Acorda Therapeutics Announces Private Exchange of $276 Million of Its 1.75% Convertible Senior Notes Due 2021

December 23 2019 - 5:30AM

Business Wire

Acorda Therapeutics, Inc. (Nasdaq: ACOR) (the “Company”) today

announced that it has entered into agreements with a limited number

of institutional investors who are holders of the Company’s 1.75%

Convertible Senior Notes due 2021 (the “Existing Convertible

Notes”) to exchange $276 million aggregate principal amount of the

Existing Convertible Notes for a combination of newly issued 6.00%

Convertible Senior Secured Notes due 2024 (the “New Convertible

Secured Notes”) and cash. For each $1,000 principal amount of

Existing Convertible Notes that a participating holder exchanges,

the Company will deliver (i) $750 in principal amount of New

Convertible Secured Notes and (ii) a cash payment of $200 (the

“Exchange”). In the aggregate, the Company expects to issue

approximately $207 million aggregate principal amount of New

Convertible Secured Notes and $55.2 million in cash to the

participating holders. The Exchange is expected to close on or

about December 23, 2019.

The New Convertible Secured Notes will be guaranteed by the

Company’s wholly owned subsidiary, Civitas Therapeutics, Inc., and

all other domestic subsidiaries acquired or formed after the date

of issuance (the “Guarantors”), and will be senior obligations of

the Company and the Guarantors, secured by a first priority

security interest in substantially all of the assets of the Company

and the Guarantors, subject to certain exceptions. Interest will be

payable semi-annually in arrears at a rate of 6.00% per annum on

each June 1 and December 1, beginning on June 1, 2020, and may be

paid in cash or, subject to the satisfaction of certain conditions,

shares of the Company’s common stock, as elected by the Company.

The New Convertible Secured Notes will mature on December 1, 2024

unless earlier converted in accordance with their terms prior to

such date.

The New Convertible Secured Notes will be convertible at the

option of the holder into shares of common stock of the Company at

any time prior to the close of business on the second scheduled

trading day immediately preceding the maturity date. The initial

conversion rate for the New Convertible Secured Notes is 285.7142

shares of the Company’s common stock per $1,000 principal amount of

New Convertible Secured Notes, which is equivalent to an initial

conversion price of approximately $3.50 per share of common stock

(a premium of approximately 97% above the Company’s closing stock

price of $1.78 on December 20, 2019), and is subject to adjustment

in certain circumstances.

The Company may elect to settle conversions of the New

Convertible Secured Notes in cash, shares of the Company’s common

stock or a combination of cash and shares of the Company's common

stock. Holders who convert their New Convertible Secured Notes

prior to June 1, 2023 (other than in connection with a fundamental

change) will also be entitled to an interest make-whole payment

equal to the sum of all regularly scheduled stated interest

payments, if any, due on such New Convertible Secured Notes on each

interest payment date occurring after the conversion date for such

conversion and on or before June 1, 2023. In addition, the Company

will have the right to cause all New Convertible Secured Notes then

outstanding to be converted automatically if the volume-weighted

average price per share of the Company’s common stock equals or

exceeds 130% of the conversion price for a specified period of time

and certain other conditions are satisfied. The Company’s ability

to settle conversions and make interest payments using shares of

its common stock will be subject to certain limitations set forth

in the indenture until the time, if any, that the Company’s

stockholders approve the issuance of more than 19.99% of its

outstanding shares for such purposes in accordance with Nasdaq

listing standards and an amendment to the Company’s certificate of

corporation to increase the number of authorized shares.

Holders of the New Convertible Secured Notes will have the

right, at their option, to require the Company to purchase their

New Convertible Secured Notes if a fundamental change (as defined

in the indenture) occurs, in each case, at a repurchase price equal

to 100% of the principal amount of the New Convertible Secured

Notes to be repurchased, plus accrued and unpaid interest, if any,

to, but excluding, the applicable repurchase date.

In connection with the exchange, the Company intends to enter

into an indenture establishing the terms of the New Convertible

Secured Senior Notes, a security agreement establishing a first

priority security interest in substantially all of the assets of

the Company and Guarantors, subject to certain material exceptions

specified therein, and a registration rights agreement under which

the Company has agreed to file a registration statement covering

the resale of the shares of common stock issued upon conversion of

the New Convertible Secured Notes.

