobodan Paessler, DVM, Ph.D of the UTMB Galveston National Laboratory and Jerome Zeldis, M.D., Ph.D of ViralClear. In-vitro studies referenced in the manuscript demonstrated that merimepodib decreased viral production by over 98%. Additional data was published in F1000 Research that demonstrated merimepodib in combination with remdesivir decreases viral production of SARS-CoV-2 to undetectable levels in pre-clinical testing. The article titled, “The IMPDH inhibitor merimepodib provided in combination with the adenosine analogue remdesivir reduces SARS-CoV-2 replication to undetectable levels in vitro” was authored by Natalya Bukreyeva, Rachel A. Sattler, Emily K. Mantlo, Timothy Wanninger, John T. Manning, Cheng Huang and Slobodan Paessler of the UTMB Galveston National Laboratory and Dr. Jerome Zeldis.

The Company is pursuing the development of this agent for the treatment of COVID-19 through FDA-approved clinical trials that commenced in Q2 2020. In May 2020, the FDA cleared the Investigational New Drug Application to enable the Company to proceed its proposed Phase II study of merimepodib oral solution in adults with COVID-19 who are hospitalized and either require supplemental oxygen or are on non-invasive ventilation or high flow oxygen devices. The first clinical trial is currently enrolling patients at three Mayo Clinic sites (Phoenix, AZ, Jacksonville, FL, and Rochester, MN), Atlantic Health System in both Morristown, NJ and Summit, NJ, and St. David’s South Austin Medical Center. This phase 2 randomized, double-blind, placebo-controlled study will enroll approximately 40 adult patients with advanced coronavirus disease 2019 (COVID-19), who have a score of 3 or 4 on the National Institute of Allergy and Infectious Disease (NIAID) 8-point ordinal scale and at least one of the following: fever, cough, sore throat, malaise, headache, muscle pain, shortness of breath at rest or with exertion, confusion or symptoms of severe lower respiratory symptoms. Approximately 40 patients will be randomized 1:1 to receive oral administration of MMPD with remdesivir or placebo with remdesivir, which design is intended to evaluate the potential synergy between merimepodib and remdesivir in clinical setting. An additional trial in the outpatient setting with just merimepodib is proposed to follow the initiation of the first trial.

ViralClear Financings

In 2019, ViralClear sold 896,690 shares of its common stock for net proceeds of $5,011,310 to fund initial operations pursuant to securities purchase agreements with certain accredited investors (collectively, the “2019 purchase agreements”). In August and September of 2019, ViralClear sold an aggregate of 739,000 shares of its common stock at the purchase price of $5.00 per share, in two private placement transactions, pursuant to securities purchase agreements with certain accredited investors, to fund initial operations. ViralClear received an aggregate purchase price of $3,695,000 from the two private placements. In subsequent private placements closed from October 21, 2019, through December 19, 2019, ViralClear sold an aggregate of 157,690 shares of ViralClear’s common stock at $8.35 per share, for an aggregate consideration of $1,316,664, pursuant to a securities purchase agreement with certain accredited investors.

We are party to the 2019 purchase agreements between ViralClear and the private placement investors with respect to a provision in each securities purchase agreement which provides that in the event that (i) ViralClear common stock is not listed on a national securities exchange by October 31, 2020, or (ii) a change of control (as defined in each securities purchase agreement) of ViralClear occurs, whichever is earlier, at the option of the holder of ViralClear common stock, each share of ViralClear common stock may be exchanged into 0.9 of a share our common stock if the ViralClear common stock subject to the share exchange was purchased in the August or September 2019 private placements, or 1.1 shares of our common stock if the ViralClear common stock subject to the share exchange was purchased in the private placement closed in October 2019 through December 2019.

On May 20, 2020, ViralClear and the Company entered into a securities purchase agreement, pursuant to which ViralClear agreed to sell in a private placement transaction an aggregate of 1,068,550 shares of ViralClear’s common stock at $10.00 per share, for an aggregate consideration of $10,685,500. This private placement closed on May 20, 2020.

Recent Developments

Dismissal of Independent Registered Public Accounting Firm.

On June 24, 2020, the Audit Committee (the “Committee”) of the Company approved the dismissal of Liggett & Webb, P.A. (“Liggett & Webb”) as the Company’s independent registered public accounting firm, effective as of June 24, 2020, and informed Liggett & Webb, P.A. of such dismissal on the date thereof.

Liggett & Webb’s audit reports on the consolidated financial statements of the Company for the two most recent fiscal years, ended December 31, 2018 and December 31, 2019, did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles, except for the audit report on the consolidated financial statements of the Company as of and for the year ended December 31, 2018, which included an explanatory paragraph describing conditions that raise substantial doubt about the Company's ability to continue as a going concern.

During the two most recent fiscal years, ended December 31, 2018 and December 31, 2019, and through June 24, 2020, the date of Liggett & Webb’s dismissal, there were no disagreements, as defined in Item 304(a)(1)(iv) of Regulation S-K, with Liggett & Webb on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreement, had it not been resolved to the satisfaction of Liggett & Webb, would have caused Liggett & Webb to make reference thereto in its reports on the Company’s consolidated financial statements for such periods. During the same periods, there have been no “reportable events,” as that term is described in Item 304(a)(1)(v) of Regulation S-K.

