AAON Reports Record Sales and Earnings For 2020

February 25 2021 - 7:00AM

AAON, INC. (NASDAQ-AAON), today announced its results for the

fourth quarter of 2020.

| Financial

Highlights: |

Three Months Ended December

31, |

|

% |

|

Years Ending December

31, |

|

% |

| |

2020 |

|

2019 |

|

Change |

|

2020 |

|

2019 |

|

Change |

| |

(in thousands, except share and per share data) |

|

(in thousands, except share and per share data) |

|

Net sales |

$ |

116,700 |

|

|

$ |

122,574 |

|

|

(4.8 |

)% |

|

$ |

514,551 |

|

|

$ |

469,333 |

|

|

9.6 |

% |

| Gross profit |

33,923 |

|

|

36,381 |

|

|

(6.8 |

)% |

|

155,849 |

|

|

119,425 |

|

|

30.5 |

% |

| Gross profit % |

29.1 |

% |

|

29.7 |

% |

|

|

|

30.3 |

% |

|

25.4 |

% |

|

|

| Selling, general and admin.

expenses |

$ |

14,622 |

|

|

$ |

13,114 |

|

|

11.5 |

% |

|

$ |

60,491 |

|

|

$ |

52,077 |

|

|

16.2 |

% |

| SG&A % |

12.5 |

% |

|

10.7 |

% |

|

|

|

11.8 |

% |

|

11.1 |

% |

|

|

| Net income* |

18,892 |

|

|

17,273 |

|

|

9.4 |

% |

|

79,009 |

|

|

53,711 |

|

|

47.1 |

% |

| Net income % |

16.2 |

% |

|

14.1 |

% |

|

|

|

15.4 |

% |

|

11.4 |

% |

|

|

| Effective Tax Rate |

26.6 |

% |

|

25.6 |

% |

|

|

|

22.5 |

% |

|

19.9 |

% |

|

|

| Earnings per diluted

share* |

$ |

0.35 |

|

|

$ |

0.33 |

|

|

6.1 |

% |

|

$ |

1.49 |

|

|

$ |

1.02 |

|

|

46.1 |

% |

| Diluted average shares |

53,469,759 |

|

|

52,701,202 |

|

|

1.5 |

% |

|

53,061,169 |

|

|

52,635,415 |

|

|

0.8 |

% |

|

*Includes $4.1 million or $0.08 per share related to a gain from

insurance proceeds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

December 31, |

|

December 31, |

% |

|

|

|

|

|

|

| |

2020 |

|

2019 |

|

Change |

|

|

|

|

|

|

| |

(in thousands) |

|

|

|

|

|

|

|

|

| Backlog |

$ |

74,417 |

|

|

$ |

142,747 |

|

|

(47.9 |

)% |

|

|

|

|

|

|

| Cash & cash equivalents

& restricted cash |

82,288 |

|

|

44,373 |

|

|

85.4 |

% |

|

|

|

|

|

|

| Total current liabilities |

59,033 |

|

|

56,028 |

|

|

5.4 |

% |

|

|

|

|

|

|

Net sales for the fourth quarter 2020 decreased

to $116.7 million from $122.6 million in 2019 primarily as a result

of this year's six additional days of planned plant holiday closure

at the end of December 2020. The Company reported diluted EPS of

$0.35, up 6.1% from $0.33 in the prior year period. The Company had

a gain of $4.1 million, net of profit sharing and taxes, associated

with insurance proceeds related to a damaged roof incurred by

adverse weather earlier in the year, which impacted our diluted EPS

by $0.08.

The Company finished the quarter with a backlog

of $74.4 million. The decline in backlog was related to initiatives

made to improve productivity and lead times to meet customer

delivery expectations. New bookings in the quarter

increased 6% compared to the same period one year

ago. As of February 1, 2021, our backlog was approximately

$103.8 million, compared to $129.2 million at February 1,

2020.

For the twelve months ending December 31, 2020,

sales were a record $514.6 million, an increase of 9.6% compared

with $469.3 million in 2019. Diluted earnings per share increased

46.1% to $1.49.

