Filed Pursuant to Rule 424(b)(3)

Registration No. 333-240314

Prospectus

AYRO, Inc.

878,680

Shares of Common Stock and Shares of Common Stock Underlying

Warrants

The

selling stockholders named in this prospectus may use this prospectus to offer and resell from time to time up to 878,680

shares of our common stock, which are the shares of common stock and shares of common stock issuable upon the conversion of warrants

held by the selling stockholders and 8,130 other shares of common stock (the “Shares”). These shares of common stock

consist of:

|

|

●

|

36,236

shares of our common stock issuable upon exercise of warrants

(the “Pre-funded Warrants”) we assumed in the Merger (defined herein) and that converted into the right to purchase

shares of our common stock in connection with the Merger;

|

|

|

|

|

|

|

●

|

100,000

shares of our common stock issuable upon exercise of the warrants (the “Penny Warrants”) we issued to certain

selling stockholders on May 28, 2020, in a private offering exempt from registration under the Securities Act, pursuant to

a subscription agreement dated as of February 20, 2020;

|

|

|

|

|

|

|

●

|

8,130

shares of our common stock (the “Non-Employee Director Grant”) we issued, pursuant to a Change of Control Letter

Agreement entered into in January 2020, to a non-employee director as consideration for his services to the Board of Directors

prior to the Merger on May 28, 2020;

|

|

|

|

|

|

|

●

|

232,403

shares of our common stock issuable upon exercise of the warrants (the “Palladium Bridge Warrants”) originally

issued to Palladium Capital Advisors, LLC (“Palladium”) as part of Palladium’s compensation for serving

as the placement agent of AYRO Operating Company, Inc. in connection with two private placements and a bridge loan, each dated

December 19, 2019, that were assumed in the Merger and that converted into the right to purchase shares of our common stock

in connection with the Merger and which have been transferred to Palladium Holdings, LLC (“Palladium Holdings”);

|

|

|

|

|

|

|

●

|

126,000

shares of our common stock issuable upon exercise of the warrants (the “June Palladium Warrants”) we issued to

Palladium Holdings as designee of Palladium as part of its tail fee in connection with an offering that closed on June 19,

2020;

|

|

|

|

|

|

|

●

|

147,368

shares of our common stock issuable upon exercise of the warrants (the “July Palladium Warrants”) we issued to

Palladium Holdings as designee of Palladium as part of its compensation for serving as our financial advisor in connection

with an offering that closed on July 8, 2020;

|

|

|

|

|

|

|

●

|

129,500

shares of our common stock issuable upon exercise of the warrants (the “July 23 Palladium Warrants” and, together

with the Palladium Bridge Warrants, June Palladium Warrants and July Palladium Warrants, the “Palladium Warrants”)

we issued to Palladium Holdings as designee of Palladium as part of its compensation for serving as our financial advisor

in connection with an offering that closed on July 23, 2020;

|

|

|

|

|

|

|

●

|

27,273

shares of our common stock issuable upon exercise of the warrants (the “June Spartan Warrants”) we issued to certain

selling stockholders as designees of Spartan Capital Securities, LLC (“Spartan”) as part of its compensation for

serving as a finder in connection with an offering that closed on June 19, 2020; and

|

|

|

|

|

|

|

●

|

71,770

shares of our common stock issuable upon exercise of the warrants (the “July Spartan Warrants” and, together with

the June Spartan Warrants, the “Spartan Warrants”) we issued to certain selling stockholders as designees of Spartan

as part of its compensation for serving as our financial advisor in connection with an offering that closed on July 8, 2020.

|

We

refer to the Pre-funded Warrants, the Penny Warrants, the Palladium Warrants and the Spartan Warrants collectively as the “Warrants,”

and the shares underlying the Warrants are the “Warrant Shares.”

We

will not receive any of the proceeds from the sale of our common stock by the selling stockholders. However, we will receive proceeds

from the exercise of the Warrants if the Warrants are exercised for cash. We intend to use those proceeds, if any, for general

corporate purposes. Any shares of common stock subject to resale hereunder will have been issued by us and acquired by the selling

stockholders prior to any resale of such shares pursuant to this prospectus.

The

selling stockholders named in this prospectus, or their donees, pledgees, transferees or other successors-in-interest, may offer

or resell the Shares from time to time through public or private transactions at prevailing market prices, at prices related to

prevailing market prices or at privately negotiated prices. The selling stockholders will bear all commissions and discounts,

if any, attributable to the sale of Shares. We will bear all costs, expenses and fees in connection with the registration of the

Shares. For additional information on the methods of sale that may be used by the selling stockholders, see “Plan of Distribution”

beginning on page 22 of this prospectus.

Effective

as of 6:05 pm Eastern Time on May 26, 2020, we filed an amendment to our Amended and Restated Certificate of Incorporation to

effect a reverse stock split of the issued and outstanding shares of our common stock, at a ratio of one share for ten shares.

Immediately following the reverse stock split,

we issued a stock dividend of one share of the Company’s common stock for each outstanding share of common stock to all

holders of record immediately following the effective time of the reverse stock split. The net result of the reverse stock split

and the stock dividend was a 1-for-5 reverse stock split. All share and per share prices

in this prospectus supplement have been adjusted to reflect the reverse stock split and the stock dividend.

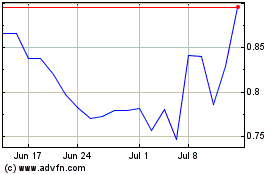

Our

common stock is listed on the Nasdaq Capital Market under the symbol “AYRO.” On August 14, 2020, the last reported

sale price of our common stock was $3.74 per share.

Investing

in our securities involves a high degree of risk. These risks are discussed in this prospectus under “Risk Factors”

beginning on page 15 and in our most recent Annual Report on Form 10-K and in the Form S-4, which are incorporated

by reference in this prospectus, as well as in any other recently filed quarterly or current reports and, if any, in any applicable

prospectus supplement.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved

of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal

offense.

The

date of this prospectus is August 14, 2020

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC using a “shelf” registration

process. The selling stockholders named in this prospectus may resell, from time to time, in one or more offerings, the common

stock offered by this prospectus. Information about the selling stockholders may change over time. When the selling stockholders

sells shares of common stock under this prospectus, we will, if necessary and required by law, provide a prospectus supplement

that will contain specific information about the terms of that offering. Any prospectus supplement may also add to, update, modify

or replace information contained in this prospectus. If a prospectus supplement is provided and the description of the offering

in the prospectus supplement varies from the information in this prospectus, you should rely on the information in the prospectus

supplement. You should carefully read this prospectus and the accompanying prospectus supplement, if any, along with all of the

information incorporated by reference herein and therein, before making an investment decision.

You

should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement.

We have not, and the selling stockholders have not, authorized any other person to provide you with different or additional information.

If anyone provides you with different or additional information, you should not rely on it. This prospectus is not an offer to

sell, nor are the selling stockholders seeking an offer to buy, the shares offered by this prospectus in any jurisdiction where

the offer or sale is not permitted. No offers or sales of any of the shares of common stock are to be made in any jurisdiction

in which such an offer or sale is not permitted. You should assume that the information contained in this prospectus or in any

applicable prospectus supplement is accurate only as of the date on the front cover thereof or the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or any sales of the

shares of common stock offered hereby or thereby.

