Current Report Filing (8-k)

October 30 2020 - 5:05PM

Edgar (US Regulatory)

false000107553100010755312020-10-282020-10-280001075531us-gaap:CommonStockMember2020-10-282020-10-280001075531bkng:A0.8SeniorNotesDueMarch2022Member2020-10-282020-10-280001075531bkng:A2.15SeniorNotesDueNovember2022Member2020-10-282020-10-280001075531bkng:A2.375SeniorNotesDueSeptember2024MemberMember2020-10-282020-10-280001075531bkng:A1.8SeniorNotesDueMarch2027Member2020-10-282020-10-28

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 28, 2020

Booking Holdings Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-36691

|

|

06-1528493

|

(State or other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

800 Connecticut Avenue

|

Norwalk

|

Connecticut

|

|

06854

|

|

(Address of principal offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (203) 299-8000

N/A

(Former name or former address, if changed since last report)

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class:

|

|

Trading Symbol

|

|

Name of Each Exchange on which Registered:

|

|

Common Stock par value $0.008 per share

|

|

BKNG

|

|

The NASDAQ Global Select Market

|

|

0.800% Senior Notes Due 2022

|

|

BKNG 22A

|

|

The NASDAQ Stock Market LLC

|

|

2.150% Senior Notes Due 2022

|

|

BKNG 22

|

|

The NASDAQ Stock Market LLC

|

|

2.375% Senior Notes Due 2024

|

|

BKNG 24

|

|

The NASDAQ Stock Market LLC

|

|

1.800% Senior Notes Due 2027

|

|

BKNG 27

|

|

The NASDAQ Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4c under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 28, 2020, Booking Holdings Inc. (the “Company”) entered into a second amendment (the “Amendment”) to its $2 billion revolving credit facility pursuant to which the maximum leverage ratio covenant, compliance with which is a condition to its ability to borrow thereunder, has been further suspended through and including the fiscal quarter ending March 31, 2022, and will continue to be replaced with a minimum liquidity covenant based on unrestricted cash, cash equivalents, short-term investments and unused capacity under the revolving credit facility. The Amendment also increases the permitted maximum leverage ratio from and including the quarter ending June 30, 2022 through and including the quarter ending March 31, 2023. The Company agreed not to declare or make any cash distribution and not to repurchase any of its shares unless (i) prior to the delivery of financial statements for the quarter ending June 30, 2022, it has at least $6.0 billion of liquidity based on unrestricted cash, cash equivalents, short-term investments and unused capacity under this revolving credit facility and (ii) after the delivery of financial statements for the quarter ending June 30, 2022, it is in compliance on a pro forma basis with the maximum leverage ratio covenant then in effect. Such restriction ends upon delivery of financial statements required for the quarter ending June 30, 2023, or the Company has the ability to terminate this restriction earlier if it demonstrates compliance with the original maximum leverage ratio covenant in the revolving credit facility. Beginning with the quarter ending June 30, 2022, the minimum liquidity covenant will cease to apply and the maximum leverage ratio covenant, as increased, will again be in effect. The foregoing description is only a summary of the Amendment and is qualified in its entirety by reference to the Amendment, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Description

10.1 Amendment, dated as of October 28, 2020, to the Credit Agreement, dated as of August 14, 2019, by and among the Company, the lenders from time to time party thereto, and JPMorgan Chase Bank, N.A., as Administrative Agent.

104 Cover Page Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOOKING HOLDINGS INC.

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Sue D'Emic

|

|

|

|

Name:

|

Sue D'Emic

|

|

|

|

Title:

|

Senior Vice President, Chief Accounting Officer and Controller

|

Date: October 30, 2020

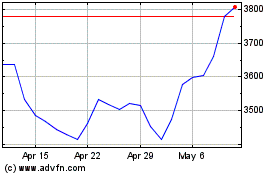

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024