Assertio Holdings, Inc. (“Assertio” or the “Company”) (Nasdaq:

ASRT), a specialty pharmaceutical company offering differentiated

products to patients, today reported financial results for the

fourth quarter and full year ended December 31, 2021 and provided a

corporate update.

Fourth Quarter and Full Year 2021 Commentary and

Financial Highlights (unaudited):

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(in millions) |

|

2021 |

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Net Product Sales

(GAAP) |

$ |

32.2 |

|

$ |

30.1 |

|

|

$ |

109.4 |

|

|

$ |

92.1 |

|

| Net Income (Loss)

(GAAP) |

$ |

4.6 |

|

$ |

(24.4 |

) |

|

$ |

(1.3 |

) |

|

$ |

(28.1 |

) |

| Adjusted EBITDA

(Non-GAAP)(1) |

$ |

17.8 |

|

$ |

8.2 |

|

|

$ |

48.8 |

|

|

$ |

16.3 |

|

| Operating Cash Flow

(GAAP) |

$ |

4.1 |

|

$ |

(6.0 |

) |

|

$ |

5.5 |

|

|

$ |

(65.6 |

) |

(1) See “Non-GAAP Financial Measures” below for additional

information on all non-GAAP measures included in this earnings

release.

- The fourth quarter net product sales of $32.2 million were

$6.2 million or 24% higher than the third quarter, which

reflected another quarter of consistent volume across the

portfolio, with net price favorability for Indocin, Cambia and

Zipsor.

- Net product sales for the fourth quarter increased by

$2.0 million or 7% compared to the prior year due to Cambia

and Indocin price favorability, partially offset by a decline in

Sprix volume and the discontinuation of a product line.

- Non-GAAP adjusted EBITDA for the fourth quarter of $17.8

million represents growth of 13% versus the third quarter and 118%

versus the prior year. The results for the quarter were positively

impacted by net pricing for Cambia and Zipsor, as well as a

one-time royalty milestone.

2022 Full Year Financial Guidance:

|

Net Product Sales (GAAP) |

$126.0 Million to $136.0 Million |

|

Adjusted EBITDA (Non-GAAP) |

$64.0 Million to $72.0 Million |

- Due to high inventory levels in the channel at acquisition on

December 15, 2021, sales of Otrexup began in late January

2022.

- The Company’s 2022 guidance accounts for addition of Otrexup,

offset by the expected loss of exclusivity for Zipsor at the end of

the first quarter of 2022.

“2021 represented the first year of our newly transformed

Company, one in which we took major steps to transition to our new

operating model, made significant strides and investments into our

digital platform, right-sized our infrastructure to generate

positive operating cash flow and improve our margins, and acquired

a new product for the first time since 2015,” said Dan Peisert,

President and Chief Executive Officer of Assertio.

“Assertio is at the forefront of the shift to a more digital,

connected pharmaceutical landscape and we are excited about

leveraging our platform to grow our portfolio and incorporate new,

acquired assets in 2022 that will benefit patients and increase

shareholder value.”

Fourth Quarter and Full Year 2021 and Subsequent

Highlights:

After the Company’s announced restructuring on December 15,

2020, management established six key priorities for 2021 to put the

Company on a path to return to growth, increase margins, and

acquire new assets. Highlights of the year track closely with these

priorities:

- Build a Strong and Committed Team with a Culture of

Teamwork, Inclusion and Results: The Company hired or

promoted an experienced and talented management team with a track

record of success in growing businesses and executing mergers and

acquisitions, including Senior Vice Presidents of Commercial and

Operations, and Vice President of Business Development, to

accelerate our strategy.

- Delivering on Our $45.0 Million of Restructuring

Synergies: The Company completed its restructuring early

in the third quarter and exceeded its target to deliver $45.0

million in annualized synergies in 2022 and beyond.