Appointment of New Independent Registered Public Accounting Firm.

On June 24, 2020, the Committee approved the engagement of Friedman LLP (“Friedman”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020, effective immediately.

Prior to the appointment of Friedman, neither the Company nor anyone on its behalf had consulted with Friedman with respect to (i) the application of accounting principles to any specified transaction, either completed or proposed or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Friedman concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, or (ii) any matter that was either the subject of a “disagreement,” as defined in Item 304(a)(1)(iv) of Regulation S-K, or a “reportable event,” as defined in Item 304(a)(1)(v) of Regulation S-K.

Corporate Information

We were formed as BioSig Technologies, Inc., a Nevada corporation, in February 2009. In April 2011, we merged with our wholly-owned subsidiary, BioSig Technologies Inc., a Delaware corporation, with the Delaware corporation continuing as the surviving entity. Our principal executive offices are located at 54 Wilton Road, 2nd Floor, Westport, Connecticut 06880, and our telephone number is (203) 409-5444. Our website address is www.biosig.com. Information accessed through our website is not incorporated into this prospectus supplement and is not a part of this prospectus supplement.

THE OFFERING

|

Common stock offered by us

|

2,187,500 shares.

|

|

Common stock to be outstanding immediately after the offering (1)

|

29,091,663 shares

|

|

|

|

|

Offering price per share

|

$8.00 per share

|

|

Use of proceeds

|

We expect to receive net proceeds from this offering of approximately $16,162,500.00, after deducting the placement agent fees and the estimated offering expenses payable by us.

We intend to use the net proceeds from this offering to support commercialization and for working capital and general corporate purposes. See “Use of Proceeds” on page S-11 of this prospect supplement.

|

|

Dividend policy

|

We have never paid cash dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future but intend to retain our capital resources for reinvestment in our business. See “Dividend Policy.”

|

|

Risk factors

|

Investing in our shares involves a high degree of risk. You should read the “Risk Factors” section beginning on page S-5 of this prospectus supplement and page 4 of the accompanying prospectus and in the documents incorporated by reference in this prospectus supplement for a discussion of factors to consider before deciding to invest in our common stock.

|

|

Nasdaq Capital Market symbol

|

“BSGM.”

|

|

(1)

|

The number of shares of common stock to be outstanding immediately after this offering is based on 26,904,163 shares of our common stock outstanding as of June 23, 2020, and excludes, as of such date:

|

|

|

•

|

|

1,774,827 shares of common stock issuable upon the exercise of warrants outstanding with an exercise price ranging from $3.75 to $6.85 per share and having a weighted average exercise price of $5.15 per share;

|

|

|

•

|

|

3,732,705 shares of common stock issuable upon the exercise of options outstanding with exercise prices ranging from $3.40 to $10.49 and having a weighted average exercise price of $5.52 per share;

|

|

|

•

|

|

887,855 shares of common stock available for future issuance under the BioSig Technologies, Inc. 2012 Equity Incentive Plan (the “2012 Plan”);

|

|

|

•

|

|

178,334 shares of common stock issuable from time to time after this offering upon the settlement of restricted stock units outstanding; and

|

|

|

•

|

|

35,254 shares of common stock issuable upon conversion of outstanding Series C preferred stock, including the payment of the dividends accrued on the Series C Preferred Stock in an aggregate of 7,252 shares of common stock at the conversion price of $9.49 per share and the stated value per share of $1,000.

|

Except as otherwise indicated, all information in this prospectus supplement assumes the sale of all shares of common stock covered by this prospectus supplement and assumes no exercise of options, vesting of restricted stock units or exercise of warrants described above.

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks described below, together with other information in this prospectus supplement, the accompanying prospectus, the information and documents incorporated by reference. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent annual report on Form 10-K, as amended, and the subsequent quarterly reports on Form 10-Q and other reports that we file with the SEC which are on file with the SEC and are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. Please also read carefully the section below entitled “Special Note Regarding Forward-Looking Statements.”

Risks Relating to ViralClear’s Business and Industry

We operate in a highly competitive industry.

The pharmaceutical market is highly competitive, it is subject to rapid technological change and is significantly affected by existing rival drugs and medical procedures, new product introductions and the market activities of other participants. Pharmaceutical and biotechnology companies, academic institutions, governmental agencies and other public and private research organizations may pursue the research and development of technologies, drugs or other therapies. Our competitors may develop products more rapidly or more effectively than us. If our competitors are more successful in commercializing their products than us, their success could adversely affect our competitive position and harm our business prospects.

The competitive landscape of anti-coronavirus therapies has been rapidly developing since the beginning of the COVID-19 pandemic in late 2019, with an increasing number of companies claiming to be investigating possible candidates. These drug candidates generally consist of therapeutics or vaccines. We believe it is likely that a combination of therapies will be used to effectively treat COVID-19, and the global footprint of the current pandemic will result in the need for multiple approved drugs to meet the needs of patients in different stages of the disease.

