UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to Rule 240.14a-12

|

BRIDGELINE DIGITAL, INC.

(Name of Registrant as Specified in its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a- 6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1) Amount Previously Paid:

|

|

|

|

|

|

|

|

(2) Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3) Filing Party:

|

|

|

|

|

|

|

|

(4) Date Filed:

|

July 30, 2020

Dear Stockholder:

I am pleased to invite you to attend Bridgeline Digital, Inc.'s Annual Meeting of Stockholders (the “Meeting”) to be held on September 8, 2020. The Meeting will begin promptly at 8:30 A.M. Eastern Time at the Company’s New York office located at 150 Woodbury Road, Woodbury, New York 11797.

As part of our efforts to conserve environmental resources and prevent unnecessary corporate expense, we are using the “Notice and Access” method of providing proxy materials to you via the internet. We believe that this process should provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about July 30, 2020, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement and vote electronically via the internet, by mail or by telephone. The Notice also contains instructions on how to receive a paper copy of your proxy materials.

This proxy statement tells you about the agenda and procedures for the Meeting. It also describes how the board of directors operates and provides information about those directors who are nominated for re-election at the Meeting. We have also made a copy of our Annual Report on Form 10-K for the year ended September 30, 2019 (“Annual Report”) available with this proxy statement. We encourage you to read our Annual Report. It includes our audited financial statements and provides information about our business.

I look forward to sharing more information with you about Bridgeline at the Meeting. Whether or not you plan to attend, I encourage you to vote your proxy as soon as possible so that your shares will be represented at the Meeting.

|

|

Sincerely,

Roger Kahn

President and Chief Executive Officer

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 8:30 A.M. Eastern Time on September 8, 2020

To the Stockholders of Bridgeline Digital, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the "Meeting") of BRIDGELINE DIGITAL, INC. (the "Company") will be held on September 8, 2020 at 8:30 A.M. Eastern Time at the Company’s New York office located at 150 Woodbury Road, Woodbury, New York 11797, to consider and vote on the following matters described under the corresponding numbers in the attached proxy statement:

|

|

1.

|

To elect one director to serve on our Board of Directors for a term of three years;

|

|

|

2.

|

To hold an advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in the accompanying proxy statement (the “say-on-pay” vote);

|

|

|

3.

|

To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for its fiscal year ending September 30, 2020;

|

|

|

4.

|

To approve an adjournment of the Meeting, if necessary and appropriate, to solicit additional proxies if there are insufficient votes at the time of the Meeting to approve each Proposal; and

|

|

|

5.

|

To vote upon such other matters as may properly come before the Meeting or any adjournment or postponement of the Meeting.

|

We have elected to provide access to our proxy materials primarily over the internet, pursuant to the Securities and Exchange Commission’s “Notice and Access” rules. We believe this process expedites stockholders’ receipt of proxy materials, while lowering the costs of our Annual Meeting and conserving natural resources. On or about July 30, 2020, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to each of our stockholders entitled to notice of and to vote at the Annual Meeting, which contains instructions for accessing the attached proxy statement, our Annual Report on Form 10-K for the fiscal year ended September 30, 2019 (“Annual Report”) and voting instructions. The Notice also includes instructions on how you can receive a paper copy of your proxy materials. This proxy statement and the Annual Report are both available online at: https://www.rdgir.com/bridgeline-digital-inc.

The Board of Directors has fixed the close of business on July 21, 2020 as the record date for the determination of stockholders entitled to vote at the Meeting, and only holders of shares of our Common Stock and Series C Convertible Preferred Stock of record at the close of business on that day will be entitled to vote. The stock transfer books of the Company will not be closed.

A complete list of stockholders entitled to vote at the Meeting shall be available for examination by any stockholder, for any purpose germane to the Meeting, during ordinary business hours for the ten days prior to the date of the Meeting at the principal executive offices of the Company. The list will also be available at the Meeting.

Whether or not you expect to be present at the Meeting, we urge you to vote your shares as promptly as possible over the Internet, by mail or by telephone so that your shares may be represented and voted at the Annual Meeting. The Proxy is revocable and will not affect your vote in person in the event you attend the Meeting.

|

|

By Order of the Board of Directors

Stacey A. Ward

Assistant Secretary

July 30, 2020

|

Requests for additional copies of the proxy materials and the Company's Annual Report on Form 10-K for its fiscal year ended September 30, 2019 should be addressed to Shareholder Relations, Bridgeline Digital, Inc., 150 Woodbury Road, Woodbury, New York 11797. This material will be furnished without charge to any stockholder requesting it.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on September 8, 2020: The Proxy Statement for the Annual Meeting and the Annual Report on Form 10-K to Shareholders for the year ended September 30, 2019 are available at https://www.rdgir.com/bridgeline-digital-inc/

Proxy Statement

Annual Meeting of Stockholders

September 8, 2020

The enclosed proxy is solicited by the management of Bridgeline Digital, Inc. in connection with the Annual Meeting of Stockholders (the “Meeting” or the “Annual Meeting”) to be held on September 8, 2020 at 8:30 A.M. Eastern Time at the Company’s New York office located at 150 Woodbury Road, Woodbury, New York 11797, and any adjournment thereof. The Board of Directors of the Company (the "Board of Directors") have set the close of business on July 21, 2020 as the record date (the “Record Date”) for the determination of stockholders entitled to receive notice of, and to vote at the Meeting.

We have elected to provide access to this year’s proxy materials primarily over the internet, under the Securities and Exchange Commission’s (“SEC”) “Notice and Access” rules. This proxy statement and the form of proxy are being made available, and the Notice of Internet Availability of Proxy Materials (the “Notice”) is being mailed, to stockholders on or about July 30, 2020. The Notice contains instructions for accessing this attached proxy statement, our Annual Report on Form 10-K for the fiscal year ended September 30, 2019 (“Annual Report”) and voting instructions. The Notice also includes instructions on how you can receive a paper copy of your proxy materials.

This proxy statement, the Notice, the Annual Report and form of proxy can also be accessed free of charge online as of July 30, 2020 at: https://www.bridgeline.com/about/investor-relations. The Company's principal executive offices are located at 100 Sylvan Road, Suite G-700, Woburn, Massachusetts 01801, and its telephone number at that location is (781) 376-5555.

.

A stockholder executing and returning a proxy over the internet, by mail or by telephone has the power to revoke it at any time before it is exercised by filing a later-dated proxy with, or other communication to, the Secretary of the Company or by attending the Meeting and voting in person.

