BIO-key International, Inc. (Nasdaq: BKYI), an

innovative provider of biometric software and hardware solutions

for strong, convenient user authentication and large-scale

identity, today reported results for its year ended December 31,

2019 and preliminary results for its first quarter ended March 31,

2020 (Q1’20). BIO-key will host a conference call today at 10:00

a.m. ET (details below) to review its results and outlook.

Recent Highlights:

- BIO-key Africa through our partner TTI won a $30M contract to

deploy biometric solutions for the enrollment and the positive

identification of millions of customers for a leading Nigerian

telecom.

- BIO-key Secures $45M Contract in Nigeria along with Exponential

Launch Africa Limited (ELA) an affiliate of Technology Transfer

Institute of Africa (TTI) and Imperial Education Services (IES) to

build secure e-commerce infrastructure across Nigeria in support of

a Nigerian Ministry of Labour program to educate, empower and

create employment for one million recent college graduates.

- South Africa’s Capitec Bank Exceeds Nine Million

BIO-key-Enrolled Customers for in-branch identification

- Manny Alia Joins Board to help drive biometric ID projects

across Africa

- Dubai Police Force Expands Deployment of Biometric

Authentication, utilizing BIO-key’s ID Director for Windows

Software and PIV-Pro Fingerprint Readers

- Three more Florida counties deploy BIO-key for election data

security since December Update

- BIO-key launches ‘Remote Worker’ sales & marketing

initiative to capitalize on the benefits of its biometric

technologies in addressing the security challenges of employees

working from home.

BIO-key CEO Michael DePasquale commented, “BIO-key navigated a

very challenging and disappointing year from a revenue and cash

flow standpoint, but laid the foundation for what we believe is the

transformation of our company to play a leadership role in

biometric multi-factor authentication as well as large scale Civil

ID projects that are emerging on an international basis,

particularly in Africa. We launched our BIO-key Africa subsidiary

in late 2019 and so far this year we have executed agreements

totaling over $75M in expected revenue over the next 24 months, and

are focused on building on this momentum.

We also took prudent steps to ensure our financial strength and

made difficult decisions regarding the write-down of software

licenses based on their increasingly unlikely monetization, the

pivoting away from our lock business and initiated efforts to

enhance our suite of multifactor authentication capabilities, while

altering our geographic focus to pursue much larger scale

opportunities.

At the same time we absorbed the near-term revenue impact of our

transition from a software license sales model to a subscription or

software as a service (SaaS) model, where customers pay a lower fee

to access our software on an annual basis. We believe the

subscription model is more favorable for BIO-key as it creates

enduring customer relationships and predictable, recurring revenue

streams that over the long term are likely to exceed what we would

have earned from a conventional software licenses.

Finally, we continue to invest in enhancing our suite of

solutions to meet the evolving needs of our customers. In

particular, we are working to provide a full suite of multi-factor

authentication capabilities to allow our customers flexibility in

addressing their needs across a wide variety of locations, devices

and requirements. We recognize such flexibility is an increasingly

important capability and differentiator in the marketplace. By

building on our core biometric strengths to put in place a full

suite of multi-factor capabilities, we expect to substantially

enhance BIO-key’s attractiveness in the market.”

OutlookDePasquale continued, “Reflecting

actions taken in 2019, our Q1’20 bottom-line performance improved

substantially compared to the same period in 2019, and we have a

strong outlook for 2020. We expect to commence work on our large

African contracts in the coming months and expect to receive

upfront deposits to precede our efforts. Given their scale and

expected duration, these projects alone position BIO-key for

substantial revenue growth and for the full year 2020, and we are

confident they will allow us to pursue other large-scale

opportunities in Africa and on a global basis. We look to provide

more visibility into the timing and expected impact of our Africa

business as final planning is completed and the projects are

underway.”