- Ensuring the Company Generates Strong Operating Cash

Flow: For full year 2021, the Company generated $5.5

million of operating cash flow, with $8.8 million generated

post restructuring in the second half of 2021 (despite cash

outflows of nearly $10.0 million for one-time legal settlements and

the extension of the Indocin supply agreement).

- The Company generated $4.1 million of operating cash flow

in the fourth quarter, representing the third consecutive quarter

of positive cash flows.

- Ensuring our Debt Never Becomes a Constraint in Running

the Business: The Company has $36.8 million of cash on

hand, well above its minimum liquidity covenants, and its remaining

senior secured debt is $70.8 million and is not due to mature until

2024.

- Mitigate our Legacy Legal Uncertainties:

Throughout 2021, the Company continued to focus on resolving legacy

legal uncertainties and took substantial steps toward settling

certain matters in a way that management believes will allow it to

invest in sustainable long-term growth.

- The Company settled its federal Glumetza antitrust litigation

for $7.0 million.

- The Company also entered into settlement agreements for its

securities class action and related derivative suits, for a net

cost of $0.4 million.

- Develop Sustainable Business Model that Reflects a

Changing Environment: The Company has invested into its

scalable, digital, non-personal promotion Commercial model and

platform.

- The Company announced on December 15, 2021 that it acquired

Otrexup (methotrexate). Assertio acquired Otrexup from Antares

Pharma, Inc. in a partially seller financed transaction for a total

cash purchase price of $44.0 million, inclusive of working capital

investments.

- Represents less than three times trailing 12-month revenue

ending September 31, 2021.

- Patents extend to 2031.

- Less than 41% upfront at closing.

- The Company has invested in the telemedicine channel and saw a

117% year-over-year total prescription growth for our portfolio of

products through our partners in the fourth quarter.

Conference Call and Investor Presentation

Information

Assertio’s management will host a conference call to discuss its

fourth quarter and full year 2021 financial results today:

|

Date: |

Wednesday, March 9, 2022 |

|

Time: |

9:00 a.m. Eastern Time |

|

Dial-in numbers: |

1-844-200-6205 (domestic) |

|

|

1-929-526-1599 (international) |

|

Conference number: |

790157 |

To access the live webcast, the recorded conference call replay,

and other materials, please visit Assertio’s investor relations

website at http://investor.assertiotx.com/overview/default.aspx.

Please connect at least 15 minutes prior to the live webcast to

ensure adequate time for any software download that may be needed

to access the webcast. The replay will be available approximately

two hours after the call on Assertio’s investor website.

About Assertio

Assertio is a specialty pharmaceutical company offering

differentiated products to patients utilizing a non-personal

promotional model. We have built and continue to build our

commercial portfolio by identifying new opportunities within our

existing products as well as acquisitions or licensing of

additional approved products. To learn more about Assertio, visit

www.assertiotx.com.

Investor Contact

Max NemmersHead, Investor Relations and

Administrationinvestor@assertiotx.com

Forward Looking StatementsStatements in this

communication that are not historical facts are forward-looking

statements that reflect Assertio's current expectations,

assumptions and estimates of future performance and economic

conditions. These forward-looking statements are made in reliance

on the safe harbor provisions of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements relate to,

among other things, future events or the future performance or

operations of Assertio. All statements other than historical facts

may be forward-looking statements and can be identified by words

such as "anticipate," "believe," "could," "design," "estimate,"

"expect," "forecast," "goal," "guidance," "imply," "intend," "may",

"objective," "opportunity," "outlook," "plan," "position,"

"potential," "predict," "project," "prospective," "pursue," "seek,"

"should," "strategy," "target," "would," "will," "aim" or other

similar expressions that convey the uncertainty of future events or

outcomes and are used to identify forward-looking statements. Such

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and other factors, some of

which are beyond the control of Assertio, including the risks

described in Assertio's Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q filed with the U.S. Securities and Exchange

Commission ("SEC") and in other filings Assertio makes with the SEC

from time to time. Investors and potential investors are urged not

to place undue reliance on forward-looking statements in this

communication, which speak only as of this date. While Assertio may

elect to update these forward-looking statements at some point in

the future, it specifically disclaims any obligation to update or

revise any forward-looking-statements contained in this press

release whether as a result of new information or future events,

except as may be required by applicable law. Nothing contained

herein constitutes or will be deemed to constitute a forecast,

projection or estimate of the future financial performance or

expected results of Assertio.