The proxy will be voted in accordance with your directions to:

|

|

1.

|

To elect a director to serve on our Board of Directors for a term of three years;

|

|

|

2.

|

To hold an advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in this proxy statement (the “say-on-pay” vote);

|

|

|

3.

|

To ratify the appointment of Marcum LLP as the Company’s independent registered public accounting firm for its fiscal year ending September 30, 2020;

|

|

|

4.

|

To approve adjournment of the Meeting, if necessary and appropriate, to solicit additional proxies if there are insufficient votes at the time of the Meeting to approve each Proposal; and

|

|

|

5.

|

To vote on such other matters as may properly come before the Meeting or any adjournment or postponement of the Meeting

|

The entire cost of soliciting proxies will be borne by the Company. The costs of solicitation will include the costs of supplying necessary additional copies of the solicitation materials and our Annual Report to beneficial owners of shares held of record by brokers, dealers, banks, trustees, and their nominees, including the reasonable expenses of such record holders for completing the mailing of such materials and Annual Reports to such beneficial owners. Solicitation of proxies may also include solicitation by telephone, fax, electronic mail, or personal solicitations by directors, officers, or employees of the Company. No additional compensation will be paid for any such services. The Company may engage a professional proxy solicitation firm to assist in the proxy solicitation and, if so, will pay such solicitation firm customary fees plus expenses.

Stockholders of record of the Company’s Common Stock at the close of business on the Record Date, July 21, 2020, are entitled to receive notice of, and to vote at, the Meeting. As of the Record Date, there were 4,420,170 shares of Common Stock issued and outstanding, all of which are entitled to vote. Each share of Common Stock outstanding at the close of business on the Record Date is entitled to one vote on each matter that is voted at the Meeting.

In addition, as of the Record Date, there were 350 shares of the Company’s Series C Convertible Preferred Stock, par value $0.001 per share (“Series C Preferred Stock”), issued and outstanding. Each shareholder of record of Series C Preferred Stock outstanding at the close of business on the Record Date is entitled to receive notice of, and to vote, on an as-converted to Common Stock basis, at the Meeting. Each share of Series C Preferred Stock outstanding at the close of business on the Record Date is entitled to 111.11 votes on each matter that is voted at the Meeting. Therefore, the holders of our outstanding shares of Series C Preferred Stock have an aggregate of 38,889 votes on matters to come before the Meeting, which represents approximately 0.9% of our outstanding voting securities.

Stockholders may vote by proxy over the Internet, over the telephone, or by mail. The procedures for voting by proxy are as follows:

|

|

●

|

To vote by proxy over the Internet, go to www.voteproxy.com to complete an electronic proxy card;

|

|

|

●

|

To vote by proxy over the telephone, dial the toll-free phone number (1-800-776-9437) listed on your proxy card and following the recorded instructions; or

|

|

|

●

|

To vote by proxy by mail you must complete, sign and date your proxy card and return it promptly in the envelope provided.

|

Stockholders of record may also vote in person at the Meeting.

The representation in person or by proxy of a majority of the votes entitled to be cast by the stockholders entitled to vote at the Meeting is necessary to establish a quorum for the transaction of all business to come before the Meeting. Abstentions and broker non-votes will be treated as shares that are present and entitled to vote for purposes of establishing a quorum.

Abstentions will be treated as shares that are present and entitled to vote for purposes of determining the number of shares present and entitled to vote with respect to any particular matter but will not be counted as a vote in favor of such matter.

A broker non-vote occurs when a broker holding shares for a beneficial owner votes on one proposal but does not vote on another proposal because the broker does not have discretionary voting power and has not received instructions from the beneficial owner. If a stockholder holds shares beneficially in street name and does not provide its broker with voting instructions, the shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. Brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals. Brokers may vote in favor of a proposal in accordance with the rules of the New York Stock Exchange (“NYSE”) that govern how brokers may cast such votes on proposals they determine to be routine matters.

The director nominee identified under Proposal 1 who receives the most votes at the Meeting will be elected, thus abstentions and broker non-votes will have no effect on the outcome of Proposal 1.

Pursuant to Delaware General Corporation Law (the “DGCL”) and our Amended and Restated Bylaws, the advisory vote presented in Proposal 2 and Proposals 3 and 4 will be determined by the vote of the holders of a majority of the voting power present or represented by proxy at the Meeting. For these matters, abstentions and broker non-votes cast, if any, will not be counted as votes in favor of such proposals, and will also not be counted as shares voting on such matter.

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Board of Directors currently consists of five (5) directors and is divided into three (3) classes. Directors in each class are generally elected to serve for three-year terms that expire in successive years. Currently, the term for each of our three classes of directors is set to expire at the Meeting, our 2021 annual meeting of stockholders and our 2022 annual meeting of stockholders, respectively.

At the Meeting, our stockholders are being asked to elect one (1) director whose term is currently set to expire at the Meeting. If elected, Mr. Taglich will hold office for a three-year term expiring in 2023. Pursuant to our Amended and Restated Bylaws, our directors are to be elected by a plurality of the shares present in person or represented by proxy at the Meeting and entitled to vote thereon. The following director has been nominated for election at the Meeting:

Mr. Taglich has advised management that, if elected, he is able to serve on the Board of Directors for the duration of his term. Management has no reason to believe that the nominee will be unable to serve. In the event the nominee becomes unavailable to serve as a director, the proxies may be voted for the election of such person who may be designated by the Board of Directors.

The following table sets forth certain information as to our current directors:

|

Name

|

Age

|

Position with the Company

|

|

Director

Since

|

|

Kenneth Galaznik*

|

68

|

Director, Chair of the Audit Committee and Member of the Compensation Committee

|

|

2006

|

|

|

|

|

|

|

|

Joni Kahn*

|

65

|

Chairperson of the Board, Chair of the Compensation Committee and Member of the Audit and Nominating and Corporate Governance Committees

|

|

2012

|

|

|

|

|

|

|

|

Roger Kahn

|

51

|

Director, President and Chief Executive Officer

|

|

2017

|

|

|

|

|

|

|

|

Scott Landers*

|

49

|

Director, Chair of Nominating and Corporate Governance Committee and Member of the Audit and Compensation Committees

|

|

2010

|

|

|

|

|

|

|

|

Michael Taglich

|

55

|

Director

|

|

2013

|

*Independent director as defined under the rules of the Nasdaq Stock Market.

