− Achieved First Quarter 2020 ONPATTRO® Net

Product Revenues of $66.7 Million with More Than 950 Patients on

Commercial Product Worldwide –

− Achieved First Quarter 2020 GIVLAARI® Net

Product Revenues of $5.3 Million with More Than 50 Patients on

Commercial Product in the U.S. –

– Completed New Drug Application and Filed

Marketing Authorisation Application for Lumasiran, Advancing

Another Alnylam Investigational RNAi Therapeutic toward Market

–

− Announces New Positive Initial Topline

Results from Ongoing Phase 1 Study of ALN-AGT in Hypertension with

Over 90 Percent Knockdown of Angiotensinogen and an Over 10 mmHg

Mean Reduction of 24-hour Systolic Blood Pressure Relative to

Placebo –

– Secured Bridge Enabling Self-Sustainable

Financial Profile without Need for Future Equity Offerings via $2

Billion Strategic Financing Collaboration with Blackstone –

– Lowers 2020 Guidance Range for ONPATTRO

Revenue from $285-$315 Million to $270-$300 Million due to COVID-19

Pandemic; Lowers Operating Expense Guidance –

Alnylam Pharmaceuticals, Inc. (Nasdaq: ALNY), the leading RNAi

therapeutics company, today reported its consolidated financial

results for the first quarter 2020 and reviewed recent business

highlights.

“The first quarter of 2020 was an unprecedented period, as the

world confronted the beginnings of an ongoing public health crisis

with the COVID-19 pandemic. It’s also a moment in time that

underscores how particularly proud we are at Alnylam to be part of

an industry advancing science and innovation to address the

coronavirus crisis at hand, while also maintaining our focus on

continuing to bring important medicines to patients in need. To

that end, we are very pleased with our first full quarter as a

multi-product, global commercial company where we delivered

continued and steady worldwide growth of ONPATTRO and impressive

early demand for GIVLAARI in the U.S.,” said John Maraganore,

Ph.D., Chief Executive Officer of Alnylam. “In addition, we also

continued to drive progress across our late-stage pipeline,

including submission of NDA and MAA filings for lumasiran,

completion of enrollment in the ILLUMINATE-B and HELIOS-A Phase 3

studies of lumasiran and vutrisiran, respectively, and continued

enrollment in our APOLLO-B and HELIOS-B Phase 3 studies of

patisiran and vutrisiran, respectively. We’re also thrilled to

highlight today the achievement of initial human proof of concept

for ALN-AGT in development for the treatment of hypertension, an

area of prevalent unmet need that cries out for innovation.”

Dr. Maraganore continued: “Notwithstanding these accomplishments

and our strong underlying confidence for Alnylam in 2020 and

beyond, the trajectory of the COVID-19 pandemic is dynamic and

remains uncertain in its scope, timeline, and impact to healthcare

systems. While we are implementing what we believe are appropriate

mitigation steps across our operations, we are lowering our 2020

revenue guidance for ONPATTRO by 5 percent and taking thoughtful

steps to reduce our expense profile. Notwithstanding the challenges

and uncertainties caused by the pandemic, we remain confident that

we are on track to exceed our Alnylam 2020 strategic plan announced

in 2015, building a multi-product, global biopharma company with a

deep clinical pipeline to fuel future growth and a robust, organic

product engine for sustainable innovation, a profile rarely

achieved in our industry.”

First Quarter 2020 and Recent Significant Corporate

Highlights

Commercial Performance

ONPATTRO®

- Achieved net product revenues for the first quarter of 2020 of

$66.7 million.

- Attained over 950 patients worldwide on commercial ONPATTRO

treatment as of March 31, 2020.

- Received marketing authorization approval for ONPATTRO in

Brazil for the treatment of hereditary transthyretin-mediated

(hATTR) amyloidosis in adults with stage 1 or stage 2

polyneuropathy, with patients now on commercial product.

- Continued progress with market access efforts across the

Canada, Europe, Middle East, and Africa (CEMEA) region, with recent

launches in Italy, Sweden, Israel, Turkey, and Spain.

- Maintained momentum in Asia with a strong launch in Japan and

submission of a New Drug Application (NDA) in Taiwan.

- In the U.S., Alnylam has now completed definitive value-based

agreements (VBAs) covering ONPATTRO with over 15 commercial payers,

including 9 of the top 10 commercial payers, with signed VBAs now

covering over 135 million U.S. lives in the aggregate.

GIVLAARI®

- Achieved net product revenues for the first quarter of 2020 of

$5.3 million, representing strong initial demand in the first full

quarter of the GIVLAARI launch in the U.S.

