00015919562020FYfalseNo——9,355,7788,443,778——7,867,1863,850,1057,867,1863,850,1053962538225P6MP6MP2YP5YUnlimitedP10YP3Y26.5——December 31, 2031December 31, 2034P5Y00015919562020-01-012020-12-31xbrli:shares00015919562020-12-31iso4217:USD00015919562019-12-31iso4217:USDxbrli:shares00015919562019-01-012019-12-3100015919562018-12-310001591956us-gaap:CommonStockMember2018-12-310001591956us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2018-12-310001591956us-gaap:PreferredStockMember2018-12-310001591956us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001591956us-gaap:RetainedEarningsMember2018-12-310001591956us-gaap:CommonStockMember2019-01-012019-12-310001591956us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-01-012019-12-310001591956us-gaap:PreferredStockMember2019-01-012019-12-310001591956us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001591956us-gaap:RetainedEarningsMember2019-01-012019-12-310001591956us-gaap:CommonStockMember2019-12-310001591956us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2019-12-310001591956us-gaap:PreferredStockMember2019-12-310001591956us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001591956us-gaap:RetainedEarningsMember2019-12-310001591956us-gaap:PreferredStockMember2020-01-012020-12-310001591956us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember2020-01-012020-12-310001591956us-gaap:CommonStockMember2020-01-012020-12-310001591956us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-01-012020-12-310001591956us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001591956us-gaap:RetainedEarningsMember2020-01-012020-12-310001591956us-gaap:CommonStockMember2020-12-310001591956us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2020-12-310001591956us-gaap:PreferredStockMember2020-12-310001591956us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001591956us-gaap:RetainedEarningsMember2020-12-3100015919562020-10-0100015919562020-05-0400015919562020-08-04xbrli:pure0001591956any:SupplierMember2020-01-012020-12-310001591956us-gaap:AccountsReceivableMember2020-01-012020-12-310001591956us-gaap:AccountsReceivableMember2019-01-012019-12-310001591956us-gaap:SalesRevenueNetMember2019-01-012019-12-310001591956us-gaap:SalesRevenueNetMember2020-01-012020-12-310001591956us-gaap:DevelopedTechnologyRightsMembersrt:MinimumMember2020-01-012020-12-310001591956us-gaap:DevelopedTechnologyRightsMembersrt:MaximumMember2020-01-012020-12-310001591956srt:MinimumMemberany:ChannelpartnerrelationshipsMember2020-01-012020-12-310001591956srt:MaximumMemberany:ChannelpartnerrelationshipsMember2020-01-012020-12-310001591956srt:MinimumMemberany:CapitalizeddevelopmentMember2020-01-012020-12-310001591956srt:MaximumMemberany:CapitalizeddevelopmentMember2020-01-012020-12-310001591956srt:MinimumMemberus-gaap:CustomerRelationshipsMember2020-01-012020-12-310001591956srt:MaximumMemberus-gaap:CustomerRelationshipsMember2020-01-012020-12-310001591956us-gaap:DevelopedTechnologyRightsMember2020-12-310001591956us-gaap:DevelopedTechnologyRightsMember2019-12-310001591956any:SupplierMember2020-12-310001591956any:SupplierMember2019-12-310001591956any:ChannelpartnerrelationshipsMember2020-12-310001591956any:ChannelpartnerrelationshipsMember2019-12-310001591956any:CapitalizeddevelopmentMember2020-12-310001591956any:CapitalizeddevelopmentMember2019-12-310001591956us-gaap:CustomerRelationshipsMember2020-12-310001591956us-gaap:CustomerRelationshipsMember2019-12-3100015919562020-08-022020-08-0300015919562020-08-030001591956us-gaap:DevelopedTechnologyRightsMember2020-01-012020-12-310001591956us-gaap:TradeNamesMember2020-01-012020-12-310001591956us-gaap:TradeNamesMember2019-01-012019-12-310001591956us-gaap:SubsequentEventMember2021-01-012021-04-020001591956us-gaap:SubsequentEventMember2021-04-020001591956us-gaap:BeneficialOwnerMember2020-07-272020-07-280001591956us-gaap:BeneficialOwnerMember2020-07-280001591956us-gaap:BeneficialOwnerMember2020-12-310001591956us-gaap:SubsequentEventMemberus-gaap:BeneficialOwnerMember2021-03-100001591956us-gaap:SubsequentEventMemberus-gaap:BeneficialOwnerMember2021-03-092021-03-1000015919562020-03-222020-03-2300015919562020-03-230001591956srt:AffiliatedEntityMember2020-01-012020-12-3100015919562020-04-0900015919562020-04-082020-04-090001591956us-gaap:SubsequentEventMember2021-03-162021-03-1700015919562020-09-162020-09-1700015919562020-09-140001591956us-gaap:SubsequentEventMember2021-03-0900015919562020-05-0600015919562020-05-052020-05-0600015919562020-04-3000015919562020-04-292020-04-300001591956us-gaap:BeneficialOwnerMember2020-04-300001591956us-gaap:BeneficialOwnerMember2020-04-210001591956us-gaap:SubsequentEventMember2021-03-310001591956us-gaap:SubsequentEventMemberus-gaap:BeneficialOwnerMember2021-03-310001591956us-gaap:SeriesCPreferredStockMember2020-01-012020-12-310001591956us-gaap:SeriesCPreferredStockMember2019-10-310001591956us-gaap:SubsequentEventMemberus-gaap:BeneficialOwnerMember2021-03-030001591956us-gaap:SubsequentEventMemberany:SBCInvestmentsMember2021-03-030001591956us-gaap:SubsequentEventMemberany:TyrellGlobalAcquisitionsMember2021-03-030001591956us-gaap:SeriesBPreferredStockMember2019-07-120001591956us-gaap:SeriesBPreferredStockMember2