Kenneth Galaznik has been a member of our Board of Directors since 2006. Mr. Galaznik is the Chairman of the Company’s Audit Committee and serves as a member of the Compensation Committee. From 2005 to 2016, Mr. Galaznik was the Senior Vice President, Chief Financial Officer and Treasurer of American Science and Engineering, Inc., a publicly held supplier of X-ray inspection and screening systems with a public market cap of over $200 million. Mr. Galaznik retired from his position at American Science and Engineering on March 31, 2016. From August 2002 to February 2005, Mr. Galaznik was Vice President of Finance of American Science and Engineering, Inc. From November 2001 to August 2002, Mr. Galaznik was self-employed as a consultant. From March 1999 to September 2001, he served as Vice President of Finance at Spectro Analytical Instruments, Inc. and has more than 35 years of experience in accounting and finance positions. Mr. Galaznik holds a B.B.A. degree in accounting from The University of Houston. Mr. Galaznik brings extensive experience to our Board and our Audit Committee as an experienced senior executive, a financial expert, and as chief financial officer of a publicly-held company.

The Board of Directors has determined that Mr. Galaznik’s deep experience in finance and his executive leadership make him qualified to continue as a member of our Board of Directors.

Joni Kahn has been a member of our Board of Directors since April 2012. In May 2015, Ms. Kahn was appointed Chairperson of the Board of Directors. She also serves as the Chair of the Compensation Committee and is a member of the Audit and Nominating and Governance Committees. Ms. Kahn has over thirty years of operating experience with high growth software and services companies with specific expertise in the SaaS (Software as a Service), ERP (Enterprise Resource Planning) Applications, Business Intelligence and Analytics and Cybersecurity segments. From 2013 to 2015, Ms. Kahn was the Senior Vice President of Global Services for Big Machines, Inc., which was acquired by Oracle in October 2013. From 2007 to 2012, Ms. Kahn was Vice President of Services for HP’s Enterprise Security Software group. From 2005 to 2007, Ms. Kahn was the Executive Vice President at BearingPoint where she managed a team of over 3,000 professionals and was responsible for North American delivery of enterprise applications, systems integration and managed services solutions. Ms. Kahn also oversaw global development centers in India, China and the U.S. From 2002 to 2005, Ms. Kahn was the Senior Group Vice President for worldwide professional services for Business Objects, a business intelligence and analytics software maker based in San Jose, where she led the applications and services division that supported that company's transformation from a products company to an enterprise solutions company. Business Objects was acquired by SAP in 2007. From 2000 to 2007, Ms. Kahn was a Member of the Board of Directors for MapInfo, a global location intelligence solutions company. She was a member of MapInfo’s Audit Committee and the Compensation Committee. MapInfo was acquired by Pitney Bowes in 2007. From 1993 to 2000, Ms. Kahn was an Executive Vice President and Partner of KPMG Consulting, where she helped grow the firm’s consulting business from $700 million to $2.5 billion. Ms. Kahn received her B.B.A in Accounting from the University of Wisconsin – Madison. Ms. Kahn brings extensive leadership experience to our Board and our Audit Committee as an experienced senior executive.

Ms. Kahn brings extensive leadership experience to our Board and our Audit Committee as an experienced senior executive. Ms. Kahn has over thirty years of executive level managerial, operational, and strategic planning experience leading world-class service and support technology organizations. Her service on prior boards also provides financial and governance experience.

The Board of Directors has determined that Ms. Kahn's vast financial experience in the technology industry, as well as her demonstrated executive leadership make her qualified to continue as the Chairperson and member of our Board of Directors.

Roger Kahn has been a member of our Board of Directors in December 2017. Mr. Kahn joined the Company as the Chief Operating Officer in August 2015 and has been our President and Chief Executive Officer since May 2016. Prior to joining Bridgeline Digital, Mr. Kahn co-founded FatWire, a leading content management and digital engagement company. As the General Manager and Chief Technology Officer of FatWire, Mr. Kahn built the company into a global corporation with offices in thirteen countries. FatWire was acquired by Oracle in 2011. Mr. Kahn received his Ph.D. in Computer Science and Artificial Intelligence from the University of Chicago.

Our Board of Directors has determined that Mr. Kahn’s vast experience as a successful entrepreneur in the technology space, as well as his technical and leadership acumen make him qualified to continue as a member of our Board of Directors.

Scott Landers has been a member of our Board of Directors since 2010. Mr. Landers is the Chair of the Nominating and Corporate Governance Committee and serves as a member of the Audit and Compensation Committees. Mr. Landers was named President and Chief Executive Officer of Monotype Imaging Holdings, Inc. on January 1, 2016 after serving as the company’s Chief Operating Officer since early 2015 and its Chief Financial Officer, Treasurer and Assistant Secretary since joining Monotype in July 2008. Effective October 11, 2019, Monotype was acquired by HGGC and is now privately-owned company and is a leading provider of typefaces, technology and expertise that enable the best user experiences and sure brand integrity. Prior to joining Monotype, from September 2007 until July 2008, Mr. Landers was the Vice President of Global Finance at Pitney Bowes Software, a $450 million division of Pitney Bowes, a leading global provider of location intelligence solutions. From 1997 until September 2007, Mr. Landers held several senior finance positions, including Vice President of Finance and Administration, at MapInfo, a publicly held company which was acquired by Pitney Bowes in April 2007. Earlier in his career, Mr. Landers was a Business Assurance Manager with Coopers & Lybrand. Mr. Landers holds a bachelor's degree in accounting from Le Moyne College in Syracuse, N.Y. and a master’s degree in business administration from The College of Saint Rose in Albany, N.Y. Mr. Landers brings extensive experience to our Board and our Audit Committee as an experienced senior executive, a financial expert, and as chief executive officer and a chief financial officer of a publicly-held company.

Our Board of Directors has determined that Mr. Lander’s financial skills, public-company experience, strategic business acumen and executive leadership make him qualified to continue as a member of our Board of Directors.

Michael Taglich has been a member of our Board of Directors since 2013. He is the Chairman and President of Taglich Brothers, Inc., a New York City based securities firm which he co-founded in 1992 with his brother Robert Taglich. Taglich Brothers, Inc. focuses on public and private micro-cap companies in a wide variety of industries. He is currently the Chairman of the Board of Air Industries Group Inc., a publicly traded aerospace and defense company (NYSE AIRI), and Mare Island Dry Dock Inc., a privately held company. He also serves as a director of a number of other private companies. Michael Taglich brings extensive professional experience which spans various aspects of senior management, including finance, operations and strategic planning. Mr. Taglich has more than 30 years of financial industry experience and served on his first public company board over 20 years ago.

Our Board of Directors has determined that Mr. Taglich’s executive strategic business skills in both private and public companies, as well as his experience leading and advising high-growth companies make him qualified to continue as a member of our Board of Directors.