Growth InitiativesFred Corsentino, BIO-key’s

Chief Revenue Officer, added, “We are very pleased with the success

of our Channel Alliance Program launched last year to attract a

growing base of Managed Service Providers, Security Integrators and

Value-Added Resellers to expand our global sales and marketing

reach. We achieved early traction in Africa where we added several

channel partners in support of our BIO-key Africa subsidiary formed

earlier this year.

“Biometrics have gained solid support across Africa as an ideal,

cost effective solution to large scale identity and authentication

challenges for governments, public programs, telecommunications,

financial services and other high-value processes vulnerable to

fraud or security breaches. Importantly, such initiatives are

gaining traction and financial support in both the public and

private sectors, including $433 million in World Bank funding for a

biometric national ID registration program in Nigeria.”

Remote Worker ProgramMr. Corsentino added, “In

response to the COVID-19 outbreak, BIO-key moved quickly to launch

our ‘Remote Worker’ sales and marketing campaign to communicate how

our finger scanners and software solutions help solve the unique

and large scale challenges posed by the sudden global transition to

working from home. Many companies relied on physical location

within a firewall to secure access, but are now forced to operate

remotely. BIO-key provides very cost-effective, user-friendly

solutions to the increased security and authentication challenges

created when workers are outside the protection of enterprise

systems and direct oversight. In this context, the use of physical

tokens becomes far more challenging, given delays and increased

costs when replacements are needed.

Governments and enterprises are now scrambling to solve remote

work challenges such as implementing stronger security and access

control for video conferencing solutions used to connect disparate

teams. We are actively highlighting BIO-key and our unique ability

to address these challenges and very excited about the opportunity

this provides going forward.”

2019 Results 2019 revenues declined to $2.3M

from $4.0M in 2018, due principally to lower license fees,

including the impact of the Company’s transition to the software

subscription business model, as well as reduced hardware sales and

lower services revenues. In particular, 2019 revenue was impacted

by the absence of anticipated software license payments totaling

$5.0M. As a result, BIO-key has determined the payments are

unlikely to be collected and it took a $7.0M charge in 2019 to

fully write down resalable software license rights it had secured

as part of a $19M strategic investment completed in 2015.

The decline in hardware sales principally reflects a decrease in

lock sales as BIO-key transitioned to an “enterprise only“ model

for its SmartlLock technology and exited lower margin U.S. and

online retail markets.

2019 operating expenses decreased to $6.4M from $6.7M in 2018,

reflecting lower selling general and administrative expense and

lower research, development and engineering expense.

The Company also recorded interest expense of $1.1M in 2019

related to interest, amortization of debt discount and issuance

costs for a convertible debt financing. In 2018, BIO-key recorded a

$1.4M “deemed dividend” expense resulting from the required

repricing of outstanding warrants, most of which have since

expired.

BIO-key reported a 2019 net loss of $14.6M, or $1.03 per basic

share, compared to a net loss of $8.5M, or $0.73 per basic share,

in 2018. The weighted average basic shares outstanding were 14.2M

and 11.6M in 2019 and 2018, respectively.

Preliminary Q1 2020 ResultsBIO-key is providing

preliminary financial results for its first quarter ended March 31,

2020 in today’s release as its final financial statements for this

period are not yet finalized. Q1’20 revenues declined to $530,000

from $552,000 in Q1’19, primarily due to lower hardware revenue

related to BIO-key’s exit of the retail lock business, and a

decrease in maintenance revenue reflecting the transition to

software subscription sales, partially offset by a more than

$150,000 increase in software license revenue.

Gross margin improved to 67% in Q1’20 versus a negative gross

margin in Q1’19, primarily reflecting the elimination of $281,000

in non-cash software license amortization expense recorded in Q1’19

which did not recur in Q1’20.

Q1’20 operating expenses declined to $1.7 million from $1.8

million, reflecting the benefit of cost reduction efforts.

BIO-key’s preliminary first quarter results include $0.5M in

non-cash compensation expense that will be allocated to each

expense category in the final results filed on form 10-Q.

