Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

September 25 2019 - 7:51AM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-225648

Broadcom Inc.

Pricing Term Sheet

September 24, 2019

3,250,000 Shares of 8.00% Mandatory Convertible Preferred Stock, Series A

The information in this pricing term sheet supplements Broadcom Inc.’s preliminary prospectus supplement, dated September 24, 2019 (the

“Preliminary Prospectus Supplement”), and supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement. In all other respects, this pricing

term sheet should be read together with the Preliminary Prospectus Supplement, the accompanying prospectus dated June 14, 2018 and the documents incorporated by reference in those documents.

Terms used, but not defined, in this pricing term sheet have the respective meanings set forth in the Preliminary Prospectus Supplement. As used in this

pricing term sheet, “Issuer,” “we,” “our” and “us” refer to Broadcom Inc. and not to its subsidiaries.

|

|

|

|

|

|

|

|

Issuer

|

|

Broadcom Inc.

|

|

|

|

|

Trade Date

|

|

September 25, 2019.

|

|

|

|

|

Expected Settlement Date

|

|

September 30, 2019, which is the fourth trading day after the date of this pricing term sheet. Currently, trades in the secondary market for securities ordinarily settle two trading days after the date of execution, unless

the parties to the trade agree otherwise. Accordingly, investors in this offering who wish to sell their Mandatory Convertible Preferred Stock before the second trading day preceding the Expected Settlement Date must specify an alternate settlement

arrangement at the time of the trade to prevent a failed settlement. Those investors should consult their advisors.

|

|

|

|

|

Title of Securities

|

|

8.00% Mandatory Convertible Preferred Stock, Series A, $0.001 par value per share, of the Issuer (the “Mandatory Convertible Preferred Stock”).

|

|

|

|

|

Shares of Mandatory Convertible

Preferred Stock Offered by

the Issuer

|

|

3,250,000.

|

|

|

|

|

Shares of Additional

Mandatory Convertible

Preferred Stock that the

Underwriters Have

the

Option to Purchase from

|

|

|

|

the Issuer

|

|

Up to an additional 487,500 shares of Mandatory Convertible Preferred Stock, solely to cover over-allotments, if any.

|

|

|

|

|

Public Offering Price

|

|

$1,000.00 per share of Mandatory Convertible Preferred Stock.

|

- 1 -

|

|

|

|

|

|

|

|

Use of Proceeds

|

|

The net proceeds of this offering will be approximately $3.2 billion (or approximately $3.7 billion if the underwriters fully exercise their option to purchase additional shares of Mandatory Convertible Preferred

Stock), after deducting estimated expenses and underwriting discounts and commissions. The Issuer intends to use the net proceeds of this offering to repay a portion of the outstanding borrowings under the Existing Credit Agreement, which provides

for three term loans, each in the principal amount of $2 billion, with a final maturity of May 2022 (the “A-3 Facility”), May 2024 (the “A-5

Facility”) and May 2026 (the “A-7 Facility,” and, together with the A-3 Facility and the A-5 Facility, the

“Existing Term Loan Facilities”), respectively. Borrowings outstanding under the Existing Term Loan Facilities will be repaid on a pro rata basis. See “Use of Proceeds” in the Preliminary Prospectus Supplement.

|

|

|

|

|

Liquidation Preference

|

|

$1,000.00 per share.

|

|

|

|

|

Dividends

|

|

8.00% per annum on the Liquidation Preference of the Mandatory Convertible Preferred Stock. Dividends shall accumulate from the most recent date as to which dividends shall have been paid or, if no dividends have been paid, from

the first original issue date, whether or not in any dividend period or periods there have been funds legally available for the payment of such dividends, and, to the extent that the Issuer is legally permitted to pay dividends and not prohibited

under the terms of its indebtedness, its board of directors (which term, as used in this pricing term sheet, includes an authorized committee of the board) declares a dividend with respect to the Mandatory Convertible Preferred Stock, the Issuer

will pay such dividend in cash or, subject to certain limitations, in shares of its common stock or by delivery of any combination of cash and shares of its common stock, as determined by the Issuer in its sole discretion, on each Dividend Payment

Date (as defined below); provided, however, that any undeclared and unpaid dividends will continue to accumulate. Dividends that are declared will be payable on the Dividend Payment Dates to holders of record of the Mandatory Convertible Preferred