- Received over 60 Start Forms in the U.S. and attained over 50

patients on commercial GIVLAARI treatment from launch through March

31, 2020.

- Made significant progress toward establishing VBAs, including a

Prevalence-Based Adjustment feature, with multiple ongoing

discussions with U.S. payers; the Company announces today

finalization of the first VBA for GIVLAARI.

- Continued progress with market access efforts across the CEMEA

region, with initial launch underway in Germany.

- Continued work with physicians in multiple regions to provide

pre-approval access to GIVLAARI in an Expanded Access Program (EAP)

in accordance with local requirements.

R&D Highlights

- Advanced the development of patisiran (the

non-proprietary name for ONPATTRO) for the potential treatment of

the cardiomyopathy of both hereditary and wild-type ATTR

amyloidosis.

- Continued enrollment in the APOLLO-B Phase 3 study in ATTR

amyloidosis patients with cardiomyopathy.

- The Company announces today that due to the impact of the

COVID-19 pandemic, enrollment delays in APOLLO-B will result in a

shift in the enrollment completion date from late 2020 into

2021.

- Received approval of GIVLAARI (givosiran) in the

European Union for the treatment of acute hepatic porphyria (AHP)

in adults and adolescents aged 12 years and older, with patients

now on commercial product.

- Advanced lumasiran, an investigational RNAi therapeutic

in development for the treatment of primary hyperoxaluria type 1

(PH1).

- Initiated and completed the rolling submission of an NDA to the

Food and Drug Administration (FDA) and submitted a Marketing

Authorisation Application (MAA) to the European Medicines Agency

(EMA), completing the filings in less than four months after

announcing topline results from the ILLUMINATE-A Phase 3

study.

- Completed enrollment in the ILLUMINATE-B Phase 3 study of

lumasiran in PH1 patients less than six years of age with preserved

renal function, and remains on track to report topline results in

mid-2020.

- Continued enrollment in the ILLUMINATE-C Phase 3 study of

lumasiran for the treatment of advanced PH1 in patients of all

ages.

- Advanced vutrisiran, a subcutaneously administered

investigational RNAi therapeutic in development for the treatment

of ATTR amyloidosis.

- Completed enrollment in the HELIOS-A Phase 3 study in patients

with hereditary ATTR amyloidosis with polyneuropathy, and remains

on track to report topline results in early 2021.

- Received Fast Track Designation from the FDA for the treatment

of the polyneuropathy of hATTR amyloidosis.

- Continued enrollment in the HELIOS-B Phase 3 study in patients

with hereditary and wild-type ATTR amyloidosis with

cardiomyopathy.

- Inclisiran, potentially the first and only siRNA

cholesterol-lowering treatment, continues to advance under

Alnylam’s partner, Novartis.

- Acceptance of NDA and MAA by FDA and EMA, respectively.

- Findings published in The New England Journal of Medicine from

the completed ORION Phase 3 pivotal trials showing durable and

potent LDL-C reduction achieved with inclisiran, with a safety

profile similar to placebo.

- New analysis of pooled data from the completed ORION Phase 3

clinical trials presented at the American College of Cardiology’s

Annual Scientific Session.

- Alnylam’s partner, Sanofi, continues enrollment in the ATLAS

Phase 3 program for fitusiran in patients with hemophilia A

or B with and without inhibitors, with topline results expected in

H1 2021.

- Advanced early- and mid-stage RNAi therapeutic pipeline

programs.

- The Company announces today positive initial topline results

from the ongoing Phase 1 study (N=48) of ALN-AGT in

hypertension, providing initial human proof of concept with over 90

percent mean knockdown of angiotensinogen (AGT) and an over 10 mmHg

reduction of mean 24-hour systolic blood pressure at week 8

relative to placebo, with a durability that supports once quarterly

or less frequent dose administration. In addition, ALN-AGT

administration was associated with an encouraging safety and

tolerability profile including no drug-related serious adverse

events (SAEs).

- Alnylam’s partner, Vir Biotechnology, presented positive

interim data from the ongoing Phase 2 trial in patients and results

from the Phase 1 trial in healthy volunteers of ALN-HBV02

(VIR-2218), an investigational RNAi therapeutic for the

treatment of chronic hepatitis B virus (HBV) infection.

- Under expanded collaboration with Vir, selected a Development

Candidate (DC), ALN-COV (VIR-2703), for SARS-CoV-2 – the

virus that causes COVID-19 – with potent and highly cross-reactive

activity, with a plan for accelerated filing of an IND at or around

year-end 2020.

- The Company announces today that it will shift filing of its

ALN-LEC IND into 2021 to focus on its COVID-19

investigational RNAi therapeutic program.