There are no family relationships between any of the directors and the Company’s executive officers, including between Ms. Joni Kahn and Mr. Roger Kahn, the Company’s President and Chief Executive Officer.

|

Mark G. Downey

|

55

|

Chief Financial Officer and Treasurer

|

Mark G. Downey has been our Executive Vice President and Chief Financial Officer and Treasurer since July 2019. Mr. Downey comes to Bridgeline with more than 25 years of executive experience, including more than 15 years as a CFO and COO at several public and privately held companies in the technology, private equity, financial services and professional services industries. Mr. Downey has extensive accounting, capital markets structuring, risk, treasury, M&A due diligence, technology enhancements, and overall operational and management experience. Prior to joining Bridgeline Digital, Inc., Mr. Downey served as a consultant and Director of Accounting & Transaction Services at MorganFranklin Consulting from 2015 to 2019. He was the global CFO and COO at Algodon Group, a private equity firm from 2014 to 2015 and CFO and COO and Treasurer at Dahlman Rose, Tullett Prebon and Commerzbank Securities from 2000 through 2014. He started his career at Coopers and Lybrand and holds a B.B.A. in Accounting from Iona College – Hagan School of Business and is a member of the American Institute of Certified Public Accountants and New York State Society of Certified Public Accountants.

Required Vote and Recommendation

Under our Amended and Restated Certificate of Incorporation, the election of our directors requires the affirmative vote of a plurality of the voting shares present or represented by proxy and entitled to vote at the Meeting. Unless otherwise instructed or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the election of Mr. Taglich.

The Board recommends that the stockholders vote “FOR” the election of Mr. Taglich to serve as a director for a three-year term until the Company’s annual meeting of stockholders to be held in 2023.

Certain Relationships and Related Transactions

Item 404(d) of Regulation S-K requires the Company to disclose any transaction or proposed transaction which occurred since the beginning of the two most recently completed fiscal years in which the amount involved exceeds the lesser of $120,000 or one percent (1%) of the average of the Company’s total assets as of the end of the last two completed fiscal years in which the Company is a participant and in which any related person has or will have a direct or indirect material interest. A related person is any executive officer, director, nominee for director, or holder of 5% or more of the Company's Common Stock, or an immediate family member of any of those persons.

In accordance with our Audit Committee charter, our Audit Committee is responsible for reviewing and approving the terms of any related party transactions. Therefore, any material financial transaction between the Company and any related person would need to be approved by our Audit Committee prior to the Company entering into such transaction.

In October 2013, Mr. Michael Taglich joined the Board of Directors. Michael Taglich is the Chairman and President of Taglich Brothers, Inc. a New York based securities firm. Taglich Brothers, Inc. acted as placement agents for many of the Company’s private offerings in 2012, 2013, 2014, and 2016. They were also the placement agent for the Company’s $3 million subordinated debt offering in 2013, the Series A Preferred stock sale in 2015, and Promissory Term Notes in 2018. As of August 16, 2019, Mr. Michael Taglich beneficially owns approximately 10% of Bridgeline stock. He has also guaranteed $1.5 million in connection with the Company’s out of formula borrowings on its credit facility with Heritage Bank. In consideration of previous loans made by Mr. Michael Taglich to the Company and the personal guaranty for Heritage Bank of Commerce, Mr. Michael Taglich has been issued warrants to purchase common stock totaling 1,080 shares at an exercise price of $1,000.00 per share.

In connection with the Company’s private placement completed in November 2016, the Company issued to the Investors warrants to purchase an aggregate total of 4,271 shares common stock. Included were warrants to purchase 172 shares of common stock issued to Roger Kahn and warrants to purchase 308 shares of common stock issued to Mr. Michael Taglich. Each warrant to purchase common stock expires five and one-half years from the date of issuance and is exercisable for $175.00 per share beginning six-months from the date of issuance, or May 9, 2017. The warrants expire May 9, 2022.

In connection with previous private offerings and debt issuances, Taglich Brothers, Inc. were granted placement agent warrants to purchase 4,246 shares of common stock at a weighted average price of $321.00 per share.

In September 2018, the Company sold and issued subordinate promissory notes (the “Promissory Term Notes”) to certain accredited investors (each, a “Purchaser”), pursuant to which it issued to the Purchasers (i) Promissory Term Notes, in the aggregate principal amount of approximately $941,000. The Promissory Term Notes have an original issue discount of fifteen percent (15%), bear interest at a rate of twelve percent (12%) per annum, and have a maturity date of the earlier to occur of (a) six months from the date of execution of the Purchase Agreement, or (b) the consummation of a debt or equity financing resulting in the gross proceeds to the Company of at least $3.0 million. Mr. Michael Taglich participated in the Note Purchase Agreement in September 2018. Mr. Michael Taglich purchased Promissory Term Notes in the amount of approximately $122,000 pursuant to the Note Purchase Agreement. Taglich Brothers, Inc. served as placement agent for the above transaction, for which services the Company paid to Taglich Brothers, Inc. $40,000 in cash compensation, or five percent (5%) of the net proceeds received by the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended. In computing the number of shares beneficially owned by a person or a group and the percentage ownership of that person or group, shares of our Common Stock subject to options or warrants currently exercisable or exercisable within 60 days after August 16, 2020 are deemed outstanding, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the address of each individual named below is our address: 100 Sylvan Road, Suite G-700, Woburn, Massachusetts 01801.

The following tables set forth, as of July 21, 2020, the beneficial ownership of each of our outstanding voting securities, consisting of our Series C Preferred Stock and Common Stock by (i) each person or group of persons known to us to beneficially own more than 5% of the outstanding shares of the outstanding securities, (ii) each of our directors and named executive officers, and (iii) all of our executive officers and directors as a group. At the close of business on July 21, 2020 there were 350 shares of Series C Preferred Stock and 4,420,170 shares of our Common Stock issued and outstanding. On July 21, 2020 the closing price of our Common Stock as reported on the Nasdaq Capital Market was $2.13 per share.

Except as indicated in the footnotes to the tables below, each shareholder named in the table has sole voting and investment power with respect to the shares shown as beneficially owned by such shareholder.

This information is based upon information received from or on behalf of the individuals named herein.

