As filed with the Securities and Exchange Commission on May 11, 2021

Registration No. 333-254742

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

Form F-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Sphere 3D Corp.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

|

Ontario, Canada

|

|

7374

|

|

98-1220792

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Primary Standard Industrial Classification Code Number)

|

|

(IRS Employer Identification No.)

|

895 Don Mills Road, Bldg. 2, Suite 900

Toronto, Ontario, Canada M3C 1W3

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

Peter Tassiopoulos

Chief Executive Officer

895 Don Mills Road, Bldg. 2, Suite 900

Toronto, Ontario, Canada M3C 1W3

(858) 571-5555

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Please send copies of all communications to:

|

M. Ali Panjwani, Esq.

Pryor Cashman LLP

7 Times Square

New York, New York 10036

(212) 421-4100

|

Barry I. Grossman, Esq.

Sarah Williams, Esq.

Matthew Bernstein, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105

(212) 370-1300

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

i

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

ii

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Proposed Maximum Aggregate Offering Price(1)(2)

|

|

Amount of Registration Fee(6)

|

|

Common Shares, no par value per share(3)

|

|

|

$9,200,000

|

|

|

$1,003.72

|

|

Underwriter's warrants to purchase Common Shares(4)(5)

|

|

|

$

|

|

|

$

|

|

Common Shares underlying warrants(3)

|

|

|

$404,800

|

|

|

$44.16

|

|

Total

|

|

|

$9,604,800

|

|

|

$1,047.88

|

|

(1)

|

Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the "Securities Act").

|

|

|

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, the shares being registered hereunder include such indeterminate number of shares as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

(3)

|

Includes the offering price of common shares that may be purchased by the underwriter if the over-allotment option to purchase additional common shares is exercised by the underwriter. See "Underwriting."

|

|

|

|

|

(4)

|

The underwriter's warrants are exercisable at a per share exercise price equal to 110% of the public offering price per share. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act, the proposed maximum aggregate offering price of the underwriter's warrants is $404,800 which is equal to 110% of $368,000 (the aggregate value of 4% of 5,750,000 the total number of common shares sold in the offering). Pursuant to Rule 416, the registrant is also registering an indeterminate number of additional common shares that are issuable by reason of the anti-dilution provisions of the underwriter's warrants.

|

|

|

|

|

(5)

|

No fee required pursuant to Rule 457(g) under the Securities Act.

|

|

|

|

|

(6)

|

$1,571.83 was previously paid in the initial filing of the registration statement on Form F-1, filed on March 25, 2021.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission acting pursuant to said Section 8(a) may determine.

iii

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer, solicitation or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED MAY 11, 2021

5,000,000 Shares

Sphere 3D Corp.

Common Shares

This prospectus relates to the sale or other disposition by the Company of 5,000,000 common shares at an assumed offering price of 1.60 per share.

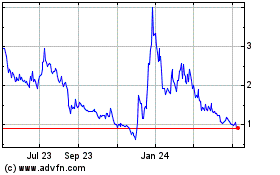

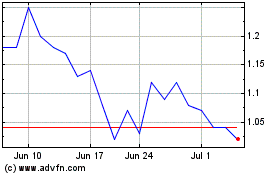

Our common shares trade on the Nasdaq Capital Market, or Nasdaq, under the symbol "ANY." On May 7, 2021, the last reported sale price of our common shares on Nasdaq was $1.60 per share.

Investing in our common shares involves risks. See "Risk Factors" beginning on page 10.

We have not authorized anyone, including any salesperson or broker, to give oral or written information about this offering, Sphere 3D Corp., or the common shares offered hereby that is different from the information included in this prospectus. You should not assume that the information in this prospectus, or any supplement to this prospectus, is accurate at any date other than the date indicated on the cover page of this prospectus or any supplement to it.

Neither the Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

Per Share

|

|

Total

|

|

|

|

|

|

|

|

|

Public offering price

|

$

|

|

$

|

|

|

Underwriting discounts and commissions(1)

|

$

|

|

$

|

|

|

Proceeds, before expenses, to us

|

$

|

|

$

|

|

(1) We have agreed to reimburse the underwriter for certain expenses in connection with this offering. We have also agreed to issue the underwriter certain warrant compensation in connection with this offering. See "Underwriting."

We have granted the underwriter an option, exercisable for 45 days from the date of this prospectus, to purchase up to an additional 750,000 common shares on the same terms as the other shares being purchased by the underwriter from us.

The underwriter expects to deliver the common shares against payment on , 2021.

Sole Book Running Manager

Maxim Group LLC

Prospectus dated , 2021

1

TABLE OF CONTENTS

2

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information that you should consider before investing in the shares. You are urged to read this prospectus in its entirety, including the information under "Risk Factors" and our financial statements and related notes included elsewhere in this Prospectus.

Our Company

Sphere 3D Corp. ("Sphere 3D," "we," "our" or the "Company") was incorporated under the Business Corporations Act (Ontario) on May 2, 2007 as T.B. Mining Ventures Inc. On December 20, 2012, we filed articles of amendment in which we changed our name to "Sphere 3D Corporation." On March 24, 2015, the Company completed a short-form amalgamation with a wholly-owned subsidiary. In connection with the short-form amalgamation, the Company changed its name to "Sphere 3D Corp." Sphere 3D provides solutions for stand-alone storage and technologies that converge the traditional silos of compute, storage and network into one integrated hyper-converged or converged solution. We provide enterprise storage management solutions, and the ability to connect to public cloud services such as Microsoft Azure for additional delivery options and hybrid cloud capabilities. Our integrated solutions include a patented portfolio for operating systems for storage, proprietary virtual desktop orchestration software, and proprietary application container software. Our software, combined with commodity x86 servers, or purpose-built appliances, deliver solutions designed to provide application mobility, security, data integrity and simplified management. These solutions can be deployed through a public, private or hybrid cloud and are delivered through a global reseller network and professional services organization. We have a portfolio of brands including SnapServer®, HVE ConneXions ("HVE") and UCX ConneXions ("UCX"), dedicated to helping customers achieve their IT goals. In November 2018, we divested ourselves of Overland Storage, Inc. and its subsidiaries ("Overland") and associated product portfolio for long term archive as well as the RDX® removable disk product portfolio. We undertook this divestiture in order to facilitate the significant reduction of secured debt and to allow us to focus greater resources to our converged and hyper-converged product portfolio.