Additional Business Updates

- Entered into a broad strategic financing collaboration with

Blackstone under which Alnylam will receive up to $2 billion that

is expected to enable Alnylam to achieve a self-sustainable

financial profile without the need for future equity

financing.

- Expanded collaboration with Vir to include the development and

commercialization of RNAi therapeutics targeting SARS-CoV-2 and up

to three additional targets focused on host factors for SARS-CoV-2,

including angiotensin converting enzyme-2 (ACE2), transmembrane

protease, serine 2 (TMPRSS2), and potentially a third host factor

target to emerge from Vir’s functional genomics work.

- Entered into an agreement with Dicerna to develop and

commercialize investigational RNAi therapeutics for the treatment

of alpha-1 antitrypsin (A1AT) deficiency-associated liver disease,

and completed a non-exclusive cross-licensing agreement with

Dicerna regarding the companies’ respective intellectual property

for Alnylam’s lumasiran and Dicerna’s nedosiran investigational

programs for the treatment of primary hyperoxaluria.

- Appointed Dr. Olivier Brandicourt, former CEO of Sanofi, to the

Company’s Board of Directors, and announced the retirement of Dr.

Paul Schimmel, an Alnylam co-founder, in May 2020 after nearly 18

years of service; Dr. Schimmel will remain a member of the

Company’s Scientific Advisory Board.

Upcoming Events

In mid-2020, Alnylam intends to:

- Continue global commercialization of ONPATTRO and

GIVLAARI.

- Present full results from the ILLUMINATE-A Phase 3 study of

lumasiran at the European Renal Association-European Dialysis and

Transplant Association (ERA-EDTA) Congress, currently scheduled for

June 7, 2020 as a virtual event.

- Report topline results from the ILLUMINATE-B Phase 3 study of

lumasiran.

- File a Clinical Trial Application (CTA) for ALN-HSD, an

investigational RNAi therapeutic targeting HSD17B13 for the

treatment of non-alcoholic steatohepatitis (NASH), in collaboration

with Regeneron.

Financial Results for the Quarter Ended March 31,

2020

“We believe our results for the first quarter demonstrate the

strength of our commercial teams in challenging circumstances,

delivering solid quarterly growth for ONPATTRO and robust uptake

for GIVLAARI in the U.S. in its first full quarter of launch. While

we have confidence in our business continuity plans, we expect an

impact from the COVID-19 pandemic and are lowering our 2020 revenue

guidance range for ONPATTRO by 5 percent from $285-$315 million to

$270-$300 million. In parallel, we are implementing further

discipline in our operations to moderate our spend and are lowering

our operating expense guidance range for the year,” said Jeff

Poulton, Chief Financial Officer of Alnylam. “Of course, a business

highlight for the recent period was the completion of our $2

billion strategic financing collaboration with Blackstone, the

largest ever financing of a pre-profitable biotechnology company.

We believe this new financing, together with our expectations for

continued topline growth and disciplined expense management,

bridges our transition toward a self-sustainable financial profile

without the need for future equity offerings. In sum, we believe

Alnylam is taking appropriate measures to operate through the

pandemic and recovery phases in 2020, into the ‘new normal’ and

beyond, continuing to deliver on the promise of RNAi therapeutics

and our commitments to patients and our shareholders.”

Financial Highlights (in thousands, except

per share amounts)

Three Months Ended March

31,

2020

2019

Net product revenues

$

71,938

$

26,291

ONPATTRO net product revenues

$

66,664

$

26,291

GIVLAARI net product revenues

$

5,274

$

—

Net revenue from collaborations

$

27,538

$

7,003

GAAP combined research and development and

selling, general and administrative expenses

$

296,332

$

218,735

Non-GAAP combined research and development

and selling, general and administrative expenses

$

261,754

$

186,703

GAAP operating loss

$

(210,158)

$

(188,788)

Non-GAAP operating loss

$

(175,580)

$

(156,756)

GAAP net loss

$

(182,221)

$

(181,915)

Non-GAAP net loss

$

(171,754)

$

(149,883)

GAAP net loss per common share - basic and

diluted

$

(1.62)

$

(1.73)

Non-GAAP net loss per common share - basic

and diluted

$

(1.52)

$

(1.42)

March 31, 2020

December 31, 2019

Cash, cash equivalents, marketable debt

and equity securities and restricted investments

$

1,366,928

$

1,550,987

Net Product Revenues

- Net product revenues were $71.9 million in the first quarter

2020 representing 174 percent growth from the first quarter 2019 as

a result of the addition of new patients on therapy and expansion

into new markets for ONPATTRO, as well as the U.S. commercial

launch of GIVLAARI.