We are aware of approximately 350 possible therapeutic products of various modes of action and over 125 potential vaccines for COVID-19. In the therapeutic category, based on our knowledge, at least five other companies are developing direct antiviral agents with studies being conducted in U.S. sites (source: ClinicalTrials.gov), which include Gilead Sciences, which is currently participating in 15 clinical studies with remdesivir in multiple clinical study sites in the United States and abroad, with the FDA having granted emergency use authorization to use remdesivir to treat adults and children hospitalized with severe COVID-19; Atea Pharmaceuticals; Fujifilm Pharmaceuticals U.S.A., which has begun one of the two Phase II clinical trials on April 17, 2020 for its drug candidate, favipiravir; Ansun Biopharma; and multiple sponsors, Eiger BioPharmaceuticals participating as a collaborator, actively recruiting for Phase III studies of interferons assessing their safety and efficacy in COVID-19 disease.

All of these therapeutic candidates are in different stages of clinical development. If we experience delayed regulatory approvals or disputed clinical claims, we may not have a commercial or clinical advantage over competitors’ products that we believe we currently possess. Moreover, many of the companies developing COVID-19 therapeutic products have significantly greater resources, experience and name recognition than we possess. Should another party be successful in producing a more efficacious therapeutic or a vaccine for COVID-19, such success could reduce the commercial opportunity for our antiviral candidate and could have a material adverse effect on our business, financial condition, results of operations and future prospects.

Risks Relating to COVID-19

The recent COVID-19 outbreak may adversely affect our business.

In December 2019, a strain of coronavirus was reported to have surfaced in Wuhan, China, and has spread globally, resulting in government-imposed quarantines, travel restrictions and other public health safety measures. On March 12, 2020, the WHO declared COVID-19 to be a pandemic, and efforts to contain the spread of COVID-19 have intensified. The COVID-19 pandemic may adversely impact our business plan as our clinical studies may be delayed as hospitals in the impacted regions may shift their resources to patients affected by the disease. The rapidly evolving nature of the circumstances is such that it is impossible, at this stage, to determine the full and overall impact the COVID-19 pandemic may have, but it could disrupt production and cause delays in the supply and delivery of products used in our research and development efforts, adversely affect our employees, and disrupt our operations, all of which may have a material adverse effect on our business. In addition, the pandemic may have an adverse effect on the ability of regulatory bodies to grant approvals or supervise our candidates and products, may further divert the attention and efforts of the medical community to coping with the coronavirus and disrupt the marketplace in which we operate and may have a material adverse effects on our operations.

Moreover, the COVID-19 pandemic has created significant economic uncertainty and volatility in the credit and capital markets. Management plans to secure the necessary financing through the issue of new equity and/or the entering into of strategic partnership arrangements; however, there is no assurance that our management will be able to obtain such financing on reasonable terms or at all. A continuation or worsening of the levels of market disruption and volatility seen in the recent past could have an adverse effect on our ability to access capital and on the market price of our common stock, and we may not be able to successfully raise capital through the sale of our securities. If we are unsuccessful in commercializing our products or raising capital, we may need to reduce activities, curtail or cease operations.

In addition, a significant outbreak of COVID-19 or other infectious diseases could result in a widespread health crisis that could adversely affect the economies and financial markets worldwide, resulting in an economic downturn that could impact our business, financial condition and results of operations.

Risks Related to This Offering and Our Common Stock

The market price for our common stock may fluctuate significantly, which could result in substantial losses by our investors.

The stock market in general, and Nasdaq in particular, as well as biotechnology companies, have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of small companies. The market price of our common stock may fluctuate significantly in response to numerous factors, some of which are beyond our control, such as:

|

|

•

|

|

announcements of technological innovations, new products or product enhancements by us or others;

|

|

|

•

|

|

actual or anticipated quarterly increases or decreases in revenue, gross margin or earnings, and changes in our business, operations or prospects;

|

|

|

•

|

|

announcements of significant strategic partnerships, out-licensing, in-licensing, joint ventures, acquisitions or capital commitments by us or our competitors;

|

|

|

•

|

|

conditions or trends in the biotechnology industry;

|

|

|

•

|

|

changes in the economic performance or market valuations of other biotechnology companies;

|

|

|

•

|

|

general market conditions or domestic or international macroeconomic and geopolitical factors unrelated to our performance or financial condition;

|

|

|

•

|

|

purchase or sale of our common stock by stockholders, including executives and directors;

|

|

|

•

|

|

volatility and limitations in trading volumes of our common stock;

|

|

|

•

|

|

changes in our capital structure or dividend policy, future issuances of securities, sales or distributions of large blocks of our common stock by stockholders;

|

|

|

•

|

|

announcements and events surrounding financing efforts, including debt and equity securities;

|

|

|

•

|

|

changes in earnings estimates or recommendations by security analysts, if our common stock is covered by analysts;

|

|

|

•

|

|

the addition or departure of key personnel;

|

|

|

•

|

|

disputes and litigation related to intellectual property rights, proprietary rights, and contractual obligations;

|

|

|

•

|

|

changes in applicable laws, rules, regulations, or accounting practices and other dynamics; and

|

|

|

•

|

|

other events or factors, many of which may be out of our control.

|

These factors and any corresponding price fluctuations may materially and adversely affect the market price of our common stock and result in substantial losses by our investors.