Stock on the immediately preceding March 15, June 15, September 15 or December 15, as applicable (each a “Record Date”), whether or not such holders convert their shares, or such shares are automatically converted,

after a Record Date and on or prior to the immediately succeeding Dividend Payment Date. The expected dividend payable on the first and each subsequent dividend payment date is $20.00 per share. Accumulated and unpaid dividends for any past dividend

period will not bear interest. See “Description of Mandatory Convertible Preferred Stock—Dividends” in the Preliminary Prospectus Supplement.

|

|

|

|

|

|

|

If the Issuer elects to make any payment of a declared dividend, or any portion thereof, in shares of its common stock, such shares shall be valued for such purpose at 97% of the Average VWAP (as defined in the Preliminary

Prospectus Supplement under “Description of Mandatory Convertible Preferred Stock—Certain Definitions”) per share of the Issuer’s common stock over the five consecutive trading day period beginning on and including the sixth

scheduled trading day prior to the applicable Dividend Payment Date

|

- 2 -

|

|

|

|

|

|

|

(such average, the “Average Price”). In no event will the number of shares of the Issuer’s common stock delivered in connection with any declared dividend, including any declared dividend payable in connection with

a conversion, exceed a number equal to the total dividend payment divided by the Floor Price (as defined below). To the extent that the amount of the declared dividend exceeds the product of the number of shares of the Issuer’s common stock

delivered in connection with such declared dividend and 97% of the Average Price, the Issuer will, if it is legally able to do so, and to the extent permitted under the terms of its indebtedness, pay such excess amount in cash.

|

|

|

|

|

Floor Price

|

|

$98.81, subject to adjustment, as described in the Preliminary Prospectus Supplement, upon the effectiveness of each adjustment to the Fixed Conversion Rates (as defined below). The Floor Price is approximately 35% of the Initial

Price (as defined below).

|

|

|

|

|

Dividend Payment Dates

|

|

March 31, June 30, September 30 and December 31 of each year, commencing on December 31, 2019, to, and including, September 30, 2022.

|

|

|

|

|

Dividend Record Dates

|

|

The March 15, June 15, September 15 or December 15, as applicable, immediately preceding the applicable Dividend Payment Date.

|

|

|

|

|

No Redemption

|

|

The Mandatory Convertible Preferred Stock will not be redeemable at the Issuer’s election before the Mandatory Conversion Date (as defined below).

|

|

|

|

|

Initial Price

|

|

$282.31, which is the last reported sale price per share of the Issuer’s common stock on the Nasdaq Global Select Market on September 24, 2019. The Initial Price is subject to adjustment, as described in the Preliminary

Prospectus Supplement, upon the effectiveness of each adjustment to the Fixed Conversion Rates.

|

|

|

|

|

Threshold Appreciation

|

|

|

|

Price

|

|

$330.00, which represents an appreciation of approximately 16.9% over the Initial Price. The Threshold Appreciation Price is subject to adjustment, as described in the Preliminary Prospectus Supplement, upon the effectiveness of

each adjustment to the Fixed Conversion Rates.

|

|

|

|

|

Mandatory Conversion

|

|

|

|

Date

|

|

The second Business Day immediately following the last Trading Day of the 20 consecutive Trading Day period beginning on, and including, the 21st Scheduled Trading Day immediately preceding September 30, 2022. The Mandatory

Conversion Date is expected to be September 30, 2022.

|

|

|

|

|

Conversion Rate

|

|

Upon conversion on the Mandatory Conversion Date, the conversion rate for each share of the Mandatory Convertible Preferred Stock will be not more than 3.5422 shares of the Issuer’s common stock (the initial “Maximum

Conversion Rate”) and not less than 3.0303 shares of the Issuer’s common stock (the initial “Minimum Conversion Rate,” and the Maximum Conversion Rate and the Minimum Conversion Rate, together, the “Fixed Conversion

Rates”), depending on the Applicable Market Value of the Issuer’s Common

|

- 3 -

|

|

|

|

|

|

|

Stock, as described in, and subject to certain anti-dilution adjustments that are described in, the Preliminary Prospectus Supplement. The following table illustrates hypothetical Conversion Rates per share of the Mandatory

Convertible Preferred Stock, subject to certain anti-dilution adjustments that are described in the Preliminary Prospectus Supplement.