Non-GAAP Financial MeasuresTo supplement the

Company’s financial results presented on a U.S. generally accepted

accounting principles (GAAP) basis, the Company has included

information about non-GAAP measures of EBITDA and adjusted EBITDA

as useful operating metrics. The Company believes that the

presentation of these non-GAAP financial measures, when viewed with

results under GAAP and the accompanying reconciliation, provides

supplementary information to analysts, investors, lenders, and the

Company’s management in assessing the Company’s performance and

results from period to period. The Company uses these non-GAAP

measures internally to understand, manage and evaluate the

Company’s performance, and for fiscal year 2021 used these non-GAAP

measures in part, in the determination of bonuses for executive

officers and employees. These non-GAAP financial measures should be

considered in addition to, and not a substitute for, or superior

to, net income or other financial measures calculated in accordance

with GAAP. Non-GAAP financial measures used by us may be calculated

differently from, and therefore may not be comparable to, non-GAAP

measures used by other companies.

This release also includes estimated non-GAAP adjusted EBITDA

information, which the Company believes enables investors to better

understand the anticipated performance of the business, but should

be considered a supplement to, and not as a substitute for or

superior to, financial measures calculated in accordance with GAAP.

No reconciliation of estimated non-GAAP adjusted EBITDA to

estimated net income is provided in this release because some of

the information necessary for estimated net income such as income

taxes, fair value change in contingent consideration, and

stock-based compensation is not yet ascertainable or accessible and

the Company is unable to quantify these amounts that would be

required to be included in estimated net income without

unreasonable efforts.

Specified ItemsNon-GAAP measures presented

within this release exclude specified items. The Company considers

specified items to be significant income/expense items not

indicative of current operations. Specified items include

adjustments to interest expense, income tax expense (benefit),

depreciation expense, amortization expense, sales reserves

adjustments for products the Company is no longer selling,

stock-based compensation expense, fair value adjustments to

contingent consideration, restructuring costs, amortization of fair

value inventory step-up as result of purchase accounting, non-cash

adjustments to Collegium Commercialization agreement revenue,

transaction-related costs, gains or losses from adjustments to

long-lived assets and assets not part of current operations, and

gains or losses resulting from debt refinancing or

extinguishment.

Revisions to Specified Items As a result of the

Company’s December 2020 restructuring plan and subsequent

announcement of a new executive team, beginning in 2021, the

Company no longer adjusts for legal costs and expenses incurred in

connection with opioid-related litigation, investigations and

regulations pertaining to the Company’s historical

commercialization of opioid products as a specified item in the

non-GAAP measure adjusted EBITDA. Management’s priorities include,

amongst other items, operating cash flows and mitigating legacy

legal uncertainties and therefore believes that investors will

benefit from the ability to view the profitability of the Company’s

current and ongoing business activities with such costs included.

Given the timing of the December 2020 restructuring plan and

subsequent announcement of the new executive team, Management

believes 2021 was the appropriate time to make such an update.

Prior period amounts of Adjusted EBITDA have been recast to conform

to this presentation.

