Current Report Filing (8-k)

May 31 2019 - 4:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 24, 2019

______________

Applied

Optoelectronics, Inc.

(Exact name of Registrant as specified

in its charter)

|

Delaware

|

001-36083

|

76-0533927

|

|

(State or incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

13139 Jess Pirtle Blvd.

Sugar Land, TX 77478

(address of principal executive offices

and zip code)

(281) 295-1800

(Registrant’s telephone number,

including area code)

______________

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each Class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, Par value $0.001

|

AAOI

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On May 24, 2019, Global Technology, Inc.

( “Global Technology”), a wholly owned subsidiary of Applied Optoelectronics, Inc., entered into a five-year revolving

credit line agreement, totaling 180,000,000 RMB (the “Credit Line”) and a mortgage security agreement (the “Security

Agreement”), with Shanghai Pudong Development Bank Co., Ltd., in Ningbo City, China ( the “Bank”). Borrowing

under the Credit Line will be used for general corporate and capital investment purposes.

The full Credit Line of 180 million RMB

shall be inclusive of all credit facilities previously entered into with the Bank including: the 30 million RMB credit facilities

entered into on May 7, 2019; the 2 million USD credit facility entered into on May 8, 2019; and the 9.9 million RMB credit facility

entered into on April 30, 2019.

Global Technology may draw upon the Credit

Line on an as-needed basis at any time during the 5-year term; however, draws under the Credit Line may become due and repayable

to the Bank at the Bank’s discretion due to changes in Chinese government regulations and/or changes in Global Technology’s

financial and operational condition. Each draw will bear interest equal to the Bank’s commercial banking interest rate effective

on the day of the applicable draw.

Global Technology’s obligations under

the Credit Line will be secured by real property owned by Global Technology and mortgaged to the Bank under the terms of the Security

Agreement. The agreements for the Credit Line and Security Agreement also contain rights and obligations, representations and warranties,

and events of default applicable to the Global Technology that are customary for agreements of this type.

The foregoing description of the Credit

Line and Security Agreement do not purport to be a complete statement of the parties’ rights and obligations under the agreements

and is qualified in its entirety by reference to the full text of the Financing Credit Line Agreement and Maximum Mortgage Contract

(Security Agreement), English translations of which are attached as Exhibit 10.1 and 10.2 to this Current Report on Form 8-K and

are incorporated by reference herein.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

|

The information contained in Item 1.01 of

this Current Report on Form 8-K with respect to the Amendment is incorporated by reference herein and made a part hereof.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: May 31, 2019

|

APPLIED OPTOELECTRONICS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

David

C. Kuo

|

|

|

|

Name

|

David C. Kuo

|

|

|

|

Title:

|

General Counsel and Secretary

|

|

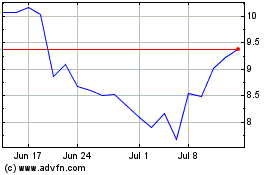

Applied Optoelectronics (NASDAQ:AAOI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Optoelectronics (NASDAQ:AAOI)

Historical Stock Chart

From Apr 2023 to Apr 2024