Series C Preferred Stock

|

Name and Address (1)

|

Number of

Shares

Owned

|

|

Percent of Shares

Outstanding

|

|

Michael and Claudia Taglich

790 New York Avenue

Huntington, New York 11743

|

350

|

|

100.00%

|

|

All current executive officers and directors as a group

|

350

|

|

*

|

|

|

(1)

|

Holders of Series C Preferred are entitled to vote on all matters presented to the Company’s stockholders on an as-converted basis. Each share of Series C Preferred Stock is convertible, at the option of each respective holder, into approximately 111.11 shares of Common Stock.

|

Common Stock

|

Name and Address

|

Number of

Shares

Owned

|

|

Percent of Shares

Outstanding

|

|

Michael Taglich

Director

|

304,366

|

(1)

|

9.88%

|

|

Roger Kahn

President, Chief Executive Officer and Director

|

8,392

|

(2)

|

0.30%

|

|

Kenneth Galaznik

Director

|

745

|

(3)

|

0.03%

|

|

Scott Landers

Director

|

700

|

(4)

|

0.03%

|

|

Joni Kahn

Director

|

698

|

(5)

|

0.02%

|

|

Mark Downey

Chief Financial Officer and Treasurer

|

-

|

|

-

|

|

All current executive officers and directors as a group (6)

|

314,901

|

(6)

|

10.18%

|

|

|

(1)

|

Includes 248,805 shares issuable upon the exercise of warrants, and 174 shares of Common Stock subject to currently exercisable options (includes options that will become exercisable within 60 days of July 21, 2020). Also includes 35 shares of Common Stock and 2 shares issuable upon the exercise of warrants owned by Mr. Taglich’s spouse.

|

|

|

(2)

|

Includes 172 shares issuable upon the exercise of warrants and 5,246 shares of Common Stock subject to currently exercisable options (includes options that will become exercisable within 60 days of July 21, 2020). Includes 545 shares of Common Stock owned by Mr. Kahn’s spouse.

|

|

|

(3)

|

Includes 146 shares of Common Stock subject to currently exercisable options (includes options that will become exercisable within 60 days of July 21, 2020).

|

|

|

(4)

|

Includes 138 shares of Common Stock subject to currently exercisable options (includes options that will become exercisable within 60 days of July 21, 2020). Includes 8 shares of Common Stock owned by Mr. Landers’ children.

|

|

|

(5)

|

Includes 130 shares of Common Stock subject to currently exercisable options (includes options that will become exercisable within 60 days of July 21, 2020).

|

|

|

(6)

|

Includes 5,834 shares of Common Stock subject to currently exercisable options (includes options that will become exercisable within 60 days of July 21, 2020).

|

EXECUTIVE COMPENSATION

Summary Compensation Table

The following Summary Compensation Table sets forth the total compensation paid or accrued for the fiscal years ended September 30, 2019 and September 30, 2018 for our principal executive officer and our other two most highly compensated executive officers who were serving as executive officers as of September 30, 2019. We refer to these officers as our named executive officers.

|

Name and

|

Fiscal

|

|

|

|

|

|

|

|

|

|

Option

|

|

|

All Other

|

|

|

|

|

|

|

Principal Position

|

Year End

|

|

Salary

|

|

|

Bonus

|

|

|

Awards

|

|

|

Compensation (3)

|

|

|

Total

|

|

|

Roger E. Kahn

|

2019

|

|

$

|

300,000

|

|

|

$

|

26,042

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

326,042

|

|

|

President and Chief

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Officer

|

2018

|

|

$

|

300,000

|

|

|

$

|

67,497

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

367,497

|

|

|

Michael Prinn (1)

|

2019

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Former Executive Vice President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Chief Financial Officer

|

2018

|

|

$

|

250,000

|

|

|

$

|

40,498

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

290,498

|

|

|

Carole Tyner (2)

|

2019

|

|

$

|

201,167

|

|

|

$

|

7,500

|

|

|

$

|

-

|

|

|

$

|

116,189

|

|

|

$

|

324,856

|

|

|

Former Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2018

|

|

$

|

186,750

|

|

|

$

|

5,933

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

192,683

|

|

|

Mark G. Downey

|

2019

|

|

$

|

60,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

60,000

|

|

|

Executive Vice President

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer and Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Mr. Prinn resigned as our Executive Vice President, Chief Financial Officer and Treasurer effective September 25, 2018. Effective September 28, 2018, Carole Tyner was appointed as our Chief Financial Officer and Treasurer.

|

|

(2)

|

Ms. Tyner resigned from her position as the Company’s Chief Financial Officer on June 28, 2019, and the Company’s current Chief Financial Officer, Mark G. Downey, was appointed on July 1, 2019. No compensation information is provided for Mr. Downey as he was not employed by the Company during the year ended September 30, 2018.

|

|

(3)

|

Amounts paid to Carole Tyner in fiscal 2019 included severance of $110,000, unused vacation of $5,077 and COBRA of $1,112.

|

Employment Agreements

Roger Kahn

We have entered into an employment agreement with Roger Kahn, our President and Chief Executive Officer, to provide executive management services. The employment agreement had an initial term of thirteen months beginning August 24, 2015 and terminating on September 30, 2016. The employment agreement was amended on May 1, 2016 (“First Amendment”) to extend through September 30, 2017 and then extended again through September 30, 2018. The First Amendment included a reimbursement for living expenses directly related to accommodations and utilities for an apartment near the Company’s corporate headquarters in an amount not to exceed $2,900 per month. The employment agreement renews for successive periods of one year if the Company provides written notice of renewal not less than 60 days prior to the end of the initial term or any applicable succeeding term. The employment agreement may be terminated by (i) us, in the event of Mr. Kahn’s death, resignation, retirement or disability, or for or without cause, or (ii) Mr. Kahn for good reason. In the event that we terminate Mr. Kahn without cause or Mr. Kahn resigns for good reason, he is entitled to receive severance payments equal to twelve months of salary and one full quarterly bonus. In addition, any stock option awards that are not exercisable will be immediately vested and exercisable.

Carole Tyner

On June 28, 2019, Ms. Carole Tyner resigned from her position of Chief Financial Officer of Bridgeline Digital, Inc. ("Bridgeline" or the "Company") to pursue new professional opportunities. Ms. Tyner continued to provide services to the Company as an employee until August 31, 2019. Upon Ms. Tyner's departure on August 31, 2019, she received a lump sum separation payment equivalent to six-months base salary, and further, she continued to receive COBRA health insurance continuation benefits with the Employer portion of the premiums paid by the Company up through February 28, 2020.

