Revenue Growth of 15% to $5.7

million

Gross Profit of 28%

Adjusted EBITDA Improvement of 41% to Loss

of $1.0 million

Boxlight Corporation (Nasdaq: BOXL) (“Boxlight”), a leading

provider of interactive technology solutions for the global

education market, today announced the Company's financial results

for the first quarter ended March 31, 2020.

Key Financial Highlights for Q1 2020

- Revenues increased by 15% to $5.7 million

- Customer orders increased by 85% to $7.6 million

- Gross profit decreased by 568 basis points to 28%

- Operating loss increased by 14% to $2.7 million

- Adjusted EBITDA loss improved by 41% to $1.0 million

- Adjusted EPS improved by 51% to a loss of $0.08

- Ended quarter with $4.5 million in backorders

Key Business Highlights for Q1 2020

- Selected by Shelby County Schools, Tennessee as approved

provider of interactive flat panel displays

- Received $750,000 follow on investment from The Lind

Partners

- Awarded district-wide contract for interactive flat panels in

Netherland Independent School District, Texas

- Implemented Mimio MyBot educational robotics system with the

Giant Moon Map™ and Giant Mars Map™programs in Union County Public

Schools, North Carolina

- Announced Daniel Leis as Global Head of Sales and

Marketing

- Announced Michael Pope as Chairman and Chief Executive

Officer

- Entered into national distribution agreement with D&H

Distributing

Management Commentary

“I would like to thank our friends and shareholders for their

tremendous support during this critical time as a Company,”

commented Michael Pope, Chairman and Chief Executive Officer. “We

have experienced significant transition since our 2016 merger of

Mimio and the Boxlight Group, and our subsequent IPO in 2017. Since

that time, we have attracted a tremendous management team,

assembled a global channel partner network, closed the acquisitions

of Cohuba, Qwizdom, EOS Education, Modern Robotics, Robo3d and

MyStemKits, continued to innovate with award-winning products and

services, consolidated our operations and supply chain, and

organized our systems and accounting under one ERP system. We are

proud of our progress, and I believe we are better positioned as a

company today than any time in our history.

I look forward to sharing additional commentary on our earnings

call concerning our product strategy, response to the COVID-19

crisis, significant operating expense reductions, plans to improve

our balance sheet and expectation to generate future profits.

Our company mission and vision have not changed. We are

committed to become the leader of innovative and effective

educational technology solutions. We aim to improve learning and

engagement in classrooms, and help educators enhance student

outcomes and build essential skills. We understand that we must be

nimble, flexible and innovate to meet the demands for today’s

evolving education requirements, and we are doing just that.”

Financial Results for the Three Months Ended March 31,

2020

Revenue for the three months ended March 31, 2020 was $5.7

million, an increase of $0.7 million or 15%, compared to $5.0

million for the three months ended March 31, 2019. Revenue growth

reflects increased sales volume related to US panel sales.

Gross profit for the three months ended March 31, 2020 was $1.6

million, a decrease of $0.1 million, compared to $1.7 million for

the three months ended March 31, 2019. The resulting gross margin

was 27.8% for the three months ended March 31, 2020, compared to

33.4% for the three months ended March 31, 2019.

General and Administrative expenses for the three months ended

March 31, 2020 was $3.9 million, a decrease of $0.1 million or 5%,

compared to $3.8 million for the three months ended March 31, 2019.

The expense remained relatively flat year over year.

Research and development expenses for the three months ended

March 31, 2020 was $0.3 million, an increase of $0.1 million or

34%, compared to $0.2 million for the three months ended March 31,

2019. The expense remained relatively flat year over year.

Operating loss for the three months ended March 31, 2020 was

$2.7 million, an increase of $0.4 million, or 14%, compared to $2.3

million for the three months ended March 31, 2019.

Adjusted EBITDA loss for the three months ended March 31, 2020

was $1.0 million, a decrease of $0.8 million or 41% compared to

$1.8 million for the three months ended March 31, 2019.