You

should read the entire prospectus and any prospectus supplement and any related issuer free writing prospectus, as well as the

documents incorporated by reference into this prospectus or any prospectus supplement or any related issuer free writing prospectus,

before making an investment decision. Neither the delivery of this prospectus or any prospectus supplement or any issuer free

writing prospectus nor any sale made hereunder shall under any circumstances imply that the information contained or incorporated

by reference herein or in any prospectus supplement or issuer free writing prospectus is correct as of any date subsequent to

the date hereof or of such prospectus supplement or issuer free writing prospectus, as applicable. You should assume that the

information appearing in this prospectus, any prospectus supplement or any document incorporated by reference is accurate only

as of the date of the applicable documents, regardless of the time of delivery of this prospectus or any sale of securities. Our

business, financial condition, results of operations and prospects may have changed since that date.

CAUTIONARY

STATEMENT REGARDING FORWARD LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements. All statements other than statements

of historical fact contained herein, including statements regarding our business plans or strategies, projected or anticipated

benefits or other consequences of our plans or strategies, projected or anticipated benefits from acquisitions to be made by us,

or projections involving anticipated revenues, earnings or other aspects of our operating results, are forward-looking statements.

Words such as “anticipates,” “assumes,” “believes,” “can,” “could,”

“estimates,” “expects,” “forecasts,” “guides,” “intends,” “is

confident that,” “may,” “plans,” “seeks,” “projects,” “targets,”

and “would,” and their opposites and similar expressions, as well as statements in future tense, are intended to identify

forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and

may not be accurate indications of when such performance or results will actually be achieved. Forward-looking statements are

based on information we have when those statements are made or our management’s good faith belief as of that time with respect

to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially

from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include,

but are not limited to:

|

|

●

|

we

have had a history of losses and have never been profitable, and we expect to incur additional losses in the future and may

never be profitable;

|

|

|

|

|

|

|

●

|

the

market for our products is developing and may not develop as expected;

|

|

|

|

|

|

|

●

|

our

business is subject to general economic and market conditions;

|

|

|

|

|

|

|

●

|

our

business, results of operations and financial condition may be adversely impacted by public health epidemics, including the

recent COVID-19 outbreak;

|

|

|

|

|

|

|

●

|

our

limited operating history makes evaluating our business and future prospects difficult and may increase the risk of any investment

in our securities;

|

|

|

|

|

|

|

●

|

we

may experience lower-than-anticipated market acceptance of our vehicles;

|

|

|

|

|

|

|

●

|

developments

in alternative technologies or improvements in the internal combustion engine may have a materially adverse effect on the

demand for our electric vehicles;

|

|

|

|

|

|

|

●

|

the

markets in which we operate are highly competitive, and we may not be successful in competing in these industries;

|

|

|

|

|

|

|

●

|

a

significant portion of our revenues are derived from a single customer;

|

|

|

|

|

|

|

●

|

we

rely on and intend to continue to rely on a single third-party supplier for the sub-assemblies in semi-knocked-down for all

of our vehicles;

|

|

|

|

|

|

|

●

|

we

may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able

to successfully defend or insure against such claims;

|

|

|

●

|

the

range of our electric vehicles on a single charge declines over time, which may negatively influence potential customers’

decisions whether to purchase our vehicles;

|

|

|

|

|

|

|

●

|

increases

in costs, disruption of supply or shortage of raw materials, in particular lithium-ion cells, could harm our business;

|

|

|

|

|

|

|

●

|

our

business may be adversely affected by labor and union activities;

|

|

|

|

|

|

|

●

|

we

will be required to raise additional capital to fund our operations, and such capital raising may be costly or difficult to

obtain and could dilute our stockholders’ ownership interests, and our long-term capital requirements are subject to

numerous risks;

|

|

|

|

|

|

|

●

|

increased

safety, emissions, fuel economy, or other regulations may result in higher costs, cash expenditures, and/or sales restrictions;

|

|

|

|

|

|

|

●

|

we

may fail to comply with environmental and safety laws and regulations;

|

|

|

|

|

|

|

●

|

our

proprietary designs are susceptible to reverse engineering by our competitors;

|

|

|

|

|

|

|

●

|

if

we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used by

others to compete against us;

|

|

|

|

|

|

|

●

|

should

we begin transacting business in other currencies, we would be subject to exposure from changes in the exchange rates of local

currencies;

|

|

|

|

|

|

|

●

|

we

are subject to governmental export and import controls that could impair our ability to compete in international market due

to licensing requirements and subject us to liability if we are not in compliance with applicable laws;

|

|

|

|

|

|

|

●

|

our

expected use of proceeds from this offering; and

|

|

|

|

|

|

|

●

|

other

factors discussed in this prospectus and the documents incorporated by reference herein, including those set forth under “Risk

Factors” in our Registration Statement on Form S-4 filed with the SEC on February 14, 2020, as amended on April 24, 2020

(the “Form S-4”).

|

We

have included important factors in the cautionary statements included in this prospectus and the documents we incorporate by reference

herein, including from the Form S-4, particularly in the “Risk Factors” sections of these documents, that we believe

could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking

statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments

we may make. No forward-looking statement is a guarantee of future performance.

You

should read this prospectus and the documents that we incorporate by reference herein completely and with the understanding that

our actual future results may be materially different from what we expect. The forward-looking statements in this prospectus and

the documents we incorporate by reference herein represent our views as of the date of this prospectus. We anticipate that subsequent

events and developments will cause our views to change. However, while we may elect to update these forward-looking statements

at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should,

therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this

prospectus.

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere or incorporated by reference in this prospectus and does

not contain all of the information you should consider before investing in our securities. You should carefully read the prospectus,

the information incorporated by reference and the registration statement of which this prospectus is a part in their entirety

before investing in our securities, including the information discussed under “Risk Factors” in this prospectus and

the documents incorporated by reference and our financial statements and notes thereto that are incorporated by reference in this

prospectus. Some of the statements in this prospectus and the documents incorporated by reference herein constitute forward-looking

statements that involve risks and uncertainties. See information set forth under the section “Special Note Regarding Forward-Looking

Statements.”

On

May 28, 2020, pursuant to the previously announced Agreement and Plan of Merger, dated December 19, 2019 (the “Merger Agreement”),

by and among AYRO, Inc., a Delaware corporation previously known as DropCar, Inc. (“we,” “us,” “our”

or the “Company”), ABC Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Merger

Sub”), and AYRO Operating Company, Inc., a Delaware corporation previously known as AYRO, Inc. (“AYRO Operating”),

Merger Sub was merged with and into AYRO Operating, with AYRO Operating continuing after the merger as the surviving entity and

a wholly owned subsidiary of the Company (the “Merger”). In this prospectus, unless the context otherwise requires,

references to “we,” “us,” “our,” “our company” and “AYRO” refer to

AYRO, Inc. and its subsidiaries.

Overview

We

design and manufacture compact, sustainable electric vehicles for closed campus mobility, urban and community transport, local

on-demand and last mile delivery, and government use. Our three- and four-wheeled purpose-built electric vehicles are geared toward

commercial customers including universities, last mile delivery services and food service providers.

Our

Products

AYRO

vehicles provide the end user an environmentally friendly alternative to internal combustion engine vehicles (cars powered by

gasoline or diesel oil), for light duty uses, including low-speed logistics, maintenance and cargo services, at a lower total

cost.