Nasdaq Listing

On February 17, 2021, the Company was notified by Nasdaq that the Nasdaq Listing Qualifications Staff issued a public letter of reprimand to the Company based upon the Company's failure to comply with the Listing Rule 5620(c) (the "Quorum Rule") during the period of time that it was no longer a foreign private issuer and could not rely on home country practice in the alternative to the Quorum Rule. The Company's By-laws required a quorum of at least 25%, instead of the 33 1/3% threshold required for a domestic issuer by the Quorum Rule. This oversight and rule violation was caused by the fact that the Company no longer qualified as a foreign private issuer during 2018, 2019 and 2020. On January 1, 2021, the Company once again qualified as a foreign private issuer, and therefore the Company once again intends to rely on home country practice in lieu of the Quorum Rule.

On January 4, 2021, the Company received a written notice (the "Listing Notice") from the Listing Qualifications Department of Nasdaq indicating that the Company was not in compliance with Listing Rule 5620(a) due to the Company's failure to hold an annual meeting of shareholders within twelve months of the end of the Company's fiscal year end. The Listing Notice stated that the Company had until February 18, 2021 to submit a plan to regain compliance with Listing Rule 5620(a). On February 17, 2021, the Company received a letter from Nasdaq indicating that the Company had regained compliance with Listing Rule 5620(a) as a result of its combined Annual and Special Meeting held on February 11, 2021.

On January 3, 2020, the Company received a letter from the Nasdaq Listing Qualifications department of Nasdaq notifying the Company that it was not in compliance with the requirement of Nasdaq Marketplace Rule 5550(a)(2) for continued inclusion on the NASDAQ Capital Market as a result of the closing bid price for the Company's common shares being below $1.00 for 30 consecutive business days. On May 19, 2020, the Company received notification from Nasdaq that it had regained compliance with Marketplace Rule 5550(a)(2), as the closing price of the Company's common shares was at least equal to $1.00 per share for each of the ten consecutive business days between May 4, 2020 and May 18, 2020.

Asset Acquisition

On August 3, 2020, Dale Allan Peters ("Peters"), as the beneficial shareholder of 101250 Investments Ltd. ("101 Invest"), a company existing under the laws of the Turks & Caicos Islands and a water partner of Rainmaker, entered into a Share Purchase Agreement (the "101 Invest Purchase Agreement") with the Company. As a result of the 101 Invest Purchase Agreement, 101 Invest is a wholly-owned subsidiary of the Company. Under the terms of the 101 Invest Purchase Agreement, the Company issued 480,000 common shares at $3.25 per share to Greenfield Investments Ltd. for a purchase price of $1,560,000. The common shares contain a legend, either statutory or contractual, which will restrict the resale of the common shares for a period of six-months and one day from the closing date. In addition, the Company held back and retained 96,000 of the common shares for a six-month period from the closing date in support of any breaches of representations and warranties by Peters under the 101 Invest Purchase Agreement (the "Escrow Shares"). The Company released the Escrow Shares to Peters on or about February 10, 2021. 101 Invest has exclusive rights to deliver the Rainmaker water solution to three Turks and Caicos island communities - Plantation Hills, Blue Sky and Village Estates. The Company completed this transaction to assist in the deployment and expansion of its opportunities in the WaaS segment.

Discontinued Operations

In February 2018, the Company, Overland, and Silicon Valley Technology Partners, Inc. (formerly Silicon Valley Technology Partners LLC) ("SVTP"), a Delaware corporation established by Eric Kelly, the Company's former Chief Executive Officer and Chairman of the Board of Directors, entered into a share purchase agreement (as amended by that certain First Amendment to Share Purchase Agreement dated August 21, 2018, and as further amended by that certain Second Amendment to Share Purchase Agreement dated November 1, 2018, the "Purchase Agreement"), pursuant to which the Company agreed to sell to SVTP all of the issued and outstanding shares of capital stock of Overland.

On November 13, 2018, pursuant the Purchase Agreement, the Company sold to SVTP all of the issued and outstanding shares of capital stock of Overland in consideration for (i) the issuance to the Company of shares of Series A Preferred Stock of SVTP representing 19.9% of the outstanding shares of capital stock of SVTP as of the closing with a value of $2.1 million, (ii) the release of the Company from outstanding debt obligations totaling $41.7 million assumed by SVTP, and (iii) $1.0 million in cash proceeds from SVTP.

In connection with the closing of the Purchase Agreement, we filed an articles of amendment to our articles of amalgamation setting forth the rights, privileges, restrictions and conditions of a new series of non-voting preferred shares of the Company (the "Series A Preferred Shares") and entered into a Conversion Agreement, by and between the Company and FBC Holdings SARL ("FBC Holdings"), a related party, pursuant to which $6.5 million of the Company's outstanding secured debt was converted into 6,500,000 Series A Preferred Shares, subsequently converted in 2019 to 6,500,000 Series B Preferred Shares.

Oasis Equity Line

On May 15, 2020, we entered into an Equity Purchase Agreement with Oasis Capital, LLC ("Oasis Capital" and such agreement, the "Equity Purchase Agreement"), which provides that, upon the terms and subject to the conditions and limitations set forth therein, Oasis Capital is committed to purchase up to an aggregate of $11,000,000 worth of common shares over the 36-month term of the Equity Purchase Agreement. Concurrently with entering into the Equity Purchase Agreement, we also entered into a registration rights agreement with Oasis Capital (the "Registration Rights Agreement"), in which we agreed to file one or more registration statements, as permissible and necessary to register under the Securities Act, the resale of the common shares that may be issued to Oasis Capital under the Equity Purchase Agreement. The purpose of the equity line is to provide us with proceeds as may be necessary for working capital and general corporate purposes.

PPP Loan Forgiveness

On October 5, 2020, the Company submitted the PPP loan forgiveness application, which is pending approval by the Lender. In accordance with the terms and conditions of the Flexibility Act, the Lender has 60 days from receipt of the completed application to issue a decision to the Small Business Administration ("SBA"). If the Lender determines that the borrower is entitled to forgiveness of some or all of the amount applied for under the statue and applicable regulations, the Lender must request payment from the SBA at the time the Lender issues its decision to the SBA. The SBA will, subject to any SBA review of the loan or loan application, remit the appropriate forgiveness amount to the Lender, plus any interest accrued through the date of payment, not later than 90 days after the Lender issues its decision to the SBA. Although the Company believes it is probable that the PPP Loan will be forgiven, the Company cannot currently provide any objective assurance that it will obtain forgiveness in whole or in part.

Products and Service

Our product offerings consist of the following disk systems: (i) HVE Converged and Hyper-converged Infrastructure; (ii) G-Series Appliance and G-Series Cloud; and (iii) Open Virtual Format SnapServer® Network Attached Storage Solutions. In addition to our product offering, we provide on-site service and installation options, round-the-clock phone access to solution experts, and proof of concept and architectural design offerings. We are able to provide comprehensive technical assistance.