CONSOLIDATED STATEMENTS OF

OPERATIONS(in thousands, except per share

amounts)(unaudited)

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Revenues: |

|

|

|

|

|

|

|

|

Product sales, net |

$ |

32,152 |

|

|

$ |

30,116 |

|

|

$ |

109,420 |

|

|

$ |

92,090 |

|

|

Commercialization agreement, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,258 |

|

|

Royalties and milestones |

|

1,188 |

|

|

|

361 |

|

|

|

2,579 |

|

|

|

1,519 |

|

|

Other revenue |

|

(10 |

) |

|

|

(301 |

) |

|

|

(985 |

) |

|

|

1,408 |

|

| Total revenues |

|

33,330 |

|

|

|

30,176 |

|

|

|

111,014 |

|

|

|

106,275 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of sales |

|

4,896 |

|

|

|

6,773 |

|

|

|

15,832 |

|

|

|

19,872 |

|

|

Research and development expenses |

|

— |

|

|

|

230 |

|

|

|

— |

|

|

|

4,213 |

|

|

Selling, general and administrative expenses |

|

13,277 |

|

|

|

21,272 |

|

|

|

56,555 |

|

|

|

104,324 |

|

|

Amortization of intangible assets |

|

7,175 |

|

|

|

6,546 |

|

|

|

28,114 |

|

|

|

24,783 |

|

|

Loss on impairment of goodwill |

|

— |

|

|

|

17,432 |

|

|

|

— |

|

|

|

17,432 |

|

|

Restructuring charges |

|

— |

|

|

|

11,019 |

|

|

|

1,089 |

|

|

|

17,806 |

|

| Total costs and expenses |

|

25,348 |

|

|

|

63,272 |

|

|

|

101,590 |

|

|

|

188,430 |

|

| Income (loss) from

operations |

|

7,982 |

|

|

|

(33,096 |

) |

|

|

9,424 |

|

|

|

(82,155 |

) |

| Other (expense) income: |

|

|

|

|

|

|

|

|

Interest expense |

|

(2,437 |

) |

|

|

(2,598 |

) |

|

|

(10,220 |

) |

|

|

(15,926 |

) |

|

Other (loss) gain |

|

(503 |

) |

|

|

346 |

|

|

|

243 |

|

|

|

(3,225 |

) |

|

Gain on sale of Gralise |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

126,655 |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(56,113 |

) |

|

Loss on sale of NUCYNTA |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14,749 |

) |

| Total other (expense)

income |

|

(2,940 |

) |

|

|

(2,252 |

) |

|

|

(9,977 |

) |

|

|

36,642 |

|

| Net income (loss) before

income taxes |

|

5,042 |

|

|

|

(35,348 |

) |

|

|

(553 |

) |

|

|

(45,513 |

) |

| Income tax (expense)

benefit |

|

(433 |

) |

|

|

10,995 |

|

|

|

(728 |

) |

|

|

17,369 |

|

| Net income (loss) and

Comprehensive income (loss) |

$ |

4,609 |

|

|

$ |

(24,353 |

) |

|

$ |

(1,281 |

) |

|

$ |

(28,144 |

) |

| Basic net income (loss) per

share |

$ |

0.10 |

|

|

$ |

(0.81 |

) |

|

$ |

(0.03 |

) |

|

$ |

(1.07 |

) |

| Diluted net income (loss) per

share |

$ |

0.10 |

|

|

$ |

(0.81 |

) |

|

$ |

(0.03 |

) |

|

$ |

(1.07 |

) |

| Shares used in computing basic

net income (loss) per share |

|

45,017 |

|

|

|

29,935 |

|

|

|

43,169 |

|

|

|

26,209 |

|

| Shares used in computing

diluted net income (loss) per share |

|

45,388 |

|

|

|

29,935 |

|

|

|

43,169 |

|

|

|

26,209 |

|

CONSOLIDATED BALANCE

SHEETS(in thousands, except share and per share

data)(unaudited)

