Statement of Ownership (sc 13g)

February 09 2021 - 4:08PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13G

(Rule 13d-102)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(b), (c) AND (d) AND AMENDMENTS THERETO FILED

PURSUANT TO § 240.13d-2

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )*

Agora, Inc.

(Name of Issuer)

Class A ordinary shares, $0.0001 par value per share

(Title of Class of Securities)

00851L103**

(CUSIP

Number)

December 31, 2020

(Date of Event Which Requires Filing of this Statement)

Check the appropriate box to

designate the rule pursuant to which this Schedule is filed:

☐ Rule 13d-1(b)

☐ Rule 13d-1(c)

☒

Rule 13d-1(d)

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

|

**

|

CUSIP number 00851L103 has been assigned to the American depositary shares (“ADSs”) of the Issuer,

which are quoted on the Nasdaq Global Select Market under the symbol “API.” Each ADS represents four Class A ordinary shares of the Issuer.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

Page

2

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Shunwei Technology II Limited

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

British Virgin Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

31,065,548 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

31,065,548 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

31,065,548 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

7.8%(2) (or 1.7%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

CO

|

|

(1)

|

Represents 31,065,548 Class A ordinary shares held by Shunwei Technology II Limited.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 1.7% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

2

Page

3

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Shunwei China Internet Fund, L.P.

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

31,065,548 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

31,065,548 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

31,065,548 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

7.8%(2) (or 1.7%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

PN

|

|

(1)

|

Represents 31,065,548 Class A ordinary shares held by Shunwei Technology II Limited. Shunwei China Internet

Fund, L.P. is the sole shareholder of Shunwei Technology II Limited.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 1.7% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

3

Page

4

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Shunwei Capital Partners GP, L.P.

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

31,065,548 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

31,065,548 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

31,065,548 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

7.8%(2) (or 1.7%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

PN

|

|

(1)

|

Represents 31,065,548 Class A ordinary shares held by Shunwei Technology II Limited. Shunwei China Internet

Fund, L.P. is the sole shareholder of Shunwei Technology II Limited. Shunwei Capital Partners GP, L.P. is the general partner of Shunwei China Internet Fund, L.P.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 1.7% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

4

Page

5

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Shunwei Capital Partners GP Limited

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

31,065,548 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

31,065,548 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

31,065,548 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

7.8%(2) (or 1.7%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

CO

|

|

(1)

|

Represents 31,065,548 Class A ordinary shares held by Shunwei Technology II Limited. Shunwei China Internet

Fund, L.P. is the sole shareholder of Shunwei Technology II Limited. Shunwei Capital Partners GP, L.P. is the general partner of Shunwei China Internet Fund, L.P. Shunwei Capital Partners GP Limited is the general partner of Shunwei Capital Partners

GP, L.P.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 1.7% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

5

Page

6

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Astrend Opportunity III Alpha Limted

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

British Virgin Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

3,000,000 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

3,000,000 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,000,000 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

0.8%(2) (or 0.2%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

CO

|

|

(1)

|

Represents 3,000,000 Class A ordinary shares (represented by 750,000 ADSs) held by Astrend Opportunity III

Alpha Limited.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 0.2% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

6

Page

7

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Shunwei China Internet Opportunity Fund III, L.P.

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

3,000,000 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

3,000,000 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,000,000 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

0.8%(2) (or 0.2%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

PN

|

|

(1)

|

Represents 3,000,000 Class A ordinary shares (represented by 750,000 ADSs) held by Astrend Opportunity III

Alpha Limited. Shunwei China Internet Opportunity Fund III, L.P. is the sole shareholder of Astrend Opportunity III Alpha Limited.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 0.2% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

7

Page

8

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Shunwei Capital Partners IV GP, L.P.