Net Revenues from Collaborations

- Net revenues from collaborations were $27.5 million in the

first quarter 2020, an increase from $7.0 million in the first

quarter 2019, primarily due to revenues recognized from our

Regeneron and Vir collaborations.

Combined Research & Development (R&D) and Selling,

General & Administrative (SG&A) Expenses

- Combined R&D and SG&A expenses increased on a GAAP and

non-GAAP basis primarily due to increased activity related to the

advancement of our late stage R&D programs and increased

activity in commercial and medical affairs to support the ongoing

launches of ONPATTRO and GIVLAARI.

Cash and Investments

- Cash, cash equivalents, marketable debt and equity securities,

and restricted investments were $1.37 billion at the end of the

first quarter 2020 compared to $1.55 billion at the end of 2019.

The decrease was due to cash used in our operations to support

overall growth. Cash at the end of the first quarter excludes

$600.0 million in proceeds from the Blackstone strategic financing

collaboration, which closed in the second quarter.

A reconciliation of our GAAP to non-GAAP results for the current

quarter is included in the tables of this press release.

2020 Updated Financial Guidance

Full year 2020 financial guidance consists of the following:

Item

Provided 2/6/2020 ($

millions)

Updated 5/6/2020 ($

millions)

ONPATTRO net product revenues

$285 - $315

$270 - $300

GIVLAARI net product revenues

No guidance provided

Unchanged

Net revenues from collaborations

$100 - $150

Unchanged

GAAP R&D and SG&A expenses

$1,180 - $1,300

$1,155 - $1,250

Non-GAAP R&D and SG&A

expenses*

$1,025 - $1,125

$1,000 - $1,075

The $2 billion strategic financing collaboration with Blackstone

is expected to enable Alnylam’s achievement of a self-sustainable

financial profile without need for future equity financings.

*Excludes $155 million - $175 million of stock-based

compensation from estimated GAAP R&D and SG&A expenses.

Use of Non-GAAP Financial Measures This press release

contains non-GAAP financial measures, including expenses adjusted

to exclude certain non-cash expenses and non-recurring gains

outside the ordinary course of the Company’s business. These

measures are not in accordance with, or an alternative to, GAAP,

and may be different from non-GAAP financial measures used by other

companies.

The items included in GAAP presentations but excluded for

purposes of determining non-GAAP financial measures for the periods

presented in the press release are stock-based compensation

expenses and unrealized gain on marketable equity securities. The

Company has excluded the impact of stock-based compensation

expense, which may fluctuate from period to period based on factors

including the variability associated with performance-based grants

for stock options and restricted stock units and changes in the

Company’s stock price, which impact the fair value of these awards.

The Company has excluded the impact of the unrealized gain on

marketable equity securities because the Company believes this item

is a one-time event occurring outside the ordinary course of the

Company’s business.

The Company believes the presentation of non-GAAP financial

measures provides useful information to management and investors

regarding the Company’s financial condition and results of

operations. When GAAP financial measures are viewed in conjunction

with non-GAAP financial measures, investors are provided with a

more meaningful understanding of the Company’s ongoing operating

performance and are better able to compare the Company’s

performance between periods. In addition, these non-GAAP financial

measures are among those indicators the Company uses as a basis for

evaluating performance, allocating resources and planning and

forecasting future periods. Non-GAAP financial measures are not

intended to be considered in isolation or as a substitute for GAAP

financial measures. A reconciliation between GAAP and non-GAAP

measures is provided later in this press release.

Conference Call Information Management will provide an

update on the Company and discuss first quarter 2020 results as

well as expectations for the future via conference call on

Wednesday, May 6, 2020 at 8:30 am ET. To access the call, please

dial 800-239-9838 (domestic) or +1-323-794-2551 (international)

five minutes prior to the start time and refer to conference ID

6976021. A replay of the call will be available beginning at 11:30

am ET on the day of the call. To access the replay, please dial

888-203-1112 (domestic) or +1-719-457-0820 (international) and

refer to conference ID 6976021.

A live audio webcast of the call will be available on the

Investors section of the Company’s website at

www.alnylam.com/events. An archived webcast will be available on

the Alnylam website approximately two hours after the event.

About ONPATTRO® (patisiran) ONPATTRO is an RNAi

therapeutic that was approved in the United States and Canada for

the treatment of the polyneuropathy of hATTR amyloidosis in adults.