The following table summarizes the sales mix of products and service (in thousands) for the years ended December 31, 2020, 2019 and 2018:

|

|

|

Year Ended December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

Disk systems

|

$

|

2,347

|

|

$

|

3,086

|

|

$

|

6,108

|

|

|

Service

|

|

2,501

|

|

|

2,493

|

|

|

2,922

|

|

|

Total

|

$

|

4,848

|

|

$

|

5,579

|

|

$

|

9,030

|

|

We divide our worldwide sales into three geographical regions: Americas; APAC, consisting of Asia Pacific countries; and EMEA consisting of Europe, the Middle East and Africa.

The following table summarizes net revenue by geographic area (in thousands) for the years ended December 31, 2020, 2019 and 2018:

|

|

|

Year Ended December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

Americas

|

$

|

4,844

|

|

$

|

5,023

|

|

$

|

8,044

|

|

|

APAC

|

|

-

|

|

|

356

|

|

|

534

|

|

|

EMEA

|

|

4

|

|

|

200

|

|

|

452

|

|

|

Total

|

$

|

4,848

|

|

$

|

5,579

|

|

$

|

9,030

|

|

Disk Systems

HVE Converged and Hyper-converged Infrastructure

In 2017, we acquired HVE, a technology provider of next generation converged and hyper-converged infrastructure dedicated to creating Manageable, Scalable, Reproducible, and Predictable ("MSRP") solutions based on virtualization technologies running on high-performance, next generation platforms. HVE solutions are engineered, purpose-built converged and hyper-converged virtual workspace and server solutions that support a distributed architecture, scalable with predictable performances, and come bundled with continuous active monitoring. HVE product can include support for our Desktop Cloud Orchestrator™ ("DCO") based on customer requirements.

|

|

•

|

The HVE-STACK high density server provides the computer and storage appliance for the data center and is ideal for high performance computing, cloud computing and virtual desktop infrastructure ("VDI"). The modular design and swappable components include hard drives and power supplies intended to improve the efficiency of data center deployment.

|

|

|

|

|

|

|

•

|

The HVE-VELOCITY High Availability Dual Enclosure storage area network ("SAN") provides data reliability and integrity for optimal data storage, protection and recovery. It also provides a unified network attached storage ("NAS") and SAN solution with thin provisioning, compression and deduplication. The HVE-VELOCITY platform is designed to eliminate single points of failure. The 12GSAS SSD design allows for faster access to data. It is optimized for mission-critical, enterprise-level storage applications.

|

|

|

|

|

|

|

•

|

The HVE 3DGFX is a VDI solution that offers hardware and software technologies to provide an appliance that can handle from eight to up to 128 high demand users in a single 2U appliance. The HVE 3DGFX was designed and engineered as a purpose-built solution based upon the MSRP engineering approach.

|

G-Series Appliance and G-Series Cloud

The G-Series appliance powered by Glassware containerization technology is designed to simplify Windows application migration and to enable access from any device including Macintosh, Windows, iOS, Chrome OS, and Android. The G-Series appliance is optimized for simplicity, flexibility and scalability. Through Glassware, a Microsoft Windows® based container technology, organizations looking to migrate applications to the cloud can quickly deploy a solution for virtualizing 16-bit, 32-bit, or 64-bit applications with their native functionality intact. For the provisioning of a 16-bit application to the G-Series appliance, users will often require advanced technical skills to set-up the application, or can contract professional services from the Company, or one of our certified system integrators. End users can access the containerized applications from cloud-connected devices (iOS, Android or Windows), through a lightweight downloadable app or simply from a browser. The G-Series appliance is designed to eliminate the complex tasks of designing, implementing, and maintaining application hosting environments and provides improved application session density and scale when compared to traditional hypervisor-based virtualization solutions.

G-Series Cloud is an offering available through Microsoft Azure and was developed to provide a virtual appliance that can be deployed from the Azure Marketplace to eliminate the task of designing, implementing, and maintaining localized application-hosting environments and their related hardware. G-Series Cloud is pre-configured, can be deployed in minutes and provides for a billing model based on usage.

SnapServer® Network Attached Storage Solutions

Our SnapServer® solutions are a platform for primary or nearline storage, and deliver stability and integration with Windows®, UNIX/Linux, and Macintosh environments. For virtual servers and database applications, the SnapServer® family supports iSCSI block-level access with Microsoft VSS and VDS integration to simplify Windows management. For data protection, the SnapServer® family offers RAID protection, and snapshots for point-in-time data recovery. The SnapServer XSR Series™ products support DynamicRAID® and traditional RAID levels 0, 1, 5, 6, and 10. The Snap family of products, SnapCLOUD®, and SnapServer®, have integrated data mobility tools to enable customers to build private clouds for sharing and synchronizing data for anytime, anywhere access.

|

|

•

|

The SnapServer® XSR40 is a 1U server that can be configured with up to four SATA III and SSD drives, and can scale to 400 TB of storage capacity by adding up to three SnapExpansion XSR™ enclosures.

|

|

|

|

|

|

|

•

|

The SnapServer® XSR120 is a 2U server that can be configured with up to 12 SATA III, SAS and SSD drives, and can scale to 960 TB of storage capacity by adding up to seven SnapExpansion XSR™ enclosures.

|

Our GuardianOS® storage software is designed for the SnapServer® family of enterprise-grade NAS systems and delivers simplified data management and consolidation throughout distributed information technology environments by combining cross-platform file sharing with block-level data access on a single system. The flexibility and scalability of GuardianOS® assists with the cost of ownership of storage infrastructures for small, medium and large businesses. In addition to a unified storage architecture, GuardianOS® offers highly differentiated data integrity and storage scalability through features such as DynamicRAID®, centralized storage management, and a comprehensive suite of data protection tools.

Our Snap Enterprise Data Replicator ("Snap EDR") provides multi-directional WAN-optimized replication. Administrators can automatically replicate data between SnapServer®, Windows, and Linux systems for data distribution, data consolidation, and disaster recovery.

Service

Customer service and support are key elements of our strategy and critical components of our commitment in making enterprise-class support and services available to companies of all sizes. Our technical support staff is trained to assist our customers with deployment and compatibility for any combination of virtual desktop infrastructures, hardware platforms, operating systems and backup, data interchange and storage management software. Our application engineers are trained to assist with more complex customer issues. We maintain global toll-free service and support phone lines. Additionally, we also provide self-service and support through our website support portal and email.

Our service offerings provide for on-site service and installation options, round-the-clock phone access to solution experts, and proof of concept and architectural design offerings.

