AAON, INC. (NASDAQ-AAON), today announced its results for the

second quarter of 2021.

| Financial

Highlights: |

Three Months Ended June

30, |

|

% |

|

|

|

Six Months Ended June

30, |

|

% |

| |

2021 |

|

2020 |

|

Change |

|

|

|

2021 |

|

2020 |

|

Change |

| |

(in thousands, except share and per share data) |

|

|

|

(in thousands, except share and per share data) |

|

Net sales |

$ |

143,876 |

|

|

$ |

125,596 |

|

|

14.6 |

% |

|

|

|

$ |

259,664 |

|

|

$ |

263,079 |

|

|

(1.3 |

)% |

| Gross profit |

42,107 |

|

|

38,131 |

|

|

10.4 |

% |

|

|

|

75,264 |

|

|

81,078 |

|

|

(7.2 |

)% |

| Gross profit % |

29.3 |

% |

|

30.4 |

% |

|

|

|

|

|

29.0 |

% |

|

30.8 |

% |

|

|

| Selling, general and admin.

expenses |

$ |

16,895 |

|

|

$ |

15,939 |

|

|

6.0 |

% |

|

|

|

$ |

31,591 |

|

|

$ |

31,153 |

|

|

1.4 |

% |

| SG&A % |

11.7 |

% |

|

12.7 |

% |

|

|

|

|

|

12.2 |

% |

|

11.8 |

% |

|

|

| Net income |

20,615 |

|

|

17,804 |

|

|

15.8 |

% |

|

|

|

36,991 |

|

|

39,657 |

|

|

(6.7 |

)% |

| Net income % |

14.3 |

% |

|

14.2 |

% |

|

|

|

|

|

14.2 |

% |

|

15.1 |

% |

|

|

| Effective Tax Rate |

18.3 |

% |

|

20.0 |

% |

|

|

|

|

|

15.4 |

% |

|

20.8 |

% |

|

|

| Earnings per diluted

share |

$ |

0.38 |

|

|

$ |

0.34 |

|

|

11.8 |

% |

|

|

|

$ |

0.69 |

|

|

$ |

0.75 |

|

|

(8.0 |

)% |

| Diluted average shares |

53,603,932 |

|

|

52,750,401 |

|

|

1.6 |

% |

|

|

|

53,736,134 |

|

|

52,885,491 |

|

|

1.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA, a non-GAAP

measure |

$ |

32,777 |

|

|

$ |

28,562 |

|

|

14.8 |

% |

|

|

|

$ |

58,653 |

|

|

$ |

62,332 |

|

|

(5.9 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

June 30, |

|

June 30, |

% |

|

|

|

|

|

|

|

|

| |

2021 |

|

2020 |

|

Change |

|

|

|

|

|

|

|

|

| |

(in thousands) |

|

|

|

|

|

|

|

|

|

|

| Backlog |

$ |

138,131 |

|

|

$ |

103,508 |

|

|

33.4 |

% |

|

|

|

|

|

|

|

|

| Cash & cash equivalents

& restricted cash |

112,119 |

|

|

70,845 |

|

|

58.3 |

% |

|

|

|

|

|

|

|

|

Net sales for the three months ended June 30,

2021 increased 14.6% to an all time record high of $143.9 million

from $125.6 million in the same period in 2020. The year over year

increase in net sales was driven by robust replacement demand

broadly across the nonresidential building market that increased

our volume 24.6%. The return to historical employee attendance

levels helped drive our production up year over year which led to

an increase in our overall revenues even as our product mix shifted

to lower priced units. The Company reported diluted EPS of $0.38,

up 11.8% from $0.34 in the prior year period. The increase in EPS

was driven by the higher revenue, improved productivity, lower

SG&A expenses as a percent of sales and a lower tax rate,

partially offset by inflationary cost pressures. The lower tax rate

compared to a year ago was associated with lower corporate income

tax rates in the state of Oklahoma that were signed into law during

the quarter. This resulted in a one-time benefit of $0.8 million,

and will also lower our effective rate starting in 2022.

The Company finished the quarter with a backlog

of $138.1 million, up from $103.5 million one year ago and up from

$96.7 million at the end of the first quarter of 2021. The

sequential improvement in backlog reflects the improved demand that

we experienced throughout the second quarter. New bookings in the

quarter increased approximately 70% compared to the same period one

year ago.

Gary Fields, President and CEO, stated, “Our

performance in the second quarter was better than we expected.

Organic sales growth of 14.6% was particularly noteworthy. Unlike

much of the commercial HVAC market that faced a very easy year over

year comparison due to the effects the pandemic had on the market

in the second quarter of 2020, we did not face such a comparison.