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

3,000,000 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

3,000,000 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,000,000 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

0.8%(2) (or 0.2%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

PN

|

|

(1)

|

Represents 3,000,000 Class A ordinary shares (represented by 750,000 ADSs) held by Astrend Opportunity III

Alpha Limited. Astrend Opportunity III Alpha Limited is wholly owned by Shunwei China Internet Opportunity Fund III, L.P. Shunwei Capital Partners IV GP, L.P. is the general partner of Shunwei China Internet Opportunity Fund III, L.P.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 0.2% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

8

Page

9

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Shunwei Capital Partners IV GP Limited

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

3,000,000 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

3,000,000 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

3,000,000 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

0.8%(2) (or 0.2%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

CO

|

|

(1)

|

Represents 3,000,000 Class A ordinary shares (represented by 75,000,000 ADSs) held by Astrend Opportunity III

Alpha Limted. Astrend Opportunity III Alpha Limited is wholly owned by Shunwei China Internet Opportunity Fund III, L.P. Shunwei Capital Partners IV GP, L.P. is the general partner of Shunwei China Internet Opportunity Fund III, L.P. Shunwei Capital

Partners IV GP Limited is the general partner of Shunwei Capital Partners IV GP, L.P. Shunwei Capital Partners IV GP Limited is controlled by Silver Unicorn Ventures Limited.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 0.2% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

9

Page

10

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Silver Unicorn Ventures Limited

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

British Virgin Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

34,065,548 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

34,065,548 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

34,065,548 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row 9

8.6%(2) (or 1.8%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

CO

|

|

(1)

|

Represents (i) 31,065,548 Class A ordinary shares held by Shunwei Technology II Limited and (ii) 3,000,000

Class A ordinary shares (represented by 75,000,000 ADSs) held by Astrend Opportunity III Alpha Limited. Shunwei China Internet Fund, L.P. is the sole shareholder of Shunwei Technology II Limited. Shunwei Capital Partners GP, L.P. is the general

partner of Shunwei China Internet Fund, L.P. Shunwei Capital Partners GP Limited is the general partner of Shunwei Capital Partners GP, L.P. Shunwei Capital Partners GP Limited is controlled by Silver Unicorn Ventures Limited. Astrend Opportunity

III Alpha Limited is wholly owned by Shunwei China Internet Opportunity Fund III, L.P. Shunwei Capital Partners IV GP, L.P. is the general partner of Shunwei China Internet Opportunity Fund III, L.P. Shunwei Capital Partners IV GP Limited is the

general partner of Shunwei Capital Partners IV GP, L.P. Shunwei Capital Partners IV GP Limited is controlled by Silver Unicorn Ventures Limited.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by the Reporting Person represented 1.8% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

10

Page

11

of 18 Pages

|

|

|

|

|

|

|

|

|

1

|

|

Name of

Reporting Person

Tuck Lye Koh

|

|

2

|

|

Check the Appropriate Box if a Member

of a Group

(a) ☐ (b) ☐

|

|

3

|

|

SEC Use Only

|

|

4

|

|

Citizenship or Place of

Organization

Singapore

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

5

|

|

Sole Voting Power

34,065,548 (1)

|

|

|

6

|

|

Shared Voting Power

0

|

|

|

7

|

|

Sole Dispositive Power

34,065,548 (1)

|

|

|

8

|

|

Shared Dispositive Power

0

|

|

9

|

|

Aggregate Amount Beneficially Owned by Each Reporting Person

34,065,548 (1)

|

|

10

|

|

Check if the Aggregate Amount in Row

(9) Excludes Certain Shares ☐

|

|

11

|

|

Percent of Class Represented by Amount

in Row

8.6%(2) (or 1.8%(2) of the aggregate voting power)

|

|

12

|

|

Type of Reporting Person

IN

|

|

(1)

|

Represents (i) 31,065,548 Class A ordinary shares held by Shunwei Technology II Limited and (ii) 3,000,000

Class A ordinary shares (represented by 75,000,000 ADSs) held by Astrend Opportunity III Alpha Limited. Shunwei China Internet Fund, L.P. is the sole shareholder of Shunwei Technology II Limited. Shunwei Capital Partners GP, L.P. is the general

partner of Shunwei China Internet Fund, L.P. Shunwei Capital Partners GP Limited is the general partner of Shunwei Capital Partners GP, L.P. Shunwei Capital Partners GP Limited is controlled by Silver Unicorn Ventures Limited. Astrend Opportunity

III Alpha Limited is wholly owned by Shunwei China Internet Opportunity Fund III, L.P. Shunwei Capital Partners IV GP, L.P. is the general partner of Shunwei China Internet Opportunity Fund III, L.P. Shunwei Capital Partners IV GP Limited is the

general partner of Shunwei Capital Partners IV GP, L.P. Shunwei Capital Partners IV GP Limited is controlled by Silver Unicorn Ventures Limited. Silver Unicorn Ventures Limited is controlled by Mr. Tuck Lye Koh.

|

|

(2)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A ordinary shares, as

reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to 20 votes, voting together as one class.

