Apellis Pharmaceuticals Reports Third Quarter 2018 Business Update and Financial Results

November 13 2018 - 8:00AM

- Commenced Phase 3 Program of APL-2 in

Geographic Atrophy (GA) -

Apellis Pharmaceuticals, Inc. (Nasdaq: APLS), a clinical-stage

biopharmaceutical company focused on the development of novel

therapeutic compounds to treat disease through the inhibition of

the complement system, today announced its third quarter 2018

financial results and business highlights.

“The third quarter of 2018 was very important for Apellis, as we

initiated our Phase 3 program in GA and now have two clinical

programs in Phase 3 following the initiation of the PEGASUS trial

of APL-2 in paroxysmal nocturnal hemoglobinuria (PNH) patients in

June,” said Cedric Francois, MD, PhD, founder and chief executive

officer of Apellis. “This is a considerable accomplishment as we

work towards the goal of treating patients with complement mediated

diseases with APL-2 as an approved drug. We remain steadfast in our

commitment to patients and voluntarily implemented a temporary

pause in dosing in both our Phase 3 GA program and in our Phase

1b/2 Wet AMD trial last month following observations of

non-infectious inflammation in patients that we believe resulted

from a single manufacturing lot of APL-2. We do not believe the

pause will delay the projected enrollment timeline of 18 months in

the Phase 3 GA program and in the first half of December we plan to

provide an update following confirmatory studies and review by the

data safety monitoring board. We also look forward to sharing

updates on our hematology programs later this quarter at the 2018

American Society of Hematology (ASH) conference.”

Business Highlights and Upcoming

Milestones:

APL-2 in GA

- Initiated patient dosing in the Phase 3 GA program, consisting

of two Phase 3 trials (DERBY & OAKS), in September 2018.

- Received Fast Track designation for the treatment of patients

with GA from the U.S. Food & Drug Administration (FDA) in July

2018.

- Plan to provide an update on the Phase 3 GA program in the

first half of December 2018.

APL-2 in PNH

- Provided interim results from the Phase 1b PHAROAH trial

evaluating APL-2 in PNH patients on treatment with eculizumab

(Soliris™) in September 2018. All four patients, who were severely

anemic and transfusion dependent while on eculizumab, were

transitioned to APL-2 monotherapy.

- Plan to provide an update on the ongoing Phase 1b PNH trials at

the 2018 ASH conference in December.

APL-2 In Other Indications

- Plan to provide an update on the ongoing Phase 2 monotherapy

trial of APL-2 in both warm autoimmune hemolytic anemia (wAIHA) and

cold agglutinin disease (CAD) at the 2018 ASH conference in

December.

- Expect data from the ongoing Phase 2 monotherapy trial of APL-2

in four types of complement-dependent nephropathies (IgA

nephropathy, C3 glomerulopathy, primary membranous nephropathy and

lupus nephritis) in 2019. The trial timeline has been updated from

a four month data readout to a one year data readout.

Third Quarter 2018 Financial Results:

As of September 30, 2018, Apellis had $220.6 million in cash and

cash equivalents, compared to $253.8 million as of June 30,

2018.

Apellis reported a net loss of $36.0 million for the third

quarter of 2018, compared to a net loss of $11.6 million for the

third quarter of 2017.

Research and development expenses were $29.5 million in the

third quarter of 2018, compared to $9.5 million in the third

quarter of 2017. The increase in research and development expenses

was primarily attributable to an increase of $10.2 million in

clinical trial costs associated with the preparation for and

commencement of our Phase 3 clinical trials, an increase of $6.8

million in manufacturing expenses in connection with the supply for

our Phase 3 clinical trials of APL-2, an increase of $2.5 million

in employee related costs primarily due to the hiring of additional

personnel, an increase of $0.3 million related to research and

development supporting activities and an increase of $0.2 million

in preclinical study expenses.

General and administrative expenses were $6.3 million in the

third quarter of 2018, compared to $2.1 million in the third

quarter of 2017. The increase in general and administrative

expenses was primarily attributable to an increase in employee

related costs of $2.0 million due to the hiring of additional

personnel, an increase in professional and consulting fees of $0.9

million, an increase in license agreement costs of $0.7 million

attributable to our achievement of milestones, an increase of $0.4

million in director stock option compensation and an increase of

$0.2 million in insurance costs.