ONPATTRO is also approved in the European Union, Switzerland and

Brazil for the treatment of hATTR amyloidosis in adults with Stage

1 or Stage 2 polyneuropathy, and in Japan for the treatment of

hATTR amyloidosis with polyneuropathy. ONPATTRO is an intravenously

administered RNAi therapeutic targeting transthyretin (TTR). It is

designed to target and silence TTR messenger RNA, thereby blocking

the production of TTR protein before it is made. ONPATTRO blocks

the production of TTR in the liver, reducing its accumulation in

the body’s tissues in order to halt or slow down the progression of

the polyneuropathy associated with the disease. For more

information about ONPATTRO, visit ONPATTRO.com.

ONPATTRO Important Safety Information Infusion-Related Reactions Infusion-related

reactions (IRRs) have been observed in patients treated with

ONPATTRO® (patisiran). In a controlled clinical study, 19% of

ONPATTRO-treated patients experienced IRRs, compared to 9% of

placebo-treated patients. The most common symptoms of IRRs with

ONPATTRO were flushing, back pain, nausea, abdominal pain, dyspnea,

and headache.

To reduce the risk of IRRs, patients should receive

premedication with a corticosteroid, acetaminophen, and

antihistamines (H1 and H2 blockers) at least 60 minutes prior to

ONPATTRO infusion. Monitor patients during the infusion for signs

and symptoms of IRRs. If an IRR occurs, consider slowing or

interrupting the infusion and instituting medical management as

clinically indicated. If the infusion is interrupted, consider

resuming at a slower infusion rate only if symptoms have resolved.

In the case of a serious or life-threatening IRR, the infusion

should be discontinued and not resumed.

Reduced Serum Vitamin A Levels and

Recommended Supplementation ONPATTRO treatment leads to a

decrease in serum vitamin A levels. Supplementation at the

recommended daily allowance (RDA) of vitamin A is advised for

patients taking ONPATTRO. Higher doses than the RDA should not be

given to try to achieve normal serum vitamin A levels during

treatment with ONPATTRO, as serum levels do not reflect the total

vitamin A in the body.

Patients should be referred to an ophthalmologist if they

develop ocular symptoms suggestive of vitamin A deficiency (e.g.

night blindness).

Adverse Reactions The most common

adverse reactions that occurred in patients treated with ONPATTRO

were upper respiratory tract infections (29%) and infusion-related

reactions (19%).

Indication ONPATTRO is indicated

for the treatment of the polyneuropathy of hereditary

transthyretin-mediated amyloidosis in adults.

For additional information about ONPATTRO, please see the full

Prescribing Information.

About GIVLAARI® (givosiran) GIVLAARI is an RNAi

therapeutic targeting aminolevulinic acid synthase 1 (ALAS1) for

the treatment of adults and adolescents with acute hepatic

porphyria (AHP). In the pivotal study, givosiran was shown to

significantly reduce the rate of porphyria attacks that required

hospitalizations, urgent healthcare visits or intravenous hemin

administration at home compared to placebo. GIVLAARI is Alnylam’s

first commercially available therapeutic based on its Enhanced

Stabilization Chemistry ESC-GalNAc conjugate technology to increase

potency and durability. GIVLAARI is administered via subcutaneous

injection once monthly at a dose based on actual body weight and

should be administered by a healthcare professional. GIVLAARI works

by specifically reducing elevated levels of aminolevulinic acid

synthase 1 (ALAS1) messenger RNA (mRNA), leading to reduction of

toxins associated with attacks and other disease manifestations of

AHP. For more information about GIVLAARI, visit GIVLAARI.com.

GIVLAARI Important Safety Information Contraindications

GIVLAARI is contraindicated in patients with known severe

hypersensitivity to givosiran. Reactions have included

anaphylaxis.

Anaphylactic Reaction Anaphylaxis has occurred with GIVLAARI

treatment (<1% of patients in clinical trials). Ensure that

medical support is available to appropriately manage anaphylactic

reactions when administering GIVLAARI. Monitor for signs and

symptoms of anaphylaxis. If anaphylaxis occurs, immediately

discontinue administration of GIVLAARI and institute appropriate

medical treatment.

Hepatic Toxicity Transaminase elevations (ALT) of at least 3

times the upper limit of normal (ULN) were observed in 15% of

patients receiving GIVLAARI in the placebo-controlled trial.

Transaminase elevations primarily occurred between 3 to 5 months

following initiation of treatment.

Measure liver function tests prior to initiating treatment with

GIVLAARI, repeat every month during the first 6 months of

treatment, and as clinically indicated thereafter. Interrupt or

discontinue treatment with GIVLAARI for severe or clinically

significant transaminase elevations. In patients who have dose

interruption and subsequent improvement, reduce the dose to 1.25

mg/kg once monthly. The dose may be increased to the recommended

dose of 2.5 mg/kg once monthly if there is no recurrence of severe

or clinically significant transaminase elevations at the 1.25 mg/kg

dose.