020-01-012020-12-310001591956us-gaap:SeriesBPreferredStockMember2019-08-1300015919562020-06-010001591956us-gaap:RestrictedStockMember2020-05-312020-06-0100015919562020-05-312020-06-0100015919562020-06-1600015919562020-06-152020-06-1600015919562020-04-2400015919562020-06-1900015919562020-06-182020-06-1900015919562020-08-042020-08-040001591956srt:AffiliatedEntityMember2020-05-142020-05-150001591956srt:AffiliatedEntityMember2020-12-310001591956srt:AffiliatedEntityMember2020-10-252020-10-260001591956srt:AffiliatedEntityMemberus-gaap:SubsequentEventMember2021-04-010001591956srt:AffiliatedEntityMemberus-gaap:SubsequentEventMember2021-02-182021-04-0100015919562019-10-0900015919562019-10-300001591956us-gaap:PrivatePlacementMember2019-08-142019-08-150001591956us-gaap:PrivatePlacementMember2020-01-012020-12-310001591956us-gaap:PrivatePlacementMember2019-08-150001591956us-gaap:PrivatePlacementMember2019-07-282019-07-290001591956us-gaap:PrivatePlacementMember2019-07-290001591956any:March42021Member2020-01-012020-12-310001591956any:March42021Member2020-12-310001591956any:August112022Member2020-01-012020-12-310001591956any:August112022Member2020-12-310001591956any:August162022Member2020-01-012020-12-310001591956any:August162022Member2020-12-310001591956any:August222022Member2020-01-012020-12-310001591956any:August222022Member2020-12-310001591956any:April172023Member2020-01-012020-12-310001591956any:April172023Member2020-12-310001591956any:March232023Member2020-01-012020-12-310001591956any:March232023Member2020-12-310001591956any:April302025Member2020-01-012020-12-310001591956any:April302025Member2020-12-310001591956us-gaap:WarrantMember2020-12-310001591956us-gaap:SubsequentEventMember2021-01-252021-02-090001591956us-gaap:RestrictedStockUnitsRSUMember2018-12-310001591956us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001591956us-gaap:RestrictedStockUnitsRSUMember2019-12-310001591956us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001591956us-gaap:RestrictedStockUnitsRSUMember2020-12-310001591956any:Outsideof2015PlanMember2019-03-252019-03-260001591956us-gaap:RestrictedStockMember2020-01-012020-12-310001591956us-gaap:RestrictedStockMember2019-01-012019-12-310001591956us-gaap:RestrictedStockMember2018-12-310001591956us-gaap:RestrictedStockMember2019-12-310001591956us-gaap:RestrictedStockMember2020-12-310001591956us-gaap:CostOfSalesMember2020-01-012020-12-310001591956us-gaap:CostOfSalesMember2019-01-012019-12-310001591956us-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310001591956us-gaap:SellingAndMarketingExpenseMember2019-01-012019-12-310001591956us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310001591956us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-12-310001591956us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001591956us-gaap:GeneralAndAdministrativeExpenseMember2019-01-012019-12-310001591956us-gaap:RedeemableConvertiblePreferredStockMember2020-01-012020-12-310001591956us-gaap:RedeemableConvertiblePreferredStockMember2019-01-012019-12-310001591956us-gaap:WarrantMember2020-01-012020-12-310001591956us-gaap:WarrantMember2019-01-012019-12-310001591956us-gaap:RestrictedStockMember2020-01-012020-12-310001591956us-gaap:RestrictedStockMember2019-01-012019-12-310001591956us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001591956us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001591956us-gaap:CanadaRevenueAgencyMember2020-12-310001591956us-gaap:DomesticCountryMember2020-12-310001591956us-gaap:CanadaRevenueAgencyMember2020-01-012020-12-310001591956us-gaap:DomesticCountryMember2020-01-012020-12-310001591956srt:AffiliatedEntityMember2020-04-210001591956us-gaap:DebtMember2019-10-302019-10-310001591956us-gaap:AccruedLiabilitiesMember2019-10-302019-10-310001591956us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2019-10-302019-10-310001591956us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-310001591956us-gaap:WarrantyReservesMember2018-12-310001591956any:DeferredRevenueMember2018-12-310001591956us-gaap:WarrantyReservesMember2019-01-012019-12-310001591956any:DeferredRevenueMember2019-01-012019-12-310001591956us-gaap:WarrantyReservesMember2019-12-310001591956any:DeferredRevenueMember2019-12-310001591956us-gaap:WarrantyReservesMember2020-01-012020-12-310001591956any:DeferredRevenueMember2020-01-012020-12-310001591956us-gaap:WarrantyReservesMember2020-12-310001591956any:DeferredRevenueMember2020-12-310001591956us-gaap:ProductMember2020-01-012020-12-310001591956us-gaap:ProductMember2019-01-012019-12-310001591956us-gaap:ServiceMember2020-01-012020-12-310001591956us-gaap:ServiceMember2019-01-012019-12-310001591956srt:AmericasMember2020-01-012020-12-310001591956srt:AmericasMember2019-01-012019-12-310001591956srt:AsiaPacificMember2020-01-012020-12-310001591956srt:AsiaPacificMember2019-01-012019-12-310001591956us-gaap:EMEAMember2020-01-012020-12-310001591956us-gaap:EMEAMember2019-01-012019-12-310001591956us-gaap:SubsequentEventMember2021-02-030001591956us-gaap:SubsequentEventMember2021-02-022021-02-030001591956us-gaap:SubsequentEventMember2021-02-042021-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from___________________________to ___________________________