|

|

|

|

|

|

Applicable Market Value of the

Issuer’s common stock

|

|

Conversion Rate (number of

shares of the Issuer’s common

stock to be received upon

conversion of each share of the

Mandatory Convertible Preferred Stock)

|

|

Greater than $330.00 (which is the initial Threshold Appreciation Price)

|

|

3.0303 shares (approximately equal to $1,000 divided by the initial Threshold Appreciation Price) (the initial Minimum Conversion Rate)

|

|

|

|

|

Equal to or less than $330.00 but greater than or equal to $282.31

|

|

Between 3.0303 and 3.5422 shares, determined by dividing $1,000 by the Applicable Market Value of the Issuer’s common stock

|

|

|

|

|

Less than $282.31 (which is the initial Initial Price)

|

|

3.5422 shares (approximately equal to $1,000 divided by the initial Initial Price) (the initial Maximum Conversion Rate)

|

|

|

|

|

|

|

|

|

Conversion at the Option

|

|

|

|

of the Holder

|

|

At any time prior to September 30, 2022, other than during a Fundamental Change Conversion Period (as defined below), holders of the Mandatory Convertible Preferred Stock have the option to elect to convert their shares of

the Mandatory Convertible Preferred Stock in whole or in part (but in no event less than one share of the Mandatory Convertible Preferred Stock), into shares of the Issuer’s common stock at the Minimum Conversion Rate of 3.0303 shares of the

Issuer’s common stock per share of the Mandatory Convertible Preferred Stock as described in the Preliminary Prospectus Supplement under “Description of Mandatory Convertible Preferred Stock—Conversion at the Option of the

Holder.” The Minimum Conversion Rate is subject to certain anti-dilution adjustments described in the Preliminary Prospectus Supplement.

|

|

|

|

|

|

|

If, as of any Early Conversion Date for an early conversion, the Issuer has not declared all or any portion of the accumulated dividends for all dividend periods ending on a dividend payment date prior to such Early Conversion

Date, the conversion rate for such early conversion will be adjusted so that holders converting their Mandatory Convertible Preferred Stock at such time receive an additional number of shares of the Issuer’s common stock equal to such amount of

undeclared, accumulated and unpaid dividends for such prior dividend periods (such amount, the “Early Conversion Additional Amount”), divided by the greater of (x) the Floor Price and (y) the Average VWAP

per

|

- 4 -

|

|

|

|

|

|

|

share of the Issuer’s common stock over the 20 consecutive trading day period commencing on and including the 21st scheduled trading day immediately preceding the Early Conversion Date (“Early Conversion Average

Price”). To the extent that the Early Conversion Additional Amount exceeds the value of the product of the number of additional shares added to the conversion rate and the Early Conversion Average Price, the Issuer will not have any obligation

to pay the shortfall in cash or any other consideration.

|

|

|

|

|

Conversion at the Option of

the Holder Upon a

Fundamental Change;

Fundamental

Change

Dividend Make-Whole

|

|

|

|

Amount

|

|

If a Fundamental Change occurs on or prior to September 30, 2022, holders of the Mandatory Convertible Preferred Stock will have the option to convert their shares of Mandatory Convertible Preferred Stock, in whole or in

part (but in no event less than one share of the Mandatory Convertible Preferred Stock), into the Issuer’s common stock at the Fundamental Change Conversion Rate during the period (the “Fundamental Change Conversion Period”) beginning

on the effective date of such Fundamental Change and ending on, and including, the date that is 20 calendar days after the effective date of such Fundamental Change (or, if earlier, September 30, 2022). The Fundamental Change Conversion Rate

will be determined based on the effective date of the Fundamental Change and the price paid or deemed paid per share of the Issuer’s common stock in such Fundamental Change.

|

|

|

|

|

|

|

Holders who convert their Mandatory Convertible Preferred Stock within the Fundamental Change Conversion Period will also receive a Fundamental Change Dividend Make-Whole Amount, in cash, in shares of the Issuer’s common

stock or any combination thereof, as determined by the Issuer in its sole discretion, equal to the present value (computed using a discount rate of 8.00% per annum) of all remaining dividend payments on their shares of the Mandatory Convertible

Preferred Stock (excluding any Accumulated Dividend Amount) from and after such effective date to, but excluding, September 30, 2022. If the Issuer elects to pay all or any portion of the Fundamental Change Dividend Make-Whole Amount in shares

of its common stock in lieu of cash, then the number of shares of the Issuer’s common stock that it will deliver will equal (x) the Fundamental Change Dividend Make-Whole Amount (or such portion thereof) divided by (y) the greater of

the Floor Price and 97% of the Stock Price for the Fundamental Change.

