Aptevo Therapeutics Announces Up To $35 Million Common Stock Purchase Agreement With Lincoln Park Capital

December 21 2018 - 9:00AM

Provides Opportunistic Capital of up to $35 Million to Aptevo

During the 36-month Term of the Agreement

Aptevo Therapeutics Inc. (Nasdaq: APVO), a biotechnology company

focused on developing novel oncology and hematology therapeutics,

announced today that it has entered into a common stock purchase

agreement and registration rights agreement with Lincoln Park

Capital (LPC) Fund, LLC, under which LPC has committed to purchase

up to an aggregate of $35 million in Aptevo’s common stock over a

36-month term.

Under the terms and conditions of the purchase

agreement, and after the filing and effectiveness of a registration

statement registering the shares to be sold to LPC, Aptevo has the

right, in its sole discretion, to sell shares of common stock to

LPC and LPC is obligated to purchase the common stock at times and

amounts as set forth in the purchase agreement. There are no upper

limits on the price per share that LPC could be obligated to

purchase common stock from Aptevo, and the purchase price of any

future shares will be based on the prevailing market prices of

Aptevo’s shares around the time of each sale. Concomitantly, LPC

has agreed not to engage in any direct or indirect short selling or

hedging of Aptevo common stock during the term of the purchase

agreement.

“We’re pleased to reach this agreement with

Lincoln Park Capital which provides enhanced operational

flexibility and the ability to opportunistically access capital at

our discretion under favorable terms, potentially minimizing

dilution to our current shareholders,” said Jeff Lamothe, Chief

Financial Officer. “Capital raised over the next three years under

these agreements may be at potentially higher valuations as we move

toward important upcoming clinical milestones in 2019, including

anticipated top-line preliminary data read-outs from two key

ADAPTIR programs, APVO436 and APVO210, which are being evaluated

for the treatment of acute myeloid leukemia and autoimmune

disorders, respectively. We believe that the combination of our

current cash, IXINITY cash flow, and the proceeds we may elect to

access under these agreements with LPC has strengthened our cash

runway, potentially providing us access to capital through the

second half of 2020. We look forward to reaching these important

milestones over the next several quarters and advancing our

portfolio of innovative ADAPTIR bispecific therapeutics for cancer

and autoimmune diseases.”

No warrants, derivatives, or financial covenants

are associated with the purchase agreement, and the agreement may

be terminated by Aptevo at any time, at its sole discretion,

without any cost or penalty. Aptevo plans to use the proceeds from

the sales to LPC to support the advancement of its next-generation

ADAPTIR bispecific antibody candidates and for working capital and

general corporate purposes. As consideration for entering into

these agreements and committing to purchase up to $35 million in

stock from the Company, Aptevo has issued shares of its common

stock to LPC as a commitment fee and will issue additional

commitment fee shares upon effectiveness of the registration

statement.

A more detailed description of these agreements will be set

forth in Aptevo’s Current Report on Form 8-K, which will be filed

with the SEC.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy the securities in this

offering, nor will there be any sale of these securities in any

jurisdiction in which such offer solicitation or sale are unlawful

prior to registration or qualification under securities laws of any

such jurisdiction.

About Aptevo Therapeutics

Inc.

Aptevo Therapeutics Inc. is a clinical-stage

biotechnology company focused on novel oncology and hematology

therapeutics to meaningfully improve patients’ lives. Aptevo has a

commercial product, IXINITY® coagulation factor IX (recombinant),

approved and marketed in the United States for the treatment of

Hemophilia B, and a versatile core technology – the ADAPTIR™

modular protein technology platform capable of generating

highly-differentiated bispecific antibodies with unique mechanisms

of action to treat cancer or autoimmune diseases. Aptevo has a

broad pipeline of novel investigational-stage bispecific antibody

candidates focused in immuno- oncology and autoimmune disease and

inflammation. For more information, please visit

www.aptevotherapeutics.com

About Lincoln Park Capital Fund,

LLC.

LPC is an institutional investor headquartered

in Chicago, Illinois. LPC’s experienced professionals manage a

portfolio of investments in public and private entities. These

investments are in a wide range of companies and industries

emphasizing life sciences, specialty financing, energy and

technology. LPC’s investments range from multi-year financial

commitments to fund growth to special situation financings to

long-term strategic capital offering companies’ certainty,

flexibility and consistency. For more information, visit

www.lpcfunds.com

Safe Harbor Statement

This press release includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Any statements, other than statements of

historical fact, including, without limitation, statements

regarding the anticipated proceeds available to Aptevo under the

share purchase agreement with LPC, the sufficiency of Aptevo’s

funding for planned operations, the anticipated timing of clinical

milestones, Aptevo’s outlook, financial performance or financial

condition, Aptevo’s technology and related pipeline, and any other

statements containing the words “believes,” “expects,”

“anticipates,” “intends,” “plans,” “forecasts,” “estimates,” “will”

and similar expressions are forward-looking statements. These

forward-looking statements are based on Aptevo’s current

intentions, beliefs and expectations regarding future events.

Aptevo cannot guarantee that any forward-looking statement will be

accurate. Investors should realize that if underlying assumptions

prove inaccurate or unknown risks or uncertainties materialize,

actual results could differ materially from Aptevo’s expectations.

Investors are, therefore, cautioned not to place undue reliance on

any forward-looking statement. Any forward-looking statement speaks

only as of the date of this press release, and, except as required

by law, Aptevo does not undertake to update any forward-looking

statement to reflect new information, events or circumstances.

There are a number of important factors that

could cause Aptevo’s actual results to differ materially from those

indicated by such forward-looking statements, including failure to

satisfy conditions necessary for Aptevo to cause LPC to purchase

shares under the share purchase agreement, a deterioration in

Aptevo’s business or prospects; adverse developments in research

and development; adverse developments in the U.S. or global capital

markets, credit markets or economies generally; and changes in

regulatory, social and political conditions. Additional risks and

factors that may affect results are set forth in Aptevo’s filings

with the Securities and Exchange Commission, including its most

recent Annual Report on Form 10-K, as filed on March 13, 2018 and

its subsequent reports on Form 10-Q and current reports on Form

8-K. The foregoing sets forth many, but not all, of the factors

that could cause actual results to differ from Aptevo’s

expectations in any forward-looking statement.

Source:

Aptevo Therapeutics Stacey JurchisonSenior Director, Investor

Relations and Corporate Communications 206-859-6628 /

JurchisonS@apvo.com

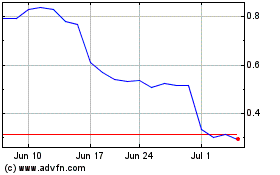

Aptevo Therapeutics (NASDAQ:APVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aptevo Therapeutics (NASDAQ:APVO)

Historical Stock Chart

From Apr 2023 to Apr 2024