| |

December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

36,810 |

|

|

$ |

20,786 |

|

|

Accounts receivable, net |

|

44,361 |

|

|

|

44,350 |

|

|

Inventories, net |

|

7,489 |

|

|

|

11,712 |

|

|

Prepaid and other current assets |

|

14,838 |

|

|

|

17,406 |

|

|

Total current assets |

|

103,498 |

|

|

|

94,254 |

|

| Property and equipment,

net |

|

1,527 |

|

|

|

2,437 |

|

| Intangible assets, net |

|

216,054 |

|

|

|

200,082 |

|

| Other long-term assets |

|

5,468 |

|

|

|

6,501 |

|

| Total assets |

$ |

326,547 |

|

|

$ |

303,274 |

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

6,685 |

|

|

$ |

14,808 |

|

|

Accrued rebates, returns and discounts |

|

52,662 |

|

|

|

63,114 |

|

|

Accrued liabilities |

|

14,699 |

|

|

|

28,864 |

|

|

Long-term debt, current portion |

|

12,174 |

|

|

|

11,942 |

|

|

Contingent consideration, current portion |

|

14,500 |

|

|

|

6,776 |

|

|

Other current liabilities |

|

34,299 |

|

|

|

7,182 |

|

|

Total current liabilities |

|

135,019 |

|

|

|

132,686 |

|

| Long-term debt |

|

61,319 |

|

|

|

72,160 |

|

| Contingent consideration |

|

23,159 |

|

|

|

31,776 |

|

| Other long-term

liabilities |

|

4,636 |

|

|

|

11,138 |

|

| Total liabilities |

|

224,133 |

|

|

|

247,760 |

|

| Commitments and

contingencies |

|

|

|

| Shareholders’ equity: |

|

|

|

|

Common stock, $0.0001 par value, 200,000,000 shares authorized;

44,640,444 and 28,392,149 shares issued and outstanding as of

December 31, 2021 and 2020, respectively |

|

4 |

|

|

|

3 |

|

|

Additional paid-in capital |

|

531,636 |

|

|

|

483,456 |

|

|

Accumulated deficit |

|

(429,226 |

) |

|

|

(427,945 |

) |

|

Total shareholders’ equity |

|

102,414 |

|

|

|

55,514 |

|

| Total liabilities and

shareholders' equity |

$ |

326,547 |

|

|

$ |

303,274 |

|

CONSOLIDATED STATEMENTS OF CASH

FLOWS(in

thousands)(unaudited)

