As

filed with the Securities and Exchange Commission on September 28, 2021

Registration

333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

F-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BORQS

TECHNOLOGIES, INC.

(Exact

Name of Registrant as Specified in Its Charter)

|

British

Virgin Islands

|

|

7373

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

Not

Applicable

|

|

(I.R.S.

Employer Identification Number)

|

Suite

309, 3/F, Dongfeng KASO

Dongfengbeiqiao,

Chaoyang District

Beijing

100016, China

Tel:

+86 10 6437 8678

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Pat

Sek Yuen Chan, Chairman & Chief Executive Officer

Borqs Technologies, Inc.

Suite 309, 3/F, Dongfeng KASO, Dongfengbeiqiao

Chaoyang

District, Beijing 100016, China

Telephone: +86 10 6437 8678

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copy

to:

Darrin

M. Ocasio, Esq.

Avital

Perlman, Esq.

Sichenzia

Ross Ference LLP

31st

Floor

New

York, NY 10036

Telephone:

(212) 930-9700

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

|

†

|

The term

“new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board

to its Accounting Standards Codification after April 5, 2012.

|

CALCULATION

OF REGISTRATION FEE

|

each class of securities to be registered

|

|

Amount

to be

registered(1)(2)

|

|

|

Proposed

maximum

aggregate

price per

common

share(3)

|

|

|

Proposed

maximum

aggregate

offering price

|

|

|

Amount of

registration

fee

|

|

|

Ordinary shares, no par value, underlying Convertible Notes

|

|

|

54,936,997

|

|

|

$

|

0.68

|

|

|

$

|

37,357,157.96

|

|

|

$

|

4,075.67

|

|

|

Ordinary shares, no par value, underlying Warrants

|

|

|

46,745,866

|

|

|

$

|

0.68

|

|

|

$

|

31,787,188.88

|

|

|

$

|

3,467.98

|

|

|

Total:

|

|

|

101,682,863

|

|

|

|

|

|

|

$

|

69,144,346.84

|

|

|

$

|

7,543.65

|

|

(1)

Under the terms of the registration rights agreement with the Company, the Company is contractually required to register 125% of the

number of common shares issuable under the 8% Convertible Notes (“Notes”) as of the filing of this Registration Statement

and the number of common shares issuable upon the exercise of outstanding warrants to purchase ordinary shares (the “Warrants”).

(2)

Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of securities

as may be issued with respect to the securities being registered hereunder as a result of stock splits, stock dividends or similar transactions.

(3)

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act. The price

per share and aggregate offering price are based on the average of the high and low prices of the registrant’s ordinary shares

on September 23, 2021, as reported on the Nasdaq Capital Market.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities nor does it

seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated September 28, 2021

Preliminary

Prospectus

Borqs

Technologies, Inc.

101,682,863

ORDINARY SHARES

This

prospectus relates to the sale or other disposition from time to time by the selling shareholders identified in this prospectus of up

to 101,682,863 ordinary shares, consisting of up to 54,936,997 ordinary shares which may be issued upon the conversion of outstanding

convertible notes (the “Notes”) and up to 46,745,866 ordinary shares which may be issued upon the exercise of outstanding

warrants (the “Warrants”). All of the ordinary shares, when sold, will be sold by the selling shareholders. We

are not selling any ordinary shares under this prospectus and will not receive any of the proceeds from the sale or other disposition

of the ordinary shares by the selling shareholders. We will, however, receive the net proceeds of any Warrants exercised for cash,

if any. The selling shareholders became entitled to receive the ordinary shares (some of which are upon their conversion of Notes

or exercise of Warrants) offered by this prospectus in private placements completed in May 2021 and September 2021 in reliance on exemptions

from registration under the Securities Act.

The

selling shareholders may sell or otherwise dispose of some or all the ordinary shares covered by this prospectus in a number of different

ways and at varying prices. We provide more information about how the selling shareholders may sell or otherwise dispose of their

ordinary shares in the section entitled “Plan of Distribution” on page 17. Discounts, concessions, commissions and similar

selling expenses attributable to the sale of ordinary shares covered by this prospectus will be borne by the selling shareholders. We

will pay the expenses incurred in registering the ordinary shares covered by this prospectus, including legal and accounting fees. We

will not be paying any underwriting discounts or commissions in this offering.

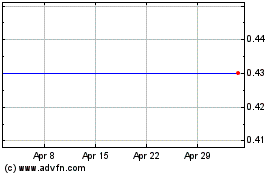

Our

ordinary shares are listed on the Nasdaq Capital Market under the symbol BRQS. On September 27, 2021, the closing price for an

ordinary share on the Nasdaq Capital Market was $0.66.

Investing

in our securities involves a high degree of risk. As we conduct most of our sales to customers

in the U.S., Europe and India while sourcing and manufacturing substantially all of our hardware products from China, we are subject

to legal and operational risks related to operations in China, which risks could result in a material change in our operations and/or

affect the value of our ordinary shares and our ability to offer or continue to offer securities to investors. Before making an

investment decision, please read “Risk Factors” beginning on page 4 of this prospectus and any other risk factor included

in any accompanying prospectus supplement and in the documents incorporated by reference into this prospectus or any prospectus supplement.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is September , 2021.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some

of the statements in this prospectus may constitute “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, as amended (“Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended

(“Exchange Act”). These statements relate to future events concerning our business and to our future revenues, operating

results and financial condition. In some cases, you can identify forward-looking statements by terminology such as “may,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “forecast,” “predict,” “propose,”

“potential” or “continue,” or the negative of those terms or other comparable terminology.

Any

forward looking statements contained in this prospectus are only estimates or predictions of future events based on information currently

available to our management and management’s current beliefs about the potential outcome of future events. Whether these future

events will occur as management anticipates, whether we will achieve our business objectives, and whether our revenues, operating results

or financial condition will improve in future periods are subject to numerous risks. There are a number of important factors that could

cause actual results to differ materially from the results anticipated by these forward-looking statements. These important factors include

those that we discuss under the heading “Risk Factors” and in other sections of our Annual Report on Form 20-F for the year

ended December 31, 2020, including all amendments thereto, as filed with the Securities and Exchange Commission (SEC), as well as in

our other reports filed from time to time with the SEC that are incorporated by reference into this prospectus. You should read these

factors and the other cautionary statements made in this prospectus and in the documents we incorporate by reference into this prospectus

as being applicable to all related forward-looking statements wherever they appear in this prospectus or the documents we incorporate

by reference into this prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our

actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied

by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result

of new information, future events or otherwise, except as required by law.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-1 that we filed with the SEC using a continuous offering process.

