Airgain, Inc. (NASDAQ: AIRG), a leading provider of advanced

antenna technologies used to enable high performance wireless

networking across a broad range of devices and markets, including

connected home, enterprise, automotive, and Internet of Things

(IoT), today announced record sales for the third quarter 2018,

GAAP diluted EPS of $0.04, and a return to GAAP earnings

profitability.

“We are very pleased with our third quarter results as we

continue to execute favorably on our stated goals, both on the

sales growth and sustainable profitability front. On the sales

growth front, we delivered record sales for the third consecutive

quarter and reported 27% year-over-year growth. The strength in our

third quarter sales reflect robust demand across our service

provider customer base for next-generation broadband technologies.

We expect to build up on our recent design win momentum within the

Connected Home, Enterprise, IoT, and Automotive markets as these

markets support higher bandwidth speeds and more complex antenna

designs. On the profitability front, we reported third quarter GAAP

and non-GAAP diluted earnings per share of $0.04 and $0.09,

respectively, ahead of our prior expectations. We are pleased with

our renewed focus on execution combined with our recent decisions

on the operating front that have resulted in our return to

profitability, both on a GAAP and non-GAAP basis during the

quarter,” said Airgain’s Interim Chief Executive Officer Jim

Sims.

Third Quarter 2018 Financial Highlights

- Sales of $15.8 million

- Gross margin of 43%

- GAAP earnings per diluted share of

$0.04

- Non-GAAP earnings per diluted share of

$0.09

- Adjusted EBITDA of $1.0 million

Third Quarter 2018 Financial Results

Sales increased 27% to $15.8 million compared to $12.4 million

in the same year-ago period. The increase in sales was primarily

driven by a ramp in existing programs as well as contributions from

new designs.

Gross profit increased 14% to $6.9 million from $6.0 million in

Q3 of last year. Gross margin as a percentage of sales was 43% in

the third quarter of 2018, which declined from 48% in the same

year-ago period, largely due to a combination of product mix along

with ramp of new programs.

Total operating expenses for the third quarter of 2018 increased

13% to $6.6 million from $5.8 million in Q3 of last year. The

increase was primarily due to an increase in personnel expenses to

support the Company’s sales, marketing, and R&D

initiatives.

Net income totaled $0.4 million or $0.04 per diluted share

(based on 10.1 million shares), compared to net income of $0.2

million or $0.02 per diluted share (based on 10.2 million shares)

in the same year-ago period.

Non-GAAP net income totaled $0.9 million or $0.09 per diluted

share (based on 10.1 million shares), compared to non-GAAP net

income of $0.6 million or $0.05 per diluted share (based on 10.2

million shares) in the same year-ago period (see note regarding

"Use of Non-GAAP Financial Measures," below for further discussion

of this non-GAAP measure).

Adjusted EBITDA (earnings before interest, taxes, depreciation,

amortization, acquisition expenses, other income, non-recurring

items and share-based compensation) increased to net income of $1.0

million from net income of $0.7 million in the same year-ago period

(see note regarding "Use of Non-GAAP Financial Measures," below for

further discussion of this non-GAAP measure).

Total shares repurchased for the third quarter 2018 were 42,995

shares at an average price of $11.95, for a total amount of $0.5

million.

Nine Months 2018 Financial Highlights

- Sales of $44.1 million

- Gross margin of 45%

- GAAP earnings per diluted share of

$(0.41)

- Non-GAAP earnings per diluted share of

$0.05

- Adjusted EBITDA of $0.9 million

Nine Months 2018 Financial Results

Sales increased 20% to $44.1 million compared to $36.7 million

in the same year-ago period. The increase in sales was primarily

driven by a ramp in existing programs as well as contributions from

new designs.

Gross profit grew 13% to $19.7 million from $17.4 million for

the first nine months of last year. Gross margin as a percentage of

sales was 45% in the first nine months of 2018, which was slightly

below gross margins of 47% in the same year-ago period.

Total operating expenses for the first nine months of 2018 grew

43% to $24.2 million from $16.9 million in the first nine months of

last year. The increase was primarily due to $2.0 million in

non-recurring items associated with the realignment of sales and

marketing initiatives combined with executive severance and $1.2

million in additional stock compensation expense due to the

acceleration of options for former executives. The remaining

increase is due to an increase in personnel expenses to support the

Company’s sales, marketing, and R&D initiatives.