Our sales in the second quarter of 2020 were up year over year 5%

versus the commercial market being down approximately 20%-25%. We

were also pleased with our gross profit performance, especially

considering the inflationary challenges of tight labor markets and

increased raw material costs. We will continue to improve

productivity and increase prices to counteract these cost

pressures.”

Mr. Fields continued, “Looking to the second

half of the year, we are optimistic sales and earnings growth will

accelerate. The backlog at the end of the second quarter was up

33.4% from a year ago and 42.8% from the end of the first quarter,

which positions us well. Order trends are robust and we show no

sign of slowing. We are particularly optimistic considering the new

construction market has yet to recover from the pandemic-related

downturn. That said, we are seeing early signs of a strong recovery

in new construction project planning. In addition to robust demand,

we are optimistic our gross profit will continue to improve. Our

disciplined pricing strategy combined with expected productivity

improvements should drive higher gross and operating profits.

Lastly, we continue to manage the business for the long-term as we

maintain a positive outlook on the fundamentals of the company over

the next several years.”

As of June 30, 2021, the Company had no debt and

unrestricted cash and cash equivalents of $111.4 million, which is

up from $79.0 million at the end of 2020. Capital expenditures

during the first six months of 2021 were $33.2 million, as compared

to $33.5 million for the same period a year ago. Rebecca Thompson,

CFO, stated, “We continue to anticipate our full-year 2021 capital

expenditures will total approximately $70.7 million.”

The Company will host a conference call on

August 6, 2021 at 9:00 A.M. (Eastern Time) to discuss the second

quarter 2021 results. To participate, call 1-888-241-0551 (code

6788945); or, for rebroadcast available through August 13, 2021,

call 1-855-859-2056 (code 6788945).

About AAONAAON, Inc. is engaged

in the engineering, manufacturing, marketing and sale of air

conditioning and heating equipment consisting of standard,

semi-custom and custom rooftop units, chillers, packaged outdoor

mechanical rooms, air handling units, makeup air units, energy

recovery units, condensing units, geothermal/water-source heat

pumps, coils and controls. Since the founding of AAON in 1988, AAON

has maintained a commitment to design, develop, manufacture and

deliver heating and cooling products to perform beyond all

expectations and demonstrate the value of AAON to our customers.

For more information, please visit www.AAON.com.

Forward-Looking StatementsThis

press release includes “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Words such as “expects”, “anticipates”, “intends”, “plans”,

“believes”, “seeks”, “estimates”, “should”, “will”, and variations

of such words and similar expressions are intended to identify such

forward-looking statements. These statements are not guarantees of

future performance and involve certain risks, uncertainties and

assumptions, which are difficult to predict. Therefore, actual

outcomes and results may differ materially from what is expressed

or forecasted in such forward-looking statements. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date on which they are made.

We undertake no obligations to update publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise. Important factors that could cause results to differ

materially from those in the forward-looking statements include (1)

the timing and extent of changes in raw material and component

prices, (2) the effects of fluctuations in the

commercial/industrial new construction market, (3) the timing and

extent of changes in interest rates, as well as other competitive

factors during the year, and (4) general economic, market or

business conditions.

Contact InformationJoseph

MondilloDirector of Investor RelationsPhone: (617) 877-6346Email:

joseph.mondillo@aaon.com

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Income |

|

(Unaudited) |

| |

Three Months Ended June

30, |

|

Six Months Ended June

30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

(in thousands, except share and per share data) |

|

Net sales |

$ |

143,876 |

|

|

$ |

125,596 |

|

|

$ |

259,664 |

|

|

$ |

263,079 |

|

| Cost of sales |

101,769 |

|

|

87,465 |

|

|

184,400 |

|

|

182,001 |

|

| Gross profit |

42,107 |

|

|

38,131 |

|

|

75,264 |

|

|

81,078 |

|

| Selling, general and

administrative expenses |

16,895 |

|

|

15,939 |

|

|

31,591 |

|

|

31,153 |

|

| (Gain) loss on disposal of

assets |

— |

|

|

— |

|

|

— |

|

|

(62 |

) |

| Income from operations |

25,212 |

|

|

22,192 |

|

|

43,673 |

|

|

49,987 |

|

| Interest (expense), income,

net |

(4 |

) |

|

19 |

|

|

(1 |

) |

|

80 |

|

| Other income (expense),

net |

39 |

|

|

32 |

|

|

56 |

|

|

5 |

|

| Income before taxes |

25,247 |

|

|

22,243 |

|

|

43,728 |

|

|

50,072 |

|

| Income tax provision |

4,632 |

|

|

4,439 |

|

|

6,737 |

|

|

10,415 |

|

| Net income |

$ |

20,615 |

|

|

$ |

17,804 |

|

|

$ |

36,991 |

|

|

$ |

39,657 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.39 |

|

|

$ |

0.34 |

|

|

$ |

0.71 |

|

|

$ |

0.76 |

|

|

Diluted |

$ |

0.38 |

|

|

$ |

0.34 |

|

|

$ |

0.69 |

|

|

$ |

0.75 |

|

| Cash dividends declared per

common share: |

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.19 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