You

should read this prospectus, exhibits filed as part of the registration statement and the information and documents incorporated by reference

carefully. Such documents contain important information you should consider when making your investment decision. See “Where You

Can Find Additional Information” and “Incorporation of Information by Reference” in this prospectus.

You

should rely only on the information provided in this prospectus, exhibits filed as part of the registration statement or documents incorporated

by reference into this prospectus. We have not authorized anyone to provide you with different information. This prospectus covers offers

and sales of our ordinary shares only in jurisdictions in which such offers and sales are permitted. The information contained in this

prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of

our ordinary shares. You should not assume that the information contained in this prospectus is accurate as of any date other than the

date on the front cover of this prospectus, or that the information contained in any document incorporated by reference is accurate as

of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any

sale of a security.

In

this prospectus, we refer to Borqs Technologies, Inc. as “we,” “us,” “our,” the “Company”

or “Borqs.” You should rely only on the information we have provided or incorporated by reference in this prospectus, exhibits

filed as part of the registration statement, any applicable prospectus supplement and any related free writing prospectus. We have not

authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information

or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus.

BORQS

TECHNOLOGIES, INC.

Borqs

Technologies, Inc. (formerly known as “Pacific Special Acquisition Corp.”, and hereinafter referred to as the “Company”

“Borqs Technologies”, “Borqs” or “we”) was incorporated in the British Virgin Islands on July 1,

2015. The Company was formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation, purchasing

all or substantially all of the assets of, entering into contractual arrangements, or engaging in any other similar business combination

with one or more businesses or entities.

On

August 18, 2017, the Company acquired 100% of the equity interest of BORQS International Holding Corp. (“Borqs International”)

and its subsidiaries, variable interest entities (the “VIE”) and the VIE’s subsidiaries (collectively referred to as

“Borqs Group” hereinafter) (the Company and Borqs Group collectively referred to as the “Group”) in an all-stock

merger transaction. Concurrent with the completion of the acquisition of Borqs International, the Company changed its name from Pacific

Special Acquisition Corp., to Borqs Technologies, Inc.

Our

principal place of business is located at Suite 309, 3/F, Dongfeng KASO, Dongfengbeiqiao, Chaoyang District, Beijing 100016, People’s

Republic of China. Our telephone number is +86 10 6437 8678. Our agent in the BVI is Kingston Chambers and their address is P.O. Box

173, Road Town, Tortola, British Virgin Islands.

We

are a global leader in software, development services and products providing customizable, differentiated and scalable Android-based

smart connected devices and cloud service solutions. We are a leading provider of commercial grade Android platform software for mobile

chipset manufacturers, mobile device OEMs and mobile operators, as well as complete product solutions of mobile connected devices for

enterprise and consumer applications.

Our

Connected Solutions business unit (the “Connected Solutions BU”) works closely with chipset partners to develop new connected

devices. Borqs developed the reference Android software platform and hardware platform for Intel and Qualcomm phones and tablets. We

provide Connected Solutions customers with customized, integrated, commercial grade Android platform software and service solutions to

address vertical market segment needs through the targeted BorqsWare software platform solutions. The BorqsWare software platform consists

of BorqsWare Client Software and BorqsWare Server Software. The BorqsWare Client Software platform has been used in Android phones, tablets,

watches and various Internet-of-things (“IoT”) devices. The BorqsWare Server Software platform consists of back-end server

software that allows customers to develop their own mobile end-to-end services for their devices.

Our

mobile virtual network operator, or MVNO, business unit provided a full range 2G/3G/4G voice and data services for general consumer usage

and IoT devices, as well as traditional telecom services such as voice conferencing. We decided to sell the MVNO BU in order to focus

on the growing IoT industry via our Connected Solutions BU, especially with the coming of 5G.

In

November 2018, the Company’s board of directors approved the plan to dispose all of its tangible and intangibles assets related

to Yuantel, our MVNO BU, the Consolidated VIEs through a series of agreements, signed in November 2018 and February 2019, with Jinan

Yuantel Communication Technology LLP (“Jinan Yuantel”) and Jinggangshan Leiyi Venture Capital LLP (“JGS Venture”).

According to the agreements, all of the Company’s 75% equity interest in Yuantel would be disposed at a consideration of RMB108.7

million. The Company received only $5.98 million from the buyers within the year ended December 31, 2019, so the Company, then amended

the agreement with other third-party buyers (the “New Buyers”) of Yuantel as of September 1, 2020 to sell the remaining percentage

of Yuantel owned by the Company for $4.54 million, of which approximately $0.4 million were received and the balance of $4.14 million

was to be received by September 30, 2020, which was later postponed to October 2020 by both parties. The Company received the last payment

of $1.2 million on October 27, 2020, and completed the disposition of Yuantel on October 29, 2020. The New Buyers also purchased the

ownership of Yuantel that was first sold to other purchasers in 2019. The disposal of the Consolidated VIEs represents a strategic shift

for the Company and has a major effect on the Company’s results of operations. Accordingly, assets and liabilities related to the

Consolidated VIEs were reclassified as held for sale as the carrying amounts would be recovered principally through the sale and revenues,

and expenses related to the Consolidated VIEs were reclassified in the accompanying consolidated financial statements as discontinued

operations for all periods presented. The consolidated balance sheets as of December 31, 2019 and 2020 and consolidated statements of

operations for the years ended December 31, 2018, 2019 and 2020 were adjusted to reflect this change. There was no gain or loss recognized

on the reclassification of the discontinued operations as held for sale. The sale of the MVNO business unit was finally completed as

of October 29, 2020, and since then the Company no longer had a VIE within its operating structure.

In

the years ended December 31, 2018, 2019 and 2020, Borqs generated 96.7%, 98.3% and 98.4% of its Connected Solutions BU revenues from

customers headquartered outside of China and 3.3%, 1.7% and 1.6% from customers headquartered in China. As of December 31,

2020, Borqs had collaborated with six mobile chipset manufacturers and 29 mobile device OEMs to commercially launch Android based connected

devices in 11 countries, and sales of connected devices with the BorqsWare software platform solutions are embedded in more than 17 million

units worldwide. The discontinued MVNO BU generated all of its revenue from China.

We

have dedicated significant resources to research and development, and have research and development centers in Beijing, China and Bangalore,

India. As of December 31, 2020, 234 out of the 286 persons under our employ were technical professionals dedicated to platform research

and development and product specific customization.