Mark G. Downey

Effective July 1, 2019, Mark G. Downey was appointed by the Company's Board of Directors as Executive Vice President, Chief Financial Officer and Treasurer of the Company. The Company and Mr. Downey entered into an employment agreement (the "Employment Agreement"), effective July 1, 2019 through September 30, 2020, whereby he will receive two-hundred and forty thousand dollars base salary and the ability to earn a bi-annual incentive bonus of thirty thousand dollars. Mr. Downey may also participate in such equity-based and cash-based incentive programs as the Company may from time to time and made available to its executive officers, in accordance with the terms and conditions of such programs, as well as, the Company's other applicable employee benefits plans and programs. His Employment Agreement also provides that in the event Mr. Downey's employment is terminated by the Company without cause or if the Company terminates his employment for good reason, he is entitled to receive severance benefits. The foregoing descriptions of the material terms of the Employment Agreement by and between the Company and Mr. Downey do not purport to be complete descriptions and are qualified in their entirety by reference to the Employment Agreement, which is filed as Exhibit 10.1 on Form 8-K.

Outstanding Equity Awards at Fiscal 2019 Year-End

The following table sets forth information concerning outstanding stock options for each named executive officer as of September 30, 2019.

|

Name

|

Grant

Date

|

|

Number of Securities

Underlying

Unexercised Options

Exercisable (1)

|

|

|

Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(1)

|

|

|

Exercise

price

($/sh)

|

|

Option

Expiration

Date

|

|

Roger Kahn (1)

|

08/24/2015

|

|

|

800

|

|

|

|

-

|

|

|

$

|

287.50

|

|

08/24/2025

|

|

|

08/19/2016

|

|

|

716

|

|

|

|

-

|

|

|

$

|

205.00

|

|

08/19/2026

|

|

|

|

|

|

1,516

|

|

|

|

-

|

|

|

|

|

|

|

|

|

(1)

|

Shares vest in equal installments upon the anniversary date of the grant over three years.

|

OTHER INFORMATION CONCERNING THE COMPANY AND THE BOARD OF DIRECTORS

Meetings of the Board of Directors

During the Company's fiscal year ended September 30, 2019, the Board of Directors held five meetings and acted eleven times by unanimous written consent. During Fiscal 2019, each director attended each meeting. The Chairman was present at all meetings. The Company encourages Board members to attend the Annual Meeting.

Structure of the Board of Directors

Ms. Joni Kahn, an independent director, was appointed as Chairperson of the Board in May 2015. The Board of Directors determined that it would be beneficial to the Company to separate the offices of Chief Executive Officer and Chairperson of the Board in order to allow the Chief Executive Officer to focus on the Company’s operations and execution of its business plan while the Chairperson of the Board would focus on the Company’s strategic plan. The Board of Directors believes that Ms. Kahn’s service as Chairperson of the Board will further help extend the Company’s footprint into both the enterprise and multi-unit technology sectors.

The Board of Directors’ Role in Risk Oversight

The Board of Directors oversees our risk management process. This oversight is primarily accomplished through the Board of Directors’ committees and management’s reporting processes, including receiving regular reports from members of senior management on areas of material risk to the company, including operational, financial and strategic risks. The Audit Committee focuses on risks related to accounting, internal controls, and financial and tax reporting and related party transactions. The Audit Committee also assesses economic and business risks and monitors compliance with ethical standards. The Compensation Committee identifies and oversees risks associated with our executive compensation policies and practices.

COMMITTEES OF THE BOARD OF DIRECTORS

The Company has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee.

Audit Committee

The Audit Committee assists the Board in the oversight of the audit of our consolidated financial statements and the quality and integrity of our accounting, auditing and financial reporting processes. The Audit Committee is responsible for making recommendations to the Board concerning the selection and engagement of independent registered public accountants and for reviewing the scope of the annual audit, audit fees, results of the audit and auditor independence. The Audit Committee also reviews and discusses with management and the Board such matters as accounting policies, internal accounting controls and procedures for preparation of financial statements. Our Audit Committee is comprised of Mr. Galaznik (Chair), Ms. Kahn and Mr. Landers. Our Board has determined that each of the members of the Audit Committee meet the criteria for independence under the standards provided by the Nasdaq Stock Market. The Board of Directors has adopted a written charter for the Audit Committee. A copy of such charter is available on the Company's website, www.bridgeline.com. During Fiscal 2019, the Audit Committee met four times. Each member of the Audit Committee attended each such meeting. The Chairman of the Audit Committee was present at all meetings.

Audit Committee Financial Expert. Our Board has also determined that each of Mr. Galaznik and Mr. Landers qualifies as an "audit committee financial expert" as defined under Item 407(d) (5) of Regulation S-K and as an independent director as defined by the Nasdaq listing standards.

Compensation Committee

The Compensation Committee evaluates the performance of our senior executives, considers the design and competitiveness of our compensation plans, including the review of independent research and data regarding compensation paid to executives of public companies of similar size and geographic location, reviews and approves senior executive compensation and administers our equity compensation plans. In addition, the Committee also conducts reviews of executive compensation to ensure compliance with Section 162(m) of the Internal Revenue Code of 1986, as amended. Our Compensation Committee is comprised of Ms. Kahn (Chair), Mr. Galaznik and Mr. Landers, all of whom are independent directors. The Board of Directors has adopted a written charter for the Compensation Committee. A copy of such charter is available on the Company's website, www.bridgeline.com. During Fiscal 2019, the Compensation Committee met five times and acted one time by unanimous written consent.

Nominating and Corporate Governance Committee

The Nominating and Governance Committee identifies candidates for future Board membership and proposes criteria for Board candidates and candidates to fill Board vacancies, as well as a slate of directors for election by the shareholders at each annual meeting. The Nominating and Governance Committee also annually assesses and reports to the Board on Board and Board Committee performance and effectiveness and reviews and makes recommendations to the Board concerning the composition, size and structure of the Board and its committees. A copy of such charter is available on the Company's website, www.bridgeline.com. Our Nominating and Governance Committee is comprised of Mr. Landers (Chair) and Ms. Kahn, each of whom are independent directors. During Fiscal 2019, the Nominating and Governance Committee met four times.

Communications with the Board of Directors

The Company encourages stockholder communications with the Board of Directors. Interested persons may directly contact any individual member of the Board of Directors by contacting Shareholder Relations, Bridgeline Digital, Inc., 150 Woodbury Road, Woodbury, New York 11797.

Audit Committee Report

The Audit Committee consists of three independent directors, all of whom are "independent directors" within the meaning of the applicable rules of the Securities and Exchange Commission and the Nasdaq Stock Market, Inc. The Audit Committee's responsibilities are as described in a written charter adopted by the Board, a copy of which is available on the Company's website at www.bridgeline.com.

