3 Overbought Stocks on the S&P 500 That May Pullback in August

August 05 2021 - 6:17AM

Finscreener.org

As the equity markets continue to trade at record levels it is

also imperative for stocks to trade at sky-high valuations. Even

from a technical perspective, several stocks might have entered

overbought territory warranting a massive pullback, especially if

the markets undergo a correction.

Here, we look at three stocks part of the S&P 500 that

index that are overbought

at current prices.

Advanced Micro Devices

The first stock on my list is Advanced Micro Devices (NASDAQ:

AMD)

that has a relative strength index (RSI) score of 83.72. An RSI

score of over 70 indicates a stock is overbought. AMD stock has

been on an absolute tear in the last five years and has returned a

staggering 1,705% since August 2016. It has surged 22.7% in 2021

and has gained close to 19% in the last month on the back of

stellar quarterly results.

In the June quarter, AMD’s sales almost doubled while adjusted

earnings rose 250% year over year to $0.63 per share. The company

also raised its guidance for 2021 and expects revenue to grow by

60% year over year, compared to its earlier forecast of 50%.

The semiconductor giant has increased its revenue from $5.32

billion in 2017 to $9.76 billion in 2020. Its operating income has

improved from $204 million to $1.37 billion in this period. Wall

Street expects sales to grow by 51% to $14.74 billion in 2021 while

earnings are estimated to expand at an annual rate of 32.4% in the

next five years. We can see why AMD stock continues to trade at a

premium given its price to 2022 sales multiple of 8.5x and its

price to earnings multiple of 44.2x.

However, analysts expect AMD stock to trade around $105 in the

next 12-months which is 14% below its current trading price.

Fortinet

A cybersecurity giant, Fortinet (NASDAQ: FTNT)

stock is up 115% in 2021 and has gained 20% in the last month. In

the second quarter of 2021, Fortinet sales grew 30% year over year

to $801 million, up from $618 million in the year-ago period. Its

adjusted net income grew by 16% year over year to $159 million

while free cash flow surged 83% to $395 million. Analysts forecast

Fortinet sales to touch $743.65 million in Q2 while adjusted

earnings were estimated at $143 million.

Fortinet’s management has forecast 2021 sales between $3.21

billion and $3.25 billion which is higher than its prior forecast

of sales between $3.08 billion and $3.13 billion, indicating a year

over year growth of 25% at the midpoint.

Fortinet has delivered consistent profits to shareholders as its

free cash flow margin has been over 30% in the last few years. It

ended Q2 with $3.36 billion in liquidity and less than $1 billion

in debt.

Despite its stellar metrics, Fortinet stock might pull back

given its RSI score of 83.63.

Nike Inc.

The final stock on my list is Nike (NYSE: NKE) which has

an RSI score of 79.5. The retail heavyweight has also gained on the

back of stellar quarterly results. Wall Street

forecast the company to post sales of $11.05 billion with

adjusted

earnings per share of $0.51 in the fiscal fourth quarter of

2021. Comparatively, its sales rose 96% year over year to $12.3

billion while adjusted earnings rose to $0.93 in Q4.

The company increased its ad spending by 21% to $1 billion

ensuring its remains one of the most recognizable brands on the

planet. Its digital sales soared 40% in Q4 allowing Nike to improve

its gross margin to 46%, up from 37.5% in the prior-year

period.

It ended the fiscal year with $13.5 billion in cash, up from

$8.8 billion in fiscal 2020, providing the company with enough

flexibility to tide over the ongoing macro-economic

uncertainty.

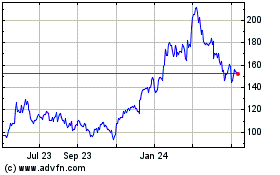

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

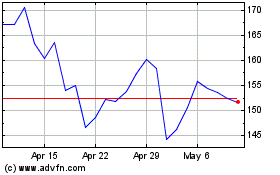

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024