The

following customers accounted for near 10% or more of our total revenues, not including discontinued operations, for the years indicated:

|

2020

|

GreatCall, Inc.

|

41.9%

|

|

|

|

ECOM Instruments

|

23.1%

|

|

|

|

Qualcomm India Ltd.

|

14.4%

|

|

|

|

|

|

|

|

2019

|

Reliance Retail Limited

|

63.9%

|

|

|

|

GreatCall, Inc.

|

7.8%

|

|

|

|

|

|

|

|

2018

|

Reliance Retail Limited

|

59.6%

|

|

|

|

E La Carte, Inc.

|

8.0%

|

|

Since

2020 and continuing into 2021, the Chinese government has been implementing increasingly stringent rules and regulations on its domestic

business activities, particularly for companies whose shares are listed on U.S. exchanges. Such policy changes have caused profound impact

on the value of the affected companies’ equities and resulted in significant drop in market valuation for their shareholders. The

recent regulatory changes in China have focused on the following industries:

|

|

1)

|

Cryptocurrency

mining and coin offerings

|

|

|

2)

|

Social

media and cyber security

|

|

|

5)

|

Extra-curriculum

education and tutoring

|

|

|

6)

|

Variable

interest entity structures

|

The

Company does not participate in any of the above six categories, and particularly our division that operated a MVNO business under a

variable interest entity structure in China was sold as of October 29, 2020. Also, as indicated in our 2020 Annual Report filed on Form

20-F, our revenues recognized from activities in China represent only 1.6%, 1.7% and 3.3% of our total net revenues for the years 2020,

2019 and 2018, respectively. However, as the rules and regulations in China continue to evolve, the Company may become affected in future

periods causing the public market valuation of our shares to decline.

Corporate

Organizational Chart

The

following diagram illustrates our current corporate structure and the place of formation, ownership interest and affiliation of each

of our subsidiaries and un-consolidated minority interests in certain entities as of September 28, 2021. The corporate organization chart

reflects our completed sale of the MVNO BU which removed the VIE structure by which it was held.

RISK

FACTORS

An

investment in our ordinary shares involves risks. Prior to making a decision about investing in our ordinary shares, you should consider

carefully all of the information contained or incorporated by reference in this prospectus, including any risks in the section entitled

“Risk Factors” contained in any supplements to this prospectus and in our Annual Report on Form 20-F for the fiscal year

ended December 30, 2020, as amended to date, and in our subsequent filings with the SEC. Each of the referenced risks and uncertainties

could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment

in our securities. Additional risks not known to us or that we believe are immaterial may also adversely affect our business, operating

results and financial condition and the value of an investment in our securities.

Risks

Related to Our Business Operations and Doing Business in China

The

Chinese government exerts substantial influence over the manner in which we may conduct our business activities, and if we are unable

to substantially comply with any PRC rules and regulations, our financial condition and results of operations may be materially adversely

affected.

The

Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through

regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those

relating to taxation, environmental regulations, land use rights, property and other matters. The central or local governments of these

jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures

and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future,

including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional

or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular

regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

As

such, our business operations of and the industries we operate in may be subject to various government and regulatory interference in

the provinces in which they operate. We could be subject to regulation by various political and regulatory entities, including various

local and municipal agencies and government sub-divisions. We may incur increased costs necessary to comply with existing and newly adopted

laws and regulations or penalties for any failure to comply. In the event that we are not able to substantially comply with any existing

or newly adopted laws and regulations, our business operations may be materially adversely affected and the value of our ordinary shares

may significantly decrease.

Furthermore,

the PRC government authorities may strengthen oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers like us. Such actions taken by the PRC government authorities may intervene or influence our operations at any

time, which are beyond our control. Therefore, any such action may adversely affect our operations and significantly limit or hinder

our ability to offer or continue to offer securities to you and reduce the value of such securities.

Substantial

uncertainties exist with respect to the interpretation and implementation of any new PRC laws, rules and regulations relating to foreign

investment and how it may impact the viability of our current corporate structure, corporate governance and our business operations.

On

March 15, 2019, the National People’s Congress promulgated the Foreign Investment Law, which came into effect on January 1,

2020 and replaced the three existing laws regulating foreign investment in China, namely, the Sino-foreign Equity Joint Venture

Enterprise Law, the Sino-foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-invested Enterprise Law, together

with their implementation rules and ancillary regulations. The existing foreign-invested enterprises, or FIEs, established prior

to the effectiveness of the Foreign Investment Law may keep their corporate forms within five years. The Foreign Investment Law stipulates

that China implements the management system of pre-establishment national treatment plus a negative list to foreign investment,

and the government generally will not expropriate foreign investment, except under certain special circumstances, in which case it will

provide fair and reasonable compensation to foreign investors. Foreign investors are barred from investing in prohibited industries on

the negative list and must comply with the specified requirements when investing in restricted industries on such list. On December 26,

2019, the State Council promulgated the Implementing Regulations of the Foreign Investment Law, which came into effect on January 1,

2020 and further requires that FIEs and domestic enterprises be treated equally with respect to policy making and implementation.

Pursuant

to the Foreign Investment Law, “foreign investment” means any foreign investor’s direct or indirect investment in the

PRC, including: (i) establishing FIEs in the PRC either individually or jointly with other investors; (ii) obtaining stock shares, stock

equity, property shares, other similar interests in Chinese domestic enterprises; (iii) investing in new project in the PRC either

individually or jointly with other investors; and (iv) making investment through other means provided by laws, administrative regulations

or State Council provisions. Although the Foreign Investment Law does not explicitly classify the contractual arrangements, as a form

of foreign investment, it contains a catch-all provision under the definition of “foreign investment,” which includes

investments made by foreign investors in China through other means stipulated by laws or administrative regulations or other methods

prescribed by the State Council without elaboration on the meaning of “other means.” However, the Implementing Regulations

of the Foreign Investment Law still does not specify whether foreign investment includes contractual arrangements.

Our

shares may be delisted under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for three consecutive

years beginning in 2021. The delisting of our shares, or the threat of their being delisted, may materially and adversely affect the

value of your investment.

The

Holding Foreign Companies Accountable Act, or the HFCA Act, was enacted on December 18, 2020. The HFCA Act states if the SEC determines

that a company has filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB

for three consecutive years beginning in 2021, the SEC shall prohibit such shares from being traded on a national securities exchange

or in the over the counter trading market in the U.S.

On

March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements

of the HFCA Act. A company will be required to comply with these rules if the SEC identifies it as having a “non-inspection”

year under a process to be subsequently established by the SEC. The SEC is assessing how to implement other requirements of the HFCA

Act, including the listing and trading prohibition requirements described above.