52,432,822 |

|

|

52,099,694 |

|

|

52,389,989 |

|

|

52,160,348 |

|

|

Diluted |

53,603,932 |

|

|

52,750,401 |

|

|

53,736,134 |

|

|

52,885,491 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

June 30, 2021 |

|

December 31, 2020 |

| Assets |

(in thousands, except share and per share data) |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

111,427 |

|

|

$ |

79,025 |

|

|

Restricted cash |

692 |

|

|

3,263 |

|

|

Accounts receivable, net of allowance for credit losses of $518 and

$506, respectively |

53,311 |

|

|

47,387 |

|

|

Income tax receivable |

3,339 |

|

|

4,587 |

|

|

Note receivable |

32 |

|

|

31 |

|

|

Inventories, net |

87,399 |

|

|

82,219 |

|

|

Prepaid expenses and other |

2,940 |

|

|

3,739 |

|

| Total current assets |

259,140 |

|

|

220,251 |

|

| Property, plant and

equipment: |

|

|

|

|

Land |

5,016 |

|

|

4,072 |

|

|

Buildings |

129,607 |

|

|

122,171 |

|

|

Machinery and equipment |

301,964 |

|

|

281,266 |

|

|

Furniture and fixtures |

20,726 |

|

|

18,956 |

|

|

Total property, plant and equipment |

457,313 |

|

|

426,465 |

|

|

Less: Accumulated depreciation |

217,549 |

|

|

203,125 |

|

| Property, plant and equipment,

net |

239,764 |

|

|

223,340 |

|

| Goodwill and intangible

assets, net |

3,229 |

|

|

3,267 |

|

| Right of use assets |

1,472 |

|

|

1,571 |

|

| Note receivable |

579 |

|

|

579 |

|

| Total assets |

$ |

504,184 |

|

|

$ |

449,008 |

|

| |

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

21,250 |

|

|

$ |

12,447 |

|

|

Dividends payable |

9,970 |

|

|

— |

|

|

Accrued liabilities |

47,291 |

|

|

46,586 |

|

| Total current liabilities |

78,511 |

|

|

59,033 |

|

| Deferred tax liabilities |

31,071 |

|

|

28,324 |

|

| Other long-term

liabilities |

4,493 |

|

|

4,423 |

|

| New market tax credit

obligation |

6,383 |

|

|

6,363 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no

shares issued |

— |

|

|

— |

|

|

Common stock, $.004 par value, 100,000,000 shares authorized,

52,416,014 and 52,224,767 issued and outstanding at June 30,

2021 and December 31, 2020, respectively |

210 |

|

|

209 |

|

|

Additional paid-in capital |

10,998 |

|

|

5,161 |

|

|

Retained earnings |

372,518 |

|

|

345,495 |

|

| Total stockholders’