Reflecting the substantial improvement in gross profit and the

decrease in operating expenses, BIO-key’s operating loss was

reduced to $1.3M in Q1’20 versus $1.8M in Q1’19. Weighted average

basic shares outstanding were approximately 16,635,606 in Q1’20

compared to 13,979,318 in the year ago first quarter.

At March 31, 2020, BIO-key had $1.3M of cash and accounts

receivable versus $0.7M at December 31, 2019.

To provide added financial liquidity to support operations and

the launch of the Africa engagements, in May, BIO-key completed a

$2.4M convertible note financing with warrants, generating gross

proceeds of $2.1M. The note is convertible at the option of the

investor into common stock at an ‘above market’ conversion price of

$1.16 per share and is subject to redemption at any time by

BIO-key.

|

Conference Call Details |

|

| Date / Time |

Friday, May 15 at 10 a.m. ET |

| Call Dial In #: |

1-877-418-5460 U.S. or 1-412-717-9594 International |

| Live Webcast / Replay: |

Investor Webcast & Replay – Available for

3 months. |

| Audio Replay: |

1-877-344-7529 U.S. or 1-412-317-0088 Int’l; code 10143410 |

About BIO-key International, Inc.

(www.bio-key.com)BIO-key

is revolutionizing authentication with biometric solutions that

enable convenient and secure access to devices, information,

applications and high-value transactions. BIO-key’s software and

hardware finger scanning solutions offer secure, user-friendly and

attractively priced alternatives to passwords, PINs, tokens and

security cards, enabling enterprises and consumers to secure their

networks and devices as well as their information in the cloud.

BIO-key Safe Harbor

StatementAll statements contained in this press release

other than statements of historical facts are "forward-looking

statements" as defined in the Private Securities Litigation Reform

Act of 1995 (the "Act"). The words "estimate," "project,"

"intends," "expects," "anticipates," "believes" and similar

expressions are intended to identify forward-looking statements.

Such forward-looking statements are made based on management's

beliefs, as well as assumptions made by, and information currently

available to, management pursuant to the "safe-harbor" provisions

of the Act. These statements are not guarantees of future

performance or events and are subject to risks and uncertainties

that may cause actual results to differ materially from those

included within or implied by such forward-looking statements.

These risks and uncertainties include, without limitation, our

history of losses and limited revenue; our ability to protect our

intellectual property; changes in business conditions; changes in

our sales strategy and product development plans; changes in the

marketplace; continued services of our executive management team;

competition in the biometric technology industry; market acceptance

of biometric products generally and our products under development;

our ability to expand into Asia, Africa and other foreign markets;

delays in the development of products and statements of assumption

underlying any of the foregoing; our ability to close the potential

private placement transaction on the terms described herein if at

all as well as other factors set forth under the caption see "Risk

Factors" in our Annual Report on Form 10-K for the year ended

December 31, 2019 and other filings with the Securities and

Exchange Commission. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date made. Except as required by law, the Company undertakes

no obligation to disclose any revision to these forward-looking

statements whether as a result of new information, future events,

or otherwise. Additionally, there may be other factors of which the

Company is not currently aware that may affect matters discussed in

forward-looking statements and may also cause actual results to

differ materially from those discussed. In particular, the

consequences of the coronavirus outbreak to economic conditions and

the industry in general and the financial position and operating

results of our company in particular have been material, are

changing rapidly, and cannot be predicted.