Gary Fields, President and CEO, said, "We are

pleased to report all-time record sales and earnings in 2020

compared to any other year in our Company's history. I am

especially proud we achieved these results in a year that presented

many challenges to the Company and our end-markets. Achieving

organic sales growth of nearly 10% while simultaneously improving

our gross margins by 490 basis points to 30.3% is truly an

achievement. At the same time, we continued to invest in growth as

our capex spend for the year was up 82.4%, amounting to 13.2% of

sales."

Mr. Fields continued, "Our fourth quarter

results demonstrate demand slowed as we finished the year. The

outlook for 2021 continues to present uncertainty, especially for

the first half of the year. Architectural billings and

nonresidential construction starts in 2020 suggest new construction

demand will be soft, particularly in end-markets significantly

impacted by the COVID-19 pandemic such as the hospitality and

office building markets."

Mr. Fields added, "However, new bookings in the

fourth quarter still grew year-over-year 6% and demand so far in

2021 has been surprisingly solid. Furthermore, we are starting to

see positive signs in our replacement business and certain

end-markets like data centers, warehouses and healthcare. We are

also well positioned to take advantage of our customers' increased

focus on indoor air quality to address COVID challenges, which we

expect will drive incremental demand. Finally, ongoing progress in

our transition from entrepreneurial leadership to a collaborative

team-based management approach, a strengthening sales channel,

improved productivity and lead times, new capacity at our Longview,

Texas facility and a strong product development pipeline keeps us

optimistic on the outlook of our business. While we believe demand

will be soft to start the year, we think activity should be

moderate in the first half and then accelerate in the second

half."

The Company finished 2020 in a strong financial

position as evidenced by a current ratio of 3.7:1 at

December 31, 2020. We had no debt and unrestricted cash and

cash equivalents of $79.0 million as of December 31, 2020. Our

capital expenditures during the twelve months ended

December 31, 2020 were $67.8 million, as compared to $37.2

million for the same period a year ago, and we anticipate our

full-year 2021 capital expenditures will total approximately $70.7

million.

The Company will host a conference call today at

4:15 P.M. (Eastern Time) to discuss the fourth quarter 2020

results. To participate, call 1-833-674-0554 (code 3448509); or,

for rebroadcast available through March 5, 2021, call

1-855-859-2056 (code 3448509).

About AAONAAON, Inc. is engaged

in the engineering, manufacturing, marketing and sale of air

conditioning and heating equipment consisting of standard,

semi-custom and custom rooftop units, chillers, packaged outdoor

mechanical rooms, air handling units, makeup air units, energy

recovery units, condensing units, geothermal/water-source heat

pumps, coils and controls. Since the founding of AAON in 1988, AAON

has maintained a commitment to design, develop, manufacture and

deliver heating and cooling products to perform beyond all

expectations and demonstrate the value of AAON to our customers.

For more information, please visit www.AAON.com.

Forward-Looking

StatementsCertain statements in this news release may be

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933. Statements regarding future prospects

and developments are based upon current expectations and involve

certain risks and uncertainties, including risks related to the

impact of the error correction, that could cause actual results and

developments to differ materially from the forward-looking

statements.

Contact InformationJoseph

MondilloDirector of Investor RelationsPhone: (617)