The Audit Committee has reviewed and discussed the Company's audited financial statements for fiscal 2019 with management and with the Company's independent registered public accounting firm, Marcum LLP. The Audit Committee has discussed with Marcum LLP the matters required to be discussed by Auditing Standard No. 16, as adopted by the Public Company Accounting Oversight Board relating to the conduct of the audit. The Audit Committee has received the written disclosures and the letter from Marcum LLP required by the Public Company Accounting Oversight Board in Ethics and Independence Rule 3526, Communications with Audit Committees Concerning Independence, and has discussed with Marcum LLP its independence.

Based on the Audit Committee's review of the audited financial statements and the review and discussions described in the foregoing paragraph, the Audit Committee recommended to the Board that the audited financial statements for fiscal 2019 be included in the Company's Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

Submitted by the members of the Audit Committee:

Kenneth Galaznik, Chairman

Scott Landers

Joni Kahn

OTHER MATTERS

Audit Fees

The firm of Marcum LLP acts as our principal independent registered public accounting firm. They have served as our independent auditors since April 26, 2010. A representative of Marcum LLP is expected to attend this year's Annual Meeting, and he will have an opportunity to make a statement if he desires to do so. It is also expected that such representative will be available to respond to appropriate questions.

The table below shows the aggregate fees that the Company paid or accrued for the audit and other services provided by Marcum LLP for the fiscal years ended September 30, 2019 and September 30, 2018. The Company did not engage its independent registered public accounting firm during either of the fiscal years ended September 30, 2019 or September 30, 2018 for any other non-audit services.

|

Type of Service

|

Amount of Fee for Fiscal Year Ended

|

|

|

September 30, 2019

|

September 30, 2018

|

|

Audit Fees

|

$268,271

|

$250,670

|

|

Audit-Related Fees

|

—

|

—

|

|

Tax Fees

|

—

|

—

|

|

Total

|

$268,271

|

$250,670

|

Audit Fees. This category includes fees for the audits of the Company's annual financial statements, review of financial statements included in the Company's Form 10-Q Quarterly Reports and services that are normally provided by the independent auditors in connection with statutory and regulatory filings or engagements for the relevant fiscal years.

Audit-Related Fees. This category consists of audits performed in connection with certain acquisitions.

Tax Fees. This category consists of professional services rendered for tax compliance, tax planning and tax advice. The services for the fees disclosed under this category include tax return preparation, research and technical tax advice.

There were no other fees paid or accrued to Marcum LLP in the fiscal years ended September 30, 2019 or September 30, 2018.

Audit Committee Pre-Approval Policies and Procedures.

Before an independent public accounting firm is engaged by the Company to render audit or non-audit services, the engagement is approved by the Audit Committee. Our Audit Committee has the sole authority to approve the scope of the audit and any audit-related services as well as all audit fees and terms. Our Audit Committee must pre-approve any audit and non-audit related services by our independent registered public accounting firm. During our fiscal year ended September 30, 2019, no services were provided to us by our independent registered public accounting firm other than in accordance with the pre-approval procedures described herein.

Code of Conduct and Ethics

The Company's Board of Directors has adopted a Code of Ethics within the meaning of Item 406(b) of Regulation S-K of the Securities Act that applies to all of the Company's officers and employees, including its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Ethics codifies the business and ethical principles that govern the Company's business. A copy of the Code of Ethics is available on the Company's website www.bridgeline.com. The Company intends to post amendments to or waivers from its Code of Ethics (to the extent applicable to its principal executive officer, principal financial officer or principal accounting officer) on its website. The Company's website is not part of this proxy statement.

PROPOSAL 2

ADVISORY VOTE TO APPROVE THE COMPENSATION OF NAMED EXECUTIVE OFFICERS (“SAY-ON-PAY”)

Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended, we provide our shareholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission.

Our executive compensation programs are designed to attract, motivate, and retain our named executive officers, who are critical to our success, and to reward our named executive officers for the achievement of short-term and long-term strategic and operational goals and the achievement of increased total shareholder return. We seek to closely align the interests of our named executive officers with the interests of our shareholders, and our Compensation Committee regularly reviews named executive officer compensation to ensure such compensation is consistent with our goals.

Required Vote

This vote is advisory, which means that the vote on executive compensation is not binding on the company, our Board of Directors, or the Compensation Committee of the Board of Directors. The vote on this resolution is not intended to address any specific element of compensation, but rather relates to the overall compensation of our named executive officers, as described in this proxy statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission. To the extent there is a significant vote against our named executive officer compensation as disclosed in this proxy statement, the Compensation Committee will evaluate whether any actions are necessary to address our shareholders’ concerns.

Accordingly, we ask our shareholders to vote on the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Summary Compensation Table, and the other related tables and disclosure.”

Vote Required and Recommendation

On this advisory, non-binding matter, the affirmative vote of at least a majority of the votes cast at the Annual Meeting is required to approve this Proposal 2.

The Board recommends that stockholders vote “FOR” the advisory resolution above, approving of the compensation paid to the Company’s Named Executive Officers.

PROPOSAL 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

Upon the recommendation of the Audit Committee, the Board of Directors has reappointed Marcum LLP to audit the consolidated financial statements of the Company for the fiscal year ending September 30, 2020. Marcum LLP has served as the Company's independent registered public accounting firm since April 2010. A representative from Marcum LLP is expected to be present at the meeting with the opportunity to make a statement if he or she desires to do so and to be available to respond to appropriate questions.

Although stockholder ratification of the appointment is not required by law, the Company desires to solicit such ratification. If the appointment of Marcum LLP is not approved by a majority of the shares represented at the Meeting, the Company will consider the appointment of other independent registered public accounting firms.

Required Vote and Recommendation

Ratification of Marcum LLP as the Company’s independent auditors for the fiscal year ending September 30, 2020 requires the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Annual Meeting. Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the ratification of Marcum LLP as the Company’s independent auditors for the fiscal year ending September 30, 2020.

The Board recommends that stockholders vote “FOR” the ratification of Marcum LLP as our independent auditors for the fiscal year ending September 30, 2020.

PROPOSAL 4

THE ADJOURNMENT PROPOSAL

This proposal is presented to stockholders at the Meeting to approve an adjournment to another time or place, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the Meeting to approve each Proposal.

If, at the Meeting, the number of shares present or represented and voting in favor of the approval of each Proposal is not sufficient to approve that proposal, we currently intend to move to adjourn the Meeting in order to enable our Board of Directors to solicit additional proxies for this approval. In that event, we will ask our stockholders to vote only upon Proposals 1, 2, 3, and 4. In the event this Proposal 4 is approved, the Meeting may be adjourned from time to time to a date that is not more than 120 days after the original record date for the Meeting.