The

SEC may propose additional rules or guidance that could impact us if our auditor is not subject to PCAOB inspection. For example, on

August 6, 2020, the President’s Working Group on Financial Markets, or the PWG, issued the Report on Protecting United States Investors

from Significant Risks from Chinese Companies to the then President of the United States. This report recommended the SEC implement five

recommendations to address companies from jurisdictions that do not provide the PCAOB with sufficient access to fulfil its statutory

mandate. Some of the concepts of these recommendations were implemented with the enactment of the HFCA Act. However, some of the recommendations

were more stringent than the HFCA Act. For example, if a company’s auditor was not subject to PCAOB inspection, the report recommended

that the transition period before a company would be delisted would end on January 1, 2022.

The

SEC has announced that the SEC staff is preparing a consolidated proposal for the rules regarding the implementation of the HFCA Act

and to address the recommendations in the PWG report. It is unclear when the SEC will complete its rulemaking and when such rules will

become effective and what, if any, of the PWG recommendations will be adopted. The implications of this possible regulation in addition

to the requirements of the HFCA Act are uncertain. Such uncertainty could cause the market price of our shares to be materially and adversely

affected, and our securities could be delisted or prohibited from being traded on the national securities exchange earlier than would

be required by the HFCA Act. If our shares are unable to be listed on another securities exchange by then, such a delisting would substantially

impair your ability to sell or purchase our shares when you wish to do so, and the risk and uncertainty associated with a potential delisting

would have a negative impact on the price of our shares.

Risks

Related to Our Ordinary Shares

The

outstanding Notes and Warrants contain full-ratchet anti-dilution protection, which may cause significant dilution to our stockholders.

As

of September 28, 2021, we had outstanding 146,390,642 ordinary shares. As of that date we had outstanding Notes and Warrants issuable

into an aggregate of 81,346,292 ordinary shares. The issuance of ordinary shares upon the conversion or exercise of these securities

would dilute the percentage ownership interest of all shareholders, might dilute the book value per share of our ordinary shares and

would increase the number of our publicly traded shares, which could depress the market price of our ordinary shares. The Notes and Warrants

contain full-ratchet anti-dilution provisions which, subject to limited exceptions, would reduce the conversion price or exercise price

of such securities (and increase the number of shares issuable) in the event that we in the future issue ordinary shares, or securities

convertible into or exercisable to purchase ordinary shares, at price per share lower than the conversion price or exercise price then

in effect, to such lower price. Our outstanding Notes convertible into an aggregate of 43,949,597 shares at a conversion price equal

to the lower of (i) $0.6534 per share, (ii) 90% of the closing price of the ordinary shares on the date that the registration statement

of which this prospectus forms a part is declared effective, or (iii) in the event that the registration statement of which this prospectus

form a part is not declared effective by the date that the shares underlying the Notes are eligible to be sold, assigned or transferred

under Rule 144, 90% of the closing price of the ordinary shares on such date. Our outstanding Warrants are convertible into an aggregate

of 37,396,694 shares at an exercise price of $0.8682 per share. This full ratchet anti-dilution provision would be triggered by

the future issuance by us of ordinary shares or ordinary share equivalents at a price per share below the then-conversion price of all

of our outstanding notes and Warrants, subject to limited exceptions.

INCORPORATION

OF DOCUMENTS BY REFERENCE

The

SEC allows us to incorporate by reference the information we file with them. This means that we can disclose important information to

you by referring you to those documents. Each document incorporated by reference is current only as of the date of such document, and

the incorporation by reference of such documents should not create any implication that there has been no change in our affairs since

such date. The information incorporated by reference is considered to be a part of this prospectus and should be read with the same care.

When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC,

the information incorporated by reference in this prospectus is considered to be automatically updated and superseded. In other words,

in the case of a conflict or inconsistency between information contained in this prospectus and information incorporated by reference

into this prospectus, you should rely on the information contained in the document that was filed later.

We

incorporate by reference the documents listed below:

|

|

●

|

Our annual report on Form 20-F for the fiscal year ended December 31, 2020 filed with the SEC on April 26, 2021;

|

|

|

●

|

Amendment No. 1 to our annual report

on Form 20-F/A for the

fiscal year ended December 31, 2020 filed with the SEC on June 14, 2021;

Amendment No. 2 to our annual report on Form 20-F/A for the fiscal year ended December 31, 2020 filed with the SEC on September 13, 2021

|

|

|

●

|

Form 6-K filed with the SEC on February 22, 2021;

|

|

|

●

|

Form 6-K filed with the SEC on May 5, 2021;

|

|

|

●

|

Form 6-K filed with the SEC on May 7, 2021

|

|

|

●

|

Form 6-K filed with the SEC on June 7, 2021;

|

|

|

●

|

Form 6-K filed with the SEC on June 15, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on June 22, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on June 23, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on July 7, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on July 15, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on July 22, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on July 30, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on August 10, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on August 11, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on August 20, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on September 9, 2021;

|

|

|

|

|

|

|

●

|

Form 6-K filed with the SEC on September 17, 2021; and

|

|

|

|

|

|

|

●

|

Form 6-K filed

with the SEC on September 28, 2021.

|

|

|

●

|

The description of our ordinary shares contained in our registration statement on Form 8-A filed on October 13, 2015 pursuant to Section 12 of the Exchange Act, together with all amendments and reports filed for the purpose of updating that description.

|

Unless

expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to,

but not filed with, the SEC. We post our SEC filings on our website, www.borqs.com. We will also provide to you, upon your written

or oral request, without charge, a copy of any or all of the documents we refer to above which we have incorporated in this prospectus

by reference, other than exhibits to those documents unless such exhibits are specifically incorporated by reference in the documents.

You should direct your requests to Anthony Chan, our Chief Financial Officer, at Suite 309, 3/F, Dongfeng KASO, Dongfengbeiqiao, Chaoyang

District, Beijing 100016, China. Our telephone number at this address is +86 10 6437 8678.

SELLING

SHAREHOLDERS

This

prospectus relates to the resale by the selling shareholders identified below of up to 101,682,863 ordinary shares, including 54,936,997

ordinary shares that may be issued upon the conversion of $28,716,667 of Notes and 46,745,866 ordinary shares which may be issued upon

the exercise of outstanding Warrants. We are contractually required to register 125% of the number of ordinary shares issuable

under the Notes and the number of ordinary shares issuable upon the exercise of outstanding Warrants. The actual number of shares, if

any, to be issued may be more or less than such number, and any shares issued in excess of such number will not be eligible for sale

under this prospectus, unless amended.