| |

Year Ended December 31, |

|

|

|

2021 |

|

|

|

2020 |

|

| Operating

Activities |

|

|

|

| Net loss |

$ |

(1,281 |

) |

|

$ |

(28,144 |

) |

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

Depreciation and amortization |

|

29,077 |

|

|

|

26,431 |

|

|

Amortization of debt discount, debt issuance costs and royalty

rights |

|

194 |

|

|

|

5,680 |

|

|

Stock-based compensation |

|

3,545 |

|

|

|

10,924 |

|

|

Provisions for inventory and other assets |

|

1,368 |

|

|

|

3,817 |

|

|

Impairment of goodwill |

|

— |

|

|

|

17,432 |

|

|

Loss on disposal of equipment and early termination of leases |

|

— |

|

|

|

1,588 |

|

|

Income tax provision |

|

— |

|

|

|

(8,424 |

) |

|

Gain on sale of Gralise |

|

— |

|

|

|

(126,655 |

) |

|

Loss on sale of NUCYNTA |

|

— |

|

|

|

14,749 |

|

|

Loss on extinguishment of Convertible Notes |

|

— |

|

|

|

47,880 |

|

|

Loss on prepayment of Senior Notes |

|

— |

|

|

|

8,233 |

|

|

Recurring fair value measurement of assets and liabilities |

|

3,913 |

|

|

|

5,129 |

|

| Changes in assets and

liabilities: |

|

|

|

|

Accounts receivable |

|

(11 |

) |

|

|

19,800 |

|

|

Inventories |

|

4,268 |

|

|

|

(291 |

) |

|

Prepaid and other assets |

|

3,079 |

|

|

|

10,797 |

|

|

Income taxes |

|

522 |

|

|

|

(8,973 |

) |

|

Accounts payable and other accrued liabilities |

|

(28,699 |

) |

|

|

(36,479 |

) |

|

Accrued rebates, returns and discounts |

|

(10,452 |

) |

|

|

(29,066 |

) |

|

Net cash provided by (used in) operating activities |

|

5,523 |

|

|

|

(65,572 |

) |

| Investing

Activities |

|

|

|

| Cash acquired in Zyla

Merger |

|

— |

|

|

|

7,585 |

|

| Proceeds from sale of

NUCYNTA |

|

— |

|

|

|

368,965 |

|

| Proceeds from sale of

Gralise |

|

— |

|

|

|

130,261 |

|

| Purchases of property and

equipment |

|

(53 |

) |

|

|

(10 |

) |

| Purchase of Otrexup |

|

(18,472 |

) |

|

|

— |

|

| Proceeds from sale of

investments |

|

— |

|

|

|

6,000 |

|

|

Net cash (used in) provided by investing activities |

|

(18,525 |

) |

|

|

512,801 |

|

| Financing

Activities |

|

|

|

| Payment of contingent

consideration |

|

(4,807 |

) |

|

|

(3,016 |

) |

| Payment of Royalty Rights |

|

(968 |

) |

|

|

(500 |

) |

| Payments in connection with

Senior Notes settlement |

|

— |

|

|

|

(171,775 |

) |

| Payments in connection with

convertible notes |

|

(335 |

) |

|

|

(264,731 |

) |

| Payment in connection with

Series A-1 and A-2 debt |

|

(9,500 |

) |

|

|

(14,750 |

) |

| Payments on Promissory

Note |

|

— |

|

|

|

(3,000 |

) |

| Payments on Revolver |

|

— |

|

|

|

(10,000 |

) |

| Proceeds from issuance of

common stock |

|

44,861 |

|

|

|

88 |

|

| Proceeds from exercise of

stock options |

|

193 |

|

|

|

— |

|

| Shares withheld for payment of

employee's withholding tax liability |

|

(418 |

) |

|

|

(866 |

) |

|

Net cash provided by (used in) financing activities |

|

29,026 |

|

|

|

(468,550 |

) |

| Net increase (decrease) in

cash and cash equivalents |

|

16,024 |

|

|

|

(21,321 |

) |

| Cash and cash equivalents at

beginning of year |

|

20,786 |

|

|

|

42,107 |

|

| Cash and cash equivalents at

end of period |

$ |

36,810 |

|

|

$ |

20,786 |

|

| Supplemental

Disclosure of Cash Flow Information |

|

|

|

|

Net cash refund of income taxes |

$ |

— |

|

|

$ |

1,136 |

|

|

Cash paid for interest |

$ |

10,124 |

|

|

$ |

17,598 |

|

| Supplemental

Disclosure of Non-Cash Investing Activities |

|

|

|

|

Acquisition of Otrexup intangible assets |

$ |

26,021 |

|

|

$ |

— |

|

RECONCILIATION OF GAAP NET INCOME (LOSS)

TO NON-GAAP EBITDA and ADJUSTED EBITDA (in

thousands)(unaudited)

| |

|

Three Months Ended December 31, |

Twelve Months Ended December 31, |

|

Financial Statement Classification |

|

|

|

|

2021 |

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

|

| GAAP Net

Income/(Loss) |

|

$ |

4,609 |

|

$ |

(24,353 |

) |

|

$ |

(1,281 |

) |

|

$ |

(28,144 |

) |

|

|

|

|

Interest expense |

|

|

2,437 |

|

|

2,598 |

|

|

|

10,220 |

|

|

|

15,926 |

|

|

|

Interest expense |

|

Income tax expense (benefit) |

|

|

433 |

|

|

(10,995 |

) |

|

|

728 |

|

|

|

(17,369 |

) |

|

|

Income tax (expense)

benefit |

|

Depreciation expense |

|

|

203 |

|

|

417 |

|

|

|

963 |

|

|

|

1,648 |

|

|

|

Selling, general and

administrative expenses |

|

Amortization of intangible assets |

|

|

7,175 |

|

|

6,546 |

|

|

|

28,114 |

|

|

|

24,783 |

|

|

|

Amortization of intangible

assets |

| EBITDA

(Non-GAAP) |

|

$ |

14,857 |

|

$ |

(25,787 |

) |

|

$ |

38,744 |

|

|

$ |

(3,156 |

) |

|

|

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Legacy products revenue reserves(1) |