In this proposal, we are asking our stockholders to authorize the holder of any proxy solicited by our Board of Directors to vote in favor of granting discretionary authority to the proxy holders, and each of them individually, to adjourn the Meeting to another time and place for the purpose of soliciting additional proxies. If the stockholders approve the adjournment proposal, we could adjourn the Meeting and any adjourned session of the Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from stockholders who have previously voted.

Vote Required and Recommendation

If the proposal to adjourn the Meeting for the purpose of soliciting additional proxies is submitted to the stockholders for approval, such proposal will be approved by the affirmative vote of a majority of the votes cast at the Meeting.

The Board of Directors unanimously recommends that stockholders vote “FOR” Proposal 4, as to the adjournment of the Meeting if necessary or appropriate to solicit additional proxies in favor of the approval of each Proposal.

The Board recommends that stockholders vote “FOR” Proposal 4.

Other Matters

The Board of Directors has no knowledge of any other matters which may come before the Meeting and does not intend to present any other matters. However, if any other matters shall properly come before the Meeting or any adjournment thereof, the persons named as proxies will have discretionary authority to vote the shares of Common Stock represented by the accompanying proxy in accordance with their best judgment.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of Securities Exchange Act of 1934 requires the Company's executive officers, directors, and persons who own more than ten percent of a registered class of the Company's equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission. With respect to 2019 and based solely on its review of the copies of such forms and amendments thereto received by it, the Company believes that all of the executive officers, directors, and owners of ten percent of the outstanding Common Stock complied with all applicable filing requirements.

Stockholder Proposals and Recommendations for Director

Any stockholder of the Company who wishes to present a proposal to be considered at the next annual meeting of stockholders of the Company and who wishes to have such proposal presented in the Company's Proxy Statement for such meeting must deliver such proposal in writing to the Company at 150 Woodbury Road, Woodbury, New York 11797, between May 22, 2021 and June 21, 2021. Such proposals may be made only by persons who are shareholders, beneficially or of record, on the date the proposals are submitted and who continue in such capacity through the date of the next annual meeting, of at least 1% or $2,000 in market value of securities entitled to be voted at the meeting, and have held such securities for at least one year.

For any stockholder proposal that is not submitted for inclusion in the Company’s Proxy Statement, but instead seeks to present such proposal directly at the Annual Meeting, management will be able to vote proxies in its discretion if the Company does not receive notice of the proposal prior to the close of business on June 21, 2021.

Stockholders may recommend individuals to the Board of Directors for consideration as potential director candidates by following the requirements under Article I, Section 10 of the Bylaws. In order to be eligible to nominate a person for election to our Board of Directors a stockholder must (i) comply with the notice procedures set forth in the Bylaws and (ii) be a stockholder of record on the date of giving such notice of a nomination as well as on the record date for determining the stockholders entitled to vote at the meeting at which directors will be elected.

To be timely, a stockholder's notice must be in writing and received by our corporate secretary at our principal executive offices as follows: (A) in the case of an election of directors at an annual meeting of stockholders, not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year's annual meeting; provided, however, that in the event that the date of the annual meeting is advanced by more than 20 days, or delayed by more than 60 days, from the first anniversary of the preceding year's annual meeting, a stockholder's notice must be so received no earlier than the 120th day prior to such annual meeting and not later than the close of business on the later of (x) the 90th day prior to such annual meeting and (y) the tenth day following the day on which notice of the date of such annual meeting was mailed or public disclosure of the date of such annual meeting was made, whichever first occurs; or (B) in the case of an election of directors at a special meeting of stockholders, provided that the board of directors has determined that directors shall be elected at such meeting, not earlier than the 120th day prior to such special meeting and not later than the close of business on the later of (1) the 90th day prior to such special meeting and (2) the tenth day following the day on which notice of the date of such special meeting was mailed or public disclosure of the date of such special meeting was made, whichever first occurs.

In addition, a stockholder's notice must contain the information specified in Article I, Section 10 of the Bylaws and must be accompanied by the written consent of the proposed nominee to serve as a director if elected. The stockholder making a nomination must personally appear at the annual or special meeting of stockholders to present the nomination, otherwise the nomination will be disregarded.

Stockholders interested in making a nomination should refer to the complete requirements set forth in our Bylaws filed as an exhibit to our Form 8-K filed with the Securities and Exchange Commission on December 14, 2018. Provided that the date of next year's annual meeting of stockholders is not advanced by more than 20 days or delayed by more than 60 days, from the first anniversary of the Annual Meeting, any stockholder who wishes to make a nomination to be considered for the next annual meeting must deliver the notice specified by our Bylaws between May 22, 2021 and June 21, 2021. The By-Laws contain a number of substantive and procedural requirements, which should be reviewed by any interested stockholder. Any notice should be mailed to: Secretary, Bridgeline Digital, Inc., 150 Woodbury Road, Woodbury, New York 11797.

|

|

By Order of the Board of Directors

Stacey A. Ward

Assistant Secretary

July 30, 2020

|

Appendix A

Appendix B

PROXY

BRIDGELINE DIGITAL, INC.

100 Sylvan Drive, Suite G700

Woburn, Massachusetts 01801

The undersigned, revoking all proxies, hereby appoints Roger E. Kahn and Mark G. Downey and each of them, proxies with power of substitution to each, for and in the name of the undersigned to vote all shares of Common Stock of Bridgeline Digital, Inc. (the "Company") which the undersigned would be entitled to vote if present at the Annual Meeting of Stockholders of the Company to be held on September 8, 2020, at 8:30 A.M. Eastern Time at the Company’s New York office located at 150 Woodbury Road, Woodbury, New York 11797, and any adjournments thereof, upon the matters set forth in the Notice of Annual Meeting.

The undersigned acknowledges receipt of the Notice of Annual Meeting, Proxy Statement and the Company’s Annual Report.

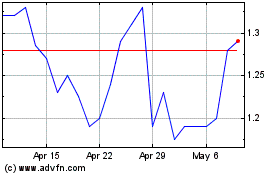

Bridgeline Digital (NASDAQ:BLIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

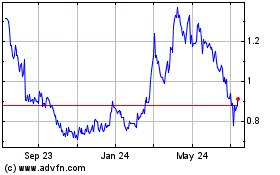

Bridgeline Digital (NASDAQ:BLIN)

Historical Stock Chart

From Apr 2023 to Apr 2024