AYRO

Club Car 411

The

AYRO Club Car 411 (the “AYRO 411 Fleet”) is a family of electric, four-wheel compact, light-duty utility trucks sold

exclusively through AYRO’s contracted partner, Club Car, as part of a global multi-year sustainability solution development,

sales and marketing agreement. Each of the AYRO 411 Fleet of vehicles is classified as a street legal low speed vehicle (“LSV”),

defined as a four-wheeled motor vehicle, other than an all-terrain vehicle, that is capable of reaching speeds of at least 20

miles per hour (“mph”) but not greater than 25 mph, with a gross vehicle weight rating of less than 3,000 pounds and

meets the safety standards in Title 49 of the U.S. Code of Federal Regulations, section 571.50.

The

AYRO 411 Fleet has an expected range of up to 50 miles and a maximum speed range of 25 mph (or 40 kilometers per hour), in line

with the United States Department of Transportation (“USDOT”) regulations for low-speed vehicles and with most state

statutes, which typically limit the speed of LSVs to 25 mph on 35 mph posted roads. The current AYRO 411 Fleet includes:

●

the 411 Flatbed truck, which provides drivers with considerable versatility of use;

●

the 411 Pickup truck, which is ideal for hauling; and

●

the 411 Cargo Van Box, a fully enclosed cargo box.

The

AYRO 411 Fleet has zero gas emissions, a recharge capability of up to six to eight hours using 120V/20A outlets and has a payload

capacity of up to 1,100 pounds. AYRO estimates that the AYRO 411 Fleet’s operating costs are approximately 50% lower per

year compared to similarly sized gas-powered trucks/vans. Vehicles in the AYRO 411 Fleet are equipped with:

●

reinforced steel (coated) chassis houses the motor, controller and enclosed battery operating system;

●

auto-grade suspension with Transverse Leaf Spring on the front and horizontal spring with coil-over shock in the rear;

●

power assisted steering;

●

street legal if registered/licensed per standard vehicles by dealer or user;

●

multi-point, anchored DOT compliant safety harnesses for driver and passenger;

●

a standard back-up camera (appears on larger LCD display – see below);

●

a standard 7-inch (17.7 centimeter) LCD display;

●

a standard manual parking break;

●

four-wheel all-disk braking system and corrosion resistant body panels; and

●

heating and ventilation systems in the cabin of the truck.

With

its low speed, zero-emissions, and cost-effectiveness, the AYRO 411 Fleet seeks to satisfy the needs of a variety of customers,

including university and college campuses, retailers, airports and ports, business parks and campuses, warehouses, production

facilities, resorts and theme parks, apartments and condos.

AYRO

311 Autocycle

The

AYRO 311 Autocycle (the “AYRO 311”) is a compact, light-duty street-legal electric vehicle with a maximum speed of

up to 50 mph. Strategically engineered with USDOT-compliant automotive parts, the AYRO 311 is built to a high-performance standard,

has standard automotive controls and does not require any special licenses or conditions in order to drive. Like the AYRO 411

Fleet, it has a range of up to 50 miles, has zero gas emissions and a recharge capability of up to six to eight hours using 120V/20A

and its operating costs are estimated to be approximately 50% lower per year compared to gas-powered vehicles.

AYRO

311’s equipment includes:

●

a standard back-up camera, a standard 7-inch (17.7 centimeter) LCD display;

●

a standard manual parking break; enclosed and corrosion resistant body panels;

●

heating, ventilation, and fan systems in the cabin of the vehicle;

●

standard automotive controls including foot accelerator and brake pedals;

●

a USDOT-approved windshield, a windshield wiper and washer system;

●

a driver’s 3-point safety belt and a passenger’s 4-point safety belt; warning flashers;

●

AM and FM radio;

●

Bluetooth capabilities;

●

a GPS system; and

●

an SD card slot.

With

its automotive-style controls (a steering wheel and foot pedals), the AYRO 311 drives like a regular car and accommodates the

average consumer and is designed for neighborhood food delivery, last mile delivery, parking enforcement and urban dwellers. More

specifically, this product targets urban dwellers due to its compact size in dense urban environments. The AYRO 311 also targets

commercial customers, such as neighborhood food and product delivery fleets, gated communities, country clubs, and colleges and

universities due to its highly customizable appearance with a range of brand and logo wraps, spot graphics, and color options

(glossy white or athletic red), its compact design and ability to go virtually anywhere. The AYRO 311 also targets municipalities

and facilities as customers for use in parking enforcement, special events, and public safety.

AYRO

511 (Concept)

AYRO

is currently investigating and researching the concept vehicle, the AYRO 511, a new full-time four-wheel drive electric vehicle.

The AYRO 511 is expected to have 13 inches (33 centimeters) of clearance and enhanced stability in a diverse array of terrains

and seasons. Additionally, the truck will be designed to operate with an automotive-style drive system, cutting driving noise

down to a minimum.

Additional

Models and Vehicles

AYRO

is currently in discussions with Club Car regarding a variety of new models and vehicles.

Manufacturing

and Supply Chain

Manufacturing

Agreement with Cenntro

In

2017, AYRO partnered with Cenntro Automotive Group, Ltd. (“Cenntro”), which operates a large electric vehicle factory

in the automotive district in Hangzhou, China, in a supply chain agreement to provide sub-assembly manufacturing services. Through

the partnership, Cenntro acquired nineteen percent (19%) of AYRO’s common stock. Cenntro beneficially owned approximately

13.7% as of December 31, 2019. Cenntro owns the design of the AYRO 411 Fleet vehicles and has granted AYRO an exclusive license

to purchase the AYRO 411 Fleet vehicles for sale in North America.

Under

AYRO’s Manufacturing License Agreement with Cenntro (the “MLA”), in order for AYRO to maintain its exclusive

territorial rights pursuant to the MLA, for the first three years after the effective date of April 27, 2017, AYRO must meet the

following minimum sale requirements: (i) a minimum of 300 units sold by the first anniversary of the effective date of the MLA;

(ii) a minimum of 800 units sold by the second anniversary of the effective date of the MLA; and (iii) a minimum of 1,300 units

sold by the third anniversary of the effective date of the MLA. Cenntro will determine the minimum sale requirements for the years

thereafter. Should any event of default occur, the other party may terminate the MLA by providing written notice to the defaulting

party, who will have 90 days from the effective date of the notice to cure the default. Unless waived by the party providing notice,

a failure to cure the default(s) within the time 90-day time frame will result in the automatic termination of the MLA. Events

of default under the MLA include a failure to make a required payment when due, the insolvency or bankruptcy of either party,

the subjection of either party’s property to any levy, seizure, general assignment for the benefit of creditors, and a failure

to make available or deliver the products in the time and manner provided for in the MLA.

Cenntro

is also being used to perform sub-assembly manufacturing of the AYRO 311. AYRO imports semi-knocked-down vehicle kits from Cenntro

for both the 411 and 311 models. The vehicle kits are received through shipping containers by AYRO’s assembly facility in

Round Rock, Texas. The vehicles are then assembled with limited customization requirements per order. As such, the partnership

with Cenntro allows AYRO to scale manufacturing operations without significant investment in capital expenditures, and therefore

bring products to market rapidly.

AYRO

currently occupies 24,000 square feet of manufacturing space configured in a “U”-shaped assembly line with multiple

stations per vehicle. AYRO’s manufacturing space allows multiple assembly lines plus adequate raw material storage. The

chart below indicates the number of vehicles and assembly time required for each. Assembly time also includes USDOT quality checks

and testing as the final step of the assembly process. Additionally, the number of vehicles indicated below assumes a single shift.

