Adverum Biotechnologies Reports Recent Business Progress and Fourth Quarter 2019 Financial Results

March 12 2020 - 4:01PM

Adverum Biotechnologies, Inc. (Nasdaq: ADVM), a clinical-stage gene

therapy company targeting unmet medical needs in ocular and rare

diseases, today reported financial results for the fourth quarter

ended December 31, 2019 and provided a corporate update. The

company will host a conference call and webcast today at 1:30 pm PT

/ 4:30 pm ET to discuss the results and recent business progress.

“2020 is poised to be an exciting year of execution as we

rapidly advance our development efforts for our lead programs

ADVM-022 for wet AMD and for diabetic retinopathy,” said Leone

Patterson, president and chief executive officer, Adverum

Biotechnologies. “Development progress in the OPTIC Phase 1 trial

continues as we recently completed patient enrollment in cohort 3

and screening is underway in cohort 4. Our goal is to develop and

commercialize our novel intravitreal gene therapy to help the large

number of patients living with wet AMD and diabetic retinopathy,

the two leading causes of vision impairment and blindness in the

elderly and working-age populations, in the U.S.”

Recent Progress

- Completed patient dosing in cohort 3 (n=9, three-fold lower

dose compared to cohort 1, 2 x 10^11 vg/eye) of the OPTIC Phase 1

clinical trial of ADVM-022 in wet age-related macular degeneration

(wet AMD). Patients are being screened in cohort 4 (n=9, dose 6 x

10^11).

- In cohorts 3 and 4, patients are receiving prophylactic topical

steroid eye drops for a total of 6 weeks instead of prophylactic

oral steroids for 13 days used in cohorts 1 and 2.

- At the Angiogenesis, Exudation, and Degeneration 2020 Annual

Meeting in February 2020, presented new data from OPTIC cohorts 1

and 2. Results demonstrated that in treatment-experienced patients

previously requiring frequent anti-VEGF injections to maintain

vision, ADVM-022 demonstrated a robust efficacy signal and evidence

of a dose response:

- Cohort 1 (6 x 10^11 vg/eye): 6 of 6 patients remained

rescue-injection-free at a median follow up of 50 weeks, with 3

patients at 52 weeks.

- Cohort 2 (three-fold lower dose 2 x 10^11 vg/eye): 4 of 6

patients remained rescue injection free at 24 weeks.

- In both cohorts combined, 10 of 12 (83%) patients remained

rescue injection free. For these patients:

- Vision was generally maintained as demonstrated by stable mean

best corrected visual acuity (BCVA) compared to baseline.

- Retinal anatomy improvements were achieved and maintained as

demonstrated by mean central subfield thickness (CST) compared to

baseline.

- ADVM-022 continued to demonstrate a favorable safety profile

and be well tolerated.

- Raised approximately $140.8 million in net proceeds from an

underwritten public offering in February 2020

- Moved to the company’s new Redwood City corporate headquarters

in January 2020, which includes approximately 81,000 square feet of

office, laboratory, and manufacturing space to advance the

development of Adverum’s novel gene therapies

- Appointed Angela Thedinga as chief technology officer. Ms.

Thedinga previously served as Adverum’s vice president, program

management, and has deep experience transitioning and expanding

viral vector gene therapy manufacturing and analytical capabilities

from academic to commercial scale, which will be important as

ADVM-022 advances in development toward potential

commercialization.

Future PlansSecond Quarter of

2020:

- Present new clinical data from the OPTIC trial in May 2020

- Submit an investigational new drug application for ADVM-022 in

diabetic retinopathy, a key VEGF-driven cause of vision loss among

working-age adults

Second Half of 2020:

- Present clinical data from cohorts 1-4 of the OPTIC trial

- Begin enrolling patients in a planned Phase 1/2 clinical trial

for ADVM-022 in diabetic retinopathy

Financial Results for the Three Months Ended December

31, 2019

- Cash, cash equivalents and short-term

investments were $166.0 million as of December 31, 2019,

of which $25.8 million in net proceeds was raised through an

at-the-market program during this quarter, compared to $162.0

million at September 30, 2019 and $205.1 million as of December 31,

2018. Adverum expects this year-end cash position, together with

approximately $140.8 million in net proceeds raised in February

2020, to fund operations into 2022.

- Research and development expenses were $11.4

million for the three months ended December 31, 2019, compared to

$11.6 million for the same period in 2018.