Discontinued Operations

The following product lines were part of the Overland divestiture completed in November 2018 and are not included in the above Product and Service disclosures.

|

|

•

|

Disk Systems - RDX® Removable Disk Solutions

|

|

|

|

|

|

|

•

|

Tape Automation Systems - NEO® Tape-Based Backup and Long-Term Archive Solutions

|

|

|

|

|

|

|

•

|

Tape Drives and Media

|

Production

A significant number of our components and finished products are manufactured or assembled, in whole or in part, by a limited number of third parties. For certain products, we control the design process internally and then outsource the manufacturing and assembly in order to achieve lower production costs.

We purchase disk drives and chassis from outside suppliers. We carefully select suppliers based on their ability to provide quality parts and components which meet technical specifications and volume requirements. We actively monitor these suppliers but we are subject to substantial risks associated with the performance of our suppliers. For certain components, we qualify only a single source, which magnifies the risk of shortages and may decrease our ability to negotiate with that supplier. For a more detailed description of risks related to suppliers, see Risk Factors.

Sales and Distribution

|

|

•

|

Reseller channel - Our reseller channel includes systems integrators, VARs and DMRs. Our resellers may package our products as part of complete application and desktop virtualization solutions data processing systems or with other storage devices to deliver complete enterprise information technology infrastructure solutions. Our resellers also recommend our products as replacement solutions when systems are upgraded, or bundle our products with storage management software specific to the end user's system. We support the reseller channel through our dedicated sales representatives, engineers and technical support organizations.

|

|

|

|

|

|

|

•

|

Cloud Marketplace - Since 2015, we have utilized the Microsoft Azure Cloud Marketplace as an additional channel for our cloud solutions to sell to end-users directly with the pay-per-use model, supported through the Microsoft Azure Cloud.

|

Patents and Proprietary Rights

We rely on a combination of patents, trademarks, trade secret and copyright laws, as well as contractual restrictions, to protect the proprietary aspects of our products and services. Although every effort is made to protect Sphere 3D's intellectual property, these legal protections may only afford limited protection.

We may continue to file for patents regarding various aspects of our products, services and delivery method at a later date depending on the costs and timing associated with such filings. We may make investments to further strengthen our copyright protection going forward, although no assurances can be given that it will be successful in such patent and trademark protection endeavors. We seek to limit disclosure of our intellectual property by requiring employees, consultants, and partners with access to our proprietary information to execute confidentiality agreements and non-competition agreements (when applicable) and by restricting access to our proprietary information. Due to rapid technological change, we believe that establishing and maintaining an industry and technology advantage in factors such as the expertise and technological and creative skills of our personnel, as well as new services and enhancements to our existing services, are more important to our company's business and profitability than other available legal protections.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our services or to obtain and use information that we regard as proprietary. The laws of many countries do not protect proprietary rights to the same extent as the laws of the U.S. or Canada. Litigation may be necessary in the future to enforce our intellectual property rights, to protect our trade secrets, to determine the validity and scope of the proprietary rights of others or to defend against claims of infringement. Any such litigation could result in substantial costs and diversion of resources and could have a material adverse effect on our business, operating results and financial condition. There can be no assurance that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar services or products. Any failure by us to adequately protect our intellectual property could have a material adverse effect on our business, operating results and financial condition. See Risk Factors under the section Risks Related to Intellectual Property.

Competitive Conditions

We believe that our products are unique and innovative and afford us various advantages in the marketplace; however, the market for information technology is highly competitive. Competitors vary in size from small start-ups to large multi-national corporations which may have substantially greater financial, research and development, and marketing resources. Competitive factors in these markets include performance, functionality, scalability, availability, interoperability, connectivity, time to market enhancements, and total cost of ownership. Barriers to entry vary from low, such as those in traditional disk-based backup products, to high, in virtualization software. The markets for all of our products are characterized by price competition and as such we may face price pressure for our products. For a more detailed description of competitive and other risks related to our business, see Risk Factors.

Governmental Regulations

The Company is subject to laws and regulations enforced by various regulatory agencies such as the U.S. Consumer Product Safety Commission and the U.S. Environmental Protection Agency. For a detailed description of the material effects of government regulations on the Company's business, see "Our international operations are important to our business and involve unique risks related to financial, political, and economic conditions" and "We are subject to laws, regulations and similar requirements, changes to which may adversely affect our business and operations" under Risk Factors-Risks Related to Our Business.

Our Corporate Information

Sphere 3D is located at 895 Don Mills Road, Building 2, Suite 900, Toronto, Ontario, Canada, M3C 1W3. Our telephone number is +1 (858) 571-5555 and our Internet website address is www.sphere3d.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus. We have included our web address as an inactive textual reference only.

About This Offering

|

Common Shares Offered

|

|

5,000,000 shares, based on an assumed offering price of $1.60 per common share (the last reported sale price of our common stock on Nasdaq on May 7, 2021).

|

|

|

|

|

|

Common Shares Outstanding at May 7, 2021

|

|

13,450,820 shares

|

|

|

|

|

|

Option to purchase additional Common Shares

|

|

We have granted the underwriter a 45-day option to purchase up to 750,000 additional common shares at the public offering price as set forth on the cover of this prospectus, solely to cover over-allotments, if any.

|

|

|

|

|

|

Use of Proceeds

|

|

We intend to use these net proceeds for working capital, general corporate purposes and to fund special purpose acquisition companies.

|

|

|

|

|

|

Risk Factors

|

|

Prospective investors should carefully consider "Risk Factors" beginning on page 10 before buying the common shares.

|

|

|

|

|

|

Nasdaq Capital Market Symbol

|

|

ANY

|

|

|

|

|

|

Lock-up

|

|

We and our directors, officers and principal stockholders have agreed with the underwriter not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common shares or securities convertible into common shares for a period of 180 days after the date of this prospectus. See "Underwriting" section on page 59.

|

The above discussion and table are based on 13,450,820 common shares outstanding as of May 7, 2021 and excludes, as of such date, the following:

|

|

•

|

101,175 shares underlying stock options with an average weighted price of $8.94;

|

|

|

|

|

|

|

•

|

75,000 shares underlying restricted stock units;

|

|

|

|

|

|

|

•

|

6,859,428 shares underlying outstanding preferred shares;

|

|

|

|

|

|

|

•

|

2,042,564 shares underlying outstanding warrants with an average weighted exercise price of $2.64; and

|

|

|

|

|

|

|

•

|

698,838 common shares available for grant under our equity incentive plans.

|

RISK FACTORS

An investment in our in our common shares involves a high degree of risk. The risks described below include all material risks to our company or to investors in this offering that are known to our company. You should carefully consider such risks before participating in this offering. If any of the following risks actually occur, our business, financial condition and results of operations could be materially harmed. As a result, the trading price of our common shares could decline, and you might lose all or part of your investment. When determining whether to buy our common shares, you should also refer to the other information in this prospectus, including our financial statements and the related notes included elsewhere in this prospectus.

