Securities Registration (foreign Private Issuer) (f-3/a)

September 01 2021 - 6:02AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on August 31, 2021

Registration No. 333-259092

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Sphere 3D Corp.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

|

Ontario, Canada

|

|

98-1220792

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

895 Don Mills Road, Bldg. 2, Suite 900

Toronto, Ontario, M3C1W3, Canada

(858) 571-5555

(Address and telephone number of registrant’s

principal executive offices)

CCS Global Solutions, Inc.

530 Seventh Avenue, Suite 508

New York, NY 10018

Telephone: (917) 566-7046

(Name, address, and telephone number of agent for

service)

Copies to:

M. Ali Panjwani, Esq.

Eric M. Hellige, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

Telephone: (212) 326-0846

Approximate date of commencement of proposed sale to the public: From

time to time after the effective date of this registration statement.

If only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the

Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements

in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

|

|

†

|

The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered(1)

|

|

Proposed

maximum

aggregate

offering

price(2)(3)

|

|

|

Amount of

registration

fee(3)

|

|

|

Common Shares, no par value per share

|

|

|

|

|

|

|

|

|

|

Preferred Shares, no par value per share

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

|

|

Units

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

250,000,000

|

|

|

$

|

27,275

|

(4)

|

|

(1)

|

The securities being registered also include such indeterminate number of securities as may be issued upon exercise, conversion or exchange of other securities. Separate consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities.

|

|

(2)

|

The proposed maximum aggregate offering price of each class of securities will be determined from time to time by the registrant in connection with the issuance by the registrant of the securities registered hereunder and is not specified as to each class of securities pursuant to the General Instruction II.C. of Form F-3 under the Securities Act of 1933.

|

|

(3)

|

The proposed maximum aggregate offering price has been estimated solely

for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act and reflects the maximum offering price

of securities registered hereunder.

|

|

(4)

|

Previously paid.

|

|

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

|

EXPLANATORY NOTE

This Amendment No. 1 to Form

F-3 (this “Amendment”) is being filed to amend the Registration Statement on Form F-3 (File No. 333-259092) originally filed

by Sphere 3D Corp. on August 26, 2021 (the “Registration Statement”). The sole purpose of this Amendment is to include Exhibit

4.3, the Form of Indenture, on the Exhibit Index hereto. Accordingly, this Amendment consists only of the cover page, this Explanatory

Note, the Exhibit Index to the Registration Statement, the signature pages and Exhibit 4.3 filed herewith. This Amendment does not modify

any provision of the prospectus contained in Part I or the balance of Part II of the Registration Statement.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 9. EXHIBITS

The exhibits to this registration statement are

listed on the Index to Exhibits to this registration statement, which Index to Exhibits is hereby incorporated by reference.

INDEX TO EXHIBITS

|

|

*

|

To

be filed as an exhibit to a post-effective amendment to this registration statement or as an exhibit to a report filed under the Exchange

Act and incorporated herein by reference.

|

|

|

+

|

To

be filed by amendment or pursuant to Trust Indenture Act Section 305(b)(2), if applicable.

|

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

F-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Toronto,

Ontario, Canada, on August 31, 2021.

|

|

Sphere 3D Corp.

|

|

|

|

|

|

|

By:

|

/s/ Peter Tassiopoulos

|

|

|

Name:

|

Peter Tassiopoulos

|

|

|

Title:

|

Chief Executive Officer

|

SIGNATURE

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities indicated below on August 31, 2021.

|

Signature

|

|

Title

|

|

|

|

|

|

/s/ Peter Tassiopoulos

|

|

Chief Executive Officer and Director

|

|

Name: Peter Tassiopoulos

|

|

(Principal Executive Officer)

|

|

|

|

|

/s/ Kurt L. Kalbfleisch

|

|

Chief Financial Officer

|

|

Name: Kurt L. Kalbfleisch

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

/s/ *

|

|

Director

|

|

Name: Vivekanand Mahadevan

|

|

|

|

|

|

|

|

/s/

*

|

|

Director

|

|

Name: Duncan McEwan

|

|

|

|

|

|

|

|

/s/

*

|

|

Director

|

|

Name: Patricia Trompeter

|

|

|

|

*By:

|

/s/ Kurt Kalbfleisch

|

|

|

|

Kurt Kalbfleisch, Attorney-In-Fact

|

|

SIGNATURE OF AUTHORIZED UNITED STATES REPRESENTATIVE

Pursuant to the Securities Act of 1933, as amended,

the undersigned, the duly authorized representative in the United States of Sphere 3D Corp., has signed this registration statement or

amendment thereto in the United States on August 31, 2021.

|

|

By:

|

/s/ Kurt L. Kalbfleisch

|

|

|

Name:

|

Kurt L. Kalbfleisch

|

|

|

Title:

|

Chief Financial Officer

|

4

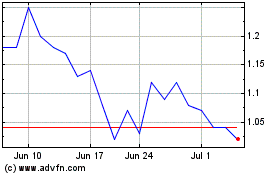

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Apr 2023 to Apr 2024