Further, the stock market in general, and the market for technology companies in particular, has experienced extreme price and volume fluctuations in the past. Continued market fluctuations could result in extreme volatility in the price of our common stock, which could cause a decline in the value of our common stock.

Moreover, the COVID-19 pandemic has resulted in significant financial market volatility and uncertainty in recent months. A continuation or worsening of the levels of market disruption and volatility seen in the recent past could have an adverse effect on our ability to access capital, on our business, results of operations and financial condition, and on the market price of our common stock.

Price volatility of our common stock might be worse if the trading volume of our common stock is low. In the past, following periods of market volatility, stockholders have often instituted securities class action litigation. If we were involved in securities litigation, it could have a substantial cost and divert resources and attention of management from our business, even if we are successful. Future sales of our common stock could also reduce the market price of such stock.

Moreover, the liquidity of our common stock is limited, not only in terms of the number of shares that can be bought and sold at a given price, but by delays in the timing of transactions and reduction in security analysts’ and the media’s coverage of us, if any. These factors may result in lower prices for our common stock than might otherwise be obtained and could also result in a larger spread between the bid and ask prices for our common stock. In addition, without a large float, our common stock is less liquid than the stock of companies with broader public ownership and, as a result, the trading prices of our common stock may be more volatile. In the absence of an active public trading market, an investor may be unable to liquidate its investment in our common stock. Trading of a relatively small volume of our common stock may have a greater impact on the trading price of our stock than would be the case if our public float were larger. We cannot predict the prices at which our common stock will trade in the future.

You will experience immediate and substantial dilution if you purchase shares of our common stock in this offering.

Because the price per share of common stock being offered in this offering is substantially higher than the net tangible book value per share of our common stock, you will experience substantial dilution to the extent of the difference between the offering price per share of common stock you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. See the section entitled “Dilution” on page S-12 below for a more detailed illustration of the dilution you will incur if you participate in this offering.

Our management team may invest or spend the proceeds raised in this offering in ways with which you may not agree or which may not yield a significant return.

Our management will have broad discretion over the use of proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by management to apply these funds effectively could result in financial losses that could have a material adverse effect on our business, cause the price of our common stock to decline, and delay the development of our product candidates.

You may experience future dilution as a result of future equity offerings and other issuances of our securities. In addition, this offering and future equity offerings and other issuances of our common stock or other securities may adversely affect the price of our common stock.

In order to raise additional capital, we may in the future offer additional shares of common stock or other securities convertible into or exchangeable for our common stock prices that may not be the same as the price per share in this offering. We may not be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of common stock or securities convertible into shares of common stock in future transactions may be higher or lower than the price per share in this offering. You will incur dilution upon exercise of any outstanding stock options, warrants or upon the issuance of shares of common stock under our stock incentive programs. In addition, the sale of shares of common stock in this offering and any future sales of a substantial number of shares of common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares for sale will have on the market price of our common stock.

If we cannot continue to satisfy the continuing listing criteria of the Nasdaq Capital Market, the exchange may subsequently delist our common stock.

Nasdaq requires us to meet certain financial, public float, bid price and liquidity standards on an ongoing basis in order to continue the listing of our common stock. Generally, we must maintain a minimum amount of stockholders equity and a minimum number of holders of our securities. If we fail to meet any of the continuing listing requirements, our common stock may be subject to delisting. If our common stock is delisted and we are not able to list our common stock on another national securities exchange, we expect our securities would be quoted on an over-the-counter market. If this were to occur, our stockholders could face significant material adverse consequences, including limited availability of market quotations for our common stock and reduced liquidity for the trading of our securities. In addition, we could experience a decreased ability to issue additional securities and obtain additional financing in the future. There can be no assurance that an active trading market for our common stock will develop or be sustained.

Offers or availability for sale of a substantial number of shares of our common stock may cause the price of our common stock to decline.

If our stockholders sell substantial amounts of our common stock in the public market, it could create a circumstance commonly referred to as an “overhang,” in anticipation of which the market price of our common stock could fall. The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we deem reasonable or appropriate.

Our stockholders may experience substantial dilution as a result of the conversion of outstanding convertible preferred stock, the exercise of options or warrants to purchase shares of our common stock, or upon exchange of the shares of ViralClear common stock into shares of our common stock.

As of June 23, 2020, we have outstanding options to purchase 3,732,705 shares of common stock and have reserved 887,855 shares of our common stock for further issuances pursuant to our 2012 Plan. In addition, as of June 23, 2020, we may be required to issue 35,254 shares of our common stock for issuance upon conversion of outstanding convertible Series C preferred stock, which includes accrued dividends as of June 23, 2020 and 1,774,827 shares of our common stock for issuance upon exercise of outstanding warrants. Should all of these shares be issued, you would experience dilution in ownership of our common stock and the price of our common stock will decrease unless the value of our company increases by a corresponding amount.