Risks Relating To Our Business

In addition to the other information in this prospectus, you should carefully consider the following factors in evaluating us and our business. This prospectus contains, in addition to historical information, forward-looking statements that involve risks and uncertainties, some of which are beyond our control. Should one or more of these risks and uncertainties materialize or should underlying assumptions prove incorrect, our actual results could differ materially. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below, as well as those discussed elsewhere in this prospectus, including the documents incorporated by reference.

In addition to risks which could apply to any company or business, you should also consider the business we are in and the following:

We have made a number of acquisitions in the past and we may make acquisitions in the future. Our ability to identify complementary assets, products or businesses for acquisition and successfully integrate them could adversely affect our business, financial condition and operating results.

In 2020, we acquired 101 Invest and entered into a definitive merger agreement with Rainmaker Worldwide Inc. ("Rainmaker"). On February 12, 2021, the Rainmaker Merger Agreement was terminated as the Company was unable to obtain all necessary regulatory approvals relating to the proposed transaction prior to the agreed upon date of January 31, 2021. No break-fee or termination costs were paid by either party.

In the future, we may continue to pursue acquisitions of assets, products or businesses that we believe are complementary to our existing business and/or to enhance our market position or expand our product portfolio. There is a risk that we will not be able to identify suitable acquisition candidates available for sale at reasonable prices, complete any acquisition, or successfully integrate any acquired product or business into our operations. We are likely to face competition for acquisition candidates from other parties including those that have substantially greater available resources. Acquisitions may involve a number of other risks, including:

|

|

•

|

diversion of management's attention;

|

|

|

|

|

|

|

•

|

disruption to our ongoing business;

|

|

|

|

|

|

|

•

|

failure to retain key acquired personnel;

|

|

|

|

|

|

|

•

|

difficulties in integrating acquired operations, technologies, products or personnel;

|

|

|

|

|

|

|

•

|

unanticipated expenses, events or circumstances;

|

|

|

|

|

|

|

•

|

assumption of disclosed and undisclosed liabilities; and

|

|

|

|

|

|

|

•

|

inappropriate valuation of the acquired in-process research and development, or the entire acquired business.

|

The operation and management of recent acquisitions, or any of our future acquisitions, may adversely affect our existing income and operations or we may not be able to effectively manage any growth resulting from these transactions. Our success will depend, in part, on the extent to which we are able to merge these functions, eliminate the unnecessary duplication of other functions and otherwise integrate these companies (and any additional businesses with which we may combine in the future) into a cohesive, efficient enterprise. This integration process may entail significant costs and delays. Our failure to integrate the operations of these companies successfully could adversely affect our business, financial condition, results of operations and prospects. To the extent that any acquisition results in additional goodwill, it will reduce our tangible net worth, which might adversely affect our business, financial condition, results of operations and prospects, as well as our credit capacity.

The extent to which the coronavirus ("COVID-19") outbreak and measures taken in response thereto impact our business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted.

Global health concerns relating to the coronavirus outbreak have been weighing on the macroeconomic environment, and the outbreak has significantly increased economic uncertainty. Risks related to consumers and businesses lowering or changing spending, which impact domestic and international spend. The outbreak has resulted in authorities implementing numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter in place orders, and business shutdowns. These measures have not only negatively impacted consumer spending and business spending habits, they have also adversely impacted and may further impact our workforce and operations and the operations of our customers, suppliers and business partners. These measures may remain in place for a significant period of time and they are likely to continue to adversely affect our business, results of operations and financial condition.

The spread of the coronavirus has caused us to modify our business practices (including employee travel, employee work locations, and cancellation of physical participation in meetings, events and conferences), and we may take further actions as may be required by government authorities or that we determine are in the best interests of our employees, customers and business partners. There is no certainty that such measures will be sufficient to mitigate the risks posed by the virus or otherwise be satisfactory to government authorities.

The extent to which the coronavirus outbreak impacts our business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Even after the coronavirus outbreak has subsided, we may continue to experience materially adverse impacts to our business as a result of its global economic impact, including any recession that has occurred or may occur in the future.

There are no comparable recent events which may provide guidance as to the effect of the spread of the coronavirus and a global pandemic, and, as a result, the ultimate impact of the coronavirus outbreak or a similar health epidemic is highly uncertain and subject to change. We do not yet know the full extent of the impacts on our business, our operations or the global economy as a whole. However, the effects could have a material impact on our results of operations, and we will continue to monitor the coronavirus situation closely.

Our cash and other sources of liquidity may not be sufficient to fund our operations beyond June 30, 2021. We may not be successful in raising additional capital necessary to meet expected increases in working capital needs. If we raise additional funding through sales of equity or equity-based securities, your shares will be diluted. If we need additional funding for operations and we are unable to raise it, we may be forced to liquidate assets and/or curtail or cease operations or seek bankruptcy protection or be subject to an involuntary bankruptcy petition.

Management has projected that cash on hand may not be sufficient to allow the Company to continue operations beyond June 30, 2021 if we are unable to raise additional funding for operations. We expect our working capital needs to increase in the future as we continue to expand and enhance our operations. Our ability to raise additional funds through equity or debt financings or other sources may depend on the financial success of our current business and successful implementation of our key strategic initiatives, financial, economic and market conditions and other factors, some of which are beyond our control. No assurance can be given that we will be successful in raising the required capital at reasonable cost and at the required times, or at all. Further equity financings may have a dilutive effect on shareholders and any debt financing, if available, may require restrictions to be placed on our future financing and operating activities. If we require additional capital and are unsuccessful in raising that capital, we may not be able to continue our business operations and advance our growth initiatives, which could adversely impact our business, financial condition and results of operations.

Significant changes from our current forecasts, including but not limited to: (i) failure to comply with the financial covenants in its debt facilities; (ii) shortfalls from projected sales levels; (iii) unexpected increases in product costs; (iv) increases in operating costs; (v) changes in the historical timing of collecting accounts receivable; and (vi) inability to maintain compliance with the requirements of Nasdaq and/or inability to maintain listing with Nasdaq could have a material adverse impact on our ability to access the level of funding necessary to continue our operations at current levels. If any of these events occurs or we are unable to generate sufficient cash from operations or financing sources, we may be forced to liquidate assets where possible and/or curtail, suspend or cease planned programs or operations generally or seek bankruptcy protection or be subject to an involuntary bankruptcy petition, any of, which would have a material adverse effect on our business, results of operations, financial position and liquidity.