Commission File Number: 001-36532

__________________________________

Sphere 3D Corp.

(Exact name of Registrant as specified in its charter)

__________________________________

|

|

|

|

|

Ontario, Canada

|

|

(State or other jurisdiction of incorporation or organization)

|

|

|

|

895 Don Mills Road, Bldg. 2, Suite 900

|

|

Toronto, Ontario, Canada, M3C 1W3

|

|

(Address of principal executive offices)

|

Peter Tassiopoulos

(858) 571-5555

Peter.Tassiopoulos@sphere3d.com

895 Don Mills Road Bldg. 2, Suite 900, Toronto, Ontario, Canada, M3C 1W3

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Common Shares

|

ANY

|

NASDAQ Capital Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common shares as of the close of the period covered by the annual report: 7,867,186 common shares as of December 31, 2020.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨

Non-accelerated filer ¨ Smaller reporting company ☒

(Do not check if a smaller reporting company) Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☒ International Financial Reporting Standards as issued Other ¨

by the International Accounting Standards Board ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐

SPHERE 3D CORP.

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GENERAL PRESENTATION MATTERS

|

|

|

FORWARD-LOOKING INFORMATION

|

|

|

PART 1

|

|

|

|

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

|

|

|

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

|

|

|

|

ITEM 3. KEY INFORMATION

|

|

|

|

|

A. Selected Financial Data

|

|

|

|

|

B. Capitalization and Indebtedness

|

|

|

|

|

C. Reasons for the Offer and Use of Proceeds

|

|

|

|

|

D. Risk Factors

|

|

|

|

ITEM 4 INFORMATION ON THE COMPANY

|

|

|

|

|

A. History and Development of the Company

|

|

|

|

|

B. Business Overview

|

|

|

|

|

C. Organizational Structure

|

|

|

|

|

D. Property, Plant and Equipment

|

|

|

|

ITEM 4A. UNRESOLVED STAFF COMMENTS

|

|

|

|

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

|

|

|

|

A. Operating Results

|

|

|

|

|

B. Liquidity and Capital Resources

|

|

|

|

|

C. Research and Development, Patents and Licenses, etc.

|

|

|

|

|

D. Trend Information

|

|

|

|

|

E. Off-Balance Sheet Information

|

|

|

|

|

F. Tabular Disclosure of Contractual Obligations

|

|

|

|

|

G. Safe Harbor

|

|

|

|

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

|

|

|

|

|

A. Directors and Senior Management

|

|

|

|

|

B. Compensation

|

|

|

|

|

C. Board Practices

|

|

|

|

|

D. Employees

|

|

|

|

|

E. Share Ownership

|

|

|

|

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

|

|

|

|

|

A. Major Shareholders

|

|

|

|

|

B. Related Party Transactions

|

|

|

|

|

C. Interests of Experts and Counsel

|

|

|

|

ITEM 8. FINANCIAL INFORMATION

|

|

|

|

|

A. Consolidated Statements and Other Financial Information

|

|

|

|

|

B. Significant Changes

|

|

|

|

ITEM 9. THE OFFERING AND LISTING

|

|

|

|

|

A. Offer and Listing Details

|

|

|

|

|

B. Plan of Distribution

|

|

|

|

|

C. Markets

|

|

|

|

|

D. Selling Shareholders

|

|

|

|

|

E. Dilution

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F. Expenses of the Issue

|

|

|

|

ITEM 10. ADDITIONAL INFORMATION

|

|

|

|

|

A. Share Capital

|

|

|

|

|

B. Memorandum and Articles of Association

|

|

|

|

|

C. Material Contracts

|

|

|

|

|

D. Exchange Controls

|

|

|

|

|

E. Taxation

|

|

|

|

|

F. Dividends and Paying Agents

|

|

|

|

|

G. Statements By Experts

|

|

|

|

|

H. Documents on Display

|

|

|

|

|

I. Subsidiary Information

|

|

|

|

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

|

|

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

|

|

|

|

|

A. Debt Securities

|

|

|

|

|

B. Warrants and Rights

|

|

|

|

|

C. Other Securities

|

|

|

|

|

D. American Depository Shares

|

|

|

PART II

|

|

|

|

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

|

|

|

|

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

|

|

|

|

ITEM 15. CONTROLS AND PROCEDURES

|

|

|

|

ITEM 16A. AUDIT COMMITTEE FINANCIAL EXPERT

|

|

|

|

ITEM 16B. CODE OF ETHICS

|

|

|

|

ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

|

|

|

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES

|

|

|

|

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS

|

|

|

|

ITEM 16F. CHANGES IN REGISTRANTS CERTIFYING ACCOUNTANT

|

|

|

|

ITEM 16G. CORPORATE GOVERNANCE

|

|

|

|

ITEM 16H. MINE SAFETY DISCLOSURE

|

|

|

PART III

|

|

|

|

ITEM 17. FINANCIAL STATEMENTS

|

|

|

|

ITEM 18. FINANCIAL STATEMENTS

|

|

|

|

ITEM 19. EXHIBITS

|

|

GENERAL PRESENTATION MATTERS

Any reference to the “Company”, “Sphere 3D”, “Sphere”, “we”, “our”, “us”, or similar terms refers to Sphere 3D Corp. and its subsidiaries. The information, including any financial information, disclosed in this Annual Report is stated as at December 31, 2020 or for the year ended December 31, 2020, as applicable, unless otherwise indicated. Unless otherwise indicated, all dollar amounts are expressed in U.S. dollars and references to “$” are to the lawful currency of the United States (“U.S.”).

Market data and other statistical information used in this Annual Report are based on independent industry publications, government publications, reports by market research firms, or other published independent sources. Some data is also based on good faith estimates that are derived from management’s review of internal data and information, as well as independent sources, including those listed above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy or completeness.

FORWARD-LOOKING INFORMATION

This Annual Report on Form 20-F contains forward-looking information that involves risks and uncertainties. This forward-looking information includes, but is not limited to, statements with respect to management’s expectations regarding the future growth, results of operations, performance and business prospects of Sphere 3D. This forward-looking information relates to, among other things, the Company’s future business plans and business planning process, the Company’s uses of cash, and may also include other statements that are predictive in nature, or that depend upon or refer to future events or conditions.

The words “could”, “expects”, “may”, “will”, “anticipates”, “assumes”, “intends”, “plans”, “believes”, “estimates”, “guidance”, and similar expressions are intended to identify statements containing forward-looking information, although not all forward-looking statements include such words. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events.

Although forward-looking statements in this Annual Report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include without limitation those discussed under the heading “Risk Factors” in Item 3D below, as well as those discussed elsewhere in this Annual Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report. Readers are urged to carefully review and consider the various disclosures made in this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

Any reference to the “Company”, “Sphere 3D”, “Sphere”, “we”, “our”, “us”, or similar terms refers to Sphere 3D Corp. and its subsidiaries. Unless otherwise indicated, all dollar amounts are expressed in U.S. dollars and references to “$” are to the lawful currency of the United States (“U.S.”). References to “Notes” are Notes included in our Notes to Consolidated Financial Statements.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

Not applicable.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

Item D. Risk Factors

An investment in our Company involves a high degree of risk. Each of the following risk factors in evaluating our business and prospects as well as an investment in our Company should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. If any of the following risks occur, our business and financial results could be harmed and the trading price of our common shares could decline.

Risks Related to our Business

We may be unable to successfully integrate our recent and future acquisitions, which could adversely affect our business, financial condition, results of operations and prospects.

In 2020, we acquired 101 Invest and entered into a definitive merger agreement with Rainmaker Worldwide Inc. (“Rainmaker”). On February 12, 2021, the Rainmaker Merger Agreement was terminated as the Company was unable to obtain all necessary regulatory approvals relating to the proposed transaction prior to the agreed date of January 31, 2021. No break-fee or termination costs were paid by either party.

The operation and management of recent acquisitions, or any of our future acquisitions, may adversely affect our existing income and operations or we may not be able to effectively manage any growth resulting from these transactions. Our success will depend, in part, on the extent to which we are able to merge these functions, eliminate the unnecessary duplication of other functions and otherwise integrate these companies (and any additional businesses with which we may combine in the future) into a cohesive, efficient enterprise. This integration process may entail significant costs and delays. Our failure to integrate the operations of these companies successfully could adversely affect our business, financial condition, results of operations and prospects. To the extent that any acquisition results in additional goodwill, it will reduce our tangible net worth, which might adversely affect our business, financial condition, results of operations and prospects, as well as our credit capacity.

The extent to which the coronavirus (“COVID-19”) outbreak and measures taken in response thereto impact our business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted.

Global health concerns relating to the coronavirus outbreak have been weighing on the macroeconomic environment, and the outbreak has significantly increased economic uncertainty. Risks related to consumers and businesses lowering or changing spending, which impact domestic and international spend. The outbreak has resulted in authorities implementing numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter in place orders, and business shutdowns. These measures have not only negatively impacted consumer spending and business spending habits, they have also adversely impacted and may further impact our workforce and operations and the operations of our customers, suppliers and business partners. These measures may remain in place for a significant period of time and they are likely to continue to adversely affect our business, results of operations and financial condition.

