Current Report Filing (8-k)

September 14 2021 - 4:07PM

Edgar (US Regulatory)

0000008670

false

0000008670

2021-09-13

2021-09-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): September 13, 2021

|

|

|

Automatic

Data Processing, Inc.

|

|

(Exact name of registrant

as specified in charter)

|

|

|

|

Delaware

|

|

1-5397

|

|

22-1467904

|

|

(State or Other

Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification

No.)

|

|

One

ADP Boulevard, Roseland,

New Jersey

|

07068

|

|

(Address of principal executive

offices)

|

(Zip Code)

|

|

|

|

|

(973)

974-5000

|

|

(Registrant's

telephone number, including area code)

|

|

|

|

N/A

|

|

(Former name

or former address, if changed since last report)

|

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered

pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.10 Par Value (voting)

|

|

ADP

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

|

On September 13, 2021, Kathleen A.

Winters, Corporate Vice President and Chief Financial Officer of Automatic Data Processing, Inc. (the “Company”), notified

the Company of her decision to retire from the Company, effective as of September 30, 2021. Effective as of October 1, 2021, the Company

has appointed Don McGuire to succeed Ms. Winters to the position of Corporate Vice President and Chief Financial Officer reporting to

the Chief Executive Officer.

Mr. McGuire, age 61, has been the

Company’s President, Employer Services International since June 2018. Prior to his appointment as President, Employer Services

International, Mr. McGuire held multiple senior leadership roles in key geographies around the globe, including as President, Global

Enterprise Solutions EMEA/Streamline from July 2016 to June 2018, as Senior Vice President, General Manager, Asia Pacific Region from

December 2012 to June 2016, and as General Manager, ADP United Kingdom/Ireland from September 2007 to December 2012. Mr. McGuire joined

the Company in 1998 as Vice President, Finance, ADP Canada and served in various positions of increasing responsibility, including as

the Chief Financial Officer for ADP Canada.

The Company is providing Mr. McGuire

the following key compensation and benefits:

|

|

·

|

An

annual base salary of CAD $823,515, equivalent to approximately $650,000 in USD, based on

a current conversion rate (as Mr. McGuire, a Canadian national, receives his cash compensation

in Canadian dollars);

|

|

|

·

|

An

annual target bonus of 150% of annual base salary, which will be prorated based on service

during the fiscal year, with the payout to be calculated based on performance against a set

of objectives under the Company’s Annual Cash Bonus Plan for Officers;

|

|

|

·

|

A

one-time, time-based restricted stock award with a grant value of $2,100,000 in USD that

will be granted on October 1, 2021, with 50% of the shares vesting on the first anniversary

of the grant date and the remaining 50% of the shares vesting on the second anniversary of

the grant date;

|

|

|

·

|

Participation

in the long-term incentive compensation program for executives consisting of performance-based

stock units (“PSUs”) and stock options, with an expected annual total target

equity award value of $3,000,000 in USD for fiscal year 2022 reflecting a target PSU award

of $1.6 million in USD to be granted on October 1, 2021, incremental to Mr. McGuire’s

pre-existing equity award of $1.4 million in USD (granted with a mix of 70% PSUs and 30%

stock options) made on September 1, 2021 in connection with his prior role; and

|

|

|

·

|

Subject

to localizing Mr. McGuire in the U.S., participation in all of the Company’s applicable

401(k), executive retirement, deferred compensation, medical and health, life, accident,

disability and other insurance programs, stock purchase and certain other perquisite and

benefit programs on the same basis as similarly situated senior executives.

|

In addition, in the event of involuntary

termination of Mr. McGuire’s employment without cause, he is entitled to 18 months of salary continuation, a prorated bonus and

continued vesting in unvested equity awards for the 18-month severance period pursuant to the Company’s Corporate Officer Severance

Plan. Mr. McGuire is also covered by the Company’s Change in Control Severance Plan for Corporate Officers, as amended, so that

if his employment is terminated either involuntarily without cause or for “good reason,” within two years after a change

in control, he would be entitled to receive 150% of his total annual compensation as defined in the plan and the accelerated vesting

of unvested equity awards. Mr. McGuire is subject to and currently satisfies the Company’s stock ownership guidelines, which require

him to have an ownership target in Company stock equal to three times base salary. He is also subject to the Company’s Clawback

Policy.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

AUTOMATIC DATA PROCESSING, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

Date: September

14, 2021

|

By:

|

/s/

David Kwon

|

|

|

|

|

Name:

|

David Kwon

|

|

|

|

|

Title:

|

Vice President

|

|

|

|

|

|

|

|

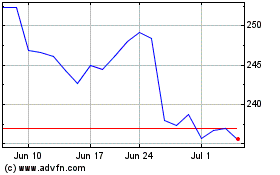

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Mar 2024 to Apr 2024

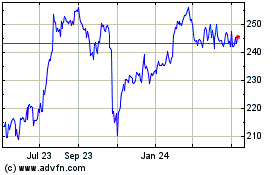

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Apr 2023 to Apr 2024