equity |

383,726 |

|

|

350,865 |

|

| Total liabilities and

stockholders’ equity |

$ |

504,184 |

|

|

$ |

449,008 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Cash Flows |

|

(Unaudited) |

| |

Six Months Ended June

30, |

| |

2021 |

|

2020 |

| Operating

Activities |

(in thousands) |

|

Net income |

$ |

36,991 |

|

|

$ |

39,657 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

14,924 |

|

|

12,340 |

|

|

Amortization of debt issuance cost |

20 |

|

|

20 |

|

|

Provision for credit losses on accounts receivable, net of

adjustments |

12 |

|

|

76 |

|

|

Provision (recoveries) for excess and obsolete inventories |

292 |

|

|

(193 |

) |

|

Share-based compensation |

5,793 |

|

|

5,694 |

|

|

(Gain) loss on disposition of assets |

— |

|

|

(62 |

) |

|

Foreign currency transaction (gain) loss |

(11 |

) |

|

30 |

|

|

Interest income on note receivable |

(19 |

) |

|

(12 |

) |

|

Deferred income taxes |

2,747 |

|

|

5,061 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

(5,936 |

) |

|

10,929 |

|

|

Income taxes |

1,248 |

|

|

(4,382 |

) |

|

Inventories |

(5,472 |

) |

|

(11,617 |

) |

|

Prepaid expenses and other |

799 |

|

|

(568 |

) |

|

Accounts payable |

10,650 |

|

|

2,893 |

|

|

Deferred revenue |

574 |

|

|

473 |

|

|

Accrued liabilities |

300 |

|

|

2,423 |

|

|

Net cash provided by operating activities |

62,912 |

|

|

62,762 |

|

| Investing

Activities |

|

|

|

|

Capital expenditures |

(33,157 |

) |

|

(33,510 |

) |

|

Proceeds from sale of property, plant and equipment |

2 |

|

|

61 |

|

|

Principal payments from note receivable |

29 |

|

|

25 |

|

|

Net cash used in investing activities |

(33,126 |

) |

|

(33,424 |

) |

| Financing

Activities |

|

|

|

|

Stock options exercised |

11,848 |

|

|

14,173 |

|

|

Repurchase of stock |

(10,271 |

) |

|

(15,937 |

) |

|

Employee taxes paid by withholding shares |

(1,532 |

) |

|

(1,102 |

) |

|

Net cash provided by (used in) financing activities |

45 |

|

|

(2,866 |

) |

| Net increase in cash,

cash equivalents and restricted cash |

29,831 |

|

|

26,472 |

|

| Cash, cash equivalents

and restricted cash, beginning of period |

82,288 |

|

|

44,373 |

|

| Cash, cash equivalents

and restricted cash, end of period |

$ |

112,119 |

|

|

$ |

70,845 |

|

Use of Non-GAAP Financial

MeasuresTo supplement the Company’s consolidated financial

statements presented in accordance with generally accepted

accounting principles (“GAAP”), an additional non-GAAP financial

measure is provided and reconciled in the following table. The

Company believes that this non-GAAP financial measure, when

considered together with the GAAP financial measures, provides

information that is useful to investors in understanding

period-over-period operating results. The Company believes that

this non-GAAP financial measure enhances the ability of investors

to analyze the Company’s business trends and operating

performance.

EBITDAEBITDA (as defined below)

is presented herein and reconciled from the GAAP measure of net

income because of its wide acceptance by the investment community

as a financial indicator of a company's ability to internally fund

operations.

The Company defines EBITDA as net income, plus

(1) depreciation and amortization, (2) interest expense (income),

net and (3) income tax expense. EBITDA is not a measure of net

income or cash flows as determined by GAAP.

The Company’s EBITDA measure provides additional

information which may be used to better understand the Company’s

operations. EBITDA is one of several metrics that the Company uses

as a supplemental financial measurement in the evaluation of its

business and should not be considered as an alternative to, or more

meaningful than, net income, as an indicator of operating

performance. Certain items excluded from EBITDA are significant

components in understanding and assessing a company's financial

performance. EBITDA, as used by the Company, may not be comparable

to similarly titled measures reported by other companies. The

Company believes that EBITDA is a widely followed measure of

operating performance and is one of many metrics used by the

Company’s management team and by other users of the Company’s

consolidated financial statements.

The following table provides a reconciliation of

net income (GAAP) to EBITDA (non-GAAP) for the periods

indicated:

| |

Three Months Ended June

30, |

|

Six Months Ended June

30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

(in thousands) |

|

Net Income, a GAAP measure |

$ |

20,615 |

|

|

$ |

17,804 |

|

|

$ |

36,991 |

|

|

$ |

39,657 |

|

| Depreciation and

amortization |

7,526 |

|

|

6,338 |

|

|

14,924 |

|

|

12,340 |

|

| Interest expense (income),

net |

|

4 |

|

|

(19 |

) |

|

|

1 |

|

|

(80 |

) |

| Income tax expense |

4,632 |

|

|

4,439 |

|

|

6,737 |

|

|

10,415 |

|

| EBITDA, a non-GAAP

measure |

$ |

32,777 |

|

|

$ |

28,562 |

|

|

$ |

58,653 |

|

|

$ |

62,332 |

|

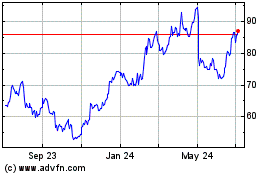

AAON (NASDAQ:AAON)

Historical Stock Chart

From Mar 2024 to Apr 2024

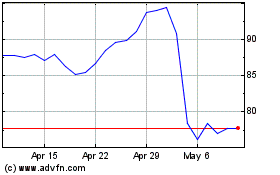

AAON (NASDAQ:AAON)

Historical Stock Chart

From Apr 2023 to Apr 2024