About APL-2 APL-2 is designed to inhibit the

complement cascade centrally at C3 and may have the potential to

treat a wide range of complement-mediated diseases more effectively

than is possible with partial inhibitors of complement. APL-2 is a

synthetic cyclic peptide conjugated to a polyethylene glycol (PEG)

polymer that binds specifically to C3 and C3b, effectively blocking

all three pathways of complement activation (classical, lectin, and

alternative).

About ApellisApellis Pharmaceuticals, Inc. is a

clinical-stage biopharmaceutical company focused on the development

of novel therapeutic compounds for the treatment of a broad range

of life-threatening or debilitating autoimmune diseases based upon

complement immunotherapy through the inhibition of the complement

system at the level of C3. Apellis is the first company to advance

chronic therapy with a C3 inhibitor into clinical trials. For

additional information about Apellis and APL-2, please visit

http://www.apellis.com. For additional information regarding our

clinical trials, visit www.apellis.com/clinical-trials.html.

Forward-Looking Statements Statements in

this press release about future expectations, plans and prospects,

as well as any other statements regarding matters that are not

historical facts, may constitute “forward-looking statements”

within the meaning of The Private Securities Litigation Reform Act

of 1995. These statements include, but are not limited to,

statements relating to the implications of preliminary clinical

data. The words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “will,” “would” and

similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Actual results may differ materially from

those indicated by such forward-looking statements as a result of

various important factors, including: whether dosing in the Phase 3

GA program will resume when anticipated; whether preliminary or

interim results from a clinical trial will be predictive of the

final results of the trial; whether results obtained in preclinical

studies and clinical trials will be indicative of results that will

be generated in future clinical trials; whether APL-2 will

successfully advance through the clinical trial process on a timely

basis, or at all; whether the results of such clinical trials will

warrant regulatory submissions and whether APL-2 will receive

approval from the United States Food and Drug Administration or

equivalent foreign regulatory agencies for GA, PNH or any other

indication; whether, if Apellis’ products receive approval, they

will be successfully distributed and marketed; and other factors

discussed in the “Risk Factors” section of Apellis’ Quarterly

Report on Form 10-Q filed with the Securities and Exchange

Commission on November 13, 2018 and the risks described in other

filings that Apellis may make with the Securities and Exchange

Commission. Any forward-looking statements contained in this press

release speak only as of the date hereof, and Apellis specifically

disclaims any obligation to update any forward-looking statement,

whether as a result of new information, future events or

otherwise.

| |

| APELLIS PHARMACEUTICALS, INC. |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| |