AYRO believes that its volumes could be doubled per line by adding a second shift that would operate from 4pm to midnight.

|

Vehicle

|

|

Assembly

time

(Man-Hours)

|

|

|

Vehicles

assembled

per

month

|

|

|

AYRO 411

|

|

|

12.0

|

|

|

|

200

|

|

|

AYRO 311

|

|

|

14.0

|

|

|

|

200

|

|

|

AYRO 311x (estimated)

|

|

|

15.0

|

|

|

|

200

|

|

Master

Procurement Agreement with Club Car

In

March 2019, AYRO entered into a five-year Master Procurement Agreement (the “MPA”) with Club Car for the sale of AYRO’s

four-wheeled vehicles. The MPA grants Club Car the exclusive right to sell the AYRO 411 Fleet in North America, provided that

Club Car orders a mutually agreed on number of AYRO vehicles per year. Under the terms of the MPA, AYRO receives orders from Club

Car dealers for vehicles of specific configurations, and AYRO invoices Club Car once the vehicle has shipped. The MPA has an initial

term of five years commencing January 1, 2019 and may be renewed by Club Car for successive one-year periods upon 60 days’

prior written notice. AYRO also agreed to collaborate with Club Car on developing new products similar to the AYRO 411 Fleet and

improvements to existing products, and AYRO granted Club Car a right of first refusal to purchase similar commercial utility vehicles

which AYRO develops during the term of the MPA. AYRO is currently engaged in discussions with Club Car to develop additional products

to be sold by Club Car in Europe and Asia, but there can be no assurance that these discussions will be successful. Pursuant to

the MPA, AYRO also granted Club Car a right of first refusal in the event that AYRO intends to sell 51% or more of its assets

or equity interests, which right of first refusal is exercisable for a period of 45 days following AYRO’s delivery of an

acquisition notice to Club Car.

Strategic

Partnership with Autonomic

Additionally,

AYRO is developing a technology platform that can be deployed to any vehicle as additional value-add subscriptions offered directly

to the end customer. AYRO has partnered with Autonomic, a wholly-owned subsidiary of Ford Smart Mobility LLC, to collect vehicle

health, use and location information (telematics) in its transportation mobility cloud and produce purpose-built information back

to AYRO, customers and fleet operators, generating an additional revenue stream. Working together, the companies aim to develop

a range of services to enable mobility applications for AYRO’s line of vehicles which power everything from moving products

and equipment to people and last-mile delivery services.

Engineering

Development and Production Process Validation

As

a baseline, AYRO’s product development and engineering efforts align with the Society of Automotive Engineering (“SAE”)

J2258_201611 standards for Light Utility Vehicles. The J2258 standard provides key compliance criteria for Gross Vehicle Weight

Rating (“GVWR”), occupant protection and safety restraint systems, lateral and longitudinal stability, center of gravity

and operating controls, among others. AYRO’s test validation and inspection standards follow Federal Motor Vehicle Safety

Standards (“FMVSS”) 49 CFR 571.500 for LSVs with the additions of SAE J585 and FMVSS 111 for rear visibility, lighting,

signaling, reflectors, changes in direction of movement, back-up camera response timing and field of view.

AYRO’s

development standards and test compliance validation processes are supported by a variety of test documentation including supplier

self-reporting, third party laboratory test reports and regional compliance validation with the California Air Resource Board

(“CARB”) for speed, range and environmental performance.

AYRO’s

production system follows a lean, cell-based, manufacturing model. The process involves the following five sequential cells: (1)

cab preparation, (2) chassis preparation, (3) system integration and testing, (4) final assembly and integration test, and (5)

QA & FMVSS Compliance. Assembly quality and shift efficiency metrics are measured daily by AYRO production staff at end of

every shift.

AYRO

maintains a certification and compliance check list for each vehicle. AYRO’s three and four-wheeled vehicles use an automotive

style steering wheel, turn signal stalk, headlight, running light and reverse light controls, a multi-speed windshield wiper and

washer and an accelerator and brake pedal consistent with controls employed in standard passenger cars. As the AYRO 311 and AYRO

411 are direct drive vehicles, there is no stick shift, clutch, paddle shift, or belt driven CSV (continuously variable) transmission

needed to operate the vehicles within the intended torque band and speed range. Accordingly, AYRO’s vehicles are homologated

under existing U.S., state and local LSV requirements and the corresponding motorcycle and autocycle requirements under 49 CFR

571.3.

The

Industry and AYRO’s Competitive Position

The

U.S. electric vehicle market is expected by many commentators to increase dramatically over the next decade, driven by factors

such as the country’s increasingly urbanized population, the significant cost of owning and operating gas-powered vehicles,

the growing global awareness of the damaging effects of pollution and greenhouse gas emissions, and rising investment in clean

technology and supporting infrastructure.

A

segment of the electric vehicle market, low speed electric vehicles (“LSEVs”)—which are LSVs but cannot be powered

by gas or diesel fuel—are growing increasingly popular as eco-friendly options for consumers and commercial entities. LSEVs

run on electric motors fueled by a variety of different batteries, such as lithium ion, molten salt, zinc-air and various nickel-based

designs.

In

2017, the global LSEV market was valued at approximately $2,395 million, according to Allied Market Research, and global sales

of LSEVs have only continued to grow over the past two years, with sales expected to reach 1.5 million units in 2021. According

to the Low Speed Electric Vehicles Market report conducted by Market Study Report, over the next five years, the LSEV market is

expected to register a 10.8% compound annual growth rate in terms of revenue, with the global market size expected to reach $8,870

million by 2024, up from $4,790 million in 2019.

Trends

Driving the Need for Electric Vehicles

Trends

such as increasingly stringent government regulations aimed toward reducing vehicle emissions, growing urban populations, and

social pressure to adopt sustainable lifestyles all create a demand for more ecologically and economically sustainable methods

of transportation. This demand continues to spur technological advancements and LSEV market growth.

Incentivizing

Effect of Government Rules and Regulations. Expanding rules and regulations governing vehicle emissions have contributed to

growth in the LSEV market. In particular, the U.S., Germany, France, and China have implemented stringent laws and regulations

governing vehicular emissions, requiring automobile manufacturers to use advanced technologies to combat high-emission levels

in vehicles. To incentivize clean-energy use, many governments are increasingly instituting substantial incentives for consumers

to purchase electric vehicles, such as:

●

tax credits, rebates, and exemptions; reduced vehicle registration fees;

●

reduced utility rates; and

●

parking incentives.

Further,

governments are establishing infrastructure benchmarks to support the growth of the electric vehicle industry.

A

prime example of government involvement in developing the electric vehicle industry, a recent New Jersey bill aims to have 330,000

electric vehicles on state roads by the end of 2024 and a total of 2 million by 2035. To facilitate this goal, the bill calls

for the state to have 400 fast-charging stations and another 1,000 slow-charging stations, both by 2025. Thirty percent of all

apartment, condo and townhouse developments in New Jersey would need to have chargers by 2030, while half of all franchise hotels

would need to have chargers by 2050. As the network of government rules and regulations expands, so too should investment in the

research and development of LSEV technology and infrastructure.

Urbanization

on the Rise. According to the U.N., in 2015, 55% of the world’s population was urban, and by 2050, it is estimated that

this percentage will increase to 68%. As the world population continues to urbanize, a growing number of consumers are expected

to seek alternatives, such as LSEVs, to internal combustion engine vehicles in order to save money and space in congested city

streets.

Increasing

Sense of Social Responsibility. In tandem with governmental efforts to curb pollution and encourage more sustainable transportation

practices, consumers face increasing social pressure to adopt eco-friendly lifestyles. As this demand grows, the LSEV market should

continue to develop.