Net loss totaled $3.9 million or $(0.41) per diluted share

(based on 9.5 million shares), compared to net income of $0.5

million or $0.05 per diluted share (based on 10.2 million shares)

in the same year-ago period. During the first nine months of 2018,

the impact of non-recurring items to GAAP earnings per diluted

share was ($0.21) which included realignment of sales and marketing

initiatives combined with executive severance.

Non-GAAP net income totaled $0.5 million or $0.05 per diluted

share (based on 10.0 million shares), compared to non-GAAP net

income of $2.2 million or $0.22 per diluted share (based on 10.2

million shares) in the same year-ago period (see note regarding

"Use of Non-GAAP Financial Measures," below for further discussion

of this non-GAAP measure).

Adjusted EBITDA (earnings before interest, taxes, depreciation,

amortization, acquisition expenses, other income, non-recurring

items and share-based compensation) decreased to $0.9 million from

$2.6 million in the same year-ago period (see note regarding "Use

of Non-GAAP Financial Measures," below for further discussion of

this non-GAAP measure).

Total shares repurchased for the first nine months of 2018 were

193,523 shares at an average price of $9.49, for a total amount of

$1.8 million.

Financial Outlook

The Company expects sales in the fourth quarter 2018 to be in

the range of $16.4 million to $16.5 million. For the fourth quarter

2018, the Company expects GAAP diluted EPS in the range of $0.02 to

$0.03 and non-GAAP diluted EPS to be in the range of $0.07 to

$0.08.

The following table summarizes the reconciliation between the

projected GAAP EPS and non-GAAP EPS for the fourth quarter

2018:

Low (1) High (1) Reconciliation of

projected GAAP to projected non-GAAP EPS Projected GAAP

earnings per diluted share $ 0.02 $ 0.03 Stock-based compensation

expense 0.04 0.04 Amortization 0.02 0.02 Other income (0.01

) (0.01 ) Projected Non-GAAP earnings per diluted share $

0.07 $ 0.08

(1) Amounts are based off of 10.0 million

diluted shares outstanding.

For fiscal year 2018, the Company reaffirms its sales outlook of

at least 20% growth over fiscal year 2017.

Conference Call

Airgain management will hold a conference call today Thursday,

November 1, 2018 at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time)

to discuss financial results for the third quarter ended September

30, 2018, and to provide an update on business conditions.

Airgain management will host the presentation, followed by a

question and answer period.

Date: Thursday, November 1, 2018Time: 4:30 p.m. Eastern Time

(1:30 p.m. Pacific Time)U.S. dial-in: 1-877-451-6152International

dial-in: 1-201-389-0879

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact the company at 1-760-579-0200.

The conference call will be broadcast live and available for

replay in the investor relations section of the company's

website.

A replay of the call will be available after 7:30 p.m. Eastern

Time on the same day through December 9, 2018.

U.S. replay dial-in: 1-844-512-2921International replay dial-in:

1-412-317-6671Replay ID: 13683831

About Airgain, Inc.

Airgain is a leading provider of advanced antenna

technologies used to enable high performance wireless networking

across a broad range of devices and markets, including connected

home, enterprise, automotive, and Internet of Things (IoT).

Combining design-led thinking with testing and development, Airgain

works in partnership with the entire ecosystem, including carriers,

chipset suppliers, OEMs, and ODMs. Airgain’s antennas are deployed

in carrier, fleet, enterprise, residential, private, government,

and public safety wireless networks and systems, including set-top

boxes, access points, routers, modems, gateways, media adapters,

portables, digital televisions, sensors, fleet, and asset tracking

devices. Airgain is headquartered in San Diego, California, and

maintains design and test centers in the U.S., U.K., and China. For

more information, visit airgain.com, or follow us on LinkedIn

and Twitter.

Airgain and the Airgain logo are registered

trademarks of Airgain, Inc.

Forward-Looking Statements

Airgain cautions you that statements in this press release that

are not a description of historical facts are forward-looking

statements. These statements are based on the company's current

beliefs and expectations. These forward-looking statements include

statements regarding the buildup on our recent design win momentum,

within the Connected Home, Enterprise, IoT and Automotive markets

and the robust demand across our service provider customer base for

next-generation broadband technologies, our continued focus on

growth and sustainable profitability, both on a GAAP and non-GAAP

basis, and our fourth quarter and 2018 financial outlook. The

inclusion of forward-looking statements should not be regarded as a

representation by Airgain that any of our plans will be achieved.

