By Tim Higgins

Apple Inc. finished 2020 with its most profitable quarter ever,

fueled by an uptick in higher-end iPhone sales and a

pandemic-induced surge in demand for its laptops and tablets.

All together, the Cupertino, Calif., company generated $111.4

billion in quarterly sales, an all-time high and the first time it

has topped $100 billion in quarterly revenue. Profit rose 29% to

$28.76 billion in the three months ended in December, its fiscal

first quarter. On a per-share basis, Apple said it earned $1.68,

exceeding the $1.41 predicted by analysts in a FactSet survey.

The results arrived Wednesday during the biggest week for

corporate earnings this quarter and on the same day Tesla Inc. and

Facebook Inc. posted closely watched profits. Facebook reported

record net income but also warned that uncertainty from regulatory

probes and ad-targeting limits could create business headwinds.

Tesla posted its sixth-straight quarter of profits but fell in

after-market trading after noting its bottom line was weighed down

by supply chain costs and preparations for updated vehicles.

"We could not be more optimistic," Apple Chief Executive Tim

Cook said in an interview about the company's product lineup.

Apple shares rose 81% in 2020 and are up about 7% this year

through Wednesday's close on investor enthusiasm around its latest

iPhone and heightened spending on its products from consumers

working, going to school and seeking entertainment while stuck at

home. It is one of a number of tech companies whose outsize

performance contrasts with the millions of Americans out of work

amid the global pandemic.

The holiday quarter is always a closely watched period for

Apple, accounting for about 30% of its annual sales. This time

around, however, it takes on greater emphasis with the arrival of

the iPhone 12 that some analysts and investors were betting would

trigger a record boom similar to when the first large-screen iPhone

was introduced in 2014. That bet, however, was thrown into question

with the spread of the coronavirus last year.

The initial outbreak in China delayed the production of the

flagship phone and pushed back its launch to October from its

typical September debut. Some versions of the new phone didn't

start shipping to customers until November, cutting down the number

of weeks Apple typically has in the period to capture sales ahead

of Christmas.

Those delays had created some uncertainty about how strong of a

period Apple could report. "There is one school of thought that

because of the delayed launch and some supply constraints, the

iPhone units may be on the low side," said Mark Stoeckle, chief

executive of Adams Funds, which counts Apple among its largest

holdings. "Although we view this as a possibility, what we believe

strongly is that the iPhone 12 will be very successful in

2021."

The results were achieved despite supply chain issues. In the

interview, Mr. Cook said the iPhone 12 should be in balance this

quarter, while he doesn't expect iPad issues to be resolved this

quarter.

Katy Huberty, a Morgan Stanley analyst, is among the more

bullish, calling the iPhone introduction in a note to investors

last week "Apple's most successful product launch in the last five

years."

Despite the delay, analysts on average had predicted that

revenue would rise to $102.8 billion. While Apple no longer breaks

out unit sales, analysts say revenue was likely helped by demand

for the higher-end models of the new smartphone. Mr. Cook said

iPhone results were helped by the iPhone 12s.

For the iPhone 12, Apple introduced four versions of the lineup,

including a new mini version with a starting price of $699, which

was the same cost as the larger iPhone 11 a year earlier. The

comparably sized iPhone 12 costs about $100 more than its

predecessor, and the biggest and most expensive iPhone 12 Max

begins at $1,099.

In the U.S., the average retail price of the iPhone rose to $873

from $809 a year ago, driven by buyers gravitating to the more

expensive versions, according to a survey of customers by Consumer

Intelligence Research Partners LLC. The improvements in pricing

follow a trend under Mr. Cook to boost the average selling price of

iPhones, squeezing more profit out of the devices as unit sales

have fallen from a peak of 231 million in fiscal 2015.

iPhone revenue rose 17% to $65.6 billion in the December

quarter. That growth was slower than in other parts of Apple's

business, which helped boost its results in recent quarters amid

declining iPhone sales. Sales increases of 21% for the Mac lineup

and 41% for iPads helped generate the record results. Laptop sales

were helped by the arrival of the company's new in-house chip,

dubbed, the M1, according to Mr. Cook.

Another closely watched metric, Apple's service business, which

has taken on increased importance in recent years, rose 24%.

Investors on Wednesday were looking for signs that the new

iPhone has legs. Analysts predict sales will rise to $74 billion in

the current quarter, up almost 30% compared with a year ago.

Normally, a closely watched part of Apple's quarterly reporting is

its sales guidance, but such forecasts were scrapped last year amid

the uncertainty around Covid-19. Apple hasn't said when it might

return to such disclosures.

The potential for the October-to-December quarter has long

excited analysts and investors who had bet that pent-up demand for

a technologically improved iPhone would spur a buying surge. The

latest iPhone has the capability of accessing the next-generation

cellular network, dubbed 5G, which promises faster internet

speeds.

The new iPhone helped sales rise 57% in China, which has a more

developed 5G network.

Cellular carriers have used the arrival of a 5G iPhone to try to

poach new customers. But it is unclear whether that is happening.

Verizon Communications Inc., the largest U.S. cellphone carrier, on

Tuesday reported fourth-quarter results that showed fewer new

customers than analysts had expected. Still, executives said they

remained optimistic about the year ahead.

The lack of killer new programs to take advantage of that 5G

speed and a limited network raised questions among some analysts

about the true interest of the feature as a selling point for the

pricey new phones.

Of the iPhone buyers in Consumer Intelligence's survey, only

seven mentioned 5G. Most said they were motivated in buying the new

iPhone because of problems with their previous phone or because of

general motivations around upgrading.

(Dow Jones & Co., publisher of The Wall Street Journal, has

a commercial agreement to supply news through Apple services.)

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

January 27, 2021 18:08 ET (23:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

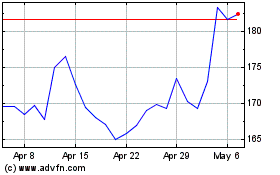

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

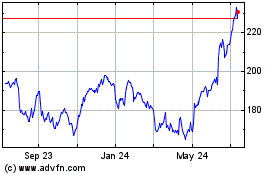

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024