Selling

Shareholders Table

The

table below sets forth:

|

|

●

|

the names and address of

the selling shareholders;

|

|

|

●

|

the number of ordinary

shares beneficially owned by the selling shareholders as of September 28, 2021;

|

|

|

●

|

the

maximum number of ordinary shares that may be sold or disposed of by the selling shareholders

under

this prospectus;

|

|

|

●

|

the

number of ordinary shares that would be owned by the selling shareholders after completion of the offering,

assuming

the sale of all of the ordinary shares covered by this prospectus; and

|

|

|

●

|

the

percentage of ordinary shares beneficially owned by the selling shareholders based on 146,390,642 ordinary shares outstanding on

September 28, 2021.

|

None

of the selling shareholders is a broker-dealer regulated by the Financial Industry Regulatory Authority. Other than the agreements

noted above, none of the selling shareholders has had any position, office or other material relationship with the Company in the past

three years. All information with respect to share ownership has been furnished by the selling shareholders. The shares being

offered are being registered to permit public secondary trading of such shares and each selling shareholders may offer all or part of

the shares it owns for resale from time to time pursuant to this prospectus.

The

term “selling shareholder” also includes any pledgees, donees, transferees or other successors in interest to the selling

shareholders named in the table below. Unless otherwise indicated, to our knowledge, each person named in the table below has voting

power and investment power (subject to applicable community property laws) with respect to the shares of common stock set forth opposite

such person’s name. We will file a supplement to this prospectus (or a post-effective amendment hereto, if necessary) to

name successors to any named selling shareholders who are able to use this prospectus to resell the securities registered hereby.

Beneficial

ownership is determined under the rules of the SEC. The number of shares beneficially owned by a person includes shares of common

stock underlying warrants, stock options and other derivative securities to acquire our common stock held by that person that are currently

exercisable or convertible within 60 days after September 28, 2021. The shares issuable under these securities are treated as outstanding

for computing the percentage ownership of the person holding these securities, but are not treated as outstanding for the purposes of

computing the percentage ownership of any other person.

As

explained below under “Plan of Distribution,” we have agreed with the selling shareholders to bear certain expenses (other

than broker discounts and commissions, if any) in connection with the registration statement, which includes this prospectus.

|

|

|

Ordinary Shares Beneficially Owned Prior to the Offering

|

|

|

Shares

Being

|

|

|

Ordinary Shares Beneficially Owned After the Offering

|

|

|

Selling Shareholders

|

|

Shares(1)

|

|

|

Percentage(2)

|

|

|

Offered

|

|

|

Shares

|

|

|

Percentage

|

|

|

Esousa Holdings, LLC(3)

|

|

|

29,078,666

|

(4)

|

|

|

16.57

|

%

|

|

|

36,348,332

|

(5)

|

|

|

0

|

|

|

|

0

|

%

|

|

LMFA Financing, LLC(6)

|

|

|

1,377,410

|

(7)

|

|

|

0.93

|

%

|

|

|

1,721,763

|

(8)

|

|

|

0

|

|

|

|

0

|

%

|

|

American West Pacific International Investment

Corporation(9)

|

|

|

5,815,733

|

(10)

|

|

|

3.82

|

%

|

|

|

7,269,666

|

(11)

|

|

|

0

|

|

|

|

0

|

%

|

|

Jess Mogul(12)

|

|

|

3,928,171

|

(13)

|

|

|

2.64

|

%

|

|

|

4,910,213

|

(14)

|

|

|

0

|

|

|

|

0

|

%

|

|

Jim Fallon(15)

|

|

|

2,907,866

|

(16)

|

|

|

1.95

|

%

|

|

|

3,634,833

|

(17)

|

|

|

0

|

|

|

|

0

|

%

|

|

Digital Power Lending, LLC(18)

|

|

|

2,907,866

|

(19)

|

|

|

1.95

|

%

|

|

|

3,634,833

|

(20)

|

|

|

0

|

|

|

|

0

|

%

|

|

TDR Capital Pty Limited(21)

|

|

|

20,355,066

|

(22)

|

|

|

12.21

|

%

|

|

|

25,443,832

|

(23)

|

|

|

0

|

|

|

|

0

|

%

|

|

BRRR Management LLC(24)

|

|

|

14,539,332

|

(25)

|

|

|

9.03

|

%

|

|

|

18,174,165

|

(26)

|

|

|

|

|

|

|

0

|

%

|

|

Michael Friedlander

|

|

|

290,787

|

(27)

|

|

|

0.20

|

%

|

|

|

363,483

|

(28)

|

|

|

|

|

|

|

0

|

%

|

|

Paul F. Pelosi, Jr.

|

|

|

145,394

|

(29)

|

|

|

0.10

|

%

|

|

|

181,742

|

(30)

|

|

|

|

|

|

|

0

|

%

|

|

|

(1)

|

Represents

the number of ordinary shares that may be issued in connection with the conversion of the Notes and upon the exercise of Warrants as

of the date of the table. Although this column does not reflect it, we have contractually agreed to register 125% of the number

of ordinary shares issuable under the Notes and the number of ordinary shares issuable upon the exercise of outstanding Warrants.

|

|

|

(2)

|

The

Notes and Warrants held by a particular holder will not be convertible or exercisable to the extent such conversion or exercise would

result in such holder owning more than 9.9% of the number of ordinary shares outstanding after giving effect to the issuance of ordinary

shares issuable upon such conversion or exercise calculated in accordance with Section 13d of the Exchange Act.

|

|

|

(3)

|

Michael

Wachs has sole authority to vote and dispose of the securities held by Esousa Holdings, LLC (“Esousa”) and may be deemed

to be the beneficial owner of these securities. The business address for Esousa is 211 East 43rd Street, Suite 402, New York,

NY 10017.

|

|

|

(4)

|

Represents

15,304,561 ordinary shares issuable upon the conversion of Notes and 13,774,105 ordinary shares issuable upon exercise of Warrants.

|

|

|

(5)

|

Represents

125% of 15,304,561 ordinary shares issuable upon the conversion of Notes and 125% of 13,774,105 ordinary shares issuable upon exercise

of Warrants.

|

|

|

(6)

|

Bruce

Rodgers and Richard Russell have shared authority to vote and dispose of the securities held by LMFA Financing, LLC (“LMFA”)

and may be deemed to be the beneficial owners of these securities. The business address for LMFA is 1200 W Plat Street, Suite 100, Tampa,

FL 33602.

|

|

|

(7)

|

Represents

1,377,410 ordinary shares issuable upon the conversion of Notes.

|

|

|

(8)

|

Represents

125% of 1,377,410 ordinary shares issuable upon the conversion of Notes.

|

|

|

(9)

|

Sherry

H. Jiang has sole authority to vote and dispose of the securities held by American West Pacific International Investment Corporation

(“American West”) and may be deemed to be the beneficial owner of these securities. The business address for American West

is 1 Sansome Street, Suite 3500, San Francisco, CA 94104.