This press release does not constitute an offer to sell or

the solicitation of an offer to buy any securities of the Company.

The offer and sale of the New Convertible Secured Notes or the

shares of common stock issuable upon their conversion have not been

registered under the Securities Act of 1933 (the “Securities Act”)

or the securities laws of any other jurisdiction, and these

securities may not be offered or sold in the United States absent

registration or an applicable exemption from the Securities Act and

applicable state laws.

J. Wood Capital Advisors LLC is acting as the Company’s

financial advisor for the Exchange and Covington & Burling LLP

is acting as the Company’s legal advisor.

About Acorda Therapeutics

Acorda Therapeutics develops therapies to restore function and

improve the lives of people with neurological disorders. INBRIJA™

(levodopa inhalation powder) is approved for intermittent treatment

of OFF episodes in adults with Parkinson’s disease treated with

carbidopa/levodopa. INBRIJA is not to be used by patients who take

or have taken a nonselective monoamine oxidase inhibitor such as

phenelzine or tranylcypromine within the last two weeks. INBRIJA

utilizes Acorda’s innovative ARCUS® pulmonary delivery system, a

technology platform designed to deliver medication through

inhalation. Acorda also markets the branded AMPYRA® (dalfampridine)

Extended Release Tablets, 10 mg.

Forward-Looking Statements

This press release includes forward-looking statements. All

statements, other than statements of historical facts, regarding

management's expectations, beliefs, goals, plans or prospects

should be considered forward-looking. These statements are subject

to risks and uncertainties that could cause actual results to

differ materially, including: we may not be able to successfully

market INBRIJA or any other products under development; risks

associated with complex, regulated manufacturing processes for

pharmaceuticals, which could affect whether we have sufficient

commercial supply of INBRIJA to meet market demand; third party

payers (including governmental agencies) may not reimburse for the

use of INBRIJA or our other products at acceptable rates or at all

and may impose restrictive prior authorization requirements that

limit or block prescriptions; competition for INBRIJA, AMPYRA and

other products we may develop and market in the future, including

increasing competition and accompanying loss of revenues in the

U.S. from generic versions of AMPYRA (dalfampridine) following our

loss of patent exclusivity; the ability to realize the benefits

anticipated from acquisitions, among other reasons because acquired

development programs are generally subject to all the risks

inherent in the drug development process and our knowledge of the

risks specifically relevant to acquired programs generally improves

over time; we may need to raise additional funds to finance our

operations and may not be able to do so on acceptable terms; the

risk of unfavorable results from future studies of INBRIJA

(levodopa inhalation powder) or from our other research and

development programs, or any other acquired or in-licensed

programs; the occurrence of adverse safety events with our

products; the outcome (by judgment or settlement) and costs of

legal, administrative or regulatory proceedings, investigations or

inspections, including, without limitation, collective,

representative or class action litigation; failure to protect our

intellectual property, to defend against the intellectual property

claims of others or to obtain third party intellectual property

licenses needed for the commercialization of our products; and

failure to comply with regulatory requirements could result in

adverse action by regulatory agencies.

These and other risks are described in greater detail in our

filings with the Securities and Exchange Commission. We may not

actually achieve the goals or plans described in our

forward-looking statements, and investors should not place undue

reliance on these statements. Forward-looking statements made in

this press release are made only as of the date hereof, and we

disclaim any intent or obligation to update any forward-looking

statements as a result of developments occurring after the date of

this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191223005108/en/

Felicia Vonella (914) 326-5146 fvonella@acorda.com

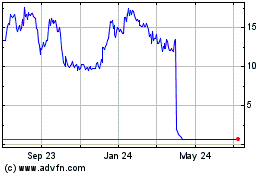

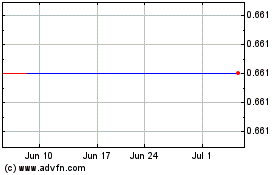

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acorda Therapeutics (NASDAQ:ACOR)

Historical Stock Chart

From Apr 2023 to Apr 2024