Target

Markets

The

multipurpose applications and clean energy use of LSEVs make them popular across a wide array of industries and customers, including

college and university campuses, resorts and hotels, corporate parks, hospitals, warehouses, individual consumers, last mile delivery

service providers, municipalities, and the food service industry. A number of these market segments, and AYRO’s competitive

position within them, are discussed in greater detail below.

Universities.

LSEVs are growing increasingly common on university and college campuses due to a number of factors. LSEVs fulfill the versatile

needs of campuses better than golf carts or standard combustion vehicles because, not only does LSEVs’ low speed threshold

promote safer driving among pedestrians, the vehicles are also street legal with on-road safety features, enabling drivers to

drive on roads and free up pedestrian space along sidewalks and smaller pathways. Additionally, the significantly reduced carbon

imprint of LSEVs compared to internal combustion engine vehicles appeal to environmentally aware students and professors looking

to promote environmental sustainability on campus. By transitioning from internal combustion engine vehicles to LSEVs, campuses

should be able to reduce significantly the costs spent on fuel, oil, parts, and maintenance. AYRO’s vehicles, particularly

the AYRO 411 Fleet, provide all of these benefits to university and college campuses. AYRO estimates that in the U.S., there are

over 1,800 higher education campuses with over 10,000 students each with over 400 on-campus vehicles that are ideal targets for

the AYRO 411 Fleet as campuses transition from fossil-fueled campus fleet vehicles to EVs.

Food

Delivery Services. As the millennial generation assumes a more substantial portion of the consumer population, customers increasingly

favor convenience and timeliness, spurring dramatic growth in online ordering and delivery services across a wide swath of industries,

including food delivery and restaurant ordering services. Food delivery sales are anticipated to increase over 20% per year, culminating

in an expected $365 billion worldwide by 2030, according to Upserve. Upserve further estimates that approximately 60% of U.S.

consumers report that they order delivery or takeout at least once a week. Within the next decade, potentially over 40% of restaurant

sales will be attributable to delivery services, according to Morgan Stanley.

In

its market research, AYRO has determined that delivery services, including restaurants using the AYRO 311 as a delivery vehicle

rather than outsourcing delivery to third party services, have reduced their delivery costs by up to 50%. Delivery service companies

using the AYRO 311 as an in-house delivery vehicle rather than outsourcing delivery are also better equipped to manage the customer

experience and maintain customer relationships and data.

Last

Mile Delivery Service. Retail focus on last mile delivery—the movement of goods from a transportation hub to the final

delivery destination—has grown exponentially over the past few years due to the rise in online ordering and e-commerce.

Consumers’ ability to pick and choose products based on delivery speed and availability makes last mile delivery a key differentiator

among retailers. Last mile delivery provides retailers timelier and more convenient delivery options not offered by the main three

shipping services in the U.S. (the U.S. Postal Service, FedEx, and UPS). Additionally, given the increasing designation of low

emission zones in urban centers, retailers will need to continue to deploy eco-friendly vehicles. Retailers will likely expand

the use of LSEV fleets to make deliveries in low emission zones due to their zero gas emissions and lower price than competing

electric vehicles. AYRO expects that the AYRO 411 Fleet, with its variety of cargo bed options ideal for hauling and delivery

and its low price point, should stand out among the competition. Additionally, the AYRO 311 autocycle is ideal for short point-destination

deliveries for smaller packages and urgent urban courier-style deliveries.

Municipalities.

As more city governments adopt regulations geared toward reducing pollution from vehicles, cities are increasingly looking to

replace their municipal vehicles with zero-emission fleets. Such fleet overhauls, however, can be costly. LSEVs are a cheaper

and more practical option for cities daunted by the cost of standard electronic vehicles. AYRO’s LSEVs have both on and

off-road capabilities, making them particularly versatile for municipalities.

On-Road

and Personal Transportation. LSEVs offer a feasible and practical method of transportation, especially in urban centers. Because

AYRO’s LSEVs are street-legal, they offer city dwellers a more sustainable, cost-efficient, easily maneuverable, compact

and light weight option compared to internal combustion engine vehicles. AYRO LSEVs also offer a variety of specifications and

equipment, meaning that consumers do not have to sacrifice comfort or convenience.

Market

Considerations

AYRO

primarily focuses on the LSEV North American market, which is highly competitive and constitutes 28% of the global LSEV market

according to Wise Guy Reports. AYRO has examined various considerations with regard to the AYRO’s market impact, including

cost comparisons to existing vehicles in the market, market validation and target commercial markets.

Competition

The

worldwide automotive market, particularly for economy and alternative fuel vehicles, is highly competitive, and AYRO expects it

will become even more so in the future. Other manufacturers have entered the three-wheeled vehicle market, and AYRO expects additional

competitors to enter this market within the next several years. As the LSEV market grows increasingly saturated, AYRO expects

to experience significant competition. The most competitive companies in the global LSEV market include HDK Electric Vehicles,

Bradshaw Electric Vehicles, Textron Inc., Polaris Industries, Yamaha Motors Co. Ltd., Ingersoll Rand, Inc., Speedway Electric,

AGT Electric Cars, Bintelli Electric Vehicles and Ligier Group. AYRO’s relationship with Club Car, a division of Ingersoll

Rand, Inc., gives AYRO a strong competitive advantage. Despite this fact, many of the other competitors listed above have significantly

greater financial, technical, manufacturing, marketing and other resources than AYRO and may be able to devote greater resources

to the design, development, manufacturing, distribution, promotion, sale and support of their products. Many of these competitors

modify an existing fossil-fuel powered golf cart to meet utility and commercial needs for an all-electric commercial utility vehicle,

unlike the AYRO 411 Fleet, which was engineered, designed and produced as a portfolio of electric, light duty trucks and vans.

When

compared to internal combustion engine vehicles, AYRO’s vehicles are significantly more attractive based on tax, title and

license fees and CO2 emissions. Compared to a standard Ford F150 (gasoline) pickup truck (2.7 liter), the AYRO 411 Fleet provides

an approximate 49% reduction in operating expenses and an approximate 100% reduction in CO2 emissions (if renewed energy is used

to charge the AYRO vehicles, an increasing trend for most higher education campuses and government facilities). Compared to a

Nissan Versa (gasoline) four cylinder (1.6 liter) sub-compact car, the AYRO 311 provides a similarly drastic reduction in operating

expenses and CO2 emissions. Additionally, the AYRO 311’s starting manufacturer suggested retail price (“MSRP”)

is $9,999. Arcimoto and SOLO market three-wheeled electric vehicles with starting MSRPs of $19,900 and $15,888, respectively.

AYRO’s

most closely-matched competitor in the LSEV industry is Polaris Gem (“Gem”), an LSEV manufacturer that manufactures

products designed for applications similar to AYRO’s. Gem offers three passenger vehicle models and two utility vehicle

models. Although Gem’s GEM el XD model, which is similar to vehicles in the AYRO 411 Fleet, has a lower starting MSRP than

the AYRO 411 Fleet, the GEM el XD would need to be highly configured to match the standard AYRO 411 Fleet features and, with such

configuration, would exceed the base MSRP of each vehicle in the AYRO 411 Fleet. The AYRO 411 Fleet has a greater pick-up bed

and van box capacity that the GEM el XD, in addition to 13% more horsepower and a 48% better turning radius, allowing drivers

of the AYRO 411 Fleet to execute maneuvers in tighter spaces than they would using the GEM el XD.

