Booking Holdings 1Q Adjusted Earnings, Revenue Fall as Travel Dries Up Amid Pandemic

May 07 2020 - 4:39PM

Dow Jones News

By Dave Sebastian

Booking Holdings Inc. said its adjusted earnings and revenue for

the first quarter declined as the Covid-19 pandemic has battered

travel and companies scaled back on their advertising spending.

The online-travel agency, which operates sites like Booking.com,

Kayak and OpenTable, on Thursday posted net loss of $699 million,

or $17.01 a share, compared with a profit of $765 million, or

$16.85 a share, in the comparable quarter last year. The company

said it had an unrealized loss of $307 million for the quarter on

marketable equity securities, as well as impairments of $489

million for OpenTable and Kayak goodwill and $100 million for an

investment in equities.

Gross travel bookings fell 51% to $12.4 billion, Booking said.

Room nights booked declined 43% from a year ago.

Adjusted earnings were $3.77 a share, down 66% from the prior

year and missing the $5.61 a share analysts polled by FactSet had

expected.

Revenue fell 19% to $2.29 billion from the year-ago period.

Analysts were targeting $2.22 billion.

Agency revenue, or that derived from travel-reservation

commissions, fell to $1.42 billion from $1.95 billion. Advertising

and other revenues fell to $205 million from $285 million. Merchant

revenue, or that derived from travel-related transactions whose

payments Booking facilitated, rose to $659 million from $603

million.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

May 07, 2020 16:24 ET (20:24 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

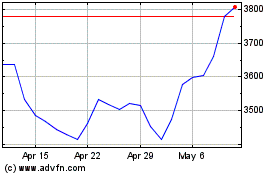

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024