Statement of Changes in Beneficial Ownership (4)

January 14 2021 - 4:45PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

HARTENSTEIN EDDY W |

2. Issuer Name and Ticker or Trading Symbol

Broadcom Inc.

[

AVGO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O BROADCOM INC., 1320 RIDDER PARK DRIVE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/12/2021 |

|

(Street)

SAN JOSE, CA 95131

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, $0.001 par value | 1/12/2021 | | S(1) | | 98 | D | $447.723 (2) | 11562 (3) | D | |

| Common Stock, $0.001 par value | 1/12/2021 | | S(1) | | 84 | D | $449.008 (4) | 11478 (3) | D | |

| Common Stock, $0.001 par value | 1/12/2021 | | S(1) | | 222 | D | $449.922 (5) | 11256 (3) | D | |

| Common Stock, $0.001 par value | 1/12/2021 | | S(1) | | 96 | D | $450.974 (6) | 11160 (3) | D | |

| Common Stock, $0.001 par value | 1/12/2021 | | S(1) | | 30 | D | $452.67 | 11130 (3) | D | |

| Common Stock, $0.001 par value | 1/13/2021 | | S(1) | | 104 | D | $449.38 (7) | 11026 (3) | D | |

| Common Stock, $0.001 par value | 1/13/2021 | | S(1) | | 284 | D | $450.839 (8) | 10742 (3) | D | |

| Common Stock, $0.001 par value | 1/13/2021 | | S(1) | | 112 | D | $451.714 (9) | 10630 (3) | D | |

| Common Stock, $0.001 par value | 1/13/2021 | | S(1) | | 30 | D | $452.46 | 10600 (3) | D | |

| Common Stock, $0.001 par value | | | | | | | | 22892 | I | See Footnote (10) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Transaction made pursuant to a Rule 10b5-1 trading plan adopted by the Reporting Person. |

| (2) | Transaction executed in multiple trades at prices ranging from $447.30 to $448.01 per share, inclusive. The price reported in column 4 above reflects the weighted average sale price per share. The Reporting Person hereby undertakes to provide the SEC staff, the Issuer or a security holder of the Issuer, upon request, full information regarding the number of shares sold at each respective price within the range set forth in this footnote. |

| (3) | Includes 949 restricted stock units. |

| (4) | Transaction executed in multiple trades at prices ranging from $448.41 to $449.38 per share, inclusive. The price reported in column 4 above reflects the weighted average sale price per share. The Reporting Person hereby undertakes to provide the SEC staff, the Issuer or a security holder of the Issuer, upon request, full information regarding the number of shares sold at each respective price within the range set forth in this footnote. |

| (5) | Transaction executed in multiple trades at prices ranging from $449.41 to $450.35 per share, inclusive. The price reported in column 4 above reflects the weighted average sale price per share. The Reporting Person hereby undertakes to provide the SEC staff, the Issuer or a security holder of the Issuer, upon request, full information regarding the number of shares sold at each respective price within the range set forth in this footnote. |

| (6) | Transaction executed in multiple trades at prices ranging from $450.48 to $451.33 per share, inclusive. The price reported in column 4 above reflects the weighted average sale price per share. The Reporting Person hereby undertakes to provide the SEC staff, the Issuer or a security holder of the Issuer, upon request, full information regarding the number of shares sold at each respective price within the range set forth in this footnote. |

| (7) | Transaction executed in multiple trades at prices ranging from $449.19 to $449.96 per share, inclusive. The price reported in column 4 above reflects the weighted average sale price per share. The Reporting Person hereby undertakes to provide the SEC staff, the Issuer or a security holder of the Issuer, upon request, full information regarding the number of shares sold at each respective price within the range set forth in this footnote. |

| (8) | Transaction executed in multiple trades at prices ranging from $450.31 to $451.22 per share, inclusive. The price reported in column 4 above reflects the weighted average sale price per share. The Reporting Person hereby undertakes to provide the SEC staff, the Issuer or a security holder of the Issuer, upon request, full information regarding the number of shares sold at each respective price within the range set forth in this footnote. |

| (9) | Transaction executed in multiple trades at prices ranging from $451.32 to $452.19 per share, inclusive. The price reported in column 4 above reflects the weighted average sale price per share. The Reporting Person hereby undertakes to provide the SEC staff, the Issuer or a security holder of the Issuer, upon request, full information regarding the number of shares sold at each respective price within the range set forth in this footnote. |

| (10) | Shares held by the Hartenstein family trust, for which the Reporting Person serves as trustee. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

HARTENSTEIN EDDY W

C/O BROADCOM INC.

1320 RIDDER PARK DRIVE

SAN JOSE, CA 95131 | X |

|

|

|

Signatures

|

| /s/ Noelle Matteson, Attorney-in-Fact for Eddy W. Hartenstein | | 1/14/2021 |

| **Signature of Reporting Person | Date |

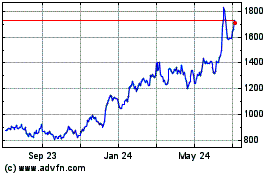

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

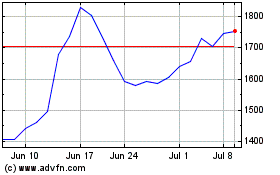

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Apr 2023 to Apr 2024