AYRO

expects competition in its industry to intensify in the future in light of increased demand for alternative fuel vehicles, continuing

globalization and consolidation in the worldwide automotive industry. Factors affecting competition include product quality and

features, innovation and development time, pricing, reliability, safety, customer service and financing terms. Increased competition

may lead to lower vehicle unit sales and increased inventory, which may result in downward price pressure and may adversely affect

AYRO’s business, financial condition, operating results and prospects. AYRO’s ability to successfully compete in its

industry will be fundamental to its future success in existing and new markets and its market share. There can be no assurances

that AYRO will be able to compete successfully in its markets. If AYRO’s competitors introduce new cars or services that

compete with or surpass the quality, price or performance of AYRO’s vehicles or services, AYRO may be unable to satisfy

existing customers or attract new customers at the prices and levels that would allow AYRO to generate attractive rates of return

on its investment. Increased competition could result in price reductions and revenue shortfalls, loss of customers and loss of

market share, which could harm AYRO’s business, prospects, financial condition and operating results.

AYRO’s

Strategy

AYRO’s

goal is to continue to develop and commercialize automotive-grade, sustainable electric transportation solutions for the markets

and use cases that AYRO believes can be well served by AYRO’s purpose-built, street legal and road-ready electric vehicles.

AYRO’s business strategy includes the following:

●

Leverage the relationship with Club Car to expand AYRO’s product portfolio and increase its customer base. AYRO is working

on and has plans to expand its current electric transportation solutions portfolio in collaboration with Club Car. This plan includes

next generation light duty trucks and new purpose-driven electric vehicles. Additionally, AYRO is collaborating with Club Car’s

sales and marketing teams to expand adoption of its vehicles in the United States and intends to expand its geographical footprint

within Club Car’s global distribution and channel network.

●

Rapidly scale up AYRO’s operations to achieve growth. AYRO intends to direct resources to scale up AYRO’s operations,

which AYRO believes is needed to increase its revenue, including expanding and optimizing its automotive component supply chain

and AYRO’s flow-based assembly operations in Round Rock, Texas. Further, AYRO plans to expand sales territories and add

distribution channels, forming strategic partnerships to build-out its whole product offering and to access additional sales channels

or to accelerate product adoption for particular vertical markets, building AYRO’s brand, and increasing manufacturing capacity

to produce higher volumes of electric vehicles.

●

Identify defined markets and use cases which are currently under-served but represent sizable market opportunity sub-sets of the

electric vehicle market and focus development efforts on road-ready autocycles and other purpose-built electric vehicles to address

such markets. AYRO is currently developing a new series of automotive-grade autocycles, engineered and optimized to meet targeted

use cases such as last mile and urban delivery. AYRO is also working on Club Car’s next generation, electric light duty

trucks and developing a new purpose-built vehicle with Club Car. AYRO intends to direct resources to advance the development of

such purpose-built transportation solutions which AYRO believes will allow the company to address currently underserved, yet growing

markets, that are application specific. AYRO believes that AYRO’s all-electric transportation solutions, such as its compact,

lightweight and maneuverable campus and urban vehicles, can benefit targeted geographical and vertical customers by offering lower

annual/lifetime total cost of ownership for zero emissions/zero carbon footprint vehicles.

●

Invest in research and development and qualification of sensors, cameras, software and mobility services seeking to enhance the

value of using AYRO’s electric vehicles and to derive incremental potential revenue streams for AYRO and its partner ecosystem.

AYRO intends to integrate radio frequency-enabled hardware and develop data collection, communication processes and mobility services

in collaboration with Autonomic. AYRO and Autonomic plan to develop a technology platform that collects vehicle health, use and

location information (telematics) into its transportation mobility cloud and produces purpose-built information back to AYRO,

customers and fleet operators, the subscription to which can be offered to the end customers which AYRO believes will enhance

the value of using AYRO’s electric vehicles and provide additional revenue stream.

Reverse

Stock Split and Stock Dividend

Effective

as of 6:05 pm Eastern Time on May 28, 2020, we filed an amendment to our certificate of incorporation to effect a reverse stock

split of the issued and outstanding shares of our common stock, at a ratio of one share for ten shares (the “Reverse Stock

Split”). Immediately following the Reverse Stock Split, we issued a stock dividend of one share of the Company’s common

stock for each outstanding share of common stock to all holders of record immediately following the effective time of the Reverse

Stock Split (the “Stock Dividend”). The net result of the Reverse Stock Split and the Stock Dividend was a 1-for-5

reverse stock split. We made proportionate adjustments to the per share exercise price and/or the number of shares issuable upon

the exercise or vesting of all stock options, restricted stock units (if any) and warrants outstanding as of the effective times

of the Reverse Stock Split and the Stock Dividend in accordance with the terms of each security based on the split or dividend

ratio (i.e., the number of shares issuable under such securities has been divided by ten and multiplied by two, and, in the case

of stock options and warrants, the exercise or conversion price per share has been multiplied by ten and divided by two). Also,

we reduced the number of shares reserved for issuance under our equity compensation plans proportionately based on the split and

dividend ratios. Except for adjustments that resulted from the rounding up of fractional shares to the next whole share, the Reverse

Stock Split and Stock Dividend affected all stockholders uniformly and did not change any stockholder’s percentage ownership

interest in the Company. All share and related option and warrant information presented in this prospectus supplement have been

retroactively adjusted to reflect the reduced number of shares outstanding and the increase in share price which resulted from

these actions; however, common stock share and per share amounts in the accompanying prospectus and certain of the documents incorporated

by reference herein have not been adjusted to give effect to the Reverse Stock Split and the Stock Dividend.

Registered

Direct Offerings

In

June 2020, we entered into a Securities Purchase Agreement with certain institutional and accredited investors, pursuant to which

AYRO agreed to issue and sell in a registered direct offering an aggregate of 2,200,000 shares (the “June 2020 Shares”)

of our common stock, par value $0.0001 per share, at an offering price of $2.50 per share, for gross proceeds of approximately

$5.5 million before the deduction of fees and offering expenses. The June 2020 Shares were offered by us pursuant to a shelf registration

statement on Form S-3 (File No. 333-227858), previously filed with the Securities and Exchange Commission on October 16, 2018,

and declared effective by the Securities and Exchange Commission on November 9, 2018.

In

July 2020, we entered into a Securities Purchase Agreement with certain institutional and accredited investors, pursuant to which

AYRO agreed to issue and sell in a registered direct offering an aggregate of 3,157,895 shares (the “July 2020 Shares”)

of our common stock, par value $0.0001 per share, at an offering price of $4.75 per share, for gross proceeds of approximately

$15.0 million before the deduction of fees and offering expenses. The July 2020 Shares were offered by us pursuant to a shelf

registration statement on Form S-3 (File No. 333-227858), previously filed with the Securities and Exchange Commission on October

16, 2018, and declared effective by the Securities and Exchange Commission on November 9, 2018.

On

July 23, 2020, we entered into a Securities Purchase Agreement with certain institutional and accredited investors, pursuant to

which we agreed to issue and sell in a registered direct offering an aggregate of 1,850,000 shares of common stock and the option

to purchase 1,387,500 additional shares of common stock through October 19, 2020 (the “July 23, 2020 Shares”)

of our common stock, par value $0.0001 per share, at an offering price of $5.00 per share, for gross proceeds of approximately

$9.25 million at the initial closing before the deduction of fees and offering expenses (the “July 23 Offering”).