Actual results may differ from those set forth in this press

release due to the risk and uncertainties inherent in our business,

including, without limitation: the market for our antenna products

is developing and may not develop as we expect; our operating

results may fluctuate significantly, including based on seasonal

factors, which makes future operating results difficult to predict

and could cause our operating results to fall below expectations or

guidance; risks and uncertainties related to management and key

personnel changes; our products are subject to intense competition,

including competition from the customers to whom we sell, and

competitive pressures from existing and new companies may harm our

business, sales, growth rates and market share; our future success

depends on our ability to develop and successfully introduce new

and enhanced products for the wireless market that meet the needs

of our customers; our ability to identify and consummate strategic

acquisitions and partnerships, and risks associated with completed

acquisitions and partnerships adversely affecting our operating

results and financial condition; we sell to customers who are

extremely price conscious, and a few customers represent a

significant portion of our sales, and if we lose any of these

customers, our sales could decrease significantly; we rely on a few

contract manufacturers to produce and ship all of our products, a

single or limited number of suppliers for some components of our

products and channel partners to sell and support our products, and

the failure to manage our relationships with these parties

successfully could adversely affect our ability to market and sell

our products; if we cannot protect our intellectual property

rights, our competitive position could be harmed or we could incur

significant expenses to enforce our rights; and other risks

described in our prior press releases and in our filings with the

Securities and Exchange Commission (SEC), including under the

heading "Risk Factors" in our Annual Report on Form 10-K and any

subsequent filings with the SEC. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date hereof, and we undertake no obligation to

revise or update this press release to reflect events or

circumstances after the date hereof. All forward-looking statements

are qualified in their entirety by this cautionary statement, which

is made under the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995.

Note Regarding Use of Non-GAAP Financial Measures

To supplement our condensed financial statements presented in

accordance with U.S. generally accepted accounting principles

(GAAP), this earnings release and the accompanying tables and the

related earnings conference call contain certain non-GAAP financial

measures, including adjusted earnings before interest, taxes,

depreciation, amortization (Adjusted EBITDA), non-GAAP net income

attributable to common stockholders (non-GAAP Net income), and

non-GAAP earnings per diluted share (non-GAAP EPS). We believe

these financial measures provide useful information to investors

with which to analyze our operating trends and performance.

In computing Adjusted EBITDA, non-GAAP Net income, and non-GAAP

EPS, we also exclude stock-based compensation expense, which

represents non-cash charges for the fair value of stock options and

other non-cash awards granted to employees, acquisition related

expenses, which include due diligence, legal, integration, and

regulatory expenses, non-recurring expenses, which include

realignment of sales and marketing initiatives, severance payments

and implementation costs, other income, which includes interest

income and gain on deferred purchase price liability offset by

interest expense, depreciation, amortization and provision for

income taxes. Because of varying available valuation methodologies,

subjective assumptions and the variety of equity instruments that

can impact a company's non-cash operating expenses, we believe that

providing non-GAAP financial measures that exclude non-cash expense

allows for meaningful comparisons between our core business

operating results and those of other companies, as well as

providing us with an important tool for financial and operational

decision making and for evaluating our own core business operating

results over different periods of time. In addition, our recent

acquisition related activities resulted in operating expenses that

would not have otherwise been incurred. Management considers these

types of expenses and adjustments, to a great extent, to be

unpredictable and dependent on a significant number of factors that

are outside of our control and are not necessarily reflective of

operational performance during a period. Furthermore, we believe

the consideration of measures that exclude such acquisition related

expenses can assist in the comparison of operational performance in

different periods which may or may not include such expenses.

Our Adjusted EBITDA, non-GAAP Net income, and non-GAAP EPS

measures may not provide information that is directly comparable to

that provided by other companies in our industry, as other

companies in our industry may calculate non-GAAP financial results

differently, particularly related to non-recurring, unusual items.

Our Adjusted EBITDA, non-GAAP Net income, and non-GAAP EPS are not

measurements of financial performance under GAAP, and should not be

considered as an alternative to operating or net income or as an

indication of operating performance or any other measure of

performance derived in accordance with GAAP. We do not consider

these non-GAAP measures to be a substitute for, or superior to, the

information provided by GAAP financial results. A reconciliation of

specific adjustments to GAAP results is provided in the last two

tables at the end of this release.