|

|

|

(10)

|

Represents

3,060,912 ordinary shares issuable upon the conversion of Notes and 2,754,821 ordinary shares issuable upon exercise of Warrants.

|

|

|

(11)

|

Represents

125% of 3,060,912 ordinary shares issuable upon the conversion of Notes and 125% 2,754,821 ordinary shares issuable upon exercise of

Warrants.

|

|

|

(12)

|

The

address for this security holder is 347 West 87th Street, New York, NY 10024.

|

|

|

(13)

|

Represents

2,550,761 ordinary shares issuable upon the conversion of Notes and 1,377,410 ordinary shares issuable upon exercise of Warrants.

|

|

|

(14)

|

Represents

125% of 2,550,761 ordinary shares issuable upon the conversion of Notes and 125% of 1,377,410 ordinary shares issuable upon exercise

of Warrants.

|

|

|

(15)

|

The

address for this security holder is 137 West 83rd Street, New York, NY 10024.

|

|

|

(16)

|

Represents

1,530,456 ordinary shares issuable upon the conversion of Notes and 1,377,410 ordinary shares issuable upon exercise of Warrants.

|

|

|

(17)

|

Represents

125% of 1,530,456 ordinary shares issuable upon the conversion of Notes and 125% of 1,377,410 ordinary shares issuable upon exercise

of Warrants.

|

|

|

(18)

|

David

J. Katzoff has sole authority to vote and dispose of the securities held by Digital Power Lending, LLC (“Digital Power”).

The address for Digital Power is 201 Shipyard Way, Suite E, Newport Beach CA 92663.

|

|

|

(19)

|

Represents

1,530,456 ordinary shares issuable upon the conversion of Notes and 1,377,410 ordinary shares issuable upon exercise of Warrants.

|

|

|

(20)

|

Represents

125% of 1,530,456 ordinary shares issuable upon the conversion of Notes and 125% of 1,377,410 ordinary shares issuable upon exercise

of Warrants.

|

|

|

(21)

|

Timothy

Davis-Rice has sole authority to vote and dispose of the securities held by TDR Capital Pty Limited (“TDR”). The address

for TDR is 4 Murchison Street, Mittagong NSW 2575 Australia.

|

|

|

(22)

|

Represents

10,713,193 ordinary shares issuable upon the conversion of Notes and 9,641,873 ordinary shares issuable upon exercise of Warrants.

|

|

|

(23)

|

Represents

125% of 10,713,193 ordinary shares issuable upon the conversion of Notes and 125% of 9,641,873 ordinary shares issuable upon exercise

of Warrants.

|

|

|

(24)

|

Richard

Russell has sole authority to vote and dispose of the securities held by BRRR Management LLC (“BRRR”). The address for BRRR

is 1200 W Platt Street, Suite 100 Tampa, FL 33606.

|

|

|

(25)

|

Represents

7,652,280 ordinary shares issuable upon the conversion of Notes and 6,887,052 ordinary shares issuable upon exercise of Warrants.

|

|

|

(26)

|

Represents

125% of 7,652,280 ordinary shares issuable upon the conversion of Notes and 125% of 6,887,052 ordinary shares issuable upon exercise

of Warrants.

|

|

|

(27)

|

Represents

153,046 ordinary shares issuable upon the conversion of Notes and 137,741 ordinary shares issuable upon exercise of Warrants.

|

|

|

(28)

|

Represents

125% of 153,046 ordinary shares issuable upon the conversion of Notes and 125% of 137,741 ordinary shares issuable upon exercise of Warrants.

|

|

|

(29)

|

Represents

76,523 ordinary shares issuable upon the conversion of Notes and 68,871 ordinary shares issuable upon exercise of Warrants.

|

|

|

(30)

|

Represents

125% of 76,523 ordinary shares issuable upon the conversion of Notes and 125% of 68,871 ordinary shares issuable upon exercise of Warrants.

|

DESCRIPTION

OF OUR CAPITAL STOCK

We

are a company incorporated in the British Virgin Islands as a BVI business company (company number 1880410) and our affairs are governed

by our memorandum and articles of association, the BVI Business Companies Act (as amended) and the common law of the British Virgin Islands.

We are authorized to issue an unlimited number of both ordinary shares of no par value and preferred shares of no par value. The following

description summarizes certain terms of our shares as set out more particularly in our memorandum and articles of association. Because

it is only a summary, it may not contain all the information that is important to you.

Ordinary

Shares

As

of September 28, 2021, there are 146,390,642 ordinary shares outstanding. Under the BVI Business Companies Act (as amended), the ordinary

shares are deemed to be issued when the name of the shareholder is entered in our register of members. Our register of members is maintained

by our transfer agent, Continental Stock Transfer & Trust Company. Our transfer agent has entered the name of Cede & Co. in our

register of members as nominee for each of the respective public shareholders. If (a) information that is required to be entered in the

register of members is omitted from the register or is inaccurately entered in the register, or (b) there is unreasonable delay in entering

information in the register, a shareholder of the company, or any person who is aggrieved by the omission, inaccuracy or delay, may apply

to the British Virgin Islands Courts for an order that the register be rectified, and the court may either refuse the application or

order the rectification of the register, and may direct the company to pay all costs of the application and any damages the applicant

may have sustained.

Any

action required or permitted to be taken by our shareholders must be effected by a meeting of shareholders of our company, duly convened

and held in accordance with our memorandum and articles of association. A resolution of our members may not be taken by a resolution

consented to in writing.

At

any general meeting of our shareholders, the chairman of the meeting is responsible for deciding in such manner as he or she considers

appropriate whether any resolution proposed has been carried or not and the result of his decision shall be announced to the meeting

and recorded in the minutes of the meeting. If the chairman has any doubt as to the outcome of the vote on a proposed resolution, the

chairman shall cause a poll to be taken of all votes cast upon such resolution. If the chairman fails to take a poll then any member

present in person or by proxy who disputes the announcement by the chairman of the result of any vote may immediately following such

announcement demand that a poll be taken and the chairman shall cause a poll to be taken. If a poll is taken at any meeting, the result

shall be announced to the meeting and recorded in the minutes of the meeting.

A

resolution of our shareholders shall be duly and validly passed if it is approved at a duly convened and constituted meeting of our shareholders

by the affirmative vote of a majority of the votes of the shares entitled to vote thereon which were present at the meeting and were

voted. Each ordinary share in our company confers upon the shareholder the right to one vote at any meeting of our shareholders or on

any resolution of shareholders.

