Amgen to Sell Cholesterol Drug for 60% Less Than Original Price

October 24 2019 - 3:40PM

Dow Jones News

By Joseph Walker

Amgen Inc. said it will sell the cholesterol drug Repatha only

at a list price 60% lower than what the company had originally

charged, in a bid to make the medicine more affordable to patients

and kick-start sales.

Starting next year, Repatha will list for $5,850 a year for all

insurers, the biotech said Thursday.

The move could help reduce the amount that patients pay for the

drug at the pharmacy counter, and reduce the number of patients who

don't fill their prescriptions because their copays are too

expensive.

Amgen had priced Repatha for more than $14,000 a year upon its

approval in 2015.

Analysts had thought Repatha would ring up billions of dollars

in sales, but that hasn't happened in large part because insurers

have restricted coverage of the drug because of its price. In the

second quarter, Amgen reported just $91 million in sales from

Repatha.

To encourage more use, Amgen last year created a new version of

Repatha priced at $5,850 a year. The company temporarily still

offered the original list price option of more than $14,000, which

Amgen discounted heavily in the form of rebates.

Some health plans offered only the higher-priced Repatha, which

meant patients faced bigger out-of-pocket costs.

Amgen said it kept selling the higher-priced product to allow

time for insurers and pharmacy benefit managers to adjust to the

loss of rebates. In it latest announcement, the company said it

will stop selling the higher-priced version after Dec. 31.

Several pharmaceutical companies have cut the list prices of

drugs in the past year in an effort to extend to patients the

discounts they were already providing to pharmacy benefit managers,

known as PBMs, which negotiate prices on behalf of insurers and

employers.

Sanofi SA and Regeneron Pharmaceuticals Inc. sell a cut-rate

version of their own anti-cholesterol medicine Praluent -- which

competes with Repatha -- at a 60% discount to the original list

price.

Gilead Sciences Inc. in January launched generic versions of two

hepatitis C medicines priced at discounts of 68% and 62%,

respectively, to their branded counterparts. Eli Lilly & Co.

said in March that it would market a half-priced version of its

diabetes medicine Humalog.

The price cuts have typically been for drugs that were already

being discounted heavily with rebates. But rebates often failed to

ease the direct costs shouldered by patients in Medicare Part D and

high-deductible commercial health plans that require them to pay a

percentage of a drug's list price before rebates are applied.

About half of Medicare Part D patients taking Repatha will have

copays of less than $50 per prescription next year, Amgen said. By

discontinuing the higher-priced version of the drug, the company

said it expects to increase the portion of patients with copays of

$50 or less.

Some Medicare patients are required to pay as much as $370 per

month for Repatha, causing about three-quarters of patients to

abandon their prescriptions, said BMO Capital Markets analyst Do

Kim in a note to clients on Thursday.

He said Amgen's termination of the higher-priced product should

increase the number of patients paying fixed $50 copays and bring

down the abandonment rate closer to the 19% observed in commercial

plans.

Write to Joseph Walker at joseph.walker@wsj.com

(END) Dow Jones Newswires

October 24, 2019 15:25 ET (19:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

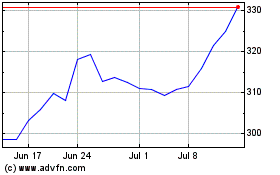

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

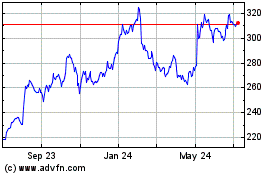

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024