Renal Toxicity Increases in serum creatinine levels and

decreases in estimated glomerular filtration rate (eGFR) have been

reported during treatment with GIVLAARI. In the placebo-controlled

study, 15% of patients receiving GIVLAARI experienced a

renally-related adverse reaction. The median increase in creatinine

at Month 3 was 0.07 mg/dL. Monitor renal function during treatment

with GIVLAARI as clinically indicated.

Injection Site Reactions Injection site reactions were reported

in 25% of patients receiving GIVLAARI in the placebo-controlled

trial. Symptoms included erythema, pain, pruritus, rash,

discoloration, or swelling around the injection site. One (2%)

patient experienced a single, transient, recall reaction of

erythema at a prior injection site with a subsequent dose

administration.

Drug Interactions Concomitant use of GIVLAARI increases the

concentration of CYP1A2 or CYP2D6 substrates, which may increase

adverse reactions of these substrates. Avoid concomitant use of

GIVLAARI with CYP1A2 or CYP2D6 substrates for which minimal

concentration changes may lead to serious or life-threatening

toxicities. If concomitant use is unavoidable, decrease the CYP1A2

or CYP2D6 substrate dosage in accordance with approved product

labeling.

Adverse Reactions The most common adverse reactions that

occurred in patients receiving GIVLAARI were nausea (27%) and

injection site reactions (25%).

For additional information about GIVLAARI, please see full

Prescribing Information.

About LNP Technology Alnylam has licenses to Arbutus

Biopharma LNP intellectual property for use in RNAi therapeutic

products using LNP technology.

About RNAi RNAi (RNA interference) is a natural cellular

process of gene silencing that represents one of the most promising

and rapidly advancing frontiers in biology and drug development

today. Its discovery has been heralded as “a major scientific

breakthrough that happens once every decade or so,” and was

recognized with the award of the 2006 Nobel Prize for Physiology or

Medicine. By harnessing the natural biological process of RNAi

occurring in our cells, a new class of medicines, known as RNAi

therapeutics, is now a reality. Small interfering RNA (siRNA), the

molecules that mediate RNAi and comprise Alnylam's RNAi therapeutic

platform, function upstream of today’s medicines by potently

silencing messenger RNA (mRNA) – the genetic precursors – that

encode for disease-causing proteins, thus preventing them from

being made. This is a revolutionary approach with the potential to

transform the care of patients with genetic and other diseases.

About Alnylam Pharmaceuticals Alnylam (Nasdaq: ALNY) is

leading the translation of RNA interference (RNAi) into a whole new

class of innovative medicines with the potential to transform the

lives of people afflicted with rare genetic, cardio-metabolic,

hepatic infectious, and central nervous system (CNS)/ocular

diseases. Based on Nobel Prize-winning science, RNAi therapeutics

represent a powerful, clinically validated approach for the

treatment of a wide range of severe and debilitating diseases.

Founded in 2002, Alnylam is delivering on a bold vision to turn

scientific possibility into reality, with a robust RNAi

therapeutics platform. Alnylam’s commercial RNAi therapeutic

products are ONPATTRO® (patisiran), approved in the U.S., EU,

Canada, Japan, Switzerland and Brazil, and GIVLAARI® (givosiran),

approved in the U.S. and EU. Alnylam has a deep pipeline of

investigational medicines, including six product candidates that

are in late-stage development. Alnylam is executing on its “Alnylam

2020” strategy of building a multi-product, commercial-stage

biopharmaceutical company with a sustainable pipeline of RNAi-based

medicines to address the needs of patients who have limited or

inadequate treatment options. Alnylam is headquartered in

Cambridge, MA. For more information about our people, science and

pipeline, please visit www.alnylam.com and engage with us on

Twitter at @Alnylam or on LinkedIn.