The

rights and obligations attaching to our ordinary shares may only be varied by a resolution passed at a meeting by the holders of more

than fifty percent (50%) of the ordinary shares present at a duly convened and constituted meeting of our shareholders holding ordinary

shares which were present at the meeting. The other provisions of our memorandum and articles of association may be amended if approved

by a resolution of our shareholders or by a resolution of our directors (save that no amendment may be made by a resolution of our directors

(a) to restrict the rights or powers of our shareholders to amend the memorandum or articles, (b) to change the percentage of shareholders

required to pass a resolution of shareholders to amend the memorandum or articles, (c) in circumstances where the memorandum or articles

cannot be amended by our shareholders, or (d) to change clauses 7, 8 or 11 of our memorandum (or any of the defined terms used in any

such clause or regulation).

In

accordance with our memorandum and articles of association, our Board is divided into three classes, with the number of directors in

each class to be as nearly equal as possible. Our existing Class I directors will serve until our 2018 annual general meeting, our existing

Class II directors will serve until our 2019 annual general meeting, and our existing Class III directors will serve until our 2020 annual

general meeting. Commencing at our 2018 annual general meeting, and at each following annual general meeting, directors elected to succeed

those directors whose terms expire shall be elected for a term of office to expire at the third annual general meeting following their

election. There is no cumulative voting with respect to the election of directors, with the result that the holders of more than 50%

of the votes of the shares entitled to vote at any general meeting of our members at which the election of directors is voted upon can

elect all of the directors (and the holders of more than 50% of the votes of the shares entitled to vote at any general meeting of our

members at which the removal of our directors is voted upon can remove a director with or without cause).

Our

shareholders are entitled to receive ratable dividends when, as and if declared by the Board. Under the laws of the British Virgin

Islands, and as provided in our memorandum and articles of association, our directors may authorize a distribution (including any interim

dividend that the directors consider to be justified by the profits of our company) only if, immediately after the distribution, the

value of our assets will exceed our liabilities, and we will be able to pay our debts as and when they fall due. In the event of a liquidation

or winding up of the company, our shareholders are entitled to share ratably in all assets remaining available for distribution to them

after payment of liabilities and after provision is made for each class of shares, if any, having preference over the ordinary shares.

Our shareholders have no preemptive or other subscription rights. There are no sinking fund provisions applicable to the ordinary shares,

except that we will provide our shareholders with the redemption rights set forth above.

Preferred

Shares

Our

memorandum and articles of association authorizes the creation and issuance without shareholder approval of an unlimited number of preferred

shares divided into five classes, Class A through Class E each with such further designation, rights and preferences as may be determined

by a resolution of our Board to amend the memorandum and articles of association to create such designations, rights and preferences.

We have five classes of preferred shares to give us flexibility as to the terms on which each Class is issued. Unlike Delaware law, all

shares of a single class must be issued with the same rights and obligations. Accordingly, starting with five classes of preferred shares

will allow us to issue shares at different times on different terms. Accordingly, our Board is empowered, without shareholder approval,

to issue preferred shares with dividend, liquidation, redemption, voting or other rights, which could adversely affect the voting power

or other rights of the holders of ordinary shares. These preferred shares could be utilized as a method of discouraging, delaying or

preventing a change in control of us.

No

preferred shares are currently issued or outstanding. Although we do not currently intend to issue any preferred shares, we may do so

in the future.

The

rights attached to any class of preferred shares in issue, may only be amended by a resolution passed at a meeting by the holders of

more than fifty percent (50%) of the preferred shares of that same class present at a duly convened and constituted meeting of our members

holding preferred shares in such class which were present at the meeting and voted, unless otherwise provided by the terms of issue of

such class. If our preferred shareholders want us to hold a meeting of preferred shareholders (or of a class of preferred shareholders),

they may requisition the directors to hold one upon the written request of preferred shareholders entitled to exercise at least 30 percent

of the voting rights in respect of the matter for which the meeting is requested. Under British Virgin Islands law, we may not increase

the required percentage to call a meeting above 30 percent.

Under

the BVI Business Companies Act (as amended) there are no provisions which specifically prevent the issuance of preferred shares or any

such other “poison pill” measures. Our memorandum and articles of association also do not contain any express prohibitions

on the issuance of any preferred shares. Therefore, the directors, without the approval of the holders of ordinary shares, may issue

preferred shares that have characteristics that may be deemed anti-takeover. Additionally, such a designation of shares may be used in

connection with plans that are poison pill plans. However, under the BVI Business Companies Act (as amended), a director in the exercise

of his powers and performance of his duties is required to act honestly and in good faith in what the director believes to be the best

interests of the company, and a director is also required to exercise his powers as a director for a proper purpose.

2017

Warrants

As

of September 28, 2021, we had outstanding 6,281,875 warrants issued by the predecessor special purpose acquisition company to purchase

ordinary shares (excluding the Warrants), which warrants were registered in connection with our initial public offering. Each public

warrant entitles the registered holder to purchase one half of one ordinary share at a price of $12.00 per full share, subject to adjustment

as discussed below. Pursuant to the warrant agreement, a warrant holder may exercise its warrants only for a whole number of shares.

This means that only an even number of warrants may be exercised at any given time by a warrant holder. However, no public warrants will

be exercisable for cash unless we have an effective and current registration statement covering the ordinary shares issuable upon exercise

of the warrants and a current prospectus relating to such ordinary shares. Notwithstanding the foregoing, if a registration statement

covering the ordinary shares issuable upon exercise of the public warrants is not effective within 90 days from August 18, 2017, warrant

holders may, until such time as there is an effective registration statement and during any period when we shall have failed to maintain

an effective registration statement, exercise warrants on a cashless basis pursuant to an available exemption from registration under

the Securities Act. If an exemption from registration is not available, holders will not be able to exercise their warrants on a cashless

basis. The warrants will expire on the fifth anniversary of the consummation of the acquisition of Borqs International by way of merger

at 5:00 p.m., New York City time.

As

of September 28, 2021, we had outstanding (i) 417,166 assumed warrants with an exercise price of $5.36 per share, (ii) 3,250,000 warrants

with an exercise price of $1.25 per share, and (iii) 100,000 warrants with an exercise price $0.01 per share, to purchase ordinary shares

that are not yet registered. These private warrants are identical to the public warrants except that such private warrants are not registered

and will be exercisable for cash (even if a registration statement covering the ordinary shares issuable upon exercise of such warrants

is not effective) or on a cashless basis, at the holder’s option, and will not be redeemable by us, in each case so long as they

are still held by the initial purchasers or their affiliates.