The spread of the coronavirus has caused us to modify our business practices (including employee travel, employee work locations, and cancellation of physical participation in meetings, events and conferences), and we may take further actions as may be required by government authorities or that we determine are in the best interests of our employees, customers and business partners. There is no certainty that such measures will be sufficient to mitigate the risks posed by the virus or otherwise be satisfactory to government authorities.

The extent to which the coronavirus outbreak impacts our business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Even after the coronavirus outbreak has subsided, we may continue to experience materially adverse impacts to our business as a result of its global economic impact, including any recession that has occurred or may occur in the future.

There are no comparable recent events which may provide guidance as to the effect of the spread of the coronavirus and a global pandemic, and, as a result, the ultimate impact of the coronavirus outbreak or a similar health epidemic is highly uncertain and subject to change. We do not yet know the full extent of the impacts on our business, our operations or the global economy as a whole. However, the effects could have a material impact on our results of operations, and we will continue to monitor the coronavirus situation closely.

Our cash and other sources of liquidity may not be sufficient to fund our operations beyond June 30, 2021. We may not be successful in raising additional capital necessary to meet expected increases in working capital needs. If we raise additional funding through sales of equity or equity-based securities, your shares will be diluted. If we need additional funding for operations and we are unable to raise it, we may be forced to liquidate assets and/or curtail or cease operations or seek bankruptcy protection or be subject to an involuntary bankruptcy petition.

Management has projected that cash on hand may not be sufficient to allow the Company to continue operations beyond June 30, 2021 if we are unable to raise additional funding for operations. We expect our working capital needs to increase in the future as we continue to expand and enhance our operations. Our ability to raise additional funds through equity or debt financings or other sources may depend on the financial success of our current business and successful implementation of our key strategic initiatives, financial, economic and market conditions and other factors, some of which are beyond our control. No assurance can be given that we will be successful in raising the required capital at reasonable cost and at the required times, or at all. Further equity financings may have a dilutive effect on shareholders and any debt financing, if available, may require restrictions to be placed on our future financing and operating activities. If we require additional capital and are unsuccessful in raising that capital, we may not be able to continue our business operations and advance our growth initiatives, which could adversely impact our business, financial condition and results of operations.

Significant changes from the Company’s current forecasts, including but not limited to: (i) failure to comply with the financial covenants in its debt facilities; (ii) shortfalls from projected sales levels; (iii) unexpected increases in product costs; (iv) increases in operating costs; (v) changes in the historical timing of collecting accounts receivable; and

(vi) inability to maintain compliance with the requirements of the NASDAQ Capital Market and/or inability to maintain listing with the NASDAQ Capital Market could have a material adverse impact on the Company’s ability to access the level of funding necessary to continue its operations at current levels. If any of these events occurs or the Company is unable to generate sufficient cash from operations or financing sources, the Company may be forced to liquidate assets where possible and/or curtail, suspend or cease planned programs or operations generally or seek bankruptcy protection or be subject to an involuntary bankruptcy petition, any of, which would have a material adverse effect on the Company’s business, results of operations, financial position and liquidity.

If we raise additional funds by selling additional shares of our capital stock, or securities convertible into shares of our capital stock, the ownership interest of our existing shareholders will be diluted. The amount of dilution could be increased by the issuance of warrants or securities with other dilutive characteristics, such as anti-dilution clauses or price resets.

We urge you to review the additional information about our liquidity and capital resources in Item 5A.“Operating Results” section of this report. If our business ceases to continue as a going concern due to lack of available capital or otherwise, it could have a material adverse effect on our business, results of operations, financial position, and liquidity.

We have granted security interests over certain of our assets in connection with various debt arrangements.

We have granted security interests over certain of our assets in connection with our line of credit and debt arrangements, and we may grant additional security interests to secure future borrowings. If we are unable to satisfy our obligations under these arrangements, we could be forced to sell certain assets that secure these loans, which could have a material adverse effect on our ability to operate our business. In the event we are unable to maintain compliance with covenants set forth in these arrangements or if these arrangements are otherwise terminated for any reason, it could have a material adverse effect on our ability to access the level of funding necessary to continue operations at current levels. If any of these events occur, management may be forced to make reductions in spending, extend payment terms with suppliers, liquidate assets where possible, and/or suspend or curtail planned programs. Any of these actions could materially harm our business, results of operations and future prospects.

A cybersecurity breach into our products when used by our customers could adversely affect our ability to conduct our business, harm our reputation, expose us to significant liability or otherwise damage our financial results.

A cybersecurity breach into a system we have sold to a customer could negatively affect our reputation as a trusted provider of storage, and data protection products by adversely impacting the market’s perception of the security of our products and services. Many of our customers and partners store sensitive data on our products, and a cybersecurity breach related to our products could harm our reputation and potentially expose us to significant liability.

We also maintain sensitive data related to our employees, partners and customers, including intellectual property, proprietary business information and personally identifiable information on our own systems. We employ sophisticated security measures; however, we may face threats across our infrastructure including unauthorized access, security breaches and other system disruptions.

It is critical to our business that our employees’, partners’ and customers’ sensitive information remains secure, and that our customers perceive that this information is secure. A cybersecurity breach could result in unauthorized access to, loss of, or unauthorized disclosure of such information. A cybersecurity breach could expose us to litigation, indemnity obligations, government investigations and other possible liabilities. Additionally, a cyber-attack, whether actual or perceived, could result in negative publicity which could harm our reputation and reduce our customers’ confidence in the effectiveness of our solutions, which could materially and adversely affect our business and results of operations. A breach of our security systems could also expose us to increased costs including remediation costs, disruption of operations or increased cybersecurity protection costs that may have a material adverse effect on our business. Although we maintain technology errors and omissions liability insurance, our insurance may not cover potential claims of these types or may not be adequate to indemnify us for inability that may be imposed. Any imposition or liability or litigation costs that are not covered by insurance or in excess of our insurance coverage could harm our business.

We face a selling cycle of variable length to secure new purchase agreements for our products and services, and design wins may not result in purchase orders or new customer relationships.

We face a selling cycle of variable lengths to secure new purchase agreements. Even if we succeed in developing a relationship with a potential new customer and/or obtaining design wins, we may not be successful in securing new sales for our products or services, or new customers. In addition, we cannot accurately predict the timing of entering into purchase agreements with new customers due to the complex purchase decision processes of some large institutional customers, such as healthcare providers or school districts, which often involve high-level management or board approvals. Consequently, we have only a limited ability to predict the timing of specific new customer relationships.

We have a history of net losses. We may not achieve or maintain profitability.

We have limited non-recurring revenues derived from operations. Sphere 3D’s near-term focus has been in actively developing reference accounts and building sales, marketing and support capabilities. HVE and UCX, which we acquired in January 2017, also have a history of net losses. We expect to continue to incur net losses and we may not achieve or maintain profitability. We may see continued losses during 2021 and as a result of these and other factors, we may not be able to achieve, sustain or increase profitability in the near future.

Sphere 3D is subject to many risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources, technology, and market acceptance issues. There is no assurance that we will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered considering our stage of operations.