Moreover, in the event that ViralClear common stock is not listed on a national securities exchange by October 31, 2020, or a change of control (as defined in the securities purchase agreement for ViralClear financings) of ViralClear occurs and the investors who participated in the ViralClear private placements completed in August through December of 2019, elects to exchange their shares of ViralClear common stock to our shares of common stock, subject to certain conditions as set forth in the respective securities purchase agreement, you would experience dilution in ownership of our common stock. Such investors’ shares of ViralClear common stock may be exchanged into up to 838,559 shares of our common stock.

The terms of our Series C Preferred Stock contain anti-dilution provisions that may result in the reduction of the conversion prices in the future.

The terms of our Series C Preferred Stock contain anti-dilution provisions, which provisions require the lowering of the conversion price to the purchase price of future offerings. If in the future we issue securities for less than the conversion of our Series C Preferred Stock then in effect, we will be required to further reduce the relevant conversion prices. We may find it more difficult to raise additional equity capital while our Series C Preferred Stock are outstanding.

The interests of our controlling stockholders may not coincide with yours and such controlling stockholders may make decisions with which you may disagree.

As of June 23, 2020, three of our stockholders beneficially owned over 19.46% of our common stock. As a result, these stockholders may be able to influence the outcome of matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, this concentration of ownership may delay or prevent a change in control of our company and make some future transactions more difficult or impossible without the support of our controlling stockholders. The interests of our controlling stockholders may not coincide with our interests or the interests of other stockholders.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, each prospectus supplement and the information incorporated by reference in this prospectus and each prospectus supplement contain “forward-looking statements,” which include information relating to future events, future financial performance, strategies, expectations, competitive environment and regulation. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will actually be achieved. Forward-looking statements are based on information we have when those statements are made or our management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

|

|

•

|

|

our history of recurring losses and negative cash flows from operating activities and the uncertainty regarding the adequacy of our liquidity to pursue or complete our business objectives, and substantial doubt regarding our ability to continue as a going concern;

|

|

|

•

|

|

the results of ongoing and future clinical studies;

|

|

|

•

|

|

our inability to successfully develop or commercialize our product candidates;

|

|

|

•

|

|

market acceptance of existing and new products;

|

|

|

•

|

|

our inability to carry out research, development and commercialization plans;

|

|

|

•

|

|

our inability to complete preclinical testing and clinical trials as anticipated;

|

|

|

•

|

|

changes in our relationship with key collaborators;

|

|

|

•

|

|

our ability to adequately protect and enforce rights to intellectual property;

|

|

|

•

|

|

our need to raise additional capital to meet our business requirements in the future and the difficulties in obtaining financing on commercially reasonable terms, or at all;

|

|

|

•

|

|

intense competition in our industry, with competitors having substantially greater financial, technological, research and development, regulatory and clinical, manufacturing, marketing and sales, distribution and personnel resources than we do;

|

|

|

•

|

|

our inability to manufacture our PURE EP product on a commercial scale on our own or in collaborations with third parties;

|

|

|

•

|

|

entry of new competitors and products and potential technological obsolescence of our products;

|

|

|

•

|

|

effect of healthcare legislation or reform measures that may substantially change the market for medical care or healthcare coverage in the U.S.;

|

|

|

•

|

|

our failure to obtain regulatory approvals;

|

|

|

•

|

|

adverse market and economic conditions;

|

|

|

•

|

|

our ability to maintain the listing of our common stock on the Nasdaq Capital Market;

|

|

|

•

|

|

our business, results of operations and financial condition may be adversely impacted by public health epidemics, including the recent COVID-19 outbreak;

|

|

|

•

|

|

loss of one or more key executives;

|

|

|

•

|

|

difficulties in securing and retaining regulatory approval to market our product and product candidates; and

|

|

|

•

|

|

depth of the trading market in our common stock.

|

You should review carefully the section titled “Risk Factors” beginning on page S-5 of this prospectus supplement for a discussion of these and other risks that relate to our business and investing in our securities. The forward-looking statements contained or incorporated by reference in this prospectus supplement are expressly qualified in their entirety by this cautionary statement. Except as required by applicable law, we do not undertake any obligation to publicly update any forward-looking statement contained in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference herein to reflect events or circumstances after the date on which any such statement is made or to reflect the occurrence of unanticipated events. For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

DIVIDEND POLICY

We have never paid cash dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future but intend to retain our capital resources for reinvestment in our business.

USE OF PROCEEDS

We expect to receive net proceeds from this offering of approximately $16,162,500, after deducting the placement agent fees and the estimated offering expenses payable by us.

We intend to use the net proceeds from this offering to support commercialization and for working capital and general corporate purposes. We do not currently have more specific plans or commitments with respect to the net proceeds from this offering and, accordingly, are unable to quantify the allocation of such proceeds among the various potential uses.