We

may call the public warrants for redemption, in whole and not in part, at a price of $0.01 per warrant:

|

|

●

|

at any time while the warrants

are exercisable,

|

|

|

●

|

upon not less than 30 days’

prior written notice of redemption to each warrant holder,

|

|

|

●

|

if, and only if, the reported

last sale price of the ordinary shares equals or exceeds $18.00 per share, for any 20 trading days within a 30 trading day period

ending on the third business day prior to the notice of redemption to warrant holders, and

|

|

|

●

|

if, and only if, there

is a current registration statement in effect with respect to the ordinary shares underlying such warrants at the time of redemption

and for the entire 30-day trading period referred to above and continuing each day thereafter until the date of redemption.

|

The

right to exercise will be forfeited unless the warrants are exercised prior to the date specified in the notice of redemption. On and

after the redemption date, a record holder of a warrant will have no further rights except to receive the redemption price for such holder’s

warrant upon surrender of such warrant.

The

redemption criteria for our warrants have been established at a price which is intended to provide warrant holders a reasonable premium

to the initial exercise price and provide a sufficient differential between the then-prevailing share price and the warrant exercise

price so that if the share price declines as a result of our redemption call, the redemption will not cause the share price to drop below

the exercise price of the warrants.

If

we call the warrants for redemption as described above, our management will have the option to require all holders that wish to exercise

warrants to do so on a “cashless basis.” In such event, each holder would pay the exercise price by surrendering the warrants

for that number of ordinary shares equal to the quotient obtained by dividing (x) the product of the number of ordinary shares underlying

the warrants, multiplied by the difference between the exercise price of the warrants and the “fair market value” (defined

below) by (y) the fair market value. The “fair market value” shall mean the average reported last sale price of the ordinary

shares for the 10 trading days ending on the third trading day prior to the date on which the notice of redemption is sent to the holders

of warrants. Whether we will exercise our option to require all holders to exercise their warrants on a “cashless basis”

will depend on a variety of factors including the price of our ordinary shares at the time the warrants are called for redemption, our

cash needs at such time and concerns regarding dilutive share issuances.

The

warrants were issued in registered form under a warrant agreement between Continental Stock Transfer & Trust Company, as warrant

agent, and us. The warrant agreement provides that the terms of the warrants may be amended without the consent of any holder to cure

any ambiguity or correct any defective provision, but requires the approval, by written consent or vote, of the holders of a majority

of the then outstanding warrants in order to make any change that adversely affects the interests of the registered holders.

The

exercise price and number of ordinary shares issuable on exercise of the warrants may be adjusted in certain circumstances including

in the event of a share dividend, extraordinary dividend or our recapitalization, reorganization, merger or consolidation. However, the

warrants will not be adjusted for issuances of ordinary shares at a price below their respective exercise prices.

The

warrants may be exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant

agent, with the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full

payment of the exercise price, by certified or official bank check payable to us, for the number of warrants being exercised. The warrant

holders do not have the rights or privileges of holders of ordinary shares and any voting rights until they exercise their warrants and

receive ordinary shares. After the issuance of ordinary shares upon exercise of the warrants, each holder will be entitled to one vote

for each share held of record on all matters to be voted on by shareholders.

Except

as described above, no public warrants will be exercisable and we will not be obligated to issue ordinary shares unless at the time a

holder seeks to exercise such warrant, a prospectus relating to the ordinary shares issuable upon exercise of the warrants is current

and the ordinary shares have been registered or qualified or deemed to be exempt under the securities laws of the state of residence

of the holder of the warrants. Under the terms of the warrant agreement, we have agreed to use our best efforts to meet these conditions

and to maintain a current prospectus relating to the ordinary shares issuable upon exercise of the warrants until the expiration of the

warrants. However, we cannot assure you that we will be able to do so and, if we do not maintain a current prospectus relating to the

ordinary shares issuable upon exercise of the warrants, holders will be unable to exercise their warrants and we will not be required

to settle any such warrant exercise. If the prospectus relating to the ordinary shares issuable upon the exercise of the warrants is

not current or if the ordinary shares is not qualified or exempt from qualification in the jurisdictions in which the holders of the

warrants reside, we will not be required to net cash settle or cash settle the warrant exercise, the warrants may have no value, the

market for the warrants may be limited and the warrants may expire worthless.

Warrant

holders may elect to be subject to a restriction on the exercise of their warrants such that an electing warrant holder would not be

able to exercise their warrants to the extent that, after giving effect to such exercise, such holder would beneficially own in excess

of 9.9% of the ordinary shares outstanding.

No

fractional shares will be issued upon exercise of warrants. If, upon exercise of the warrants, a holder would be entitled to receive

a fractional interest in a share, we will, upon exercise, round up or down to the nearest whole number the number of ordinary shares

to be issued to the warrant holder.

In

connection with our acquisition of Borqs International by way of merger, holders of issued and outstanding warrants to purchase shares

of Borqs International received replacement warrants to purchase an aggregate of 344,559 of our ordinary shares, the terms and conditions

of which are as described above.

Prior

Private Placement Notes and Warrants

On

February 25, 2021 and April 14, 2021 we entered into securities purchase agreements with institutional and individual investors, pursuant

to which we sold approximately $6.67 million of notes (the “February 25 Notes”) and 11,695,906 warrants at an exercise price

of $2.222 per share (the “February 25 Warrants), $1 million of notes (the “April 14 Notes”) and 2,521,008 warrants

at an exercise price of $1.540 per share (the “April 14 Warrants” and, together with the February 25 Warrants, the “Prior

Private Placement Warrants”) and $15.3 million of notes (the “May 5 Notes” and, together with the February 25 Notes

and the April 14 Notes, the “Prior Private Placement Notes.”) The Prior Private Placement Notes have a two year term a conversion

price of $0.972 per share. The Prior Private Placement Notes have certain anti-dilution protections in the event of a lower priced issuance.

Interest shall accrue on the notes at 8% annually, payable on a quarterly basis, in either cash or, in the event the registration statement

of which this prospectus forms a part has been declared effective, ordinary shares. The Prior Private Placement Notes held by a particular

holder will not be convertible to the extent such conversion would result in such holder owning more than 9.9% of the number of ordinary

shares outstanding after giving effect to the issuance of ordinary shares issuable upon conversion of such note calculated in accordance

with Section 13(d) of the Exchange Act. On May 5, 2021, the Company issued additional $15.3

million Prior Private Placement Notes to investors in the February and April transactions.

The

Prior Private Placement Warrants are exercisable immediately for a period of five years for cash, at an exercise price of $2.222 per

ordinary share for the February 25 Warrants and $1.540 per ordinary share for the April 14 Warrants, subject to adjustment in the event

of stock dividends and splits, or sales or grants of ordinary shares or ordinary share equivalents in certain transactions at less than

the then current exercise price, or where the exercise price is higher than the then-current market price of the ordinary shares, on

a cashless exercise basis, using the Black Scholes Value. The Prior Private Placement Warrants held by a particular holder will