|

|

| |

|

December 31, |

|

September 30, |

| |

|

|

2017 |

|

|

|

2018 |

|

|

Assets |

|

|

|

(Unaudited) |

| Current

assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

175,643,529 |

|

|

$ |

220,640,818 |

|

|

Refundable research and development credit |

|

|

1,297,361 |

|

|

|

1,364,259 |

|

| Prepaid

assets |

|

|

5,059,593 |

|

|

|

16,846,183 |

|

| Other

current assets |

|

|

14,823 |

|

|

|

81,532 |

|

| Total

current assets |

|

|

182,015,306 |

|

|

|

238,932,792 |

|

| Other

assets |

|

|

116,150 |

|

|

|

212,979 |

|

| Total

assets |

|

$ |

182,131,456 |

|

|

$ |

239,145,771 |

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

3,663,253 |

|

|

$ |

5,468,800 |

|

| Accrued

expenses |

|

|

2,890,705 |

|

|

|

10,565,640 |

|

| Total

current liabilities |

|

|

6,553,958 |

|

|

|

16,034,440 |

|

|

Long-term liabilities: |

|

|

|

|

| Term loan

facility |

|

|

19,806,944 |

|

|

|

20,270,032 |

|

|

Promissory note - related party |

|

|

6,583,402 |

|

|

|

6,636,449 |

|

| Common

stock warrant liability |

|

|

244,292 |

|

|

|

250,000 |

|

| Total

liabilities |

|

|

33,188,596 |

|

|

|

43,190,921 |

|

|

Stockholders' equity: |

|

|

|

|

| Preferred

stock, $0.0001 par value; 10,000,000 shares authorized, and zero

shares issued and outstanding at December 31, 2017 and

September 30, 2018 |

|

|

- |

|

|

|

- |

|

| Common

stock, $0.0001 par value; 200,000,000 shares authorized at

December 31, 2017 and September 30, 2018 and 50,334,152 shares

issued and outstanding at December 31, 2017 and 56,242,571

shares issued and outstanding at September 30, 2018 |

|

|

5,033 |

|

|

|

5,624 |

|

|

Additional paid in capital |

|

|

298,201,480 |

|

|

|

435,915,657 |

|

|

Accumulated other comprehensive income |

|

|

- |

|

|

|

339,942 |

|

|

Accumulated deficit |

|

|

(149,263,653 |

) |

|

|

(240,306,373 |

) |

| Total

stockholders' equity |

|

|

148,942,860 |

|

|

|

195,954,850 |

|

| Total

liabilities and stockholders' equity |

|

$ |

182,131,456 |

|

|

$ |

239,145,771 |

|

| |

|

|

|

|

| |

|

|

|

| APELLIS PHARMACEUTICALS, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS |

| (Unaudited) |

| |

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

| |

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

| Research

and development |

$ |

9,517,882 |

|

|

$ |

29,539,456 |

|

|

$ |

27,171,025 |

|

|

$ |

74,479,965 |

|

| General

and administrative |

|

2,071,437 |

|

|

|

6,265,125 |

|

|

|

5,603,190 |

|

|

|

16,248,203 |

|

|

Operating loss |

|

(11,589,319 |

) |

|

|

(35,804,581 |

) |

|

|

(32,774,215 |

) |

|

|

(90,728,168 |

) |

|

Unrealized foreign currency loss |

|

— |

|

|

|

(426,191 |

) |

|

|

— |

|

|

|

(426,191 |

) |

| Interest

income (expense), net |

|

16,847 |

|

|

|

280,891 |

|

|

|

32,813 |

|

|

|

198,214 |

|

| Other

income (expense), net |

|

(801 |

) |

|

|

(22,234 |

) |

|

|

(8,796 |

) |

|

|

(86,575 |

) |

| Net

loss |

|

(11,573,273 |

) |

|

|

(35,972,115 |

) |

|

|

(32,750,198 |

) |

|

|

(91,042,720 |

) |

| Other

comprehensive income: |

|

|

|

|

|

|

|

| Foreign

currency translation |

|

— |

|

|

|

339,942 |

|

|

|

— |

|

|

|

339,942 |

|

|

Comprehensive loss, net of tax |

$ |

(11,573,273 |

) |

|

$ |

(35,632,173 |

) |

|

$ |

(32,750,198 |

) |

|

$ |

(90,702,778 |

) |

| Net loss

per common share, basic and diluted |

$ |

(1.37 |

) |

|

$ |

(0.64 |

) |

|

$ |

(3.88 |

) |

|

$ |

(1.69 |

) |

|

Weighted-average number of common shares used in net loss

per common share, basic and diluted |

|

8,442,072 |

|

|

|

56,201,299 |

|

|

|

8,432,983 |

|

|

|

53,770,400 |

|

| |

|

|

|

|

|

|

|

Investor Contact:

Alex Kane

akane@w2ogroup.com

212.301.7218 (office)

929.400.2691 (mobile)

Media Contact:

Tully Nicholas

tnicholas@denterlein.com

617.482.0042 (office)

860.490.0218 (mobile)

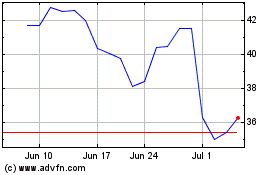

Apellis Pharmaceuticals (NASDAQ:APLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apellis Pharmaceuticals (NASDAQ:APLS)

Historical Stock Chart

From Apr 2023 to Apr 2024