Current Report Filing (8-k)

March 02 2020 - 4:06PM

Edgar (US Regulatory)

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 25, 2020

Anika Therapeutics, Inc.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

000-21326

|

|

04-3145961

|

|

(State or other

|

|

(Commission file number)

|

|

(I.R.S. Employer

|

|

jurisdiction of incorporation)

|

|

|

|

Identification No.)

|

32 Wiggins Avenue, Bedford, Massachusetts

01730

(Address of principal executive offices)

(Zip code)

Registrant’s telephone number, including

area code: (781) 457-9000

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

ANIK

|

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934: Emerging

growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.02

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

|

On February 25, 2020, we entered into a letter agreement with

Cheryl R. Blanchard with respect to her compensation as our Interim Chief Executive Officer. The terms of the letter agreement

were set by the compensation committee, based in part upon advice of the Rewards Solution practice at Aon, specifically members

of the Radford advisory team, who serve as independent compensation consultants to the compensation committee.

The letter agreement provides for the at-will employment of

Dr. Blanchard as our Interim Chief Executive Officer for a term, or the Term, that commenced on February 10, 2020 and will

expire upon the earliest of (a) the effective date of our appointment of a permanent chief executive officer, (b) August 7, 2020,

(c) a change in control (as defined in our 2017 Omnibus Incentive Plan), and (d) such date as of which either we or Dr. Blanchard

elects to terminate her employment as Interim CEO.

Under the terms of the letter agreement, we will pay Dr. Blanchard

a base salary at an annualized rate of $600,000 during the Term, provided that if the Term ends for any reason other than

her election to terminate employment, Dr. Blanchard will be entitled to receive an additional payment equal to the amount

by which her total earned base salary was less than $150,000. Dr. Blanchard will also be entitled to receive a cash retention bonus

of which (a) $127,500 will become payable upon the earlier of May 10, 2020 and the end of the Term, as long as she does not

elect to terminate employment prior to such earlier date, and (b) an amount equal to 85% of base salary, if any, earned on and

after May 10, 2020 will become payable upon the earlier of August 10, 2020 and the end of the Term, as long as she does not elect

to terminate employment prior to such earlier date. In addition, on February 25, 2020, we granted to Dr. Blanchard restricted stock

units with respect to 4,231 shares of our common stock, which will vest in full and settle as of the earlier of (i) immediately

prior to the end of the Term, so long as the Term does not end as the result of Dr. Blanchard’s election to terminate employment,

and (ii) February 25, 2021, so long as she continues to serve on the Board as of such date.

The letter agreement contains covenants of Dr. Blanchard with

respect to confidentiality, non-competition and non-solicitation of customers, business partners and employees.

The foregoing description of the letter agreement does not

purport to be complete and is subject to, and qualified in its entirety by, the full text of the letter agreement, which is included

as Exhibit 10.1 to this report and is incorporated herein by reference.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d)

Exhibits.

________

† Management

contract or compensatory plan or arrangement.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

Anika Therapeutics, Inc.

|

|

|

|

|

|

|

|

Date: March 2, 2020

|

By:

|

/s/ Sylvia Cheung

|

|

|

|

Chief Financial Officer

|

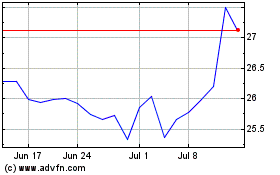

Anika Therapeutics (NASDAQ:ANIK)

Historical Stock Chart

From Mar 2024 to Apr 2024

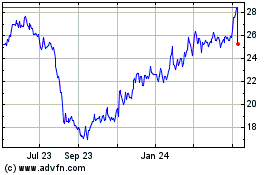

Anika Therapeutics (NASDAQ:ANIK)

Historical Stock Chart

From Apr 2023 to Apr 2024