Arbutus Biopharma Corporation (Nasdaq: ABUS), a clinical-stage

biopharmaceutical company primarily focused on developing a cure

for people with chronic hepatitis B virus (HBV) infection, as well

as therapies to treat coronaviruses (including COVID-19), today

reports its second quarter 2020 financial results and provides a

corporate update.

William Collier, President and Chief Executive

Officer of Arbutus, stated, “Despite the challenging conditions

resulting from the COVID-19 pandemic, we continue to make steady

progress in our Phase 1a/1b clinical trial of AB-729, a

subcutaneously delivered RNAi agent, and have recently initiated an

additional AB-729 90 mg single-dose cohort in HBV DNA positive

subjects. We also intend to initiate two 90 mg multi-dose cohorts

in the second half of this year.”

Mr. Collier added, “Importantly, in March and

May of this year we announced positive preliminary results from

this trial, and we look forward to providing additional clinical

updates in the second half of 2020. We anticipate these updates

will include data from 60 mg multi-dose cohorts with dosing

intervals every four and eight weeks and 90 mg single-dose week 12

data in HBV DNA negative and positive subjects. We continue to

believe AB-729 is a potent RNAi agent capable of reducing HBsAg

plasma levels.”

Pipeline Update

AB-729

- AB-729 is an RNA interference (RNAi) therapeutic targeted to

hepatocytes using Arbutus’ novel covalently conjugated

N-acetylgalactosamine (GalNAc) delivery technology that enables

subcutaneous delivery. AB-729 inhibits viral replication and

reduces all HBV antigens, including hepatitis B surface antigen

(HBsAg), in preclinical models. Reducing HBsAg is thought to be

essential to enable the reawakening of a patient’s immune system so

that it can respond to the virus.

- Arbutus is currently conducting a single- and multi-dose Phase

1a/1b clinical trial to determine the safety, tolerability,

pharmacokinetics, and pharmacodynamics of AB-729 in healthy

subjects and in subjects with chronic HBV infection.

- Preliminary positive safety data in single-dose cohorts of

healthy subjects and safety and efficacy data in the 60 mg and 180

mg single-dose cohorts in subjects with chronic HBV infection were

reported in March 2020. Additional follow-on week 12 data for the

60 mg single-dose cohort were reported in May 2020. The data

demonstrate the robust activity of AB-729 and, at week 12, the 60

mg single-dose achieved equivalent reductions in HBsAg as the 180

mg single-dose and did so while remaining generally safe and well

tolerated with no abnormal transaminase values in any of the six

subjects.

|

|

Mean HBsAg changes from baseline: |

|

|

|

60 mg Single-Dose Cohort (N=6) |

180 mg Single-Dose Cohort (N=4) |

| |

Day 29 mean log10 IU/mL (Standard Error of the Mean) |

-0.24 (0.13) |

-0.8 (0.38) |

| |

Week 12 (day 84) mean log10 IU/mL(Standard Error of the Mean) |

-0.99 (0.24) |

-0.98 (0.22) |

- Arbutus is dosing two 60 mg multi-dose cohorts of subjects with

chronic HBV infection with dosing intervals of every four and eight

weeks, respectively. Arbutus is also dosing subjects in a 90 mg

single-dose cohort. Results from these cohorts are expected in the

second half of 2020. We also intend to initiate two 90 mg

multi-dose cohorts in the second half of this year.

- Arbutus has also initiated an additional AB-729 90 mg

single-dose cohort in HBV DNA positive subjects with results

expected in the second half of 2020.

AB-836: Oral Capsid Inhibitor

- AB-836 is an oral HBV capsid inhibitor. HBV core protein

assembles into a capsid structure, which is required for viral

replication. The current standard-of-care therapy for HBV,

primarily nucleos(t)ide analogues that work by inhibiting the viral

polymerase, significantly reduce virus replication, but not

completely. Capsid inhibitors inhibit replication by preventing the

assembly of functional viral capsids. They also have been shown to

inhibit the uncoating step of the viral life cycle thus reducing

the formation of new covalently closed circular DNA (cccDNA), the

genetic reservoir which the virus uses to replicate

itself.

- In January 2020, Arbutus selected AB-836 as its next-generation

oral capsid inhibitor. AB-836 is from a novel chemical series

differentiated from Arbutus’ second generation capsid inhibitor

candidate, AB-506, as well as competitor compounds. AB-836 has the

potential for increased potency and an enhanced resistance profile

as compared to AB-506. Arbutus continues to expect completion of

IND-enabling studies by the end of 2020.