The expected use of net proceeds of this offering represents our current intentions based upon our present plan and business conditions. Investors are cautioned, however, that expenditures may vary substantially from these uses. Investors will be relying on the judgment of our management, who will have broad discretion regarding the application of the proceeds of this offering. The amounts and timing of our actual expenditures will depend upon numerous factors, including the amount of cash generated by our operations, the amount of competition we face and other operational factors. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes.

From time to time, we evaluate these and other factors and we anticipate continuing to make such evaluations to determine if the existing allocation of resources, including the proceeds of this offering, is being optimized. Circumstances that may give rise to a change in the use of proceeds include:

|

|

●

|

a change in development plan or strategy;

|

|

|

|

|

|

|

●

|

the addition of new products or applications;

|

|

|

|

|

|

|

●

|

technical delays;

|

|

|

|

|

|

|

●

|

delays or difficulties with our clinical trials;

|

|

|

|

|

|

|

●

|

negative results from our clinical trials;

|

|

|

|

|

|

|

●

|

difficulty obtaining regulatory approval;

|

|

|

|

|

|

|

●

|

failure to achieve sales as anticipated; and

|

|

|

|

|

|

|

●

|

the availability of other sources of cash including cash flow from operations and new bank debt financing arrangements, if any.

|

Pending application of the net proceeds as described above, we intend to invest the proceeds to us in investment-grade, interest-bearing securities such as money market funds, certificates of deposit, or direct or guaranteed obligations of the U.S. government, or hold as cash. We cannot predict whether the proceeds invested will yield a favorable, or any, return.

DILUTION

If you invest in our common stock, your interest will be diluted immediately to the extent of the difference between the offering price per share you will pay in this offering and the pro forma as adjusted net tangible book value per share of our common stock immediately after giving effect to this offering.

Our net tangible book value as of March 31, 2020 was approximately $15.4 million, or $0.60 per share of common stock. Net tangible book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of shares of our common stock outstanding as of March 31, 2020.

Our as adjusted net tangible book value as of March 31, 2020, after giving effect to the sale of 2,187,500 shares of common stock at the offering price of $8.00 per share, after deducting the placement agent fees and estimated offering expenses payable by us, would have been approximately $31.56 million, or $1.13 per share. This represents an immediate increase in our net tangible book value of $0.53 per share to our existing stockholders and an immediate dilution of approximately $6.87 per share to purchasers of our common stock in this offering.

The following table illustrates this per share dilution.

|

Offering price per share

|

|

|

|

|

|

$

|

8.00

|

|

|

Net tangible book value per share as of March 31, 2020

|

|

$

|

0.60

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

$

|

0.53

|

|

|

|

|

|

|

As adjusted net tangible book value per share as of March 31, 2020, after giving effect to this offering

|

|

|

|

|

|

$

|

1.13

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

|

|

$

|

6.87

|

|

The above discussion and table are based on 26,010,318 shares of common stock outstanding as of March 31, 2020 and excludes as of that date:

|

|

•

|

|

1,963,030 shares of common stock issuable upon the exercise of warrants outstanding with an exercise price ranging from $3.75 to $6.85 per share and having a weighted average exercise price of $5.05 per share;

|

|

|

•

|

|

3,828,896 shares of common stock issuable upon the exercise of options outstanding with exercise prices ranging from $3.40 to $9.975 and having a weighted average exercise price of $5.54 per share;

|

|

|

•

|

|

1,444,718 shares of common stock available for future issuance under the 2012 Plan;

|

|

|

•

|

|

181,334 shares of common stock issuable from time to time after this offering upon the settlement of restricted stock units outstanding; and

|

|

|

•

|

|

81,465 shares of common stock issuable upon conversion of outstanding Series C preferred stock, including the payment of the dividends accrued on the Series C Preferred Stock in an aggregate of 26,796 shares of common stock at the conversion price of $4.82 per share and the stated value per share of $1,000.

|

To the extent that outstanding exercisable options or warrants are exercised and restricted stock units settle, you may experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that we raise additional capital by issuing equity or convertible debt securities, your ownership will be further diluted.

PLAN OF DISTRIBUTION

The Special Equities Group, LLC, a division of Bradley Woods & Co. LTD, which we refer to herein as the placement agent, has agreed to act as our exclusive placement agent in connection with this offering subject to the terms and conditions of the engagement letter, dated June 23, 2020. The placement agent is not purchasing or selling any of the shares of our common stock offered by this prospectus supplement, nor is it required to arrange the purchase or sale of any specific number or dollar amount of shares of our common stock, but has agreed to use its reasonable best efforts to arrange for the sale of all of the shares of our common stock offered hereby. We have entered into a securities purchase agreement directly with investors in connection with this offering, and we may not sell the entire amount of shares of our common stock offered pursuant to this prospectus supplement. We will make offers only to a limited number of qualified institutional buyers and accredited investors. The placement agent may retain sub-agents and selected dealers in connection with this offering.

Delivery of the shares of common stock offered hereby is expected to take place on or about June 26, 2020, subject to satisfaction of certain closing conditions.