Airgain, Inc. Unaudited Condensed Balance Sheets

September 30, 2018 December 31,

2017 Assets Current assets: Cash and cash equivalents $

13,064,656 $ 15,026,068 Short term investments 18,765,236

21,287,064 Trade accounts receivable, net 7,388,688 8,418,132

Inventory 1,217,831 741,557 Prepaid expenses and other current

assets 876,183 609,786 Total current assets

41,312,594 46,082,607 Property and equipment, net 1,366,309

1,036,860 Goodwill 3,700,447 3,700,447 Customer relationships, net

3,713,668 4,075,918 Intangible assets, net 906,545 1,052,333 Other

assets 339,000 349,743 Total assets $ 51,338,563 $

56,297,908

Liabilities and stockholders’ equity Current

liabilities: Accounts payable $ 3,879,235 $ 3,969,083 Accrued bonus

2,378,805 2,224,517 Accrued liabilities 696,482 1,121,833 Deferred

purchase price — 1,000,000 Notes payable 333,333 1,333,333 Current

portion of deferred rent obligation under operating lease

81,332 81,332 Total current liabilities 7,369,187 9,730,098

Deferred tax liability 29,887 7,971 Deferred rent obligation under

operating lease 247,157 334,860 Total liabilities

7,646,231 10,072,929 Stockholders’ equity: Common shares, par value

$0.0001, 200,000,000 shares authorized at September 30, 2018 and

December 31, 2017; 9,914,711 and 9,616,992 shares issued at

September 30, 2018 and December 31, 2017, respectively; 9,586,188

and 9,481,992 shares outstanding at September 30, 2018 and December

31, 2017, respectively 991 961 Additional paid in capital

93,060,369 89,907,766 Treasury stock, at cost: 328,523 and 135,000

shares at September 30, 2018 and December 31, 2017, respectively

(3,093,974 ) (1,257,100 ) Accumulated other comprehensive loss, net

deferred taxes (6,434 ) (16,907 ) Accumulated deficit

(46,268,620 ) (42,409,741 ) Total stockholders’ equity

43,692,332 46,224,979 Commitments and contingencies

Total liabilities and stockholders’ equity $

51,338,563 $ 56,297,908

Airgain, Inc.

Unaudited Condensed Statements of

Operations

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2018 2017 2018 2017 Sales $ 15,786,913

$ 12,448,436 $ 44,063,692 $ 36,713,996 Cost of goods sold

8,921,571 6,444,544 24,402,658 19,300,120

Gross profit 6,865,342 6,003,892 19,661,034

17,413,876 Operating expenses: Research and development

2,474,653 2,094,774 7,162,092 5,510,861 Sales and marketing

2,161,143 1,809,037 9,140,356 5,229,188 General and administrative

1,922,326 1,899,449 7,864,320 6,174,869

Total operating expenses 6,558,122 5,803,260

24,166,768 16,914,918 Income (loss) from operations 307,220

200,632 (4,505,734 ) 498,958 Other expense (income): Interest

income (158,790 ) (98,689 ) (398,003 ) (189,855 ) Gain on deferred

purchase price liability — — (388,733 ) — Interest expense

5,756 22,762 29,506 80,239 Total other income

(153,034 ) (75,927 ) (757,230 ) (109,616 ) Income (loss) before

income taxes 460,254 276,559 (3,748,504 ) 608,574 Provision for

income taxes 22,995 42,206 110,375

59,251 Net income (loss) $ 437,259 $ 234,353 $ (3,858,879 ) $

549,323 Net income (loss) per share: Basic $ 0.05 $ 0.02 $ (0.41 )

$ 0.06 Diluted $ 0.04 $ 0.02 $ (0.41 ) $ 0.05 Weighted average

shares used in calculating income (loss) per share: Basic

9,566,118 9,545,235 9,495,278 9,475,708

Diluted 10,092,501 10,169,559 9,495,278

10,238,987

Airgain, Inc. Unaudited Condensed Statements

of Cash Flows Nine Months Ended September

30, 2018 2017 Cash flows from operating

activities: Net income (loss) $ (3,858,879 ) $ 549,323

Adjustments to reconcile net income (loss) to net cash used in

operating activities: Depreciation 422,549 336,817 Amortization

508,038 396,206 Amortization of premium (discount) on investments,

net (94,317 ) (23,683 ) Stock-based compensation

2,536,132

463,856 Deferred tax liability 21,916 67,709 Gain on deferred

purchase price liability (388,733 ) — Changes in operating assets

and liabilities: Trade accounts receivable 667,375 (1,969,507 )