Net loss for the three months ended March 31, 2020 was $1.9

million, a decrease of $2.7 million, or 58%, compared to $4.6

million for the three months ended March 31, 2019. The resulting

EPS loss for the three months ended March 31, 2020 was $(0.16) per

diluted share, compared to $(0.45) per diluted share for the three

months ended March 31, 2019.

At March 31, 2020, Boxlight had $0.6 million of cash, $19.3

million of total assets, $7.4 debt, and 13.9 million shares issued

and outstanding.

1st Quarter 2020 Financial Results Conference Call

Management will host a conference call to discuss the first

quarter 2020 financial results on Monday, May 18, 2020 at 11:00

a.m. Eastern Time. The conference call details are as follows:

Date:

Monday, May 18, 2020

Time:

11:00 a.m. Eastern Time / 8:00 a.m.

Pacific Time

Dial-in:

1-888-428-7458 (Domestic)

1-862-298-0702 (International)

Webcast:

https://www.webcaster4.com/Webcast/Page/2213/34810

For those unable to participate during the live broadcast, a

replay of the call will also be available from until 11:59 p.m.

Eastern Time on Monday, June 1, 2020 by dialing 1-877-481-4010

(domestic) and 1-919-882-2331 (international) and referencing the

replay pin number: 34810.

Use of Non-GAAP Financial Measures

To supplement Boxlight’s financial statements presented on a

GAAP basis, Boxlight provides EBITDA and Adjusted EBITDA as

supplemental measures of its performance.

To provide investors with additional insight and allow for a

more comprehensive understanding of the information used by

management in its financial and decision-making surrounding pro

forma operations, we supplement our consolidated financial

statements presented on a basis consistent with U.S. generally

accepted accounting principles, or GAAP, with EBITDA and Adjusted

EBITDA, non-GAAP financial measures of earnings. EBITDA represents

net income before income tax expense (benefit), interest expense,

depreciation and amortization. Adjusted EBITDA represents EBITDA

plus stock-based compensation and change in fair value of

derivative liabilities. Our management uses EBITDA and Adjusted

EBITDA as financial measures to evaluate the profitability and

efficiency of our business model. We use these non-GAAP financial

measures to access the strength of the underlying operations of our

business. These adjustments, and the non-GAAP financial measures

that are derived from them, provide supplemental information to

analyze our operations between periods and over time. We find this

especially useful when reviewing pro forma results of operations,

which include large non-cash amortizations of intangible assets

from acquisitions and stock-based compensation. Investors should

consider our non-GAAP financial measures in addition to, and not as

a substitute for, financial measures prepared in accordance with

GAAP.

About Boxlight Corporation

Boxlight Corporation (Nasdaq: BOXL) (“Boxlight”) is a leading

provider of technology solutions for the global education market.

The company aims to improve learning and engagement in classrooms

and to help educators enhance student outcomes, by developing the

products they need. The company develops, sells, and services its

integrated, interactive solution suite including software,

classroom technologies, professional development and support

services. For more information about the Boxlight story, visit

http://www.boxlight.com.

Forward Looking Statements

This press release may contain information about Boxlight's view

of its future expectations, plans and prospects that constitute

forward-looking statements. Actual results may differ materially

from historical results or those indicated by these forward-looking

statements as a result of a variety of factors including, but not

limited to, risks and uncertainties associated with its ability to

maintain and grow its business, variability of operating results,

its development and introduction of new products and services,

marketing and other business development initiatives, competition

in the industry, etc. Boxlight encourages you to review other

factors that may affect its future results in Boxlight's filings

with the Securities and Exchange Commission.

Boxlight Corporation Consolidated Balance Sheets

March 31

December 31

2020

2019

ASSETS Current asset: Cash and cash

equivalents

$

612,936

$

1,172,994

Accounts receivable-trade, net of allowances

4,260,345

3,665,057

Inventories, net of reserves

2,884,640

3,318,857

Prepaid expenses and other current assets

1,179,349

1,765,741

Total current assets

8,937,270

9,922,649

Property and equipment, net of accumulated depreciation

203,487

207,397

Intangible assets, net of accumulated amortization

5,343,557

5,559,097

Goodwill

4,723,549

4,723,549

Other assets

59,649

56,193

Total Assets

$

19,267,512

$

20,468,885

LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Accounts payable and accrued expenses