Alnylam Forward Looking Statements Various statements in

this release concerning Alnylam’s expectations, plans and

prospects, including, without limitation, expectations regarding

the direct or indirect effects on Alnylam’s business, activities

and prospects as a result of the COVID-19 pandemic, or delays or

interruptions resulting therefrom and the success of Alnylam’s

mitigation efforts, Alnylam's views and plans with respect to the

potential for RNAi therapeutics, including ONPATTRO, GIVLAARI,

lumasiran, patisiran, vutrisiran, inclisiran, fitusiran, ALN-AAT02,

ALN-HBV02, ALN-AGT, ALN-COV and ALN-HSD, its expectations for

ALN-AGT as a potential treatment of hypertension, an area of

prevalent unmet need, its plans for additional global regulatory

filings and the continuing product launches of ONPATTRO and

GIVLAARI, expectations regarding reimbursement for ONPATTRO and

GIVLAARI in various territories and the status of VBA negotiations

and executed agreements, the advancement of lumasiran and

inclisiran through regulatory review and toward the market, the

expected presentation of full ILLUMINATE-A Phase 3 results and

topline ILLUMINATE-B Phase 3 results for lumasiran, the achievement

of additional pipeline milestones, including relating to ongoing

clinical studies of vutrisiran and the delay in completion of

enrollment in its APOLLO-B study of patisiran in ATTR amyloidosis

with cardiomyopathy due to the impact of COVID-19, the expected

timing for filing INDs for ALN-COV and ALN-HSD, as well as the

delayed filing of an IND for ALN-LEC, its expectations relating to

continued ONPATTRO and GIVLAARI revenue growth and the revised

expected range of ONPATTRO net product revenues for 2020, the

expected range for net revenues from collaborations for 2020, the

expected range of 2020 aggregate annual non-GAAP and GAAP R&D

and SG&A expenses after reductions expected from the

implementation of further discipline in operations to moderate

spend, Alnylam’s belief that the funding provided by Blackstone

should enable Alnylam to achieve a self-sustainable profile without

the need for future equity financing, and expectations regarding

the achievement or potential to exceed its “Alnylam 2020” strategic

plan announced in 2015 for the advancement and commercialization of

RNAi therapeutics, constitute forward-looking statements for the

purposes of the safe harbor provisions under The Private Securities

Litigation Reform Act of 1995. Actual results and future plans may

differ materially from those indicated by these forward-looking

statements as a result of various important risks, uncertainties

and other factors, including, without limitation: the direct or

indirect impact of the COVID-19 global pandemic or a future

pandemic, such as the scope and duration of the outbreak,

government actions and restrictive measures implemented in

response, material delays in diagnoses of rare diseases, initiation

or continuation of treatment for diseases addressed by Alnylam

products, or in patient enrollment in clinical trials, potential

supply chain disruptions, and other potential impacts to Alnylam’s

business, the effectiveness or timeliness of steps taken by Alnylam

to mitigate the impact of the pandemic, and Alnylam’s ability to

execute business continuity plans to address disruptions caused by

the COVID-19 or a future pandemic; Alnylam's ability to discover

and develop novel drug candidates and delivery approaches and

successfully demonstrate the efficacy and safety of its product

candidates, including vutrisiran, ALN-AGT, ALN-HSD and ALN-COV; the

pre-clinical and clinical results for its product candidates, which

may not be replicated or continue to occur in other subjects or in

additional studies or otherwise support further development of

product candidates for a specified indication or at all; actions or

advice of regulatory agencies, which may affect the design,

initiation, timing, continuation and/or progress of clinical trials

or result in the need for additional pre-clinical and/or clinical

testing; delays, interruptions or failures in the manufacture and

supply of its product candidates or its marketed products,

including ONPATTRO, GIVLAARI, inclisiran, lumasiran and vutrisiran;

obtaining, maintaining and protecting intellectual property;

intellectual property matters including potential patent litigation

relating to its platform, products or product candidates; obtaining

regulatory approval for its product candidates, including lumasiran

and inclisiran, and maintaining regulatory approval and obtaining

pricing and reimbursement for its products, including ONPATTRO and

GIVLAARI; progress in continuing to establish a commercial and

ex-United States infrastructure; successfully launching, marketing

and selling its approved products globally, including ONPATTRO and

GIVLAARI and achieving net product revenues for ONPATTRO within its

revised expected range during 2020; Alnylam’s ability to

successfully expand the indication for ONPATTRO in the future;

competition from others using technology similar to Alnylam's and

others developing products for similar uses; Alnylam's ability to

manage its growth and operating expenses within the reduced ranges

of guidance provided by Alnylam through the implementation of

further discipline in operations to moderate spend and its ability

to achieve a self-sustainable financial profile in the future

without the need for future equity financing; Alnylam’s ability to

establish and maintain strategic business alliances and new

business initiatives, including completing an agreement for funding

by Blackstone of certain R&D activities for vutrisiran and

ALN-AGT; Alnylam's dependence on third parties, including

Regeneron, for development, manufacture and distribution of certain

products, including eye and CNS products, and Ironwood, for

assistance with the education about and promotion of GIVLAARI, and

Vir for the development of ALN-COV and other potential RNAi

therapeutics targeting SARS-CoV-2 and host factors for SARS-CoV-2;

the outcome of litigation; the risk of government investigations;

and unexpected expenditures, as well as those risks more fully

discussed in the “Risk Factors” filed with Alnylam's most recent

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission (SEC) and in other filings that Alnylam makes

with the SEC. In addition, any forward-looking statements represent

Alnylam's views only as of today and should not be relied upon as

representing its views as of any subsequent date. Alnylam

explicitly disclaims any obligation, except to the extent required

by law, to update any forward-looking statements.