- General and administrative expenses were $8.3

million for the three months ended December 31, 2019, compared to

$5.2 million for the same period in 2018. General and

administrative expenses increased primarily due to higher

consultant and professional service expenses and increased

facilities costs related to the company’s new facility, partially

offset by lower stock-based compensation expenses.

- Net loss was $18.9 million, or $0.29 per basic

and diluted share, for the three months ended December 31, 2019,

compared to $15.7 million, or $0.25 per basic and diluted share,

for the same period in 2018.

- Shares of common stock outstanding were 79.7

million as of February 28, 2020.

Conference Call

InformationIndividuals can participate in today’s

conference call at 1:30 pm PT (4:30 pm ET) by dialing

1-866-420-8347 (domestic) or 1-409-217-8241 (international) and

refer to the “Adverum Biotechnologies’ Fourth Quarter 2019 Earnings

Call.” The webcast will be accessible under Events and

Presentations in the Investors section of the company's website.

The archived audio webcast will be available on the Adverum website

following the call and will be available for 30 days.

About Adverum BiotechnologiesAdverum

Biotechnologies (Nasdaq: ADVM) is a clinical-stage gene therapy

company targeting unmet medical needs in serious ocular and rare

diseases. Adverum is evaluating its novel gene therapy candidate,

ADVM-022, as a one-time, intravitreal injection for the treatment

of its lead indication, wet age-related macular degeneration. For

more information, please visit www.adverum.com.

Forward-looking StatementsStatements contained

in this press release regarding events or results that may occur in

the future are “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. Such

statements include, but are not limited to statements regarding:

Adverum’s plans to advance ADVM-022 in 2020, all other statements

under the caption “Future Plans”, Adverum’s expectations that its

current cash will fund operations into 2022, and the potential

benefits of ADVM-022, all of which are based on certain assumptions

made by Adverum on current conditions, expected future developments

and other factors Adverum believes are appropriate in the

circumstances. Adverum may not achieve any of these in a timely

manner, or at all, or otherwise carry out the intentions or meet

the expectations disclosed in its forward-looking statements, and

you should not place undue reliance on these forward-looking

statements. Actual results and the timing of events could differ

materially from those anticipated in such forward-looking

statements as a result of various risks and uncertainties, which

include risks inherent to, without limitation: Adverum’s novel

technology, which makes it difficult to predict the time and cost

of product candidate development and obtaining regulatory approval;

the results of early clinical trials not always being predictive of

future results; the potential for future complications or side

effects in connection with use of ADVM-022; obtaining regulatory

approval for gene therapy product candidates; enrolling patients in

clinical trials; reliance on third parties for conducting the OPTIC

trial and vector production; and ability to fund operations through

completion of the OPTIC trial and thereafter. Risks and

uncertainties facing Adverum are described more fully in Adverum’s

Form 10-K filed with the SEC on March 12, 2020 under the heading

“Risk Factors.” All forward-looking statements contained in this

press release speak only as of the date on which they were made.

Adverum undertakes no obligation to update such statements to

reflect events that occur or circumstances that exist after the

date on which they were made.

Investor and Media Inquiries:

Investors:Myesha LacyAdverum Biotechnologies,

Inc.mlacy@adverum.com1-650-304-3892

Media:Cherilyn Cecchini, M.D.LifeSci

Communicationsccecchini@lifescicomms.com1-646-876-5196

| Adverum

Biotechnologies, Inc. |

| Consolidated Balance

Sheets |

| (In thousands) |

|

|

|

|

|

|

|

December

31, |

December

31, |

|

|

|

2019 |

|

|

|

2018 |

|

| |

|

|

Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

65,897 |

|

|

$ |

154,949 |

|

|

Short-term investments |

|

100,138 |

|

|

|

50,130 |

|

|

Prepaid expenses and other current assets |

|

9,835 |

|

|

|

3,675 |

|

|

Total current assets |

|

175,870 |

|

|

|

208,754 |

|

| Operating

lease right-of-use asset |

|

20,963 |

|

|

|

- |

|

| Property and

equipment, net |

|

24,884 |

|

|

|

3,586 |

|

| Restricted

cash |

|

999 |

|

|

|

999 |

|

| Deposit and

other long-term assets |

|

11 |

|

|

|

156 |

|

|

Total assets |

$ |

222,727 |

|

|

$ |

213,495 |

|

|

Liabilities and stockholders' equity |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

