UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2021

Commission File Number: 001-36532

SPHERE 3D CORP.

895 Don Mills Road, Bldg. 2, Suite 900

Toronto, Ontario, M3C1W3, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

The information contained in this Form 6-K is incorporated by reference into, or as additional exhibits to, as applicable, the registrant's outstanding registration statements.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Stock Purchase Agreement

On September 2, 2021, Sphere 3D Corp. (the "Company") entered into a Securities Purchase Agreement (the "Purchase Agreement") with the institutional investors named therein (the "Purchasers"), pursuant to which the Company agreed to issue and sell, in a registered direct offering (the "Offering"), an aggregate of 22,600,000 common shares (the "Shares"), no par value, of the Company, and warrants to purchase an aggregate of up to 11,300,000 common shares of the Company (the "Purchase Warrants") at a combined offering price of $8.50 per share. The Purchase Warrants have an exercise price of $9.50 per share. Each Purchase Warrant is exercisable for one share of Common Stock and will be immediately exercisable and will expire five years from the issuance date.

A holder (together with its affiliates) may not exercise any portion of such holder's Purchase Warrants to the extent that the holder would own more than 4.99% of the Company's outstanding Common Shares immediately after exercise, except that upon notice from the holder to the Company, the holder may decrease or increase the limitation of ownership of outstanding stock after exercising the holder's Purchase Warrants up to 9.99% of the number of Common Shares outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Purchase Warrants, provided that any increase in such limitation shall not be effective until 61 days following notice to the Company.

Pursuant to the Purchase Agreement, subject to certain exceptions, the Company agreed not to (i) issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of Common Stock or securities convertible into Common Stock or (ii) file any registration statement or any amendment or supplement thereto, other than the prospectus supplement for the Offering or a registration statement on Form S-8 or Form F-4, for forty-five (45) days following the closing of the Offering (such period, the "Standstill Period"). Pursuant to the Purchase Agreement, the Company also agreed not to enter into any "variable rate transactions" so long as any Purchaser holds any Purchase Warrants.

The Purchase Agreement contains customary representations and warranties and agreements of the Company and the Purchasers and customary indemnification rights and obligations of the parties. The Offering closed on September 8, 2021. The Company received gross proceeds of approximately $192.1 million in connection with the Offering, before deducting placement agent fees and related offering expenses.

On September 2, 2021, in connection with the Offering, the Company and Maxim Group LLC (the "Placement Agent") entered into a Placement Agency Agreement (the "Placement Agency Agreement"), as amended on September 7, 2021 ("Amendment to Placement Agency Agreement") wherein the Placement Agent acted as the exclusive placement agent on a reasonable best efforts basis in connection with the Offering. Pursuant to the Placement Agency Agreement, as amended, the Company agreed to pay to the Placement Agent a cash fee of 7% (or 3.0%, in the case of certain investors) of the aggregate gross proceeds raised in the Offering, plus the reimbursement of certain expenses and legal fees in an amount up to $70,000. The Placement Agency Agreement contains customary representations and warranties and agreements of the Company and the Placement Agent and customary indemnification rights and obligations of the parties.

The foregoing summaries of the form of Purchase Agreement, the Placement Agency Agreement, the Amendment to the Placement Agency Agreement and the form of Purchase Warrants do not purport to be complete and are subject to, and qualified in their entirety by, the documents attached as Exhibits 99.1, 99.2, 99.3 and 99.4, respectively, to this Form 6-K, which are incorporated herein by reference.

The Securities in the Offering were offered by the Company pursuant to a registration statement on Form F-3 (File No. 333-259092), which was filed with the Securities and Exchange Commission (the "SEC") on August 26, 2021, as amended on September 1, 2021, and declared effective on September 2, 2021 (the "Initial Registration Statement"), a registration statement on Form F-3MEF (File No. 333-259277), which was filed with the SEC on September 2, 2021 and declared effective on September 2, 2021 (together with the Initial Registration Statement, the "Registration Statement") and a base prospectus dated as of September 2, 2021 included in the Registration Statement and the related prospectus supplement for the Offering to be filed with the SEC. This Report shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any sale of securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

On September 3, 2021, the Company issued a press release announcing the pricing of the Offering. A copy of the press release is attached hereto as Exhibit 99.5 and is incorporated herein by reference.

On September 8, 2021, the Company issued a press release announcing that the Offering closed. A copy of the press release is attached hereto as Exhibit 99.6 and is incorporated herein by reference.

Amendment to Promissory Note

On July 6, 2021, the Company entered into a Promissory Note (the "Note") and Security Agreement with Gryphon Digital Mining, Inc. ("Gryphon"), pursuant to which the Company loaned Gryphon $2.7 million in exchange for the Note bearing interest at 9.5% per annum. On August 30, 2021, the Company entered into Amendment No. 1 to Promissory Note and Security Agreement (the "Amendment") pursuant to which the Company loaned Gryphon an additional $3,650,000.

The foregoing summary of the terms of the Amendment are subject to, and qualified in its entirety by reference to the full text of the Amendment filed hereto as Exhibit 99.7, to this Current Report on Form 6-K.

Cautionary Note Regarding Forward-Looking Statements

The information contained in this Form 6-K and the exhibits attached hereto contain "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words "intend," "may," "should," "would," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue" or the negative of these terms or other comparable terminology are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. As noted above, the closing of the Offering is subject to the satisfaction of customary closing conditions and there is no assurance that the Company. will satisfy those conditions. While the Company. believes its plans, intentions and expectations reflected in those forward-looking statements are reasonable, these plans, intentions or expectations may not be achieved. The Company's actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements. For information about the factors that could cause such differences, please refer to the Company's filings with the SEC. Given these uncertainties, you should not place undue reliance on these forward-looking statements. The Company assumes no obligation to update any forward-looking statement.

SUBMITTED HEREWITH

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SPHERE 3D CORP.

|

|

|

|

|

|

|

|

Date: September 8, 2021

|

/s/ Peter Tassiopoulos

|

|

|

Name: Peter Tassiopoulos

|

|

|

Title: Chief Executive Officer

|

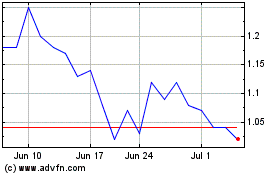

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Apr 2023 to Apr 2024