Early HBV R&D Programs

- Arbutus’ drug discovery efforts are focused on follow-on

compounds for its current HBV pipeline, including the development

of oral RNA-destabilizers that have shown compelling antiviral

effects in multiple HBV preclinical models. Arbutus is now focused

on advancing next-generation oral RNA-destabilizers with chemical

scaffolds distinct from Arbutus’ prior generation HBV RNA

destabilizer candidate, AB-452, through lead optimization. Arbutus

also has several oral anti-PD-L1 inhibitors in lead optimization

that are potentially capable of reawakening the immune response to

HBV in infected patients.

Research Efforts to Combat COVID-19 and Future

Coronavirus Outbreaks

- Earlier this year, the Company initiated an internal research

program to identify new small molecule antiviral medicines to treat

COVID-19 and future coronavirus outbreaks. Dr. Michael Sofia,

Arbutus’ Chief Scientific Officer, who was awarded the

Lasker-DeBakey Award for his discovery of sofosbuvir, brings

extensive antiviral drug discovery experience to this new program.

Arbutus has also joined forces with the COVID R&D consortium to

further support and expedite efforts to address the COVID-19

pandemic. At this time, Arbutus’ COVID-19 research program will

focus on the discovery and development of new molecular entities

that address specific viral targets including the nsp12 viral

polymerase and the viral protease. These targets are essential

viral proteins which Arbutus has experience in targeting. The

Company is actively screening multiple new oral molecular entities.

The establishment of the COVID-19 effort does not impact Arbutus’

current cash burn guidance for 2020 of $54 to $58 million.

Genevant Sciences Ltd.

Update

On July 23, 2020, the United States Patent and

Trademark Office before the Patent Trial and Appeal Board (PTAB)

announced their decision in Moderna Therapeutics, Inc.’s challenge

of the validity of U.S. Patent 8,058,069 (“the '069 Patent”). In

this decision, the PTAB determined no challenged claims were

unpatentable. While Arbutus is the patent holder, this patent has

been licensed to Genevant. The '069 Patent was included in this

license agreement between Genevant and Arbutus. Arbutus is

gratified by the recent decision of the PTAB, upholding the

validity of one of the patents protecting Arbutus’ LNP technology

that Arbutus licensed to Genevant. This decision reinforces

Arbutus’ continuing belief in the potential of this technology.

Arbutus is entitled to receive tiered low single

digit royalties on future sales of Genevant products covered by the

licensed patents. If Genevant sub-licenses the intellectual

property licensed by Arbutus to Genevant, Arbutus would receive

upon the commercialization of a product developed by such

sub-licensee the lesser of (i) twenty percent of the revenue

received by Genevant for such sublicensing and (ii) tiered low

single digit royalties on product sales by the sublicensee.

On July 31, 2020, Roivant recapitalized Genevant

through an equity investment and conversion of previously issued

convertible debt securities held by Roivant. Arbutus participated

in the recapitalization of Genevant with an equity investment of

$2.5 million. Following the recapitalization, Arbutus owns

approximately 16% of the common equity of Genevant. Arbutus’

entitlement to receive future royalties or sublicensing revenue

from Genevant remains unchanged.

COVID-19 Impact

In December 2019 an outbreak of a novel strain

of coronavirus (COVID-19) was identified in Wuhan, China. This

virus continues to spread globally, has been declared a pandemic by

the World Health Organization and has spread to nearly every

country in the world. The impact of this pandemic has been, and

will likely continue to be, extensive in many aspects of society.

The pandemic has resulted in and will likely continue to result in

significant disruptions to businesses. A number of countries and

other jurisdictions around the world have implemented extreme

measures to try and slow the spread of the virus. These measures

include the closing of businesses and requiring people to stay in

their homes, the latter of which raises uncertainty regarding the

ability to travel to hospitals in order to participate in clinical

trials. Additional measures that have had, and will likely continue

to have, a major impact on clinical development, at least in the

near-term, include shortages and delays in the supply chain, and

prohibitions in certain countries on enrolling subjects in new

clinical trials. While we have been able to progress with our

clinical and pre-clinical activities to date, it is not possible to

predict if the COVID-19 pandemic will negatively impact our plans

and timelines in the future.