We have agreed to indemnify the placement agent against specified liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”), and to contribute to payments the placement agent may be required to make in respect thereof.

Fees and Expenses

We have agreed to pay the placement agent a cash fee equal to 7.5% of the aggregate gross proceeds raised in the offering. We have also agreed to pay the placement agent up to $25,000 for fees and expenses of legal counsel and other out-of-pocket expenses The following table shows the per share and total cash placement agent’s fees we will pay to the placement agent in connection with the sale of the shares of our common stock offered pursuant to this prospectus supplement and the accompanying prospectus, assuming the purchase of all of the shares offered hereby.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

8.00

|

|

|

$

|

17,500,000

|

|

|

Placement agent fees

|

|

$

|

0.60

|

|

|

$

|

1,312,500

|

|

|

Proceeds, before expenses, to us

|

|

$

|

7.40

|

|

|

$

|

16,187,500

|

|

We estimate that the total expenses of the offering payable by us, excluding the placement agent fees, will be approximately $25,000.

Regulation M

The placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale of the securities sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares of common stock by the placement agent acting as principal. Under these rules and regulations, the placement agent:

|

|

●

|

may not engage in any stabilization activity in connection with our securities; and

|

|

|

●

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

Discretionary Accounts

The placement agent does not intend to confirm sales of the securities offered hereby to any accounts over which it has discretionary authority.

Listing

Our shares of common stock are listed on the Nasdaq Capital Market under the symbol BSGM.

Other Relationships

The placement agent and its affiliates may in the future engage in investment banking and other commercial dealings in the ordinary course of business with us or our affiliates. However, except as disclosed in this prospectus, we have no present arrangements with the placement agent for any further services.

LEGAL MATTERS

The validity of the shares of common stock offered by this prospectus supplement has been passed upon for us by Haynes and Boone, LLP, New York, New York. Ellenoff Grossman & Schole LLP, New York, New York is acting as counsel to the placement agent in connection with this offering.

EXPERTS

The consolidated financial statements for the fiscal years ended December 31, 2019 and 2018 incorporated by reference into this prospectus have been so incorporated in reliance on the report of Liggett & Webb, P.A., an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION;

INFORMATION INCORPORATED BY REFERENCE

Available Information

We have filed with the SEC a registration statement on Form S-3 under the Securities Act, of which this prospectus supplement forms a part. The rules and regulations of the SEC allow us to omit from this prospectus supplement and the accompanying prospectus certain information included in the registration statement. For further information about us and the securities we are offering under this prospectus supplement, you should refer to the registration statement and the exhibits and schedules filed with the registration statement. With respect to the statements contained in this prospectus supplement and the accompanying prospectus regarding the contents of any agreement or any other document, in each instance, the statement is qualified in all respects by the complete text of the agreement or document, a copy of which has been filed as an exhibit to the registration statement.

We file reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The address of the SEC’s website is www.sec.gov.

We make available free of charge on or through our website at www.biosigtech.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with or otherwise furnish it to the Securities and Exchange Commission. The information on, or accessible through, our website is not part of, and is not incorporated into, this prospectus supplement or the accompanying prospectus and should not be considered part of this prospectus supplement or the accompanying prospectus.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus supplement, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement and the accompanying prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus supplement and accompanying prospectus to the extent that a statement contained in this prospectus supplement or the accompanying prospectus modifies or replaces that statement.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act in this prospectus supplement, between the date of this prospectus supplement and the termination of the offering of the securities described in this prospectus supplement. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including our Compensation Committee report and performance graph or any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

This prospectus supplement and the accompanying prospectus incorporate by reference the documents set forth below that have previously been filed with the SEC:

|

|

•

|

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the Securities and Exchange Commission on March 13, 2020;

|

|

|

•

|

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, filed with the SEC on May 11, 2020;

|

|

|

•

|

|

our Current Reports on Form 8-K filed with the SEC on January 17, 2020, February 19, 2020, February 24, 2020, February 26, 2020, March 5, 2020, March 25, 2020, April 13, 2020, April 16, 2020 (two reports), April 20, 2020, April 22, 2020, April 24, 2020, May 1, 2020, May 8, 2020, May 15, 2020, May 19, 2020, May 22, 2020, June 1, 2020 (two reports), June 2, 2020, June 3, 2020, and June 5, 2020; and

|

|

|

•

|

|

the description of the Company’s common stock and warrants contained in the Form 8-A filed with the SEC on September 17, 2018, including any amendments thereto or reports filed for the purposes of updating this description.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this offering, including, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus supplement and the accompanying prospectus and deemed to be part of this prospectus supplement and the accompanying prospectus from the date of the filing of such reports and documents.

You should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone else to provide you with different information. You should not assume that the information in this prospectus supplement is accurate as of any date other than the date of this prospectus supplement or the date of the documents incorporated by reference in this prospectus supplement.

You may request a free copy of any of the documents incorporated by reference in this prospectus supplement and the accompanying prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

BioSig Technologies, Inc.