If we raise additional funds by selling additional shares of our capital stock, or securities convertible into shares of our capital stock, the ownership interest of our existing shareholders will be diluted. The amount of dilution could be increased by the issuance of warrants or securities with other dilutive characteristics, such as anti-dilution clauses or price resets.

We urge you to review the additional information about our liquidity and capital resources in Operating and Financial Review and Prospects section of this registration statement. If our business ceases to continue as a going concern due to lack of available capital or otherwise, it could have a material adverse effect on our business, results of operations, financial position, and liquidity.

We have granted security interests over certain of our assets in connection with various debt arrangements.

We have granted security interests over certain of our assets in connection with our line of credit and debt arrangements, and we may grant additional security interests to secure future borrowings. If we are unable to satisfy our obligations under these arrangements, we could be forced to sell certain assets that secure these loans, which could have a material adverse effect on our ability to operate our business. In the event we are unable to maintain compliance with covenants set forth in these arrangements or if these arrangements are otherwise terminated for any reason, it could have a material adverse effect on our ability to access the level of funding necessary to continue operations at current levels. If any of these events occur, management may be forced to make reductions in spending, extend payment terms with suppliers, liquidate assets where possible, and/or suspend or curtail planned programs. Any of these actions could materially harm our business, results of operations and future prospects.

A cybersecurity breach into our products when used by our customers could adversely affect our ability to conduct our business, harm our reputation, expose us to significant liability or otherwise damage our financial results.

A cybersecurity breach into a system we have sold to a customer could negatively affect our reputation as a trusted provider of storage, and data protection products by adversely impacting the market's perception of the security of our products and services. Many of our customers and partners store sensitive data on our products, and a cybersecurity breach related to our products could harm our reputation and potentially expose us to significant liability.

We also maintain sensitive data related to our employees, partners and customers, including intellectual property, proprietary business information and personally identifiable information on our own systems. We employ sophisticated security measures; however, we may face threats across our infrastructure including unauthorized access, security breaches and other system disruptions.

It is critical to our business that our employees', partners' and customers' sensitive information remains secure, and that our customers perceive that this information is secure. A cybersecurity breach could result in unauthorized access to, loss of, or unauthorized disclosure of such information. A cybersecurity breach could expose us to litigation, indemnity obligations, government investigations and other possible liabilities. Additionally, a cyber-attack, whether actual or perceived, could result in negative publicity which could harm our reputation and reduce our customers' confidence in the effectiveness of our solutions, which could materially and adversely affect our business and results of operations. A breach of our security systems could also expose us to increased costs including remediation costs, disruption of operations or increased cybersecurity protection costs that may have a material adverse effect on our business. Although we maintain technology errors and omissions liability insurance, our insurance may not cover potential claims of these types or may not be adequate to indemnify us for inability that may be imposed. Any imposition or liability or litigation costs that are not covered by insurance or in excess of our insurance coverage could harm our business.

We face a selling cycle of variable length to secure new purchase agreements for our products and services, and design wins may not result in purchase orders or new customer relationships.

We face a selling cycle of variable lengths to secure new purchase agreements. Even if we succeed in developing a relationship with a potential new customer and/or obtaining design wins, we may not be successful in securing new sales for our products or services, or new customers. In addition, we cannot accurately predict the timing of entering into purchase agreements with new customers due to the complex purchase decision processes of some large institutional customers, such as healthcare providers or school districts, which often involve high-level management or board approvals. Consequently, we have only a limited ability to predict the timing of specific new customer relationships.

We have a history of net losses. We may not achieve or maintain profitability.

We have limited non-recurring revenues derived from operations. Our near-term focus has been in actively developing reference accounts and building sales, marketing and support capabilities. HVE and UCX, which we acquired in January 2017, also have a history of net losses. We expect to continue to incur net losses and we may not achieve or maintain profitability. We may see continued losses during 2021 and as a result of these and other factors, we may not be able to achieve, sustain or increase profitability in the near future.

We are subject to many risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources, technology, and market acceptance issues. There is no assurance that we will be successful in achieving a return on shareholders' investment and the likelihood of success must be considered considering our stage of operations.

Our plans for growth will place significant demands upon our resources. If we are unsuccessful in achieving our plan for growth, our business could be harmed.

We are actively pursuing a plan to market our products domestically and internationally. The plan will place significant demands upon managerial, financial, and human resources. Our ability to manage future growth will depend in large part upon several factors, including our ability to rapidly:

|

|

•

|

build or leverage, as applicable, a network of channel partners to create an expanding presence in the evolving marketplace for our products and services;

|

|

|

|

|

|

|

•

|

build or leverage, as applicable, a sales team to keep end-users and channel partners informed regarding the technical features, issues and key selling points of our products and services;

|

|

|

|

|

|

|

•

|

attract and retain qualified technical personnel in order to continue to develop reliable and flexible products and provide services that respond to evolving customer needs;

|

|

|

|

|

|

|

•

|

develop support capacity for end-users as sales increase, so that we can provide post-sales support without diverting resources from product development efforts; and

|

|

|

|

|

|

|

•

|

expand our internal management and financial controls significantly, so that we can maintain control over our operations and provide support to other functional areas as the number of personnel and size increases.

|

Our inability to achieve any of these objectives could harm our business, financial condition and results of operations.

Our market is competitive and dynamic. New competing products and services could be introduced at any time that could result in reduced profit margins and loss of market share.

The technology industry is very dynamic, with new technology and services being introduced by a range of players, from larger established companies to start-ups, on a frequent basis. Our competitors may announce new products, services, or enhancements that better meet the needs of end-users or changing industry standards. Further, new competitors or alliances among competitors could emerge. Increased competition may cause price reductions, reduced gross margins and loss of market share, any of which could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, the worldwide storage market is intensely competitive. A number of manufacturers of disk-based storage solutions compete for a limited number of customers. Barriers to entry are relatively low in these markets, and some of our competitors in this market have substantially greater financial and other resources, larger research and development staffs, and more experience and capabilities in manufacturing, marketing and distributing products. Ongoing pricing pressure could result in significant price erosion, reduced profit margins and loss of market share, any of which could have a material adverse effect on our business, results of operations, financial position and liquidity.

Our success depends on our ability to anticipate technological changes and develop new and enhanced products.