Financial Results

Cash, Cash Equivalents and

Investments

Arbutus had cash, cash equivalents and

investments totaling $84.0 million as of June 30, 2020, as

compared to $90.8 million as of December 31, 2019. During the

six months ended June 30, 2020, Arbutus used $24.3 million in

operating activities, which was partially offset by $17.4 million

of net proceeds from the issuance of common shares under Arbutus’s

ATM program. During July 2020, Arbutus fully utilized the remaining

availability under the ATM program resulting in an additional $36.5

million of net proceeds from the issuance of 9.5 million common

shares. The Company believes its ending second quarter cash, cash

equivalents and investments of $84.0 million plus the additional

$36.5 million of proceeds received under the ATM program during

July 2020 are sufficient to fund the Company’s operations into

mid-2022 versus prior guidance of mid-2021.

Net Loss

Net loss attributable to common shares for the

three months ended June 30, 2020 was $17.1 million ($0.25 basic and

diluted loss per common share) as compared to $26.1 million ($0.46

basic and diluted loss per common share) in 2019. Net loss

attributable to common shares for the three months ended June 30,

2020 and 2019 included non-cash expense for the accrual of coupon

on the Company’s convertible preferred shares of $3.0 million and

$2.8 million, respectively. Additionally, net loss attributable to

common shares for the three months ended June 30, 2019 included

$3.3 million of non-cash equity losses associated with our

investment in Genevant Sciences Ltd. (“Genevant”), a company

launched with Roivant Sciences Ltd., Arbutus’s largest shareholder,

in April 2018.

Operating Expenses

Research and development expenses were $10.5

million for the three months ended June 30, 2020 compared to $12.7

million in 2019. The decrease in research and development expenses

for the three months ended June 30, 2020 versus the same period in

2019 was due primarily to lower clinical expenses. General and

administrative expenses were $3.6 million for the three months

ended June 30, 2020 compared to $8.2 million in 2019. The decrease

in general and administrative expenses was due primarily to the

departure of the Company’s former President and Chief Executive

Officer in June 2019 and a decrease in legal fees. In accordance

with the terms of his legacy employment agreement, the Company’s

former President and Chief Executive Officer received $2.3 million

in cash severance and the Company recognized $1.1 million of

non-cash stock-based compensation expense for accelerated vesting

of his stock options in 2019.

Outstanding Shares

The Company had approximately 71.3 million

common shares issued and outstanding as of June 30, 2020.

During July 2020, Arbutus issued an additional 9.5 million common

shares under the ATM program. In addition, the Company had

approximately 11.0 million stock options outstanding and 1.164

million convertible preferred shares outstanding, which (including

the annual 8.75% coupon) will be mandatorily convertible into

approximately 23.0 million common shares on October 18, 2021.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF LOSS(in thousands, except share and