|

|

|

|

|

|

|

In addition, to the extent that an Accumulated Dividend Amount exists as of the effective date of the Fundamental Change, holders who convert their Mandatory Convertible Preferred Stock within the Fundamental Change Conversion

Period will be entitled to receive such Accumulated Dividend Amount in cash (to the extent the Issuer is legally permitted and not prohibited under the terms of its indebtedness to make such payment in cash) or shares of the Issuer’s common

stock or any combination thereof, at the Issuer’s election, upon conversion. If the Issuer elects to pay the Accumulated Dividend Amount in shares of its common stock in lieu of cash, the number of shares of its common stock that the Issuer

will deliver will equal (x) the Accumulated Dividend Amount divided by (y) the greater of the Floor Price and 97% of the Stock Price for the Fundamental Change.

|

- 5 -

|

|

|

|

|

|

|

|

|

|

To the extent that the sum of the Fundamental Change Dividend Make-Whole Amount and Accumulated Dividend Amount or any portion thereof paid in shares of the Issuer’s common stock exceeds the product of the number of

additional shares the Issuer delivers in respect thereof and 97% of the Stock Price, the Issuer will, if it is legally able to do so and not prohibited under the terms of its indebtedness, pay such excess amount in cash. See “Description of

Mandatory Convertible Preferred Stock—Conversion at the Option of the Holder upon Fundamental Change; Fundamental Change Dividend Make-Whole Amount” in the Preliminary Prospectus Supplement.

|

|

|

|

|

Fundamental Change

|

|

|

|

Conversion Rate

|

|

The Fundamental Change Conversion Rate will be determined by reference to the table below and is based on the Effective Date and the Stock Price of the applicable Fundamental Change.

|

|

|

|

|

|

|

Each of the Stock Prices set forth in the first row of the table below (i.e., the column headers), and each of the Fundamental Change Conversion Rates in the table below, are subject to adjustment in the manner described in the

Preliminary Prospectus Supplement.

|

|

|

|

|

|

|

The following table sets forth the Fundamental Change Conversion Rate per share of the Mandatory Convertible Preferred Stock for each Stock Price and Effective Date set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Price

|

|

|

Effective Date

|

|

$100.00

|

|

|

$120.00

|

|

|

$140.00

|

|

|

$160.00

|

|

|

$200.00

|

|

|

$240.00

|

|

|

$282.31

|

|

|

$305.00

|

|

|

$330.00

|

|

|

$400.00

|

|

|

$500.00

|

|

|

$600.00

|

|

|

$800.00

|

|

|

$1,000.00

|

|

|

September 30, 2019

|

|

|

2.4033

|

|

|

|

2.5726

|

|

|

|

2.6816

|

|

|

|

2.7506

|

|

|

|

2.8160

|

|

|

|

2.8324

|

|

|

|

2.8306

|

|

|

|

2.8276

|

|

|

|

2.8243

|

|

|

|

2.8205

|

|

|

|

2.8280

|

|

|

|

2.8424

|

|

|

|

2.8713

|

|

|

|

2.8928

|

|

|

September 30, 2020

|

|

|

2.7729

|

|

|

|

2.8893

|

|

|

|

2.9637

|

|

|

|

3.0079

|

|

|

|

3.0346

|

|

|

|

3.0163

|

|

|

|

2.9815

|

|

|

|

2.9631

|

|

|

|

2.9453

|

|

|

|

2.9125

|

|

|

|

2.8994

|

|

|

|

2.9042

|

|

|

|

2.9228

|

|

|

|

2.9376

|

|

|

September 30, 2021

|

|

|

3.1536

|

|

|

|

3.2147

|

|

|

|

3.2558

|

|

|

|

3.2805

|

|

|

|

3.2820

|

|

|

|

3.2301

|

|

|

|

3.1494

|

|

|

|

3.1072

|

|

|

|

3.0667

|

|

|

|

2.9944

|

|

|

|

2.9644

|

|

|

|

2.9647

|

|

|

|

2.9756

|

|

|

|

2.9834

|

|

|

September 30, 2022

|

|

|

3.5422

|

|

|

|

3.5422

|

|

|

|

3.5422

|

|

|

|

3.5422

|

|

|

|

3.5422

|

|

|

|

3.5422

|

|

|

|

3.5422

|

|

|

|

3.2787

|

|

|

|

3.0303

|

|

|

|

3.0303

|

|

|

|

3.0303

|

|

|

|

3.0303

|

|

|

|

3.0303

|

|

|

|

3.0303

|

|

The exact Stock Price and Effective Date may not be set forth in the table, in which case:

|

|

•

|

|

if the Stock Price is between two Stock Price amounts on the table or the Effective Date is between two Effective

