Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

January 07 2021 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2021

Commission File Number: 001-36532

SPHERE 3D CORP.

895 Don Mills Road, Bldg. 2, Suite 900

Toronto, Ontario, M3C1W3, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

The information contained in this Form 6-K is incorporated by reference into, or as additional exhibits to, as applicable, the registrant's outstanding registration statements.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Share Purchase Agreement for the Acquisition of Rainmaker Holland BV

On January 3, 2021, Sphere 3D Corp. (the "Company") entered into a definitive share purchase agreement (the "Purchase Agreement") for the acquisition of Rainmaker Holland BV ("RHBV"), a wholly-owned subsidiary of Rainmaker Worldwide Inc. (OTC Pink: RAKR) ("RAKR"). The consideration for the purchase of RHBV includes, among other things, the issuance of 11,350,000 Series F preferred shares of the Company ("Series F Shares") and the issuance of warrants to acquire 500,000 Series F Shares at an exercise price of $2.00 per share for a period of two years, cash consideration of $1,960,000 payable to third parties to cancel certain royalty agreements, and an amendment to the $3.1 million secured advance the Company previously made to RAKR to extend the repayment term to 48 months and to reduce the face value by $362,000. Torrington Financial Services Limited ("Torrington") will also receive 1,800,000 Series F Shares upon closing of the transaction pursuant to the Business Advisory Agreement, as amended, between the Company and Torrington. Each Series F Share is exchangeable on a one-for-one basis into common shares of the Company for no additional consideration. The foregoing description does not purport to be complete and is qualified in its entirety by reference to a copy of the Purchase Agreement filed as Exhibit 99.1 hereto and is incorporated by reference into this report.

The closing of the transaction is expected to occur on or about January 14, 2021, and is subject to NASDAQ approval and any other board and/or regulatory approvals, as applicable.

The previously announced merger transaction between the Company and RAKR has been mutually terminated, without any payments being made by either party.

On January 4, 2021, the Company issued a press release announcing the acquisition. A copy of the press release is filed as Exhibit 99.2 hereto and is incorporated by reference into this report.

On January 4, 2021 the Company filed an amendment to its Articles of Amalgamation to create the Series F Shares (the "Amendment"). A copy of the Amendment is filed as Exhibit 99.3 hereto and is incorporated by reference into this report.

Amendment to Equity Purchase Agreement

On January 4, 2021, the Company and Oasis Capital, LLC (the "Investor") entered into an amendment to the Equity Purchase Agreement dated May 15, 2020 (the "Equity Agreement") to add a restriction regarding when the Company and the Investor can effectuate a put under the Equity Agreement.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the Amendment to the Equity Purchase Agreement which is attached hereto as Exhibit 99.4 and incorporated herein by reference.

Nasdaq Letter

On January 4, 2021, the Company received a written notice (the "Notice") from the Listing Qualifications Department of The Nasdaq Stock Market ("Nasdaq") indicating that the Company is not in compliance with Listing Rule 5620(a) due to the Company's failure to hold an annual meeting of shareholders within twelve months of the end of the Company's fiscal year end. The Notice is only a notification of deficiency, not of imminent delisting, and has no current effect on the listing or trading of the Company's securities on the NASDAQ Capital Market.

The Notice states that the Company has until February 18, 2020 to submit a plan to regain compliance with Listing Rule 5620(a). The Company's annual meeting of shareholders is scheduled for February 11, 2021, at which time the Company should regain compliance with Listing Rule 5620(a).

SUBMITTED HEREWITH

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SPHERE 3D CORP.

|

|

|

|

|

|

|

|

|

|

|

Date: January 7, 2021

|

/s/ Peter Tassiopoulos

|

|

|

Name: Peter Tassiopoulos

|

|

|

Title: Chief Executive Officer

|

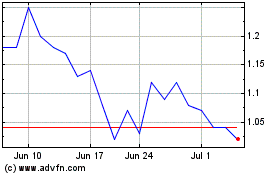

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Apr 2023 to Apr 2024