per share data)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| Revenue |

|

|

|

|

|

|

|

|

Collaborations and licenses |

$ |

825 |

|

|

$ |

398 |

|

|

$ |

1,660 |

|

|

$ |

814 |

|

| Non-cash royalty revenue |

689 |

|

|

255 |

|

|

1,345 |

|

|

518 |

|

| Total

Revenue |

1,514 |

|

|

653 |

|

|

3,005 |

|

|

1,332 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

Research and development |

10,465 |

|

|

12,740 |

|

|

20,881 |

|

|

27,452 |

|

|

General and administrative |

3,566 |

|

|

8,189 |

|

|

7,119 |

|

|

12,601 |

|

|

Depreciation and amortization |

501 |

|

|

505 |

|

|

1,001 |

|

|

1,014 |

|

|

Change in fair value of contingent consideration |

116 |

|

|

130 |

|

|

228 |

|

|

255 |

|

|

Site consolidation |

7 |

|

|

(266 |

) |

|

64 |

|

|

(149 |

) |

| Loss from

operations |

(13,141 |

) |

|

(20,645 |

) |

|

(26,288 |

) |

|

(39,841 |

) |

| Other income

(loss) |

|

|

|

|

|

|

|

|

Interest income |

200 |

|

|

606 |

|

|

545 |

|

|

1,206 |

|

|

Interest expense |

(1,099 |

) |

|

(2 |

) |

|

(2,140 |

) |

|

(14 |

) |

|

Foreign exchange gain (loss) |

(47 |

) |

|

60 |

|

|

(65 |

) |

|

68 |

|

|

Equity investment loss |

— |

|

|

(3,334 |

) |

|

— |

|

|

(7,985 |

) |

| Total other

loss |

(946 |

) |

|

(2,670 |

) |

|

(1,660 |

) |

|

(6,725 |

) |

| Net loss |

$ |

(14,087 |

) |

|

$ |

(23,315 |

) |

|

$ |

(27,948 |

) |

|

$ |

(46,566 |

) |

| Dividend accretion of

convertible preferred shares |

(2,995 |

) |

|

(2,762 |

) |

|

(5,973 |

) |

|

(5,477 |

) |

| Net loss attributable

to common shares |

$ |

(17,082 |

) |

|

$ |

(26,077 |

) |

|

$ |

(33,921 |

) |

|

$ |

(52,043 |

) |

| Loss per

share |

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.25 |

) |

|

$ |

(0.46 |

) |

|

$ |

(0.49 |

) |

|

$ |

(0.92 |

) |

| Weighted average

number of common shares |

|

|

|

|

|

|

|

|

Basic and diluted |

69,604,726 |

|

|

56,805,583 |

|

|

68,656,566 |

|

|

56,275,795 |

|

| |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands)

| |

June 30, 2020 |

|

December 31, 2019 |

|

Cash and cash equivalents |

$ |

45,899 |

|

|

$ |

31,799 |

|

| Investments in marketable

securities, current |

36,489 |

|

|

59,035 |

|

| Accounts receivable and other

current assets |

3,148 |

|

|

2,994 |

|

|

Total current assets |

85,536 |

|

|

93,828 |

|

| Property and equipment, net of

accumulated depreciation |

7,741 |

|

|

8,676 |

|

| Investments in marketable

securities, non-current |

1,600 |

|

|

— |

|

| Right of use asset |

2,575 |

|

|

2,738 |

|

| Other non-current assets |

173 |

|

|

293 |

|

|

Total assets |

$ |

97,625 |

|

|

$ |

105,535 |

|

| Accounts payable and accrued

liabilities |

$ |

5,813 |

|

|

$ |

7,235 |

|

| Liability-classified options |

150 |

|

|

253 |

|

| Lease liability, current |

364 |

|

|

340 |

|

|

Total current liabilities |

6,327 |

|

|

7,828 |

|

| Liability related to sale of

future royalties |

19,739 |

|

|

18,992 |

|

| Contingent consideration |

3,181 |

|

|

2,953 |

|

| Lease liability, non-current |

2,867 |

|

|

3,018 |

|

| Total stockholders’ equity |

65,511 |

|

|

72,744 |

|

|

Total liabilities and stockholders’ equity |

$ |

97,625 |

|

|

$ |

105,535 |

|

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOW(in thousands)

| |

Six Months Ended June 30, |

| |

2020 |

|

2019 |

|

Net loss |

$ |

(27,948 |

) |

|

$ |

(46,566 |

) |

| Non-cash items |

5,114 |

|

|

13,936 |

|

| Changes in working capital |

(1,420 |

) |

|

(1,555 |

) |

|

Net cash used in operating activities |

(24,254 |

) |

|

(34,185 |

) |

|

Net cash provided by investing activities |

20,970 |

|

|

71,005 |

|

|

Net cash provided by financing activities |

17,440 |

|

|

5,015 |

|

| Effect of foreign exchange rate

changes on cash and cash equivalents |

(56 |

) |

|

95 |

|

|

Increase in cash and cash equivalents |

$ |

14,100 |

|

|

$ |

41,930 |

|

| Cash and cash equivalents,

beginning of period |

31,799 |

|

|

36,942 |

|

|

Cash and cash equivalents, end of period |

$ |

45,899 |

|

|

$ |

78,872 |

|

| Investments in marketable

securities |

38,089 |

|

|

16,410 |

|

|

Cash, cash equivalents and investments, end of

period |

$ |

83,988 |

|

|

$ |

95,282 |

|

Conference Call and Webcast Today

Arbutus will hold a conference call and webcast

today, Friday, August 7, 2020 at 8:45 AM Eastern Time to provide a

corporate update. You can access a live webcast of the call through

the Investors section of Arbutus’ website at www.arbutusbio.com or

directly at Live Webcast. Alternatively, you can dial (866)

393-1607 or (914) 495-8556 and reference conference ID 4974547.

An archived webcast will be available on the

Arbutus website after the event. Alternatively, you may access a

replay of the conference call by calling (855) 859-2056 or (404)

537-3406, and reference conference ID 4974547.