Inventory (476,274 ) (30,265 ) Prepaid expenses and other assets

(255,654 ) (501,506 ) Accounts payable 35,954 (123,112 ) Accrued

bonus 154,288 (83,140 ) Accrued liabilities (425,351 ) 16,143

Deferred obligation under operating lease (87,703 )

(92,216 ) Net cash used in operating activities

(1,240,659

) (993,375 )

Cash flows from investing activities: Cash paid

for acquisition — (6,348,730 ) Purchases of available-for-sale

securities (24,328,831 ) (18,441,161 ) Maturities of

available-for-sale securities 26,955,449 — Purchases of property

and equipment (751,998 ) (195,922 ) Net cash provided

by (used in) investing activities 1,874,620 (24,985,813 )

Cash

flows from financing activities: Repayment of notes payable

(1,000,000 ) (1,055,230 ) Payments on acquisition related deferred

purchase price (375,000 ) — Reversal of costs related to initial

public offering — 781 Common stock repurchases (1,836,874 )

(468,823 ) Proceeds from exercise of stock options

616,501

506,704 Net cash used in financing activities

(2,595,373

) (1,016,568 ) Net decrease in cash and cash equivalents (1,961,412

) (26,995,756 ) Cash and cash equivalents, beginning of period

15,026,068 45,161,403 Cash and cash equivalents, end

of period $ 13,064,656 $ 18,165,647

Supplemental disclosure of

cash flow information Interest paid $ 33,812 $ 85,085 Taxes

paid $ 26,026 $ 114,639

Airgain, Inc. Unaudited

Reconciliation of GAAP to non-GAAP Net Income

For the Three Months Ended September 30,

For the Nine Months Ended September 30, 2018

2017 2018 2017 Reconciliation of GAAP to

non-GAAP Net Income Net income (loss) $ 437,259 $ 234,353 $

(3,858,879 ) $ 549,323 Stock-based compensation expense 408,274

213,968 2,536,133 463,856 Amortization 169,346 74,402 508,038

396,206 Acquisition expenses — 65,364 — 860,833 Software

implementation costs 3,166 3,166 Non-recurring items (1) — —

1,956,489 — Other income (153,034 ) (75,927 ) (757,230 ) (109,616 )

Provision for income taxes 22,995 42,206

110,375 59,251 Non-GAAP net income $ 888,006 $ 554,366 $

498,092 $ 2,219,853 Non-GAAP net income per share: Basic $ 0.09 $

0.06 $ 0.05 $ 0.23 Diluted $ 0.09 $ 0.05 $ 0.05 $ 0.22 Weighted

average shares used in calculating non-GAAP income per share: Basic

9,566,118 9,545,235 9,495,278 9,475,708

Diluted 10,092,501 10,169,559 9,965,632

10,238,987

Airgain, Inc. Unaudited Reconciliation

of Net Income to Adjusted EBITDA

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2018 2017 2018 2017 Reconciliation

of Net Income (Loss) to Adjusted EBITDA Net income (loss) $

437,259 $ 234,353 $ (3,858,879 ) $ 549,323 Stock-based compensation

expense 408,274 213,968 2,536,133 463,856 Depreciation and

amortization 325,439 188,760 930,587 733,023 Acquisition expenses —

65,364 — 860,833 Software implementation costs 3,166 3,166

Non-recurring items (1) — — 1,956,489 Other income (153,034 )

(75,927 ) (757,230 ) (109,616 ) Provision benefit for income taxes

22,995 42,206 110,375 59,251 Adjusted

EBITDA $ 1,044,099 $ 668,724 $ 920,641 $ 2,556,670

(1) Non-recurring items include $2.0 million in sales and

marketing initiative realignment and executive severance for the

nine months ended September 30, 2018.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181101005992/en/

Airgain, Inc.Anil Doradla, Chief Financial

OfficerInvestors@airgian.com

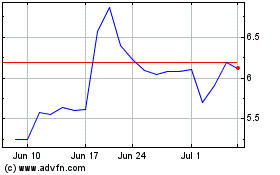

Airgain (NASDAQ:AIRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Airgain (NASDAQ:AIRG)

Historical Stock Chart

From Apr 2023 to Apr 2024