Dates on the table, the Fundamental Change Conversion Rate will be determined by straight-line interpolation between the Fundamental Change Conversion Rates set forth for the higher and lower Stock Price amounts and the earlier and later Effective

Dates, as applicable, based on a 365- or 366-day year, as applicable;

|

|

|

•

|

|

if the Stock Price is in excess of $1,000.00 per share (subject to adjustment in the same manner as the Stock

Prices set forth in the first row of the table above), then the Fundamental Change Conversion Rate will be the Minimum Conversion Rate; and

|

|

|

•

|

|

if the Stock Price is less than $100.00 per share (subject to adjustment in the same manner as the Stock Prices

set forth in the first row of the table above), then the Fundamental Change Conversion Rate will be the Maximum Conversion Rate.

|

|

|

|

|

|

|

|

|

Listing

|

|

The Issuer intends to apply to have the Mandatory Convertible Preferred Stock listed on The Nasdaq Global Select Market under the symbol “AVGO.A.” The listing application will be subject to the approval of The Nasdaq

Global Select Market.

|

- 6 -

|

|

|

|

|

|

|

|

CUSIP / ISIN

|

|

11135F200 / US11135F2002.

|

|

|

|

|

Joint Book-Running

Managers

|

|

BofA Securities, Inc.

|

|

|

|

Citigroup Global Markets Inc.

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

Morgan Stanley & Co. LLC

|

|

|

|

|

Book-Running Managers

|

|

Barclays Capital Inc.

|

|

|

|

BMO Capital Markets Corp.

|

|

|

|

BNP Paribas Securities Corp.

|

|

|

|

HSBC Securities (USA) Inc.

|

|

|

|

RBC Capital Markets, LLC

|

|

|

|

Wells Fargo Securities, LLC

|

|

|

|

|

Co-Managers

|

|

Academy Securities, Inc.

|

|

|

|

BBVA Securities Inc.

|

|

|

|

Commerz Markets LLC

|

|

|

|

Credit Suisse Securities (USA) LLC

|

|

|

|

Deutsche Bank Securities Inc.

|

|

|

|

Mizuho Securities USA LLC

|

|

|

|

MUFG Securities Americas Inc.

|

|

|

|

PNC Capital Markets LLC

|

|

|

|

Scotia Capital (USA) Inc.

|

|

|

|

SMBC Nikko Securities America, Inc.

|

|

|

|

Standard Chartered Bank

|

|

|

|

SunTrust Robinson Humphrey, Inc.

|

|

|

|

TD Securities (USA) LLC

|

The Issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement, the Preliminary Prospectus Supplement referred to above and other documents the Issuer has filed with the SEC for more complete information

about the Issuer and the offering. You may get these documents free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the applicable offering will

arrange to send you the prospectus and the Preliminary Prospectus Supplement upon request to BofA Securities, Inc., Attention: Prospectus Department, 200 North College Street, 3rd Floor, Charlotte, North Carolina 28255, by telephone at (800) 294-1322, or by email at dg.prospectus_requests@baml.com; Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, New York 11717, or by telephone at (800) 831-9146; J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, Attention: Prospectus Department, 1155 Long Island Avenue, Edgewood, New York 11717, by telephone at (866)

803-9204, or by email at prospectus-eq_fi@jpmchase.com; or Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, Second Floor, New

York, New York 10014, or by telephone at (866) 718-1649.

Any legends, disclaimers or other notices that may

appear below are not applicable to this communication and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this communication having been sent via Bloomberg or another system.

- 7 -

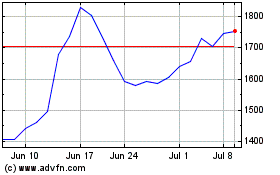

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

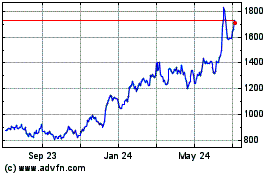

Broadcom (NASDAQ:AVGO)

Historical Stock Chart

From Apr 2023 to Apr 2024