Broadcom Withdraws Annual Financial Guidance Over Coronavirus Uncertainty

March 12 2020 - 5:42PM

Dow Jones News

By Maria Armental

Chip maker Broadcom Inc. on Thursday pulled its financial

projections for the year, citing uncertainty around the coronavirus

pandemic.

Broadcom said it expected revenue this quarter to come in at

about $5.7 billion, short of analysts' projected $5.94 billion,

according to FactSet.

The company, based in California, had projected about $25

billion for the year that ends Nov. 1.

"The fundamental semiconductor backdrop has been improving, and

we did not see any material impact on our businesses due to

Covid-19 in our first quarter," said Chief Executive Hock Tan, who

referred to the disease caused by the coronavirus. "However,

visibility in our global markets is lacking and demand uncertainty

is intensifying."

Apple Inc., which last month warned that it would likely fall

short of quarterly revenue projections due to the coronavirus

outbreak, is Broadcom's largest customer, accounting for roughly

20% of Broadcom's revenue last year.

Broadcom shares closed down 11% for the day at $218.78, and fell

5% to $208.12 in after-hours trading.

First-quarter profit, before dividends on preferred stock, fell

to $385 million, or 74 cents a share, from $471 million, or $1.12 a

share a year earlier. On an adjusted basis, which excludes costs

tied to acquisitions and other items, profit fell to $5.25 a share

from $5.55 a share a year earlier.

Meanwhile, revenue from continuing operations rose to $5.86

billion from $5.79 billion a year earlier.

Analysts surveyed by FactSet expected a profit of $1.42 a share,

or $5.33 a share on an adjusted basis, and roughly $6 billion in

revenue.

Broadcom's semiconductor business, which accounts for the bulk

of revenue and has weighed on results in recent quarters, fell 4%

from the year earlier but was partially offset by a 19% revenue

growth in the infrastructure software segment.

Mr. Tan had said the core semiconductor business would return to

growth in the second half of the year, following the latest

cyclical downturn, and that Broadcom would also benefit from its

recent acquisition of Symantec's enterprise business.

Broadcom, whose roots in wireless run deep, is trying to move

away from the wireless hardware it sells to companies like

Apple.

In December, Mr. Tan, said company officials now considered

wireless as noncore and one of several businesses seen "as more

financial assets, especially in terms of capital allocation."

The company is trying to sell its radio-frequency, or RF, chips

business, which makes chips that amplify and filter wireless

signals in smartphones.

(END) Dow Jones Newswires

March 12, 2020 17:27 ET (21:27 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

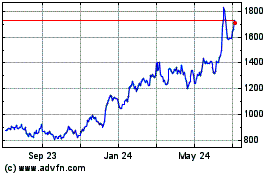

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

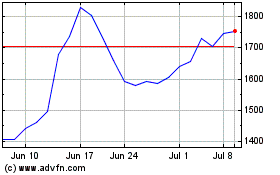

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Apr 2023 to Apr 2024