Urban Escapees Provide Some Comfort to Travel Industry

May 21 2020 - 5:39PM

Dow Jones News

By Laura Forman

Expedia is giving new meaning to the term "cabin fever."

The global pandemic had reduced investors' expectations for

quarterly results to virtually zero. That explains why investors

reacted only mildly to Expedia's first-quarter report after the

closing bell Wednesday in which revenue fell 15% from a year

earlier.

While declining to give concrete guidance for the second

quarter, which investors largely expect to be the trough, the

company also dropped a small nugget of hope.

Expedia said business in May has been looking "considerably

better" than late March and early April, citing "really markedly

better" performance in its homestay business, Vrbo. The company

said this is likely driven by people looking to get out of densely

populated cities for the summer with their families.

This, of course, should benefit all alternative accommodation

players, including online travel agent Booking Holdings and Airbnb,

the latter of which boasts more than seven million listings

world-wide. But while smaller than Airbnb, Expedia's homestay

business may have a coronavirus upper hand: SunTrust analyst Naved

Khan notes that whole homes have been a historical focus for Vrbo,

many of which are in secondary and tertiary towns. While Airbnb

says the majority of its listings are also whole homes, it also has

a big focus on shared rooms and urban apartments, which may be less

on-trend at the moment.

In its first-quarter report, Expedia said it changed its segment

reporting such that it didn't break out revenues for Vrbo. As such,

it's difficult to know exactly how Vrbo's business has performed

amid the pandemic. As of the fourth quarter, Vrbo accounted for

just 9% of Expedia's overall sales.

While the business is small, it could offer some positive signs

of a more general travel recovery trend as the country opens back

up. Mr. Khan said property managers in the vacation rental space

with whom he spoke are seeing a bounce in bookings, particularly in

destinations to which travelers can drive rather than fly.

Investors should stay grounded as well. Expedia's gross bookings

in the first quarter were down 39% year-over-year, an indication

that travel in the next few months should continue to be light.

Time will tell just how desperate travelers are to flee the

coop. But it seems more clear that those who do leave are mainly

looking for another nest to inhabit.

Write to Laura Forman at laura.forman@wsj.com

(END) Dow Jones Newswires

May 21, 2020 17:24 ET (21:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

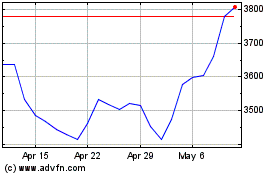

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024