Blackstone Bets On Biotechnology -- WSJ

April 14 2020 - 3:02AM

Dow Jones News

Alnylam gets cash and $750 million loan to help bring late-stage

drugs to market

By Miriam Gottfried

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 14, 2020).

Blackstone Group Inc. is investing $2 billion in Alnylam

Pharmaceuticals Inc. through a combination of equity and debt,

giving the biotech company the cash it needs to bring more of its

products to market.

The biggest piece of the deal, announced Monday, consists of a

$1 billion investment led by Blackstone Life Sciences to purchase

up to 10% of the future total royalties of inclisiran, a drug to

treat high cholesterol. The life-sciences unit will also invest up

to $150 million in the development of two other Alnylam drugs.

The Wall Street Journal first reported the deal earlier

Monday.

On top of that, Blackstone credit arm GSO Capital Partners is

providing Alnylam with a term loan of up to $750 million, and

Blackstone is buying $100 million of the company's newly issued

stock. The deal gives Alnylam, a publicly traded company with a

market capitalization of around $13 billion, the firepower to move

through the costly phase of bringing late-stage drugs to market.

With Blackstone receiving a relatively small amount of stock,

Alnylam avoids significantly diluting its existing

shareholders.

"We're using our domain expertise, together with our scale, to

solve a unique problem for Alnylam, while advancing potentially

game-changing treatments for patients," said Nicholas Galakatos,

head of Blackstone Life Sciences.

Inclisiran is designed to be administered as a semiannual

injection for patients with high cholesterol for whom traditional

cholesterol drugs haven't been effective. The companies expect to

receive approval from the U.S. Food and Drug Administration in the

fourth quarter and from European regulators in the following

quarter.

The loan component of the deal is noteworthy both for its size

and because biotech companies with unproven drugs and uncertain

cash flow are often considered too risky for many lenders. Alnylam

was unique because it has two drugs already on the market and a

manufacturing facility, in addition to the new cholesterol drug,

said Brad Marshall, a senior managing director at GSO.

The combination of relatively low risk and relatively high need

for capital puts Alnylam in the sweet spot for Blackstone Life

Sciences, a business line the private-equity firm launched in the

fall of 2018 when it purchased Mr. Galakatos's investment firm

Clarus.

In February 2019, Blackstone Life Sciences invested $250 million

in a joint venture with Novartis AG to develop drugs to treat blood

clots. In November, the unit contributed $400 million to a joint

venture with Ferring Pharmaceuticals Inc. to develop and market a

gene therapy to treat bladder cancer.

A regulatory filing in January showed that the life-sciences

unit had raised $3.4 billion so far of the $4.6 billion it is

targeting for a new fund.

Blackstone Group, which had $571 billion in assets under

management at the end of 2019, is counting on such initiatives,

along with growth investing, insurance and infrastructure, to help

it achieve its goal of reaching $1 trillion in assets by 2026.

Blackstone, under Chief Executive Stephen Schwarzman, had about

$150 billion in unspent cash to do deals as of the end of last

year.

Based in Cambridge, Mass., Alnylam was founded in 2002 and went

public in 2004. It designs its drugs using a technology called RNA

interference, which intercepts disease-causing proteins.

"With this capital infusion, we can now get to profitability

without the drip, drip, drip of equity dilution," Alnylam Chief

Executive John Maraganore said.

Write to Miriam Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

April 14, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

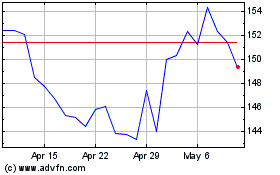

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Apr 2023 to Apr 2024