Our plans for growth will place significant demands upon our resources. If we are unsuccessful in achieving our plan for growth, our business could be harmed.

We are actively pursuing a plan to market our products domestically and internationally. The plan will place significant demands upon managerial, financial, and human resources. Our ability to manage future growth will depend in large part upon several factors, including our ability to rapidly:

•build or leverage, as applicable, a network of channel partners to create an expanding presence in the evolving marketplace for our products and services;

•build or leverage, as applicable, a sales team to keep end-users and channel partners informed regarding the technical features, issues and key selling points of our products and services;

•attract and retain qualified technical personnel in order to continue to develop reliable and flexible products and provide services that respond to evolving customer needs;

•develop support capacity for end-users as sales increase, so that we can provide post-sales support without diverting resources from product development efforts; and

•expand our internal management and financial controls significantly, so that we can maintain control over our operations and provide support to other functional areas as the number of personnel and size increases.

Our inability to achieve any of these objectives could harm our business, financial condition and results of operations.

Our market is competitive and dynamic. New competing products and services could be introduced at any time that could result in reduced profit margins and loss of market share.

The technology industry is very dynamic, with new technology and services being introduced by a range of players, from larger established companies to start-ups, on a frequent basis. Our competitors may announce new products, services, or enhancements that better meet the needs of end-users or changing industry standards. Further, new competitors or alliances among competitors could emerge. Increased competition may cause price reductions, reduced gross margins and loss of market share, any of which could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, the worldwide storage market is intensely competitive. A number of manufacturers of disk-based storage solutions compete for a limited number of customers. Barriers to entry are relatively low in these markets, and some of our competitors in this market have substantially greater financial and other resources, larger research and development staffs, and more experience and capabilities in manufacturing, marketing and distributing products. Ongoing pricing pressure could result in significant price erosion, reduced profit margins and loss of market share, any of which could have a material adverse effect on our business, results of operations, financial position and liquidity.

Our success depends on our ability to anticipate technological changes and develop new and enhanced products.

The markets for our products are characterized by rapidly changing technology, evolving industry standards and increasingly sophisticated customer requirements. The introduction of products embodying new technology and the emergence of new industry standards can negatively impact the marketability of our existing products and can exert price pressures on existing products. It is critical to our success that we are able to anticipate and react quickly to changes in technology or in industry standards and to successfully develop, introduce, manufacture and achieve market acceptance of new, enhanced and competitive products on a timely basis and cost-effective basis. We invest resources towards continued innovation; however, there can be no assurance that we will successfully develop new products or enhance and improve our existing products, that new products and enhanced and improved existing products will achieve market acceptance or that the introduction of new products or enhanced existing products by others will not negatively impact us. Our inability to develop products that are competitive in technology and price and that meet end-user needs could have a material adverse effect on our business, financial condition or results of operations.

Development schedules for technology products are inherently uncertain. We may not meet our product development schedules, and development costs could exceed budgeted amounts. Our business, results of operations, financial position and liquidity may be materially and adversely affected if the products or product enhancements that we develop are delayed or not delivered due to developmental problems, quality issues or component shortage problems, or if our products or product enhancements do not achieve market acceptance or are unreliable. We or our competitors will continue to introduce products embodying new technologies, such as new sequential or random access mass storage devices. In addition, new industry standards may emerge. Such events could render our existing products obsolete or not marketable, which would have a material adverse effect on our business, results of operations, financial position and liquidity.

Our business is dependent on the continued market acceptance and usage of disk-based solutions. The impact of recent storage technology trends on our business is uncertain.

While information technology spending has fluctuated periodically due to technology transitions and changing economic and business environments, overall growth in demand for storage has continued. Recent technology trends, such as the emergence of hosted storage, software as a service and mobile data access are driving significant changes in storage architectures and solution requirements. The impact of these trends on overall long-term growth patterns is uncertain. Nevertheless, if the general level of industry growth, or if the growth of the specific markets in which we compete, were to decline, our business and results of operations could suffer.

Our management team continually reviews and evaluates our product portfolio, operating structure, and markets to assess the future viability of our existing products and market positions. We may determine that the infrastructure and expenses necessary to sustain an existing product offering are greater than the potential contribution margin that we would realize. As a result, we may determine that it is in our best interest to exit or divest one or more existing product offerings, which could result in costs incurred for exit or disposal activities and/or impairments of long-lived assets. Moreover, if we do not identify other opportunities to replace discontinued products or operations, our revenues would decline, which could lead to further net losses and adversely impact the market price of our common shares.

In addition, we could incur charges for excess and obsolete inventory. The value of our inventory may be adversely affected by factors that affect our ability to sell the products in our inventory. Such factors include changes in technology, introductions of new products by us or our competitors, the current or future economic downturns, or other actions by our competitors. If we do not effectively forecast and manage our inventory, we may need to write off inventory as excess or obsolete, which adversely affects cost of sales and gross profit. Our business has previously experienced, and we may in the future experience, reductions in sales of older generation products as customers delay or defer purchases in anticipation of new products that we or our competitors may introduce. We have established reserves for slow moving or obsolete inventory. These reserves, however, may prove to be inadequate, which would result in additional charges for excess or obsolete inventory.

Our products may contain defects in components or design, and our warranty reserves may not adequately cover our warranty obligations for these products.

Although we employ a testing and quality assurance program, our products may contain defects or errors, particularly when first introduced or as new versions are released. We may not discover such defects or errors until after a solution has been released to a customer and used by the customer and end-users. Defects and errors in our products could materially and adversely affect our reputation, result in significant costs, delay planned release dates and impair our ability to sell our products in the future. The costs incurred in correcting any solution defects or errors may be substantial and could adversely affect our operating margins. While we plan to continually test our products for defects and errors and work with end-users through our post-sales support services to identify and correct defects and errors, defects or errors in our products may be found in the future.

We have also established reserves for the estimated liability associated with product warranties. However, we could experience unforeseen circumstances where these or future reserves may not adequately cover our warranty obligations. For example, the failure or inadequate performance of product components that we purchase could increase our warranty obligations beyond these reserves.

The failure to attract, hire, retain and motivate key personnel could have a significant adverse impact on our operations.

Our success depends on the retention and maintenance of key personnel, including members of senior management and our technical, sales and marketing teams. Achieving this objective may be difficult due to many factors, including competition for such highly skilled personnel; fluctuations in global economic and industry conditions; changes in our management or leadership; competitors’ hiring practices; and the effectiveness of our compensation programs. The loss of any of these key persons could have a material adverse effect on our business, financial condition or results of operations. As an example, in the first quarter of 2019, our financial controller, and certain other members of our finance team, resigned from employment to seek other opportunities, which has required us to retain finance consultants while we search for full-time replacements, and we cannot guarantee that we will be able to retain such consultants or find adequate replacements.

