AT&T's Xandr Ad Unit Cuts TV Deals With Disney and AMC

March 11 2020 - 8:29AM

Dow Jones News

By Sahil Patel

AT&T Inc.'s efforts to build a TV advertising business

fueled by its trove of consumer data got a boost with new deals

that enlist national commercial time on TV networks it doesn't

own.

Under the new arrangements, marketers will be able to use tools

offered by AT&T's Xandr advertising unit to plan for and buy

commercial time on networks operated by Walt Disney Co., whose

portfolio includes ABC and the cable channel Freeform, and AMC

Networks Inc. They also will be able to buy ad inventory from

networks such as CNN, TNT and TBS, which are part of AT&T's

WarnerMedia division.

Xandr's new deals center on national TV inventory sold by the

networks. It also has an addressable TV business, which sells

targeted ads within the two minutes of commercial time per hour

controlled by AT&T's DirecTV on the networks it carries.

Advertisers will be able to buy inventory from participating

networks through Xandr's Invest tool. Xandr won't actually control

or sell the outside companies' commercial time, according to a

company spokesman.

Executives from AMC, Disney and WarnerMedia said they would make

almost all of their national TV inventory available through Xandr

-- with a few exceptions, such as high-profile events like

WarnerMedia's telecasts of NCAA March Madness games.

"We're looking at this platform as a way to accelerate

data-driven linear buys," said Laura Nelson, senior vice president

of cross portfolio solutions for Disney's ad sales group.

Xandr is the linchpin for AT&T's efforts to build a

so-called advanced TV advertising business, which aims to mimic how

advertisers buy and target custom audience segments through digital

ad giants such as Facebook Inc. and Alphabet Inc.'s Google. Xandr

builds similar audience groups based on customer data from

AT&T's wireless and broadband businesses, DirecTV and AT&T

U-Verse, anonymously aggregated into segments such as homeowners or

those in the market for a new car.

Xandr's ad tools include Invest, a "demand-side platform" that

lets ad buyers access ad inventory; Monetize, a "supply-side

platform" through which publishers offer their ad inventory; and

Community, a marketplace that connects both tools and facilitates

transactions.

AT&T last fall acquired Clypd, which worked with TV networks

on data-based ad targeting and automated advertising, and

integrated it into Xandr's platform.

Xandr and its new TV partners said the new deals will give

marketers the ability to access a wider pool of national TV

commercial time, all in one place.

"It's hard for marketers to define a single, uniform audience

segment and transact against that across multiple publishers on

TV," said Dan Aversano, senior vice president of ad innovation and

programmatic solutions for WarnerMedia's ad sales group.

Xandr has found it slow-going in convincing other TV companies

to open up their national, traditional TV inventory, in part due to

competitive reasons, according to industry insiders. Other TV

powers are also interested in setting up data-driven advanced TV

products.

AT&T last year asked Viacom Inc., which since merged with

CBS Corp. to form ViacomCBS Inc., to buy advanced ad products and

sales services from Xandr during carriage talks between the

companies. A Xandr spokesman declined to comment on the outcome of

those talks.

Ms. Nelson said working with competitors has become common in

advertising, citing Disney's relationships with technology giants

like Facebook that have their own ad businesses. Executives from

the participating networks added that they have ensured all ad

sellers would be on equal footing on Xandr.

"We work with many partners in the space that also compete with

us in the marketplace," she said. "It's something we are

comfortable with."

Write to Sahil Patel at sahil.patel@wsj.com

(END) Dow Jones Newswires

March 11, 2020 08:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

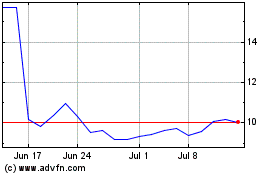

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

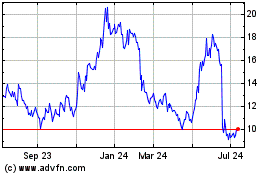

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Apr 2023 to Apr 2024