The markets for our products are characterized by rapidly changing technology, evolving industry standards and increasingly sophisticated customer requirements. The introduction of products embodying new technology and the emergence of new industry standards can negatively impact the marketability of our existing products and can exert price pressures on existing products. It is critical to our success that we are able to anticipate and react quickly to changes in technology or in industry standards and to successfully develop, introduce, manufacture and achieve market acceptance of new, enhanced and competitive products on a timely basis and cost-effective basis. We invest substantial resources towards continued innovation; however, there can be no assurance that we will successfully develop new products or enhance and improve our existing products, that new products and enhanced and improved existing products will achieve market acceptance or that the introduction of new products or enhanced existing products by others will not negatively impact us. Our inability to develop products that are competitive in technology and price and that meet end-user needs could have a material adverse effect on our business, financial condition or results of operations.

Development schedules for technology products are inherently uncertain. We may not meet our product development schedules, and development costs could exceed budgeted amounts. Our business, results of operations, financial position and liquidity may be materially and adversely affected if the products or product enhancements that we develop are delayed or not delivered due to developmental problems, quality issues or component shortage problems, or if our products or product enhancements do not achieve market acceptance or are unreliable. We or our competitors will continue to introduce products embodying new technologies, such as new sequential or random access mass storage devices. In addition, new industry standards may emerge. Such events could render our existing products obsolete or not marketable, which would have a material adverse effect on our business, results of operations, financial position and liquidity.

Our business is dependent on the continued market acceptance and usage of disk-based solutions. The impact of recent storage technology trends on our business is uncertain.

While information technology spending has fluctuated periodically due to technology transitions and changing economic and business environments, overall growth in demand for storage has continued. Recent technology trends, such as the emergence of hosted storage, software as a service and mobile data access are driving significant changes in storage architectures and solution requirements. The impact of these trends on overall long-term growth patterns is uncertain. Nevertheless, if the general level of industry growth, or if the growth of the specific markets in which we compete, were to decline, our business and results of operations could suffer.

Our management team continually reviews and evaluates our product portfolio, operating structure, and markets to assess the future viability of our existing products and market positions. We may determine that the infrastructure and expenses necessary to sustain an existing product offering are greater than the potential contribution margin that we would realize. As a result, we may determine that it is in our best interest to exit or divest one or more existing product offerings, which could result in costs incurred for exit or disposal activities and/or impairments of long-lived assets. Moreover, if we do not identify other opportunities to replace discontinued products or operations, our revenues would decline, which could lead to further net losses and adversely impact the market price of our common shares.

In addition, we could incur charges for excess and obsolete inventory. The value of our inventory may be adversely affected by factors that affect our ability to sell the products in our inventory. Such factors include changes in technology, introductions of new products by us or our competitors, the current or future economic downturns, or other actions by our competitors. If we do not effectively forecast and manage our inventory, we may need to write off inventory as excess or obsolete, which adversely affects cost of sales and gross profit. Our business has previously experienced, and we may in the future experience, reductions in sales of older generation products as customers delay or defer purchases in anticipation of new products that we or our competitors may introduce. We have established reserves for slow moving or obsolete inventory. These reserves, however, may prove to be inadequate, which would result in additional charges for excess or obsolete inventory.

Our products may contain defects in components or design, and our warranty reserves may not adequately cover our warranty obligations for these products.

Although we employ a testing and quality assurance program, our products may contain defects or errors, particularly when first introduced or as new versions are released. We may not discover such defects or errors until after a solution has been released to a customer and used by the customer and end-users. Defects and errors in our products could materially and adversely affect our reputation, result in significant costs, delay planned release dates and impair our ability to sell our products in the future. The costs incurred in correcting any solution defects or errors may be substantial and could adversely affect our operating margins. While we plan to continually test our products for defects and errors and work with end-users through our post-sales support services to identify and correct defects and errors, defects or errors in our products may be found in the future.

We have also established reserves for the estimated liability associated with product warranties. However, we could experience unforeseen circumstances where these or future reserves may not adequately cover our warranty obligations. For example, the failure or inadequate performance of product components that we purchase could increase our warranty obligations beyond these reserves.

The failure to attract, hire, retain and motivate key personnel could have a significant adverse impact on our operations.

Our success depends on the retention and maintenance of key personnel, including members of senior management and our technical, sales and marketing teams. Achieving this objective may be difficult due to many factors, including competition for such highly skilled personnel; fluctuations in global economic and industry conditions; changes in our management or leadership; competitors' hiring practices; and the effectiveness of our compensation programs. The loss of any of these key persons could have a material adverse effect on our business, financial condition or results of operations. As an example, in the first quarter of 2019, our financial controller, and certain other members of our finance team, resigned from employment to seek other opportunities, which has required us to retain finance consultants while we search for full-time replacements, and we cannot guarantee that we will be able to retain such consultants or find adequate replacements.

Our success is also dependent on our continuing ability to identify, hire, train, motivate and retain highly qualified management, technical, sales, marketing and finance personnel. Any such new hire may require a significant transition period prior to making a meaningful contribution. Competition for qualified employees is particularly intense in the technology industry, and we have in the past experienced difficulty recruiting qualified employees. Our failure to attract and to retain the necessary qualified personnel could seriously harm our operating results and financial condition. Competition for such personnel can be intense, and no assurance can be provided that we will be able to attract or retain highly qualified technical and managerial personnel in the future, which may have a material adverse effect on our future growth and profitability. We do not have key person insurance.

Our financial results may fluctuate substantially for many reasons, and past results should not be relied on as indications of future performance.

Our revenues and operating results may fluctuate from quarter to quarter and from year to year due to a combination of factors, including, but not limited to:

|

|

•

|

varying size, timing and contractual terms of orders for our products, which may delay the recognition of revenue;

|

|

|

|

|

|

|

•

|

competitive conditions in the industry, including strategic initiatives by us or our competitors, new products or services, product or service announcements and changes in pricing policy by us or our competitors;

|

|

|

|

|

|

|

•

|

market acceptance of our products and services;

|

|

|

|

|

|

|

•

|

our ability to maintain existing relationships and to create new relationships with channel partners;

|

|

|

|

|

|

|

•

|

the discretionary nature of purchase and budget cycles of our customers and end-users;

|

|

|

|

|

|

|

•

|

the length and variability of the sales cycles for our products;

|

|

|

|

|

|

|

•

|

general weakening of the economy, from the pandemic or otherwise, resulting in a decrease in the overall demand for our products and services or otherwise affecting the capital investment levels of businesses with respect to our products or services;

|

|

|

|

|

|

|

•

|

timing of product development and new product initiatives;

|

|

|

|

|

|

|

•

|

changes in customer mix;

|

|

|

|

|

|

|

•

|

increases in the cost of, or limitations on, the availability of materials;

|

|

|

•

|

fluctuations in average selling prices;

|

|

|

|

|

|

|

•

|

changes in product mix; and

|

|

|

|

|

|

|

•

|

increases in costs and expenses associated with the introduction of new products.