Our success is also dependent on our continuing ability to identify, hire, train, motivate and retain highly qualified management, technical, sales, marketing and finance personnel. Any such new hire may require a significant transition period prior to making a meaningful contribution. Competition for qualified employees is particularly intense in the technology industry, and we have in the past experienced difficulty recruiting qualified employees. Our failure to attract and to retain the necessary qualified personnel could seriously harm our operating results and financial condition. Competition for such personnel can be intense, and no assurance can be provided that we will be able to attract or retain

highly qualified technical and managerial personnel in the future, which may have a material adverse effect on our future growth and profitability. We do not have key person insurance.

Our financial results may fluctuate substantially for many reasons, and past results should not be relied on as indications of future performance.

Our revenues and operating results may fluctuate from quarter to quarter and from year to year due to a combination of factors, including, but not limited to:

•varying size, timing and contractual terms of orders for our products, which may delay the recognition of revenue;

•competitive conditions in the industry, including strategic initiatives by us or our competitors, new products or services, product or service announcements and changes in pricing policy by us or our competitors;

•market acceptance of our products and services;

•our ability to maintain existing relationships and to create new relationships with channel partners;

•the discretionary nature of purchase and budget cycles of our customers and end-users;

•the length and variability of the sales cycles for our products;

•general weakening of the economy resulting in a decrease in the overall demand for our products and services or otherwise affecting the capital investment levels of businesses with respect to our products or services;

•timing of product development and new product initiatives;

•changes in customer mix;

•increases in the cost of, or limitations on, the availability of materials;

•fluctuations in average selling prices;

•changes in product mix; and

•increases in costs and expenses associated with the introduction of new products.

Further, the markets that we serve are volatile and subject to market shifts that we may be unable to anticipate. A slowdown in the demand for workstations, mid-range computer systems, networks and servers could have a significant adverse effect on the demand for our products in any given period. In the past, we have experienced delays in the receipt of purchase orders and, on occasion, anticipated purchase orders have been rescheduled or have not materialized due to changes in customer requirements. Our customers may cancel or delay purchase orders for a variety of reasons, including, but not limited to, the rescheduling of new product introductions, changes in our customers’ inventory practices or forecasted demand, general economic conditions affecting our customers’ markets, changes in our pricing or the pricing of our competitors, new product announcements by us or others, quality or reliability problems related to our products, or selection of competitive products as alternate sources of supply.

Thus, there can be no assurance that we will be able to reach profitability on a quarterly or annual basis. We believe that our revenue and operating results will continue to fluctuate, and that period-to-period comparisons are not necessarily indications of future performance. Our revenue and operating results may fail to meet the expectations of public market analysts or investors, which could have a material adverse effect on the price of our common shares. In addition, portions of our expenses are fixed and difficult to reduce if our revenues do not meet our expectations. These fixed expenses magnify the adverse effect of any revenue shortfall.

Our plans for implementing our business strategy and achieving profitability are based upon the experience, judgment and assumptions of our key management personnel, and available information concerning the communications and technology industries. If management’s assumptions prove to be incorrect, it could have a material adverse effect on our business, financial condition or results of operations.

We rely on indirect sales channels to market and sell our branded products. Therefore, the loss of, or deterioration in, our relationship with one or more of our distributors or resellers could negatively affect our operating results.

We have relationships with third party resellers, system integrators and enterprise application providers that facilitate our ability to sell and implement our products. These business relationships are important to extend the geographic reach and customer penetration of our sales force and ensure that our products are compatible with customer network infrastructures and with third party products.

We believe that our success depends, in part, on our ability to develop and maintain strategic relationships with resellers, independent software vendors, system integrators, and enterprise application providers. Should any of these third parties go out of business, or choose not to work with us, we may be forced to increase the development of those capabilities internally, incurring significant expense and adversely affecting operating margins. Any of these third parties may develop relationships with other companies, including those that develop and sell products that compete with ours. We could lose sales opportunities if we fail to work effectively with these parties or they choose not to work with us. Most of our distributors and resellers also carry competing product lines that they may promote over our products. A distributor or reseller might not continue to purchase our products or market them effectively, and each determines the type and amount of our products that it will purchase from us and the pricing of the products that it sells to end user customers. Further, the long-term success of any of our distributors or resellers is difficult to predict, and we have no purchase commitments or long-term orders from any of them to assure us of any baseline sales through these channels.

Therefore, the loss of, or deterioration in, our relationship with one or more of our distributors or resellers could negatively affect our operating results. Our operating results could also be adversely affected by a number of factors, including, but not limited to:

•a change in competitive strategy that adversely affects a distributor’s or reseller’s willingness or ability to stock and distribute our products;

•the reduction, delay or cancellation of orders or the return of a significant amount of our products;

•the loss of one or more of our distributors or resellers; and

•any financial difficulties of our distributors or resellers that result in their inability to pay amounts owed to us.

If our suppliers fail to meet our manufacturing needs, it would delay our production and our product shipments to customers and this could negatively affect our operations.

Some of our products have a large number of components and subassemblies produced by outside suppliers. We depend greatly on these suppliers for items that are essential to the manufacturing of our products, including disk drives and chassis. We work closely with our regional, national and international suppliers, which are carefully selected based on their ability to provide quality parts and components that meet both our technical specifications and volume requirements. For certain items, we qualify only a single source, which magnifies the risk of shortages and decreases our ability to negotiate with that supplier on the basis of price. From time to time, we have in the past been unable to obtain as many drives as have needed due to drive shortages or quality issues from certain of our suppliers. If these suppliers fail to meet our manufacturing needs, it would delay our production and our product shipments to customers and negatively affect our operations.

We are subject to laws, regulations and similar requirements, changes to which may adversely affect our business and operations.

We are subject to laws, regulations and similar requirements that affect our business and operations, including, but not limited to, the areas of commerce, intellectual property, income and other taxes, labor, environmental, health and safety, and our compliance in these areas may be costly. While we have implemented policies and procedures to comply with laws and regulations, there can be no assurance that our employees, contractors, suppliers or agents will not violate such laws and regulations or our policies. Any such violation or alleged violation could materially and adversely affect

our business. Any changes or potential changes to laws, regulations or similar requirements, or our ability to respond to these changes, may significantly increase our costs to maintain compliance or result in our decision to limit our business or products, which could materially harm our business, results of operations and future prospects.

The Dodd-Frank Wall Street Reform and Consumer Protection Act includes provisions regarding certain minerals and metals, known as conflict minerals, mined from the Democratic Republic of Congo and adjoining countries. These provisions require companies to undertake due diligence procedures and report on the use of conflict minerals in its products, including products manufactured by third parties. Compliance with these provisions will cause us to incur costs to certify that our supply chain is conflict free and we may face difficulties if our suppliers are unwilling or unable to verify the source of their materials. Our ability to source these minerals and metals may also be adversely impacted. In addition, our customers may require that we provide them with a certification and our inability to do so may disqualify us as a supplier.