877-6346Email: joseph.mondillo@aaon.com

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Income |

|

(Unaudited) |

|

|

| |

Three Months Ended December

31, |

|

Years Ending December

31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

(in thousands, except share and per share data) |

|

Net sales |

$ |

116,700 |

|

|

$ |

122,574 |

|

|

$ |

514,551 |

|

|

$ |

469,333 |

|

| Cost of sales |

82,777 |

|

|

86,193 |

|

|

358,702 |

|

|

349,908 |

|

| Gross profit |

33,923 |

|

|

36,381 |

|

|

155,849 |

|

|

119,425 |

|

| Selling, general and

administrative expenses |

14,622 |

|

|

13,114 |

|

|

60,491 |

|

|

52,077 |

|

| (Gain) loss on disposal of

assets and insurance recoveries |

(6,417 |

) |

|

41 |

|

|

(6,478 |

) |

|

337 |

|

| Income from operations |

25,718 |

|

|

23,226 |

|

|

101,836 |

|

|

67,011 |

|

| Interest income, net |

(2 |

) |

|

17 |

|

|

88 |

|

|

66 |

|

| Other income (expense),

net |

31 |

|

|

(30 |

) |

|

51 |

|

|

(46 |

) |

| Income before taxes |

25,747 |

|

|

23,213 |

|

|

101,975 |

|

|

67,031 |

|

| Income tax provision |

6,855 |

|

|

5,940 |

|

|

22,966 |

|

|

13,320 |

|

| Net income |

$ |

18,892 |

|

|

$ |

17,273 |

|

|

$ |

79,009 |

|

|

$ |

53,711 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.36 |

|

|

$ |

0.33 |

|

|

$ |

1.51 |

|

|

$ |

1.03 |

|

|

Diluted |

$ |

0.35 |

|

|

$ |

0.33 |

|

|

$ |

1.49 |

|

|

$ |

1.02 |

|

| Cash dividends declared per

common share: |

$ |

0.19 |

|

|

$ |

0.16 |

|

|

$ |

0.38 |

|

|

$ |

0.32 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

52,240,829 |

|

|

52,094,125 |

|

|

52,168,679 |

|

|

52,079,865 |

|

|

Diluted |

53,469,759 |

|

|

52,701,202 |

|

|

53,061,169 |

|

|

52,635,415 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

December 31, 2020 |

|

December 31, 2019 |

| Assets |

(in thousands, except share and per share data) |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

79,025 |

|

|

$ |

26,797 |

|

|

Restricted cash |

3,263 |

|

|

17,576 |

|

|

Accounts receivable, net of allowance for credit losses of $506 and

$353, respectively |

47,387 |

|

|

67,399 |

|

|

Income tax receivable |

4,587 |

|

|

772 |

|

|

Note receivable |

31 |

|

|

29 |

|

|

Inventories, net |

82,219 |

|

|

73,601 |

|

|

Prepaid expenses and other |

3,739 |

|

|

1,375 |

|

| Total current assets |

220,251 |

|

|

187,549 |

|

| Property, plant and

equipment: |

|

|

|

|

Land |

4,072 |

|

|

3,274 |

|

|

Buildings |

122,171 |

|

|

101,113 |

|

|

Machinery and equipment |

281,266 |

|

|

236,087 |

|

|

Furniture and fixtures |

18,956 |

|

|

16,862 |

|

|

Total property, plant and equipment |

426,465 |

|

|

357,336 |

|

|

Less: Accumulated depreciation |

203,125 |

|

|

179,242 |

|

| Property, plant and equipment,

net |

223,340 |

|

|

178,094 |

|

| Intangible assets, net |

38 |

|

|

272 |

|

| Goodwill |

3,229 |

|

|

3,229 |

|

| Right of use assets |

1,571 |

|

|

1,683 |

|

| Note receivable |

579 |

|

|

597 |

|

| Total assets |

$ |

449,008 |

|

|

$ |

371,424 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Revolving credit facility |

$ |

— |

|

|

$ |

— |

|

|

Accounts payable |

12,447 |

|

|

11,759 |

|

|

Accrued liabilities |

46,586 |

|

|

44,269 |

|

| Total current liabilities |

59,033 |

|

|

56,028 |

|

| Deferred tax liabilities |

28,324 |

|

|

15,297 |

|

| Other long-term

liabilities |

4,423 |

|

|

3,639 |

|

| New market tax credit

obligation |

6,363 |

|

|

6,320 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no

shares issued |

— |

|

|

— |

|

|

Common stock, $.004 par value, 100,000,000 shares authorized,

52,224,767 and 52,078,515 issued and outstanding at

December 31, 2020 and December 31, 2019,

respectively |

209 |

|

|

208 |

|

|

Additional paid-in capital |

5,161 |

|

|

3,631 |

|

|

Retained earnings |

345,495 |

|

|

286,301 |

|

| Total stockholders'

