Current Report Filing (8-k)

July 29 2019 - 4:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 23, 2019

______________

Applied

Optoelectronics, Inc.

(Exact name of Registrant as specified

in its charter)

|

Delaware

|

001-36083

|

76-0533927

|

|

(State or incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

13139 Jess Pirtle Blvd.

Sugar Land, TX 77478

(address of principal executive offices

and zip code)

(281) 295-1800

(Registrant’s telephone number,

including area code)

______________

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each Class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, Par value $0.001

|

AAOI

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On July 23, 2019, Prime World International

Holdings, Ltd. (“Prime World”), a wholly owned subsidiary of Applied Optoelectronics, Inc., entered into a one-year

revolving credit facility totaling 100,000,000 NTD (the “NT$100M Credit Line”) and 1,000,000 USD (the “US$1M

Credit Line”) with Taishin International Bank in Taiwan (the “Bank”). Borrowing under the NT$100M Credit Line

will be used for short-term working capital; the borrowing under the US$1M Credit Line will be strictly used for spot transactions

in the foreign exchange market. The NT$100M Credit Line and US$1M Credit Line are collectively referred to as the “Credit

Facility”.

Prime World may draw upon the Credit Facility

from July 23, 2019 through July 31, 2020. The term of each draw shall be either 90 or 120 days. Borrowings under the NT$100M Credit

Line will bear interest at a rate of 2.25% for 90 day draws and 2.2% for 120 day draws; borrowings under the US$1M Credit Line

will bear interest equal to the Bank’s foreign exchange rate effective on the day of the applicable draw. At the end of the

draw term Prime World will make payment for all principal and accrued interest.

Prime World’s obligations under

the Credit Facility will be secured by a promissory note executed between Prime World and the Bank. The agreements for the Credit

Facility contain representations and warranties, and events of default applicable to Prime World that are customary for agreements

of this type.

The foregoing description of the Credit

Facility does not purport to be a complete statement of the parties’ rights and obligations under the Credit Facility and

is qualified in its entirety by reference to the translation of the full text of the Approval Notice of Credit Line, General Agreement

for Financial Transaction, Credit Facility Agreement, and Promissory Note which are attached as Exhibit 10.1 through 10.4 to this

Current Report on Form 8-K and are incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

|

The information contained in Item 1.01

of this Current Report on Form 8-K with respect to the Amendment is incorporated by reference herein and made a part hereof.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Applied Optoelectronics, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David C. Kuo

|

|

|

|

Name

|

David C. Kuo

|

|

|

|

Title:

|

General Counsel and Vice President

|

|

Date: July 29, 2019

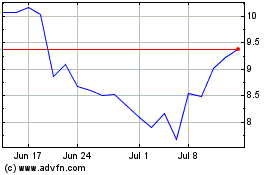

Applied Optoelectronics (NASDAQ:AAOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

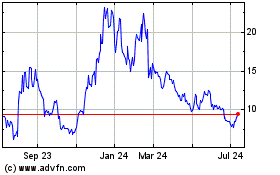

Applied Optoelectronics (NASDAQ:AAOI)

Historical Stock Chart

From Apr 2023 to Apr 2024