Attn: Chief Executive Officer

54 Wilton Road, 2nd Floor

Westport, CT 06880

(203) 409-5444

You may also access the documents incorporated by reference in this prospectus through our website at www.biosigtech.com. Except for the specific incorporated documents listed above, no information available on or through our website shall be deemed to be incorporated in this prospectus or the registration statement of which it forms a part.

PROSPECTUS

BioSig Technologies, Inc.

$75,000,000

Common Stock

Preferred Stock

Warrants

Units

We may offer and sell from time to time, in one or more series or issuances and on terms that we will determine at the time of the offering, any combination of the securities described in this prospectus, up to an aggregate amount of $75,000,000.

We will provide specific terms of any offering in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities offered hereby.

These securities may be offered and sold in the same offering or in separate offerings; to or through underwriters, dealers, and agents; or directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of our securities, their compensation and any over-allotment options held by them will be described in the applicable prospectus supplement. See “Plan of Distribution.”

Our common stock is listed on the Nasdaq Capital Market under the symbol “BSGM.” On March 21, 2019, the last reported sale price of our common stock as reported on the Nasdaq Capital Market was $6.00 per share. We recommend that you obtain current market quotations for our common stock prior to making an investment decision. We will provide information in any applicable prospectus supplement regarding any listing of securities other than shares of our common stock on any securities exchange.

Effective as of 5:00 pm Eastern Time on September 11, 2018, we filed an amendment to our Amended and Restated Certificate of Incorporation to effect a reverse stock split of the issued and outstanding shares of our common stock, at a ratio of one share for 2.5 shares. All share and per share prices in this prospectus have been adjusted to reflect the reverse stock split.

You should carefully read this prospectus, any prospectus supplement relating to any specific offering of securities, and all information incorporated by reference herein and therein.

Investing in our securities involves a high degree of risk. These risks are discussed in this prospectus under “Risk Factors” beginning on page 4 and in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019

TABLE OF CONTENTS

|

|

Page

|

|

ABOUT THIS PROSPECTUS

|

ii

|

|

PROSPECTUS SUMMARY

|

1

|

|

RISK FACTORS

|

4

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

5

|

|

USE OF PROCEEDS

|

6

|

|

DESCRIPTION OF CAPITAL STOCK

|

7

|

|

DESCRIPTION OF WARRANTS

|

10

|

|

DESCRIPTION OF UNITS

|

11

|

|

PLAN OF DISTRIBUTION

|

12

|

|

LEGAL MATTERS

|

14

|

|

EXPERTS

|

14

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

14

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

15

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission using a “shelf” registration process. Under this shelf process, we may, from time to time, sell any combination of the securities described in this prospectus in one or more offerings up to a total amount of $75,000,000.

This prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. We may also add, update or change in a prospectus supplement any information contained in this prospectus. To the extent any statement made in a prospectus supplement or a document incorporated by reference herein after the date hereof is inconsistent with the statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in the prospectus supplement or the incorporated document.

The prospectus supplement to be attached to the front of this prospectus may describe, as applicable: the terms of the securities offered; the public offering price; the price paid for the securities; net proceeds; and the other specific terms related to the offering of the securities.

You should only rely on the information contained or incorporated by reference in this prospectus and any prospectus supplement or issuer free writing prospectus relating to a particular offering. No person has been authorized to give any information or make any representations in connection with this offering other than those contained or incorporated by reference in this prospectus, any accompanying prospectus supplement and any related issuer free writing prospectus in connection with the offering described herein and therein, and, if given or made, such information or representations must not be relied upon as having been authorized by us. Neither this prospectus nor any prospectus supplement nor any related issuer free writing prospectus shall constitute an offer to sell or a solicitation of an offer to buy offered securities in any jurisdiction in which it is unlawful for such person to make such an offering or solicitation. This prospectus does not contain all of the information included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration statement, including its exhibits.

You should read the entire prospectus and any prospectus supplement and any related issuer free writing prospectus, as well as the documents incorporated by reference into this prospectus or any prospectus supplement or any related issuer free writing prospectus, before making an investment decision. Neither the delivery of this prospectus or any prospectus supplement or any issuer free writing prospectus nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated by reference herein or in any prospectus supplement or issuer free writing prospectus is correct as of any date subsequent to the date hereof or of such prospectus supplement or issuer free writing prospectus, as applicable. You should assume that the information appearing in this prospectus, any prospectus supplement or any document incorporated by reference is accurate only as of the date of the applicable documents, regardless of the time of delivery of this prospectus or any sale of securities. Our business, financial condition, results of operations and prospects may have changed since that date.

PROSPECTUS SUMMARY

This summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus and does not contain all of the information you should consider before investing in our securities. You should carefully read the prospectus, the information incorporated by reference and the registration statement of which this prospectus is a part in their entirety before investing in our securities, including the information discussed under “Risk Factors” in this prospectus and the documents incorporated by reference and our financial statements and related notes that are incorporated by reference in this prospectus. As used in this prospectus, unless the context otherwise indicates, the terms “we,” “our,” “us,” or “the Company” refer to BioSig Technologies, Inc., a Delaware corporation, and its subsidiaries taken as a whole.

Overview