|

|

10 |

|

|

301 |

|

|

|

985 |

|

|

|

(1,408 |

) |

|

|

Other Revenue |

|

Stock-based compensation(2) |

|

|

949 |

|

|

3,886 |

|

|

|

3,545 |

|

|

|

9,925 |

|

|

|

Multiple |

|

Contingent consideration fair value change(3) |

|

|

2,011 |

|

|

(356 |

) |

|

|

3,913 |

|

|

|

1,500 |

|

|

|

Selling, general and

administrative expenses |

|

Restructuring cost(4) |

|

|

— |

|

|

11,019 |

|

|

|

1,089 |

|

|

|

17,806 |

|

|

|

Restructuring charges |

|

Other(5) |

|

|

— |

|

|

1,151 |

|

|

|

554 |

|

|

|

5,945 |

|

|

|

Multiple |

|

Loss on goodwill impairment(6) |

|

|

— |

|

|

17,432 |

|

|

|

— |

|

|

|

17,432 |

|

|

|

Loss on impairment of

goodwill |

|

Prior year adjustments not repeating(7) |

|

|

— |

|

|

524 |

|

|

|

— |

|

|

|

(31,763 |

) |

|

|

Multiple |

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

17,827 |

|

$ |

8,170 |

|

|

$ |

48,830 |

|

|

$ |

16,281 |

|

|

|

|

(1) Removal of the impact of revenue adjustment related to

previously divested products. During the third quarter of 2021, the

Company reclassified product sales adjustments for previously

divested products from Product sales, net to Other revenue. There

was no change to Total revenue as a result of the

reclassifications. Prior period results have been recast to conform

with current period presentation.

(2) Stock based compensation for the three and twelve

months ended December 31, 2021 and three months ended December 31,

2020 is included in Selling, general and administrative expenses.

Stock based compensation for the twelve months ended December 31,

2020 included $0.1 million in in Cost of sales, $0.3 million in

Research and development expense and $9.6 million in Selling,

general and administrative expenses.

(3) The fair value of the contingent consideration is

remeasured each reporting period, with changes in the fair value

resulting from a change in the underlying inputs being recognized

in operating expenses until the contingent consideration

arrangement is settled.

(4) Restructuring and related costs represents

non-recurring costs associated with the Company’s announced

restructuring plans

(5) For the three and twelve months ended December 31,

2021 and the three and twelve months ended December 31, 2020, Other

represents amortization of inventory step-up recognized in Cost of

sales related to Zyla acquired inventories sold. For the twelve

months ended December 31, 2020, Other also includes credit loss

reserve recognized in the first quarter of 2020 in Other gain

(loss) related the Company’s investment in a company engaged in

medical research.

(6) At December 31, 2020, the Company recorded a non-cash

impairment charge of $17.4 million on its goodwill.

(7) Represent the following one-time adjustments included

in three and twelve months ended December 31, 2020:

- Gain on sale of Gralise of zero and $126.7 million,

respectively

- Loss on sale of NUCYNTA of zero and $14.7 million,

respectively

- Loss on extinguishment of convertible notes and debt of zero

and $56.1 million, respectively

- Transaction costs of $0.5 million and $18.6 million,

respectively

- Change in fair value of Collegium warrants of zero and $3.6

million, respectively

- NUCYNTA Commercialization agreement revenues of zero and $1.8

million, respectively

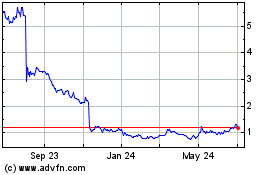

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

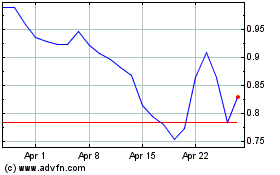

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2023 to Apr 2024