equity |

350,865 |

|

|

290,140 |

|

| Total liabilities and

stockholders' equity |

$ |

449,008 |

|

|

$ |

371,424 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Cash Flows |

|

(Unaudited) |

| |

Years Ending December

31, |

| |

2020 |

|

2019 |

| Operating

Activities |

(in thousands) |

|

Net income |

$ |

79,009 |

|

|

$ |

53,711 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

25,634 |

|

|

22,766 |

|

|

Amortization of debt issuance cost |

43 |

|

|

7 |

|

|

Provision for credit losses on accounts receivable, net of

adjustments |

153 |

|

|

91 |

|

|

Provision for excess and obsolete inventories |

1,108 |

|

|

1,454 |

|

|

Share-based compensation |

11,342 |

|

|

11,799 |

|

|

(Gain) loss on disposition of assets |

(6,478 |

) |

|

337 |

|

|

Foreign currency transaction (gain) loss |

(12 |

) |

|

(27 |

) |

|

Interest income on note receivable |

(24 |

) |

|

(25 |

) |

|

Deferred income taxes |

13,027 |

|

|

6,038 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

19,859 |

|

|

(13,412 |

) |

|

Income taxes |

(3,815 |

) |

|

5,129 |

|

|

Inventories |

(9,726 |

) |

|

2,557 |

|

|

Prepaid expenses and other |

(2,364 |

) |

|

(329 |

) |

|

Accounts payable |

(2,155 |

) |

|

280 |

|

|

Deferred revenue |

1,010 |

|

|

425 |

|

|

Accrued liabilities |

2,203 |

|

|

7,124 |

|

|

Net cash provided by operating activities |

128,814 |

|

|

97,925 |

|

| Investing

Activities |

|

|

|

|

Capital expenditures |

(67,802 |

) |

|

(37,166 |

) |

|

Proceeds from sale of property, plant and equipment |

60 |

|

|

69 |

|

|

Insurance proceeds |

6,417 |

|

|

— |

|

|

Investment in certificates of deposits |

— |

|

|

(6,000 |

) |

|

Maturities of certificates of deposits |

— |

|

|

6,000 |

|

|

Principal payments from note receivable |

52 |

|

|

51 |

|

|

Net cash used in investing activities |

(61,273 |

) |

|

(37,046 |

) |

| Financing

Activities |

|

|

|

|

Proceeds from financing obligation, net of issuance costs |

— |

|

|

6,614 |

|

|

Payment related to financing costs |

— |

|

|

(301 |

) |

|

Stock options exercised |

21,418 |

|

|

12,625 |

|

|

Repurchase of stock |

(30,060 |

) |

|

(19,586 |

) |

|

Employee taxes paid by withholding shares |

(1,169 |

) |

|

(1,207 |

) |

|

Dividends paid to stockholders |

(19,815 |

) |

|

(16,645 |

) |

|

Net cash used in financing activities |

(29,626 |

) |

|

(18,500 |

) |

| Net increase in cash,

cash equivalents and restricted cash |

37,915 |

|

|

42,379 |

|

| Cash, cash equivalents

and restricted cash, beginning of period |

44,373 |

|

|

1,994 |

|

| Cash, cash equivalents

and restricted cash, end of period |

$ |

82,288 |

|

|

$ |

44,373 |

|

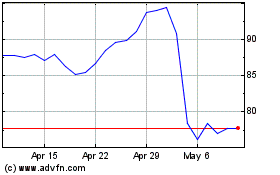

AAON (NASDAQ:AAON)

Historical Stock Chart

From Mar 2024 to Apr 2024

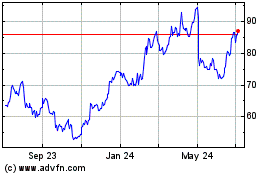

AAON (NASDAQ:AAON)

Historical Stock Chart

From Apr 2023 to Apr 2024