The voting power of the shares beneficially owned by Reporting Person represented 1.8% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer.

|

11

Page

12

of 18 Pages

|

|

|

|

|

Item 1(a).

|

|

Name of Issuer:

Agora, Inc.

|

|

Item 1(b).

|

|

Address of Issuer’s Principal Executive Offices:

Floor 8, Building 12, Phase III of ChuangZhiTianDi, 333 Songhu Road, Yangpu District, Shanghai, People’s Republic of China

|

|

Item 2(a).

|

|

Name of Person Filing:

(i) Shunwei Technology II Limited;

(ii) Shunwei China Internet Fund, L.P.;

(iii) Shunwei Capital Partners GP, L.P.;

(iv) Shunwei Capital Partners GP Limited;

(v) Astrend Opportunity III Alpah Limited;

(vi) Shunwei China Internet Opportunity Fund III, L.P.;

(vii) Shunwei Capital Partners IV GP, L.P.;

(viii) Shunwei Capital Partners IV GP Limited;

(ix) Silver Unicorn Ventures Limited; and

(x) Tuck Lye Koh (collectively, the “Reporting Persons”).

|

|

|

|

|

Item 2(b).

|

|

Address of Principal Business Office or, if none, Residence:

The addresses of the Reporting Persons are:

For Shunwei Technology II Limited

Vistra Corporate Services Center

Wickhams Cay II, Road Town,

Tortola, VG 1110

British Virgin Islands

For Shunwei China Internet Fund, L.P.

Walker House

87 Mary Street

George Town, Grand Cayman KY1-9005

Cayman Islands

For Shunwei Capital Partners GP, L.P.

Walker House

87 Mary Street

George Town, Grand Cayman KY1-9005

Cayman Islands

For Shunwei Capital Partners GP Limited

Walker House

87 Mary Street

George Town, Grand Cayman KY1-9005

Cayman Islands

For Astrend Opportunity III Alpha Limited

Vistra Corporate

Services Center

Wickhams Cay II, Road Town, Tortola, VG 1110

British Virgin Islands

|

12

Page

13

of 18 Pages

|

|

|

|

|

|

|

For Shunwei China Internet Opportunity Fund III, L.P.

c/o Campbells Corporate Services Limited

Floor 4, Willow

House

Cricket Square, Grand Cayman KY1-9010

Cayman Islands

For Shunwei Capital Partners IV GP, L.P.

Walker House

c/o Campbells Corporate Services Limited

Floor 4, Willow

House

Cricket Square, Grand Cayman KY1-9010

Cayman Islands

For Shunwei Capital Partners IV GP Limited

c/oWalker House

87 Mary Street

George Town, Grand Cayman KY1-9005

Cayman Islands

For Silver Unicorn Ventures Limited

Vistra Corporate Services

Center

Wickhams Cay II, Road Town, Tortola, VG 1110

British

Virgin Islands

For Mr. Tuck Lye Koh

32D Watten Rise, Singapore 286651

|

|

|

|

|

Item 2(c)

|

|

Citizenship:

Shunwei Technology II Limited – British Virgin Islands

Shunwei China Internet Fund, L.P. – Cayman Islands

Shunwei

Capital Partners GP, L.P. – Cayman Islands

Shunwei Capital Partners GP Limited – Cayman Islands

Astrend Opportunity III Alpha Limited – British Virgin Islands

Shunwei China Internet Opportunity Fund III, L.P. – Cayman Islands

Shunwei Capital Partners IV GP, L.P. – Cayman Islands

Shunwei Capital Partners IV GP Limited – Cayman Islands

Silver Unicorn Ventures Limited – British Virgin Islands

Tuck Lye Koh – Singapore

|

|

|

|

|

Item 2(d).

|

|

Title of Class of Securities:

Class A ordinary shares, par value US$0.0001 per share, of the Issuer.