About Arbutus

Arbutus Biopharma Corporation is a publicly

traded (Nasdaq: ABUS) biopharmaceutical company dedicated to

discovering, developing and commercializing a cure for people with

chronic hepatitis B virus (HBV) infection. The Company is advancing

multiple drug product candidates that may be combined into a

potentially curative regimen for chronic HBV infection. Arbutus has

also initiated a drug discovery and development effort for treating

coronaviruses (including COVID-19). For more information, visit

www.arbutusbio.com.

Forward-Looking Statements and

Information

This press release contains forward-looking

statements within the meaning of the Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934,

and forward-looking information within the meaning of Canadian

securities laws (collectively, “forward-looking statements”).

Forward-looking statements in this press release include statements

about Arbutus’ expectations regarding the timing and clinical

development of its product candidates, including Arbutus’

expectations that results from the multi-dose 60 mg cohorts and

single-dose 90 mg cohorts in HBV DNA negative and positive subjects

will be available in the second half of 2020 and that IND-enabling

studies for AB-836 will be complete by the end of 2020; Arbutus’

planned 2020 cash burn guidance; the potential safety and efficacy

of Arbutus’ product candidates, including the potential for AB-836

to have increase potency and an enhanced resistance profile

compared to AB-506; Arbutus’ expectations regarding its internal

and external research efforts to combat COVID-19 and future

coronavirus outbreaks; Arbutus’ expectation to dose two 90 mg

multi-dose cohorts in the second half of this year; the expected

sufficiency of Arbutus’ ending second quarter cash, cash

equivalents and investments plus additional proceeds received under

Arbutus’ ATM program during July 2020 are sufficient to fund

operations into mid-2022; Arbutus’ expectations regarding its

technology licensed to Genevant and Arbutus’ expectations regarding

the effect of the COVID-19 pandemic on its business.

With respect to the forward-looking statements

contained in this press release, Arbutus has made numerous

assumptions regarding, among other things: the timely receipt of

expected payments; the effectiveness and timeliness of preclinical

studies and clinical trials, and the usefulness of the data; the

timeliness of regulatory approvals; the continued demand for

Arbutus’ assets; and the stability of economic and market

conditions. While Arbutus considers these assumptions to be

reasonable, these assumptions are inherently subject to significant

business, economic, competitive, market and social uncertainties

and contingencies, including uncertainties and contingencies

related to the ongoing COVID-19 pandemic.

Additionally, there are known and unknown risk

factors which could cause Arbutus’ actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements contained herein. Known risk factors

include, among others: anticipated pre-clinical studies and

clinical trials may be more costly or take longer to complete than

anticipated, and may never be initiated or completed, or may not

generate results that warrant future development of the tested drug

candidate; changes in Arbutus’ strategy regarding its product

candidates and clinical development activities; Arbutus may not

receive the necessary regulatory approvals for the clinical

development of Arbutus’ products; economic and market conditions

may worsen; and market shifts may require a change in strategic

focus; and the ongoing COVID-19 pandemic could significantly

disrupt our clinical development programs.

A more complete discussion of the risks and

uncertainties facing Arbutus appears in Arbutus’ Annual Report on

Form 10-K, Arbutus’ Quarterly Reports on Form 10-Q and Arbutus’

continuous and periodic disclosure filings, which are available at

www.sedar.com and at www.sec.gov. All forward-looking statements

herein are qualified in their entirety by this cautionary

statement, and Arbutus disclaims any obligation to revise or update

any such forward-looking statements or to publicly announce the

result of any revisions to any of the forward-looking statements

contained herein to reflect future results, events or developments,

except as required by law.

Contact Information

Investors and Media

William H. CollierPresident and CEOPhone:

267-469-0914Email: ir@arbutusbio.com

Pam MurphyInvestor Relations ConsultantPhone: 267-469-0914Email:

ir@arbutusbio.com

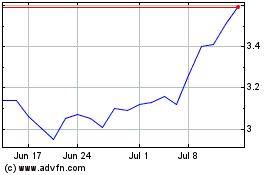

Arbutus Biopharma (NASDAQ:ABUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

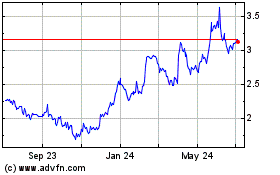

Arbutus Biopharma (NASDAQ:ABUS)

Historical Stock Chart

From Apr 2023 to Apr 2024