We have made a number of acquisitions in the past and we may make acquisitions in the future. Our ability to identify complementary assets, products or businesses for acquisition and successfully integrate them could affect our business, financial condition and operating results.

In the future, we may continue to pursue acquisitions of assets, products or businesses that we believe are complementary to our existing business and/or to enhance our market position or expand our product portfolio. There is a risk that we will not be able to identify suitable acquisition candidates available for sale at reasonable prices, complete any acquisition, or successfully integrate any acquired product or business into our operations. We are likely to face competition for acquisition candidates from other parties including those that have substantially greater available resources. Acquisitions may involve a number of other risks, including:

•diversion of management’s attention;

•disruption to our ongoing business;

•failure to retain key acquired personnel;

•difficulties in integrating acquired operations, technologies, products or personnel;

•unanticipated expenses, events or circumstances;

•assumption of disclosed and undisclosed liabilities; and

•inappropriate valuation of the acquired in-process research and development, or the entire acquired business.

If we do not successfully address these risks or any other problems encountered in connection with an acquisition, the acquisition could have a material adverse effect on our business, results of operations and financial condition. Problems with an acquired business could have a material adverse effect on our performance or our business as a whole. In addition, if we proceed with an acquisition, our available cash may be used to complete the transaction, diminishing our liquidity and capital resources, or shares may be issued which could cause significant dilution to existing shareholders.

We have implemented cost reduction efforts; however, these efforts may need to be modified, and if we need to implement additional cost reduction efforts it could materially harm our business.

We have implemented certain cost reduction efforts. There can be no assurance that these cost reduction efforts will be successful. As a result, we may need to implement further cost reduction efforts across our operations, such as further reductions in the cost of our workforce and/or suspending or curtailing planned programs, either of which could materially harm our business, results of operations and future prospects.

Risks Related to Intellectual Property

Our ability to compete depends in part on our ability to protect our intellectual property rights.

Our success depends in part on our ability to protect our rights in our intellectual property. We rely on various intellectual property protections, including copyright, trade-mark and trade secret laws and contractual provisions, to preserve our intellectual property rights. We have filed a number of patent applications and have historically protected our intellectual property through trade secrets and copyrights. As our technology is evolving and rapidly changing, current intellectual property rights may not adequately protect us.

Intellectual property rights may not prevent competitors from developing products that are substantially equivalent or superior to our products. Competitors may independently develop similar products, duplicate our products or, if patents are issued to us, design around these patents. To the extent that we have or obtain patents, such patents may not afford meaningful protection for our technology and products. Others may challenge our patents and, as a result, our patents could be narrowed, invalidated or declared unenforceable. The patents that are material to our business began expiring in November 2015. In addition, our current or future patent applications may not result in the issuance of patents in the U.S. or foreign countries.

Although we believe we have a proprietary platform for our technologies and products, we may in the future become subject to claims for infringement of intellectual property rights owned by others. Further, to protect our own intellectual property rights, we may in the future bring claims for infringement against others.

Our commercial success depends, in part, upon not infringing intellectual property rights owned by others. Although we believe that we have a proprietary platform for our technologies and products, we cannot determine with certainty whether any existing third party patents or the issuance of any third party patents would require us to alter our technology, obtain licenses or cease certain activities. We may become subject to claims by third parties that our technology infringes their intellectual property rights. While we provide our customers with a qualified indemnity against the infringement of third party intellectual property rights, we may become subject to these claims either directly or through indemnities against these claims that we routinely provide to our end-users and channel partners.

Further, our customers may use our products in ways that may infringe the intellectual property rights of third parties and/or require a license from third parties. Although our customers are contractually obligated to use our products only in a manner that does not infringe third party intellectual property rights, we cannot guarantee that such third parties will not seek remedies against us for providing products that may enable our customers to infringe the intellectual property rights of others.

In addition, we may receive in the future, claims from third parties asserting infringement, claims based on indemnities provided by us, and other related claims. Litigation may be necessary to determine the scope, enforceability and validity of third party proprietary or other rights, or to establish our proprietary or other rights. Furthermore, despite precautions, it may be possible for third parties to obtain and use our intellectual property without our authorization. Policing unauthorized use of intellectual property is difficult, and some foreign laws do not protect proprietary rights to the same extent as the laws of Canada or the U.S. To protect our intellectual property, we may become involved in litigation. In addition, other companies may initiate similar proceedings against us. The patent position of information technology firms is highly uncertain, involves complex legal and factual questions, and continues to be the subject of much litigation. No consistent policy has emerged from the U.S. Patent and Trademark Office or the courts regarding the breadth of claims allowed or the degree of protection afforded under information technology patents.

Some of our competitors have, or are affiliated with companies having, substantially greater resources than us and these competitors may be able to sustain the costs of complex intellectual property litigation to a greater degree and for a longer period of time than us. Regardless of their merit, any such claims could:

•divert the attention of our management, cause significant delays, materially disrupt the conduct of our business or materially adversely affect our revenue, financial condition and results of operations;

•be time consuming to evaluate and defend;

•result in costly litigation and substantial expenses;

•cause product shipment delays or stoppages;

•subject us to significant liabilities;

•require us to enter into costly royalty or licensing agreements;

•require us to modify or stop using the infringing technology; or

•result in costs or other consequences that have a material adverse effect on our business, results of operations and financial condition.

Risks Related to Our Public Company Status and Our Common Shares

Sales of common shares issuable upon exercise of outstanding warrants, the conversion of outstanding preferred shares, or the effectiveness of our registration statement may cause the market price of our common shares to decline. Currently outstanding preferred shares could adversely affect the rights of the holders of common shares.

As of December 31, 2020, we have in the aggregate 9,355,778 Preferred Shares outstanding. The conversion of the outstanding Preferred Shares will result in substantial dilution to our common shareholders. Pursuant to our articles of amalgamation, our Board of Directors has the authority to fix and determine the voting rights, rights of redemption and other rights and preferences of preferred stock.

Pursuant to the articles of amendment governing the rights and preferences of outstanding shares of Series B Preferred Shares, each preferred share (i) is convertible into our common shares, at a conversion rate equal to $1.00 per share, plus accrued and unpaid dividends, divided by an amount equal to 0.85 multiplied by a 15-day volume weighted average price per share of common stock prior to the date the conversion notice is provided, subject to a conversion price floor of $0.80, (ii) fixed, preferential, cumulative cash dividends at the rate of 8% of the Series B Preferred Shares subscription price per year, and (iii) carry a liquidation preference equal to the subscription price per Series B Preferred Share plus any accrued and unpaid dividends. On July 14, 2020, the Company entered into a lock-up agreement (the "Lock-up Agreement") with FBC Holdings with respect to the 6,500,000 Series B Preferred Shares of the Company owned by FBC Holdings. Pursuant to the terms of the Lock-up Agreement, FBC Holdings has agreed that for the period of time between (a) July 14, 2020 and (b) the earlier to occur of (i) April 30, 2021 and (ii) the date that is 180 days after a Change of Control (as defined in the Lock-up Agreement), it will not without the prior written consent of the Company convert any of the Series B Preferred Shares into common shares of the Company.