$

4,794,939

$

4,721,417

Accounts payable and accrued expenses - related parties

3,301,412

5,031,367

Warranty

31,448

12,775

Current portion of debt-third parties

5,264,057

4,536,227

Current portion of debt- related parties

405,550

368,383

Earn-out payable - related party

351,595

387,118

Deferred revenues - short-term

1,733,660

1,972,565

Derivative liabilities

117,941

146,604

Other short-term liabilities

54,640

31,417

Total current liabilities

16,055,242

17,207,873

Deferred revenues - long-term

2,759,831

2,582,602

Long-term debt - third parties

1,058,797

1,201,139

Long-term debt - related party

53,561

108,228

Other long term liabilities

12,389

16,696

Total liabilities

19,939,820

21,116,538

Commitments and contingencies

Stockholders's

equity: Preferred stock, $0.0001 par value, 50,000,000 shares

authorized; 167,972 shares issued and outstanding

17

17

Common stock, $0.0001 par value, 200,000,000 shares authorized;

13,871,087 and 11,698,697 Class A shares issued and outstanding,

respectively

1,388

1,170

Additional paid-in capital

32,763,992

30,735,815

Subscriptions receivable

(200

)

(200

)

Accumulated deficit

(33,296,054

)

(31,346,431

)

Other comprehensive loss

(141,451

)

(38,024

)

Total stockholders' equity

(672,308

)

(647,653

)

Total liabilities and stockholders' equity

$

19,267,512

$

20,468,885

Boxlight Corporation Consolidated Statement of

Operations

Three Months Ended

March 31,

2020

2019

Revenues

$

5,723,049

$

4,993,399

Cost of Revenues

4,131,989

3,321,332

Gross Profit

1,591,060

1,672,067

27.80

%

33.49

%

Operating Expense: General and administrative expenses

3,937,729

3,766,068

Research and development expenses

316,756

235,996

Total operating expense

4,254,485

4,002,064

Loss from operations

(2,663,425

)

(2,329,997

)

Other income(expense): Interest expense, net

(459,320

)

(280,603

)

Other income (expense), net

57,950

21,209

Gain on settlement of liabilities, net

1,086,509

146,434

Change in fair value of derivative liabilities

28,663

(2,162,495

)

Total other income (expense)

713,802

(2,275,455

)

Net Loss

$

(1,949,623

)

$

(4,605,452

)

Comprehensive loss: Net Loss

$

(1,949,623

)

$

(4,605,452

)

Other comprehensive income (loss): Foreign currency translation

gain (loss)

(103,427

)

(38,147

)

Total comprehensive loss

$

(2,053,050

)

$

(4,643,599

)

Net loss per common share - basic

(0.16

)

(0.45

)

Net loss per common share - diluted

(0.16

)

(0.45

)

Weighted average number of common shares outstanding - basic

12,493,786

10,255,808

Weighted average number of common shares outstanding - diluted

12,493,786

10,255,808

Boxlight Corporation

Reconciliation of Net Loss to

Adjusted EBITDA

Three Months Ended

March 31,

2020

2019

Net Loss

$

(1,950

)

$

(4,605

)

Depreciation and amortization

219

242

Interest expense

459

281

EBITDA

$

(1,272

)

$

(4,082

)

Stock compensation expense

271

161

Change in fair value of derivative liabilities

(29

)

2,162

Adjusted EBITDA

$

(1,030

)

$

(1,759

)

Adjusted EPS

$

(0.08

)

$

(0.17

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200515005595/en/

Media Sunshine Nance +1 360-464-2119 x254

sunshine.nance@boxlight.com Investor Relations Michael Pope

+1 360-464-4478 michael.pope@boxlight.com

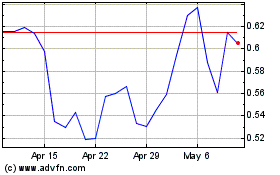

Boxlight (NASDAQ:BOXL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boxlight (NASDAQ:BOXL)

Historical Stock Chart

From Apr 2023 to Apr 2024