The Issuer’s ordinary shares consist of Class A ordinary shares and Class B ordinary shares. Each holder of Class A ordinary shares is

entitled to one vote per share and each holder of Class B ordinary shares is entitled to 20 votes per share, on all matters submitted to shareholders for vote. Class B ordinary shares are convertible at any time by the holder thereof into

Class A ordinary shares on a one-for-one basis. Class A ordinary shares are not convertible into Class B ordinary shares under any

circumstances.

|

|

|

|

|

Item 2(e).

|

|

CUSIP Number:

00851L103

This CUSIP number applies to the American depositary shares of the Issuer, each representing two Class A ordinary shares of the Issuer.

|

13

Page

14

of 18 Pages

|

|

|

|

|

Item 3.

|

|

If this statement is filed pursuant to §§ 240.13d-1(b), or 240.13d-2(b) or (c), check whether the persons filing is a:

|

|

|

|

|

|

|

Not applicable

|

|

|

|

|

Item 4.

|

|

Ownership:

|

The following information with respect to the ownership of Class A ordinary shares by the Reporting Persons filing this

statement on Schedule 13G is provided as of December 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reporting

Persons

|

|

Sole Voting

Power

|

|

|

Shared

Voting

Power)

|

|

|

Sole

Dispositive

Power

|

|

|

Shared

Dispositive

Power

|

|

|

Beneficial

Ownership

|

|

|

Percentage

of Class A

Ordinary

Shares(1)

|

|

|

Percentage

of Total

Ordinary

Shares(1)

|

|

|

Percentage

of the

Aggregate

Voting

Power(2)

|

|

|

Shunwei Technology II Limited .(3)

|

|

|

31,065,548

|

|

|

|

0

|

|

|

|

31,065,548

|

|

|

|

0

|

|

|

|

31,065,548

|

|

|

|

9.7

|

%

|

|

|

7.8

|

%

|

|

|

1.7

|

%

|

|

Shunwei China Internet Fund, L.P.(3)

|

|

|

31,065,548

|

|

|

|

0

|

|

|

|

31,065,548

|

|

|

|

0

|

|

|

|

31,065,548

|

|

|

|

9.7

|

%

|

|

|

7.8

|

%

|

|

|

1.7

|

%

|

|

Shunwei Capital Partners GP, L.P.

(3)

|

|

|

31,065,548

|

|

|

|

0

|

|

|

|

31,065,548

|

|

|

|

0

|

|

|

|

31,065,548

|

|

|

|

9.7

|

%

|

|

|

7.8

|

%

|

|

|

1.7

|

%

|

|

Shunwei Capital Partners GP Limited

(3)

|

|

|

31,065,548

|

|

|

|

0

|

|

|

|

31,065,548

|

|

|

|

0

|

|

|

|

31,065,548

|

|

|

|

9.7

|

%

|

|

|

7.8

|

%

|

|

|

1.7

|

%

|

|

Astrend Opportunity III Alpha

Limited(4)

|

|

|

3,000,000

|

|

|

|

0

|

|

|

|

3,000,000

|

|

|

|

0

|

|

|

|

3,000,000

|

|

|

|

0.9

|

%

|

|

|

0.8

|

%

|

|

|

0.2

|

%

|

|

Shunwei China Internet Opportunity Fund III, L.P.(4)

|

|

|

3,000,000

|

|

|

|

0

|

|

|

|

3,000,000

|

|

|

|

0

|

|

|

|

3,000,000

|

|

|

|

0.9

|

%

|

|

|

0.8

|

%

|

|

|

0.2

|

%

|

|

Shunwei Capital Partners IV GP,

L.P.(4)

|

|

|

3,000,000

|

|

|

|

0

|

|

|

|

3,000,000

|

|

|

|

0

|

|

|

|

3,000,000

|

|

|

|

0.9

|

%

|

|

|

0.8

|

%

|

|

|

0.2

|

%

|

|

Shunwei Capital Partners IV GP

Limited(4)

|

|

|

3,000,000

|

|

|

|

0

|

|

|

|

3,000,000

|

|

|

|

0

|

|

|

|

3,000,000

|

|

|

|

0.9

|

%

|

|

|

0.8

|

%

|

|

|

0.2

|

%

|

|

Silver Unicorn Ventures Limited

(3)(4)

|

|

|

34,065,548

|

|

|

|

0

|

|

|

|

34,065,548

|

|

|

|

0

|

|

|

|

34,065,548

|

|

|

|

10.6

|

%

|

|

|

8.6

|

%

|

|

|

1.8

|

%

|

|

Tuck Lye Koh (3)(4)

|

|

|

34,065,548

|

|

|

|

0

|

|

|

|

34,065,548

|

|

|

|

0

|

|

|

|

34,065,548

|

|

|

|

10.6

|

%

|

|

|

8.6

|

%

|

|

|

1.8

|

%

|

|

(1)

|

The beneficial ownership percentage is calculated based on 396,897,929 ordinary shares of the Issuer as a

single class, being the sum of (i) 320,717,991 Class A ordinary shares, and (ii) 76,179,938 Class B ordinary shares issued and outstanding as of June 25, 2020, assuming conversion of all Class B ordinary shares into Class A

ordinary shares, as reported in the Issuer’s prospectus filed with the Securities and Exchange Commission on June 25, 2020.