ALNYLAM PHARMACEUTICALS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands, except per share amounts) (Unaudited)

Three Months Ended March

31,

2020

2019

Statements of Operations

Revenues:

Net product revenues

$

71,938

$

26,291

Net revenues from collaborations

27,538

7,003

Total revenues

99,476

33,294

Operating costs and expenses:

Cost of goods sold

$

13,302

$

3,347

Research and development

169,571

129,127

Selling, general and administrative

126,761

89,608

Total operating costs and expenses

309,634

222,082

Loss from operations

(210,158)

(188,788)

Other income:

Interest income

5,480

7,525

Other income

23,032

43

Total other income

28,512

7,568

Loss before income taxes

(181,646)

(181,220)

Provision for income taxes

(575)

(695)

Net loss

$

(182,221)

$

(181,915)

Net loss per common share - basic and

diluted

$

(1.62)

$

(1.73)

Weighted-average common shares used to

compute basic and diluted net loss per common share

112,748

105,400

Statements of Comprehensive

Loss

Net loss

$

(182,221)

$

(181,915)

Unrealized gain on marketable debt

securities

4,045

360

Foreign currency translation

340

—

Defined benefit pension plans, net of

tax

74

—

Comprehensive loss

$

(177,762)

$

(181,555)

ALNYLAM PHARMACEUTICALS, INC.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES (In

thousands, except per share amounts)

Three Months Ended March

31,

2020

2019

Reconciliation of GAAP to Non-GAAP

R&D and SG&A expenses:

GAAP R&D and SG&A expenses

296,332

218,735

Less: Stock-based compensation

expenses

(34,578)

(32,032)

Non-GAAP R&D and SG&A expenses

261,754

186,703

Reconciliation of GAAP to Non-GAAP

operating loss:

GAAP operating loss

(210,158)

(188,788)

Add: Stock-based compensation expenses

34,578

32,032

Non-GAAP operating loss

(175,580)

(156,756)

Reconciliation of GAAP to Non-GAAP net

loss:

GAAP net loss

(182,221)

(181,915)

Add: Stock-based compensation expenses

34,578

32,032

Less: Unrealized gain on marketable equity

securities

(24,111)

—

Non-GAAP net loss

(171,754)

(149,883)

Reconciliation of GAAP to Non-GAAP net

loss per common share-basic and diluted:

GAAP net loss per common share - basic and

diluted

(1.62)

(1.73)

Add: Stock-based compensation expenses

0.31

0.31

Less: Unrealized gain on marketable equity

securities

(0.21)

—

Non-GAAP net loss per common share - basic

and diluted

(1.52)

(1.42)

Please note that the figures presented

above may not sum exactly due to rounding

ALNYLAM PHARMACEUTICALS, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands,

except share amounts) (Unaudited)

March 31, 2020

December 31, 2019

Cash, cash equivalents and marketable debt

and equity securities

$

1,342,203

$

1,536,162

Restricted investments

24,725

14,825

Accounts receivable, net

75,572

43,011

Inventory

68,300

56,348

Prepaid expenses and other assets

117,730

98,412

Property, plant and equipment, net

429,814

425,179

Operating lease right-of-use lease

assets

221,280

221,197

Total assets

$

2,279,624

$

2,395,134

Accounts payable, accrued expenses and

other liabilities

$

232,903

$

256,415

Total deferred revenue

392,167

396,204

Operating lease liability

304,825

303,823

Total stockholders’ equity (113.2 million

shares issued and outstanding at March 31, 2020; 112.2 million

shares issued and outstanding at December 31, 2019)

1,349,729

1,438,692

Total liabilities and stockholders'

equity

$

2,279,624

$

2,395,134

This selected financial information should be read in

conjunction with the consolidated financial statements and notes

thereto included in Alnylam’s Annual Report on Form 10-K which

includes the audited financial statements for the year ended

December 31, 2019.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200506005169/en/

Alnylam Pharmaceuticals, Inc. Christine Regan Lindenboom

(Investors and Media) 617-682-4340

Josh Brodsky (Investors) 617-551-8276

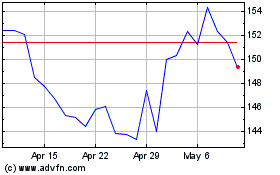

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Apr 2023 to Apr 2024