The July 23, 2020 Shares were offered by us pursuant to a shelf registration statement on Form S-3 (File No. 333-227858), previously

filed with the Securities and Exchange Commission on October 16, 2018, and declared effective by the Securities and Exchange Commission

on November 9, 2018.

Corporate

Information

We

were incorporated in the State of Delaware on December 18, 1997 under the name “Internet International Communications Ltd.”

Pursuant to a Certificate of Amendment to our Certificate of Incorporation filed on December 23, 2004, our name was changed to

“WPCS International Incorporated.” On January 30, 2018, we completed a business combination with DropCar, Inc., a

then privately held Delaware corporation (“Private DropCar”), in accordance with the terms of a merger agreement,

pursuant to which a merger subsidiary merged with and into Private DropCar, with Private DropCar surviving as our wholly owned

subsidiary (the “2018 Merger”). On January 30, 2018, immediately after completion of the 2018 Merger, we changed our

name to “DropCar, Inc.” The 2018 Merger was treated as a reverse merger under the acquisition method of accounting

in accordance with U.S. GAAP. In May 2020, we completed the Merger and changed our name to “AYRO, Inc.” Our principal

corporate office is located at AYRO, Inc., 900 E. Old Settlers Boulevard, Suite 100, Round Rock, TX 78664, telephone 512-994-4917.

Our internet address is https://ayro.com/. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K, and all amendments to those reports, are available to you free of charge through the “Investors” section

of our web site as soon as reasonably practicable after such materials have been electronically filed with, or furnished to, the

Securities and Exchange Commission. Information contained on our web site does not form a part of this prospectus.

THE

OFFERING

|

Securities

offered by the selling stockholders

|

|

Up

to 878,680 shares of our common stock, par value $0.0001 per share, including 864,550 shares that may be issued to

the selling stockholders upon exercise of the Warrants.

|

|

|

|

|

|

Selling

stockholders

|

|

All

of the shares of common stock are being offered by the selling stockholders named herein. See “Selling Stockholders”

on page 17 of this prospectus for more information on the selling stockholders.

|

|

|

|

|

|

Use

of proceeds

|

|

We

will not receive any proceeds from the sale of the common stock offered by the selling stockholders. However, we will receive

proceeds from the exercise price of the Warrants if the Warrants are exercised for cash. We intend to use those proceeds,

if any, for general corporate purposes. See “Use of Proceeds” on page 16 of this prospectus.

|

|

|

|

|

|

Plan

of Distribution

|

|

The

selling stockholders, or their pledgees, donees, transferees, distributees, beneficiaries or other successors-in-interest,

may offer or sell the shares from time to time through public or private transactions at prevailing market prices, at prices

related to prevailing market prices or at privately negotiated prices. The selling stockholders may also resell the shares

of common stock to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts,

concessions or commissions. See “Plan of Distribution” beginning on page 22 of this prospectus

for additional information on the methods of sale that may be used by the selling stockholders.

|

|

|

|

|

|

Risk

factors

|

|

See

“Risk Factors” beginning on page 15 and the other information included elsewhere in this

prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock.

|

|

|

|

|

|

NASDAQ

trading symbol for common stock

|

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “AYRO.”

|

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the specific factors discussed under the heading “Risk Factors” in the applicable prospectus supplement,

together with all of the other information contained or incorporated by reference in the prospectus supplement or appearing or

incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under

Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, and to

the “Risk Factors” section in the Form S-4, which are incorporated herein by reference, as updated or superseded

by the risks and uncertainties described under similar headings in the other documents that are filed after the date hereof and

incorporated by reference into this prospectus and any prospectus supplement related to a particular offering. The risks and uncertainties

we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently

deem immaterial may also affect our operations. Past financial performance may not be a reliable indicator of future performance,

and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs,

our business, business prospects, financial condition or results of operations could be seriously harmed. This could cause the

trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully

the section below entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Risks

Related to Our Business

The

recent coronavirus outbreak may have a significant adverse effect on our business.

In

December 2019, a novel strain of coronavirus, COVID-19, was reported to have surfaced in Wuhan, China and has reached multiple

other countries, resulting in government-imposed quarantines, travel restrictions and other public health safety measures in China

and such other countries. On March 12, 2020, the WHO declared COVID-19 to be a global pandemic, and the COVID-19 pandemic has

resulted in significant financial market volatility and uncertainty in recent months. A continuation or worsening of the levels

of market disruption and volatility seen in the recent past could have an adverse effect on our ability to access capital, on

our business, results of operations and financial condition, and on the market price of our common stock.

Moreover,

the COVID-19 outbreak has caused and continues to cause indeterminable adverse effects on general commercial activity and the

world economy, and the Company’s business and results of operations could be adversely affected to the extent that COVID-19

or any other epidemic harms the global economy generally.

We

do not yet know the full extent of potential delays or impact on our business or the global economy as a whole. However, any one

or a combination of these events could have an adverse effect on the operation of and results from our business operations.

USE

OF PROCEEDS

All

shares of our common stock offered by this prospectus are being registered for the accounts of the selling stockholders and we

will not receive any proceeds from the sale of these shares. However, we will receive proceeds from the exercise price of the

Warrants if the Warrants are exercised for cash. We intend to use those proceeds, if any, for general corporate purposes.

SELLING

STOCKHOLDERS

The

selling stockholders named in the table below may from time to time offer and sell pursuant to this prospectus and any applicable

prospectus supplement up to 878,680 shares of common stock. This reflects the aggregate number of shares of common stock

into which the Warrants are exercisable and the Non-Employee Director Grant.

December

2019 Private Placements of the Pre-Funded Warrants and the Palladium Bridge Warrants (the “December 2019 Private Placements”)

On

December 19, 2019, the Company entered into the Merger Agreement with AYRO Operating, pursuant to which a subsidiary of DropCar

merged with and into AYRO, with AYRO continuing as a wholly owned subsidiary of DropCar. Simultaneously with the signing of the

Merger Agreement, certain accredited investors, including certain stockholders of DropCar, purchased $1.0 million of AYRO’s

convertible bridge notes (the “Bridge Notes”) in connection with a bridge loan (the “Bridge Loan”) and

agreed to purchase, prior to the Merger, shares of AYRO common stock and warrants for an aggregate purchase price of $850,000

in a private placement (the “$850K Private Placement”), $1.15 million in another private placement (the “$1.15M

Private Placement” and, collectively with the $850K Private Placement, the “AYRO Private Placements”) and 1,750,000

shares of AYRO common stock for nominal consideration in the Nominal Stock Subscription. Upon closing of the Merger in May 2020,

this debt was converted to equity under the terms of the Merger Agreement.

Pursuant

to the $850K Private Placement, on the closing date of the Merger, AYRO Operating issued to Alpha Capital Anstalt (“Alpha”)

pre-funded warrants to purchase a total of 286,896 shares of AYRO common stock at an exercise price of $0.000367 per pre-funded

warrant share (on a post-Reverse Stock Split and post-Stock Dividend basis). Alpha subsequently exercised the pre-funded warrant

to purchase 250,660 of these warrant shares and currently may exercise the pre-funded warrants to purchase an additional 36,236

shares of AYRO common stock. Pursuant to the $850K Private Placement, Alpha was also issued shares of AYRO Operating common

stock and warrants to purchase AYRO Operating common stock, which converted, pursuant to their terms or the Merger, into 80,435

shares of AYRO common stock and warrants to purchase a total of 367,331 shares of common stock at an exercise price of $0.7423

per warrant share, respectively (on a post-Reverse Stock Split and post-Stock Dividend basis).

