AstraZeneca's Covid-19 Vaccine Shortfall Threatens EU Plans to Boost Inoculations

January 23 2021 - 1:04PM

Dow Jones News

By Jenny Strasburg and Laurence Norman

AstraZeneca PLC expects to deliver tens of millions fewer

Covid-19 vaccine doses than planned to the European Union in coming

months, according to people familiar with the matter, threatening

the continent's plans to ramp up vaccinations and delivering a

fresh reputational blow to the drugmaker.

AstraZeneca disclosed the shortfall late Friday after briefing

European officials earlier in the day. It blamed a manufacturing

issue in Europe, but didn't disclose the magnitude of the

shortfall.

According to people familiar with the matter, the company told

European officials that in a worst-case scenario, AstraZeneca may

be able to provide only around 30 million of roughly 80 million

doses EU countries had anticipated for February and March, a

roughly 60% decline from the company's earlier estimates.

AstraZeneca is working to significantly reduce that potential

shortfall and says the roughly 30 million doses is the minimum it

should be able to deliver, these people said.

The root cause of the problem is a manufacturing facility in

Belgium owned by Novasep Holding SAS that has been unable to make

as much bulk vaccine as projected, the people said. The facility's

so-called yield, or the amount of vaccine it can make from base

ingredients, is running at about a third of AstraZeneca's

expectations, one of the people said. Novasep didn't respond to

requests for comment Saturday.

Vaccine yields can vary widely depending on "seeding" steps,

taken over weeks, to grow cells needed to make the vaccine and

later-stage processes to filter and purify the substance before

it's packed into vials. AstraZeneca has found yields varying among

its many manufacturing partners and has been working to boost

production where it is lagging, the person said. The process is

labor- and time-intensive. Reuters first reported the number of

doses AstraZeneca may no longer be able to deliver.

The size of the expected shortfall has raised alarms in European

capitals, which are racing to accelerate vaccination drives that

have fallen behind other Western countries, including the U.K. and

U.S. The bad news came after European officials clashed this week

with Pfizer Inc. and BioNTech SE over the companies' decision to

cut their own planned deliveries of Covid-19 vaccines to the

bloc.

It also demonstrates the delicate supply lines that vaccine

producers rely on to push out the hundreds of millions of vaccine

doses they have promised to deliver. AstraZeneca partnered with the

University of Oxford to get its vaccine candidate to market.

AstraZeneca has agreed to make 3 billion doses of the vaccine this

year and not profit from it during the pandemic -- or ever in the

case of poorer countries.

The ambitious volume target and no-profit promise set

AstraZeneca apart from other big pharmaceutical companies rolling

out vaccines, but it also brings massive logistical challenges and

reputational risks. The company, which has relatively little

experience in vaccines, is relying on its own manufacturing

facilities and those of contractors and other partners around the

world.

Complicating the massive distribution effort: different drug

approval procedures AstraZeneca has had to navigate to get its

vaccine authorized for use. The company, alongside Oxford,

initially stumbled in efforts to communicate results of the shot's

late-stage human trials, sowing confusion about the vaccine's

effectiveness.

The U.K. approved it for emergency use in late December, and

others, including India, have followed suit. The Food and Drug

Administration, however, is waiting for full U.S. trial data before

reviewing it for authorization, data expected as soon as February.

The European Medicines Agency, which approves new drugs for the

bloc, will consider it next week.

The U.K. had a head start with AstraZeneca, agreeing to buy

hundreds of millions of doses earlier than Europe and working

closely with the drugmaker to set up a U.K. supply chain to begin

churning out those vaccines. European agreements and manufacturing

arrangements took longer to pull together, according to people

familiar with the process. What's more, the U.K. authorized the

AstraZeneca vaccine before any other Western countries -- and

almost a month before the anticipated European signoff.

As AstraZeneca ramped up to supply the U.K., it used production

capacity available in Europe -- and not needed yet there -- to

prepare doses and ship them to the U.K., according to people

familiar with the matter. The vaccines coming from Europe early on

supplemented doses manufactured and packaged within the U.K.

itself, they said. Now AstraZeneca's European manufacturing chain

is set up to serve Europe, while doses made in the U.K. are staying

in the U.K.

Europe is relying heavily on the AstraZeneca vaccine to reach

broad swaths of its population. The bloc has ordered 300 million

doses of the AstraZeneca vaccine with an option for 100 million

more.

AstraZeneca has told some officials it is tailoring deliveries

according to contracts and regulatory authorizations, according to

one of the people close to the discussions. Some European officials

want to know how AstraZeneca is deciding where and when to route

doses and whether orders from outside Europe are directly impacting

resources devoted to deliveries to the bloc, according to people

familiar with the deliberations.

European Health Commissioner Stella Kyriakides said Friday on

Twitter that AstraZeneca's expected delivery shortfall is putting

at risk the delivery schedule the company had pledged. She said the

European Commission will press AstraZeneca for more information so

countries can plan vaccinations. Officials will meet with the

company Monday.

In anticipation of clearance for the AstraZeneca shot across the

bloc, the drugmaker and partners have been planning required labels

that must accompany every shipment. The labels must be provided in

multiple languages, and what they say depends in large part on

advice from the European medicines regulator that isn't yet

finalized, a person close to the process said. Preparing the labels

could take more than a week, but the person said AstraZeneca is

trying to cut that down to a few days in the hopes of making doses

available in the first week of February, pending expected

regulatory signoff.

Write to Jenny Strasburg at jenny.strasburg@wsj.com and Laurence

Norman at laurence.norman@wsj.com

(END) Dow Jones Newswires

January 23, 2021 12:49 ET (17:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

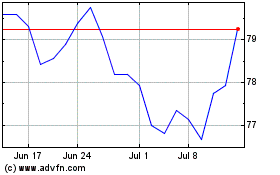

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

From Apr 2023 to Apr 2024