Pursuant to the articles of amendment governing the rights and preferences of outstanding shares of Series C Preferred Shares, each preferred share is convertible into our common shares, at a conversion rate in effect on the date of conversion. Overland, the sole holder of the Series C Preferred Shares, may, at any time, convert all or any part of the Series C Preferred Shares. On October 31, 2019, Overland agreed that it would not exercise its conversion right with respect to its Series C Preferred Shares until the earlier of (i) October 31, 2020. On October 31, 2020, the Company received notification requesting conversion of the Series C Preferred Shares held by Overland. On March 3, 2021, the Company converted 1,600,000 Series C Preferred Shares and issued 1,440,000 common shares of the Company.

Pursuant to the articles of amendment governing the rights and preferences of outstanding shares of Series D Preferred Shares, each preferred share is convertible at the option of the holder thereof, into that number of our common shares determined by dividing the stated value of such share of Series D Preferred Stock (which is $0.65) by the conversion price. The initial conversion price, which is also $0.65, shall be adjusted in the event that we (i) pay a stock dividend or otherwise make a distribution or distributions payable in our common share, (ii) subdivide our outstanding common shares into a larger number of shares, (iii) combine (including by way of a reverse stock split) our outstanding common shares into a small number of shares, or (iv) issue, in the event of a reclassification of our common shares, any of our capital shares. Each shareholder of the Series D Preferred Shares, may, at any time, convert all or any part of the Series D Preferred Shares provided that after such conversion the common shares issuable, together with all the common shares held by the shareholder in the aggregate would not exceed 4.99% of the total number of outstanding common

shares of the Company. This amount may be increased to 9.99% with 61 days’ notice to the Company. In the first quarter of 2021, the Company converted 895,000 Series D Preferred Shares and issued 895,000 common shares of the Company.

Pursuant to the articles of amendment governing the rights and preferences of outstanding shares of Series E Preferred Shares, each preferred share is convertible at the option of the holder thereof. The shareholder of the Series E Preferred Shares, may, at any time, convert all or any Series E Preferred Shares provided that the common shares issuable upon such conversion, together with all other common shares of the Company held by the shareholder in the aggregate, would not cause such shareholder’s ownership of the Company’s common shares to exceed 4.99% of the total number of outstanding common shares of the Company. This amount may be increased to 9.99% with 61 days’ notice to the Company. Each Series E Preferred Share has a stated value of $1,000 and is convertible into the Company’s common shares at a conversion price equal to the lower of (i) 70% of the average of the three lowest volume weighted average prices of the common shares during the ten trading days immediately preceding, but not including, the conversion date and (ii) $2.00; however, in no event shall the conversion price be lower than $1.00 per share. The Series E Preferred Shares are non-voting and pay dividends at a rate of 8.0% per annum, payable quarterly. On March 9, 2021, the Company converted 300 Series E Preferred shares and issued 197,798 common shares of the Company.

Additionally, as of December 31, 2020 we have warrants outstanding for the purchase of up to 2,786,534 common shares having a weighted-average exercise price of $2.14 per share. The sale of our common shares upon exercise of our outstanding warrants, the conversion of the Preferred Shares into common shares, or the sale of a significant amount of the common shares issued or issuable upon exercise of the warrants in the open market, or the perception that these sales may occur, could cause the market price of our common shares to decline or become highly volatile.

The sale of our common shares to Oasis Capital may cause substantial dilution to our existing stockholders and the sale of our common shares acquired by Oasis Capital could cause the price of our common shares to decline.

We have registered for sale 6,962,026 common shares that we may sell to Oasis Capital, LLC (“Oasis Capital”) under the Equity Purchase Agreement. It is anticipated that these shares will be sold over a period of up to approximately 36 months. The number of shares ultimately offered for sale by Oasis Capital is dependent upon the number of shares we elect to sell to Oasis Capital under the Equity Purchase Agreement. Sales by Oasis Capital of shares acquired pursuant to the Equity Purchase Agreement may result in dilution to the interests of other holders of our common shares.

The sale of a substantial number of our common shares by Oasis Capital, or anticipation of such sales, could cause the trading price of our common share to decline or make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise desire. Following the issuance of common shares under the Equity Line, Oasis Capital may offer and resell the shares at a price and time determined by them. This may cause the market price of our common shares to decline, and the timing of sales and the price at which the shares are sold by Oasis Capital could have an adverse effect upon the public market for our common shares.

There is an increased potential for short sales of our common shares due to the sale of shares pursuant to the Equity Purchase Agreement, which could materially affect the market price of our common shares.

Downward pressure on the market price of our common shares that likely will result from resales of the common shares issued pursuant to the Equity Purchase Agreement could encourage short sales of common shares by market participants. Generally, short selling means selling a security not owned by the seller. The seller is committed to eventually purchase the security previously sold. Short sales are used to capitalize on an expected decline in the security’s price - typically, investors who sell short believe that the price of the stock will fall, and anticipate selling at a price higher than the price at which they will buy the stock. Significant amounts of such short selling could place further downward pressure on the market price of our common shares.

We may not be able to access sufficient funds under the Equity Purchase Agreement with Oasis Capital when needed.

Our ability to sell shares to Oasis Capital and obtain funds under the Equity Purchase Agreement is limited by the terms and conditions in the Equity Purchase Agreement, including restrictions on when we may sell shares to Oasis Capital, restrictions on the amounts we may sell to Oasis Capital at any one time, and a limitation on our ability to sell shares to Oasis Capital to the extent that it would cause Oasis Capital to beneficially own more than 9.99% of our outstanding common shares. In addition, any amounts we sell under the Equity Purchase Agreement may not satisfy all of our funding needs.

The extent we rely on Oasis Capital as a source of funding will depend on a number of factors including, the prevailing market price and trading volume of our common shares and the extent to which we are able to secure working capital from other sources. If obtaining sufficient funding from Oasis Capital were to prove unavailable or prohibitively dilutive, we will need to secure another source of funding in order to satisfy our working capital needs. Even if we sell all 6,962,026 Purchase Shares to Oasis Capital, we may still need additional capital to fully implement our business, operating and development plans. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences could be a material adverse effect on our business, operating results, financial condition and prospects.

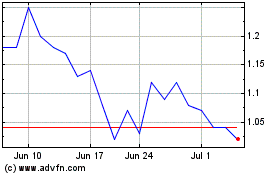

The market price of our common shares is volatile.

The market price for common shares may be volatile and subject to wide fluctuations in response to numerous factors, many of which are beyond our control, including the following:

•price and volume fluctuations in the overall stock market from time to time;

•volatility in the market prices and trading volumes of technology stocks;