Pursuant

to the $1.15M Private Placement, on the closing date of the Merger, AYRO Operating issued to Alpha shares of AYRO Operating common

stock, pre-funded warrants to purchase AYRO Operating common stock and warrants to purchase AYRO Operating common stock, all of

which converted, pursuant to their terms or the Merger, into 120,359 shares of AYRO common, pre-funded warrants to purchase 429,306

shares of AYRO Operating common stock at an exercise price of $0.000367 per pre-funded warrant share and warrants to purchase

549,665 shares of common stock at an exercise price of $1.3599 per warrant share (on a post-Reverse Stock Split and post-Stock

Dividend basis).

Pursuant

to the Bridge Loan, on the closing date of the Merger, AYRO Operating issued to Alpha shares of AYRO Operating common stock and

warrants to purchase shares of AYRO Operating common stock that converted, pursuant to their terms or the Merger, into 695,645

shares of AYRO common stock and warrants to purchase 695,645 shares of AYRO common stock at an exercise price of $1.1159 per warrant

share (on a post-Reverse Stock Split and post-Stock Dividend basis).

Pursuant

to an engagement agreement (the “Palladium Advisory Agreement”), dated December 19, 2019, between AYRO Operating and

Palladium, AYRO Operating engaged Palladium to (i) act as the non-exclusive placement agent in a private placement of, or similar

unregistered transaction involving, equity or equity-linked securities of AYRO to a limited number of institutional, accredited

individual or strategic investors, and (ii) serve as AYRO Operating’s non-exclusive advisor in connection with a merger.

Palladium served as the non-exclusive placement agent in the Bridge Loan and the AYRO Private Placements. AYRO Operating issued

to Palladium warrants to purchase AYRO Operating common stock that converted pursuant to their terms in the Merger into the right

to purchase an aggregate of 232,403 shares of AYRO common stock, of which 92,186 related to the $850K Private Placement, at an

exercise price of $0.7423 per warrant share, 68,075 related to the $1.15M Private Placement, at an exercise price of $1.3599 per

warrant share, and 72,142 related to the Bridge Loan, at an exercise price of $1.1159 per warrant share (on a post-Reverse Stock

Split and post-Stock Dividend basis).

February

2020 Private Offering and Concurrent Private Placement of the Penny Warrants (the “February 2020 Offering”)

On

February 20, 2020, certain investors of AYRO (the “Noteholders”) agreed to extend a loan in the aggregate amount of

$500,000 to AYRO Operating, which loan was evidenced by a Secured Promissory Note dated as of February 20, 2020 (the “Secured

Loan”). In connection with the Secured Loan, AYRO entered into a subscription agreement with Alpha, Iroquois Capital Investment

Group LLC (“ICIG”) and Iroquois Master Fund, Ltd. (“IMF”), pursuant to which, contingent upon the closing

of the Merger and effective immediately thereafter, AYRO agreed to issue and sell warrants to purchase 70,000 shares of AYRO common

stock to Alpha, warrants to purchase 12,999 shares of common stock to ICIG and warrants to purchase 17,001 shares of common stock

to IMF at an exercise price of $0.01 per share.

Non-Employee

Director Grant

Pursuant

to a Change of Control Letter Agreement entered into in January 2020 by and among AYRO and Solomon Mayer (the “Non-Employee

Director”), on May 28, 2020, AYRO issued the Non-Employee Director a total of 8,130 shares of AYRO common stock as consideration

for his services to the Board of Directors prior to the Merger.

Financial

Advisor Warrants

June

2020 Warrants

In

June 2020, AYRO entered into a Securities Purchase Agreement with certain institutional and accredited investors, pursuant to

which AYRO agreed to issue and sell in a registered direct offering an aggregate of 2,200,000 shares (the “June 2020 Shares”)

of common stock of AYRO, par value $0.0001 per share, at an offering price of $2.50 per share, for gross proceeds of approximately

$5.5 million before the deduction of fees and offering expenses (the “June Offering”). The June 2020 Shares were offered

by AYRO pursuant to a shelf registration statement on Form S-3 (File No. 333-227858), previously filed with the Securities and

Exchange Commission on October 16, 2018, and declared effective by the Securities and Exchange Commission on November 9, 2018.

Pursuant

to the Palladium Advisory Agreement, upon the closing of the June Offering, we issued to Palladium the June Palladium Warrants

to purchase an aggregate of 126,000 shares of our common stock (which equals 7% of the aggregate number of shares sold in the

June Offering to investors introduced to us by Palladium) at an exercise price of $2.875 per share (which represents 115% of the

offering price per share sold in the June Offering). The June Palladium Warrants are exercisable at any time and from time to

time, in whole or in part, following the date of issuance and until June 19, 2025.

Pursuant

to our Investment Banking Agreement, dated March 6, 2020, with Spartan, in connection with the June Offering in which Spartan

acted as a finder, Spartan was entitled to a fee that included compensation warrants to purchase a number of shares of our common

stock equal to 7.5% of the gross proceeds raised in the June Offering to investors introduced to us by Spartan at an exercise

price of 110% of the offering price per share sold in the June Offering. We issued to Spartan the June Spartan Warrants to purchase

27,273 shares of our common stock at an exercise price of $2.75 per share. The compensation warrants are immediately exercisable,

have a term of five years, contain cashless exercise provisions and piggyback registration rights.

July

2020 Warrants

In

July 2020, AYRO entered into a Securities Purchase Agreement with certain institutional and accredited investors, pursuant to

which AYRO agreed to issue and sell in a registered direct offering an aggregate of 3,157,895 shares (the “July 2020 Shares”)

of common stock of AYRO, par value $0.0001 per share, at an offering price of $4.75 per share, for gross proceeds of approximately

$15 million before the deduction of fees and offering expenses (the “July Offering”). The July 2020 Shares were offered

by AYRO pursuant to a shelf registration statement on Form S-3 (File No. 333-227858), previously filed with the Securities and

Exchange Commission on October 16, 2018, and declared effective by the Securities and Exchange Commission on November 9, 2018.

Pursuant

to the Palladium Advisory Agreement, upon the closing of the July Offering, we issued to Palladium the July Palladium Warrants

to purchase an aggregate of 147,368 shares of our common stock (which equals 7% of the aggregate number of shares sold in this

offering to investors introduced to us by Palladium) at an exercise price of $5.4625 per share (which represents 115% of the offering

price per share sold in this offering). The July Palladium Warrants are exercisable at any time and from time to time, in whole

or in part, following the date of issuance and until July 8, 2025.

Pursuant

to our Investment Banking Agreement, dated March 6, 2020, with Spartan, in connection with the July Offering in which Spartan

acted as a finder, we issued to Spartan the July Spartan Warrants to purchase 71,770 shares of our common stock (which represents

a number of shares equal to 7.5% of the gross proceeds raised in this offering to investors introduced to us by Spartan divided

by 110% of the purchase price per share sold in this offering) at an exercise price of $5.225 per share (which represents 110%

of the offering price per share sold in this offering). The compensation warrants are immediately exercisable, have a term of

five years, contain cashless exercise provisions and piggyback registration rights.

On

July 23, 2020, AYRO entered into a Securities Purchase Agreement with certain institutional and accredited investors, pursuant

to which AYRO agreed to issue and sell in a registered direct offering an aggregate of 1,850,000 shares of common stock and options

to purchase 1,387,500 shares of common stock through October 19, 2020 (the “July 23, 2020 Shares”) of common