|

Further, the markets that we serve are volatile and subject to market shifts that we may be unable to anticipate. A slowdown in the demand for workstations, mid-range computer systems, networks and servers could have a significant adverse effect on the demand for our products in any given period. In the past, we have experienced delays in the receipt of purchase orders and, on occasion, anticipated purchase orders have been rescheduled or have not materialized due to changes in customer requirements. Our customers may cancel or delay purchase orders for a variety of reasons, including, but not limited to, the rescheduling of new product introductions, changes in our customers' inventory practices or forecasted demand, general economic conditions affecting our customers' markets, changes in our pricing or the pricing of our competitors, new product announcements by us or others, quality or reliability problems related to our products, or selection of competitive products as alternate sources of supply.

Thus, there can be no assurance that we will be able to reach profitability on a quarterly or annual basis. We believe that our revenue and operating results will continue to fluctuate, and that period-to-period comparisons are not necessarily indications of future performance. Our revenue and operating results may fail to meet the expectations of public market analysts or investors, which could have a material adverse effect on the price of our common shares. In addition, portions of our expenses are fixed and difficult to reduce if our revenues do not meet our expectations. These fixed expenses magnify the adverse effect of any revenue shortfall.

Our plans for implementing our business strategy and achieving profitability are based upon the experience, judgment and assumptions of our key management personnel, and available information concerning the communications and technology industries. If management's assumptions prove to be incorrect, it could have a material adverse effect on our business, financial condition or results of operations.

We rely on indirect sales channels to market and sell our branded products. Therefore, the loss of, or deterioration in, our relationship with one or more of our distributors or resellers could negatively affect our operating results.

We have relationships with third party resellers, system integrators and enterprise application providers that facilitate our ability to sell and implement our products. These business relationships are important to extend the geographic reach and customer penetration of our sales force and ensure that our products are compatible with customer network infrastructures and with third party products.

We believe that our success depends, in part, on our ability to develop and maintain strategic relationships with resellers, independent software vendors, system integrators, and enterprise application providers. Should any of these third parties go out of business, or choose not to work with us, we may be forced to increase the development of those capabilities internally, incurring significant expense and adversely affecting operating margins. Any of these third parties may develop relationships with other companies, including those that develop and sell products that compete with ours. We could lose sales opportunities if we fail to work effectively with these parties or they choose not to work with us. Most of our distributors and resellers also carry competing product lines that they may promote over our products. A distributor or reseller might not continue to purchase our products or market them effectively, and each determines the type and amount of our products that it will purchase from us and the pricing of the products that it sells to end user customers. Further, the long-term success of any of our distributors or resellers is difficult to predict, and we have no purchase commitments or long-term orders from any of them to assure us of any baseline sales through these channels.

Therefore, the loss of, or deterioration in, our relationship with one or more of our distributors or resellers could negatively affect our operating results. Our operating results could also be adversely affected by a number of factors, including, but not limited to:

|

|

•

|

a change in competitive strategy that adversely affects a distributor's or reseller's willingness or ability to stock and distribute our products;

|

|

|

|

|

|

|

•

|

the reduction, delay or cancellation of orders or the return of a significant amount of our products;

|

|

|

|

|

|

|

•

|

the loss of one or more of our distributors or resellers; and

|

|

|

|

|

|

|

•

|

any financial difficulties of our distributors or resellers that result in their inability to pay amounts owed to us.

|

If our suppliers fail to meet our manufacturing needs, it would delay our production and our product shipments to customers and this could negatively affect our operations.

Some of our products have a large number of components and subassemblies produced by outside suppliers. We depend greatly on these suppliers for items that are essential to the manufacturing of our products, including disk drives and chassis. We work closely with our regional, national and international suppliers, which are carefully selected based on their ability to provide quality parts and components that meet both our technical specifications and volume requirements. For certain items, we qualify only a single source, which magnifies the risk of shortages and decreases our ability to negotiate with that supplier on the basis of price. From time to time, we have in the past been unable to obtain as many drives as have needed due to drive shortages or quality issues from certain of our suppliers. If these suppliers fail to meet our manufacturing needs, it would delay our production and our product shipments to customers and negatively affect our operations.

We are subject to laws, regulations and similar requirements, changes to which may adversely affect our business and operations.

We are subject to laws, regulations and similar requirements that affect our business and operations, including, but not limited to, the areas of commerce, intellectual property, income and other taxes, labor, environmental, health and safety, and our compliance in these areas may be costly. While we have implemented policies and procedures to comply with laws and regulations, there can be no assurance that our employees, contractors, suppliers or agents will not violate such laws and regulations or our policies. Any such violation or alleged violation could materially and adversely affect our business. Any changes or potential changes to laws, regulations or similar requirements, or our ability to respond to these changes, may significantly increase our costs to maintain compliance or result in our decision to limit our business or products, which could materially harm our business, results of operations and future prospects.

The Dodd-Frank Wall Street Reform and Consumer Protection Act includes provisions regarding certain minerals and metals, known as conflict minerals, mined from the Democratic Republic of Congo and adjoining countries. These provisions require companies to undertake due diligence procedures and report on the use of conflict minerals in its products, including products manufactured by third parties. Compliance with these provisions will cause us to incur costs to certify that our supply chain is conflict free and we may face difficulties if our suppliers are unwilling or unable to verify the source of their materials. Our ability to source these minerals and metals may also be adversely impacted. In addition, our customers may require that we provide them with a certification and our inability to do so may disqualify us as a supplier.

We have implemented cost reduction efforts; however, these efforts may need to be modified, and if we need to implement additional cost reduction efforts it could materially harm our business.

We have implemented certain cost reduction efforts. There can be no assurance that these cost reduction efforts will be successful. As a result, we may need to implement further cost reduction efforts across our operations, such as further reductions in the cost of our workforce and/or suspending or curtailing planned programs, either of which could materially harm our business, results of operations and future prospects.

Risks Related to Intellectual Property

Our ability to compete depends in part on our ability to protect our intellectual property rights.

Our success depends in part on our ability to protect our rights in our intellectual property. We rely on various intellectual property protections, including copyright, trade-mark and trade secret laws and contractual provisions, to preserve our intellectual property rights. We have filed a number of patent applications and have historically protected our intellectual property through trade secrets and copyrights. As our technology is evolving and rapidly changing, current intellectual property rights may not adequately protect us.