$ |

4,103 |

|

|

$ |

1,707 |

|

|

Accrued expenses and other current liabilities |

|

11,271 |

|

|

|

8,784 |

|

|

Lease liability, current portion |

|

4,034 |

|

|

|

- |

|

|

Deferred rent, current portion |

|

- |

|

|

|

228 |

|

|

Total current liabilities |

|

19,408 |

|

|

|

10,719 |

|

| Deferred

rent, net of current portion |

|

- |

|

|

|

1,366 |

|

| Lease

liability, net of current portion |

|

28,214 |

|

|

|

- |

|

| Other

noncurrent liabilities |

|

148 |

|

|

|

243 |

|

|

Total liabilities |

|

47,770 |

|

|

|

12,328 |

|

|

Stockholders' equity: |

|

|

|

|

Common stock |

|

7 |

|

|

|

6 |

|

|

Additional paid-in capital |

|

560,704 |

|

|

|

522,503 |

|

|

Accumulated other comprehensive loss |

|

(725 |

) |

|

|

(799 |

) |

|

Accumulated deficit |

|

(385,029 |

) |

|

|

(320,543 |

) |

| Total

stockholders' equity |

|

174,957 |

|

|

|

201,167 |

|

|

Total liabilities and stockholders' equity |

$ |

222,727 |

|

|

$ |

213,495 |

|

| Adverum

Biotechnologies, Inc. |

| Consolidated

Statements of Operations and Comprehensive Loss |

| (In thousands except

per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

Collaboration and license revenue |

|

$ |

- |

|

|

$ |

70 |

|

|

$ |

250 |

|

|

$ |

1,612 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Research and

development |

|

|

11,374 |

|

|

|

11,642 |

|

|

|

40,419 |

|

|

|

50,133 |

|

| General and

administrative |

|

|

8,279 |

|

|

|

5,187 |

|

|

|

28,376 |

|

|

|

24,560 |

|

|

Impairment of goodwill and intangible asset |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,000 |

|

| Total

operating expenses |

|

|

19,653 |

|

|

|

16,829 |

|

|

|

68,795 |

|

|

|

79,693 |

|

| Operating

loss |

|

|

(19,653 |

) |

|

|

(16,759 |

) |

|

|

(68,545 |

) |

|

|

(78,081 |

) |

| Other

income, net |

|

|

728 |

|

|

|

1,100 |

|

|

|

4,059 |

|

|

|

4,204 |

|

| Net loss

before income taxes |

|

|

(18,925 |

) |

|

|

(15,659 |

) |

|

|

(64,486 |

) |

|

|

(73,877 |

) |

| Income tax

benefit |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,250 |

|

| Net

loss |

|

|

(18,925 |

) |

|

|

(15,659 |

) |

|

|

(64,486 |

) |

|

|

(72,627 |

) |

| Other

comprehensive income |

|

|

|

|

|

|

|

|

|

Net unrealized gain on marketable securities |

|

6 |

|

|

|

39 |

|

|

|

33 |

|

|

|

168 |

|

| Foreign

currency translation adjustment |

|

|

14 |

|

|

|

17 |

|

|

|

41 |

|

|

|

(4 |

) |

|

Comprehensive loss |

|

$ |

(18,905 |

) |

|

$ |

(15,603 |

) |

|

$ |

(64,412 |

) |

|

$ |

(72,463 |

) |

| Net loss per

share — basic and diluted |

|

$ |

(0.29 |

) |

|

$ |

(0.25 |

) |

|

$ |

(1.01 |

) |

|

$ |

(1.18 |

) |

|

Weighted-average common shares outstanding - basic and diluted |

|

|

65,104 |

|

|

|

62,915 |

|

|

|

64,102 |

|

|

|

61,375 |

|

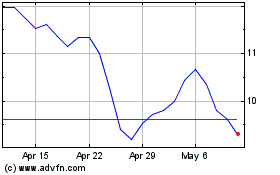

Adverum Biotechnologies (NASDAQ:ADVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

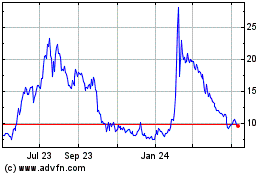

Adverum Biotechnologies (NASDAQ:ADVM)

Historical Stock Chart

From Apr 2023 to Apr 2024