| Engage

with BIO-keyFacebook – Corporate:Twitter –

Corporate: Twitter – Investors: StockTwits –

Investors: |

BIO-key

International @BIOkeyIntl @BIO_keyIR @BIO_keyIR |

Investor & Media Contacts William Jones,

David CollinsCatalyst

IR212-924-9800bkyi@catalyst-ir.com

BIO-KEY INTERNATIONAL, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

|

Three months endedMarch

31,(Preliminary) |

|

|

|

Year endedDecember 31, |

|

| |

|

2020 |

|

|

2019 |

|

|

|

2019 |

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License fees |

|

$ |

239,379 |

|

|

$ |

83,208 |

|

|

|

$ |

442,649 |

|

|

$ |

1,739,897 |

|

|

Services |

|

|

202,849 |

|

|

|

226,805 |

|

|

|

|

925,245 |

|

|

|

1,012,576 |

|

|

Hardware |

|

|

87,938 |

|

|

|

83,208 |

|

|

|

|

899,634 |

|

|

|

1,292,069 |

|

|

Total Revenues |

|

|

530,166 |

|

|

|

551,623 |

|

|

|

|

2,267,528 |

|

|

|

4,044,542 |

|

| Costs and other expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of license fees, hardware and other |

|

|

128,480 |

|

|

|

513,221 |

|

|

|

|

2,188,927 |

|

|

|

3,720,980 |

|

|

Cost of services |

|

|

48,379 |

|

|

|

90,829 |

|

|

|

|

272,318 |

|

|

|

443,210 |

|

|

Total costs and other expenses |

|

|

176,859 |

|

|

|

604,050 |

|

|

|

|

2,461,245 |

|

|

|

4,164,190 |

|

| Gross Profit (Loss) |

|

|

353,307 |

|

|

|

(52,427 |

) |

|

|

|

(193,717 |

) |

|

|

(119,648 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

1,346,083 |

|

|

|

1,377,033 |

|

|

|

|

5,036,820 |

|

|

|

5,333,906 |

|

|

Research, development and engineering |

|

|

325,449 |

|

|

|

374,118 |

|

|

|

|

1,331,667 |

|

|

|

1,415,401 |

|

| Total operating expenses |

|

|

1,671,532 |

|

|

|

1,751,151 |

|

|

|

|

6,368,487 |

|

|

|

6,749,307 |

|

|

Operating loss |

|

|

(1,318,225 |

) |

|

|

(1,803,578 |

) |

|

|

|

(6,562,204 |

) |

|

|

(6,868,955 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

|

|

|

|

70 |

|

|

|

|

154 |

|

|

|

80 |

|

|

Interest expense |

|

|

|

|

|

|

|

- |

|

|

|

(1,069,134 |

) |

|

|

- |

|

|

Impairment of resalable software license rights |

|

|

|

|

|

|

|

- |

|

|

|

(6,957,516 |

) |

|

|

|

|

| Total other income (expense),

net |

|

|

|

|

|

|

70 |

|

|

|

|

(8,026,496 |

) |

|

|

64 |

|

| Net loss |

|

|

|

|

|

|

(1,803,508 |

) |

|

|

|

(14,588,700 |

) |

|

|

(6,868,875 |

) |

| Deemed dividend from trigger

of anti-dilution provision feature |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

(1,428,966 |

) |

| Convertible preferred stock

dividends |

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

(198,033 |

) |

| Net loss available to common

stockholders |

|

|

|

|

|

$ |

(1,803,508 |

) |

|

|

$ |

(14,588,700 |

) |

|

$ |

(8,495,874 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per Common Share

attributable to common stockholders -

Basic |

|

|

|

|

|

$ |

(0.13 |

) |

|

|

$ |

(1.03 |

) |

|

$ |

(0.73 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average

Shares Outstanding - Basic: |

|

|

|

|

|

|

13,979,318 |

|

|

|

|

14,223,685 |

|

|

|

11,607,933 |

|

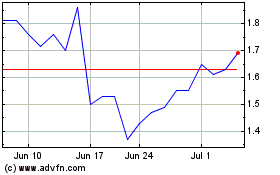

BIO key (NASDAQ:BKYI)

Historical Stock Chart

From Mar 2024 to Apr 2024

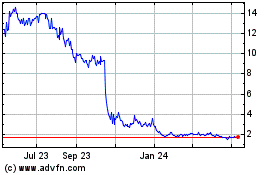

BIO key (NASDAQ:BKYI)

Historical Stock Chart

From Apr 2023 to Apr 2024