|

14

Page

15

of 18 Pages

|

(2)

|

The percentage of voting power is calculated by dividing the voting power beneficially owned by each Reporting

Person by the voting power of all of the Issuer’s Class A ordinary shares and Class B ordinary shares as a single class. Each Class A ordinary share is entitled to one vote and each Class B ordinary share is entitled to 20

votes, on all matters submitted to them for vote.

|

|

(3)

|

Shunwei China Internet Fund, L.P. is the sole shareholder of Shunwei Technology II Limited. Shunwei Capital

Partners GP, L.P. is the general partner of Shunwei China Internet Fund, L.P. Shunwei Capital Partners GP Limited is the general partner of Shunwei Capital Partners GP, L.P. Shunwei Capital Partners GP Limited is controlled by Silver Unicorn

Ventures Limited, which is controlled by Mr. Tuck Lye Koh.

|

|

(4)

|

Astrend Opportunity III Alpha Limited is wholly owned by Shunwei China Internet Opportunity Fund III, L.P.

Shunwei Capital Partners IV GP, L.P. is the general partner of Shunwei China Internet Opportunity Fund III, L.P. Shunwei Capital Partners IV GP Limited is the general partner of Shunwei Capital Partners IV GP, L.P. Shunwei Capital Partners IV GP

Limited is controlled by Silver Unicorn Ventures Limited. Silver Unicorn Ventures Limited is controlled by Mr. Tuck Lye Koh.

|

|

Item 5.

|

Ownership of Five Percent or Less of a Class:

|

Not applicable

|

Item 6.

|

Ownership of More than Five Percent on Behalf of Another Person:

|

Not applicable

|

Item 7.

|

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the

Parent Holding Company or Controlling Person:

|

Not applicable

|

Item 8.

|

Identification and Classification of Members of the Group:

|

Not applicable

|

Item 9.

|

Notice of Dissolution of Group:

|

Not applicable

Not applicable

15

Page

16

of 18 Pages

LIST OF EXHIBITS

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Joint Filing Agreement by and among the Reporting Persons dated February 9, 2021

|

16

Page

17

of 18 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: February 9, 2021

|

|

|

|

|

|

|

|

|

Shunwei Technology II Limited

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Director

|

|

|

|

|

|

|

Shunwei China Internet Fund, L.P.

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Authorized Representative

|

|

|

|

|

|

|

Shunwei Capital Partners GP, L.P.

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Authorized Representative

|

|

|

|

|

|

|

Shunwei Capital Partners GP Limited

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Director

|

|

|

|

|

|

|

Astrend Opportunity III Alpha Limited

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Director

|

|

|

|

|

|

|

Shunwei China Internet Opportunity Fund III, L.P.

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Authorized Representative

|

|

|

|

|

|

|

Shunwei Capital Partners IV GP, L.P.

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Authorized Representative

|

|

|

|

|

|

|

Shunwei Capital Partners IV GP Limited

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Director

|

|

|

|

|

|

|

Silver Unicorn Ventures Limited

|

|

|

|

By:

|

|

/s/ Tuck Lye Koh

|

|

|

|

|

|

Name:

|

|

Tuck Lye Koh

|

|

|

|

|

|

Title:

|

|

Director

|

|

|

|

|

|

|

Tuck Lye Koh

|

|

|

|

|

|

/s/ Tuck Lye Koh

|

17

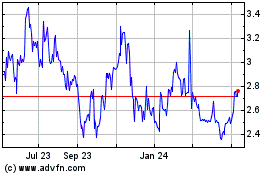

Agora (NASDAQ:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

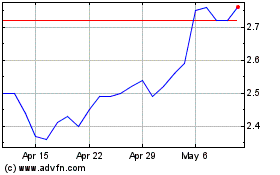

Agora (NASDAQ:API)

Historical Stock Chart

From Apr 2023 to Apr 2024