Atlantic American Corporation Reports Fourth Quarter and Year End Results for 2018; Declares Annual Dividend

April 01 2019 - 2:04PM

Atlantic American Corporation (Nasdaq- AAME) today reported its

results for the fourth quarter and year ended December 31,

2018. For the fourth quarter ended December 31, 2018, the

Company reported net income of $0.2 million, or $0.01 per diluted

share, down from $2.5 million, or $0.12 per diluted share, in the

fourth quarter of 2017. The decrease in net income was

primarily attributable to an increase in unrealized losses on

equity securities recognized in net income of $2.9 million and a

decrease in realized investment gains of $2.0 million, partially

offset by improvements in underwriting results. Premiums for

the fourth quarter of 2018 increased 12.4% to $45.3 million

compared to $40.3 million for the fourth quarter of 2017, as

premiums in the life and health operations and property and

casualty operations increased 14.4% and 8.3%, respectively, as

compared to 2017.

For the year ended December 31, 2018, the

Company reported a net loss of $0.7 million, or $0.05 per diluted

share, as compared to net income of $4.5 million, or $0.20 per

diluted share, for the year ended December 31, 2017. The

decrease was primarily attributable to a decline in realized

investment gains of $4.0 million coupled with $2.2 million in

unrealized losses on equity securities recognized in net

income. Total premiums during 2018 increased 5.9% to $172.9

million from $163.3 million in 2017, as premiums in the life and

health operations increased 8.6% in 2018 as compared to 2017.

Commenting on the results, Hilton H. Howell,

Jr., chairman, president and chief executive officer, stated, “We

are pleased with the year over year growth in premium revenues in

each of our insurance subsidiaries and remain focused on refining

processes and improving profitability. Rate increases

implemented in our life and health operations are beginning to take

hold and we are pleased to report the renewal of a significant

multi-year state contract with our property and casualty

operations, which also included a rate increase. While

prudent pricing practices are key to profitability, the Company has

embarked on a number of initiatives to enhance underwriting, better

educate our agents, and improve the policyholder experience.

We remain confident in the long-term viability of our strategy and

in our commitment to deliver value to our shareholders.

Accordingly, the Board of Directors recently approved the Company’s

8th annual dividend, which is payable on April 24, 2019 to

shareholders of record on April 10, 2019.”

Atlantic American is an insurance holding

company involved through its subsidiary companies in specialty

markets of the life, health, and property and casualty insurance

industries. Its principal insurance subsidiaries are American

Southern Insurance Company, American Safety Insurance Company,

Bankers Fidelity Life Insurance Company and Bankers Fidelity

Assurance Company.

Note regarding Private Securities Litigation

Reform Act: Except for historical information contained herein,

this press release contains forward-looking statements that involve

a number of risks and uncertainties. Actual results could

differ materially from those indicated by such forward-looking

statements due to a number of factors and risks detailed from time

to time in statements and reports that Atlantic American

Corporation files with the Securities and Exchange Commission.

| For

further information contact: |

|

|

| J. Ross

Franklin |

|

Hilton H.

Howell, Jr. |

| Chief

Financial Officer |

|

Chairman,

President & CEO |

| Atlantic

American Corporation |

|

Atlantic

American Corporation |

|

404-266-5580 |

|

404-266-5505 |

Atlantic American

CorporationFinancial Data

| |

Three Months Ended |

|

Year ended |

| |

December 31, |

|

December 31, |

| (Unaudited; In

thousands, except per share data) |

2018 |

|

2017 |

|

2018 |

|

2017 |

| Insurance premiums |

|

|

|

|

|

|

|

| Life and health |

|

|

|

|

|

|

|

| Gross earned

premiums |

$ |

47,425 |

|

|

$ |

39,749 |

|

|

$ |

180,583 |

|

|

$ |

142,251 |

|

| Ceded premiums |

|

(16,606 |

) |

|

|

(12,811 |

) |

|

|

(61,459 |

) |

|

|

(32,585 |

) |

| Net earned premiums |

|

30,819 |

|

|

|

26,938 |

|

|

|

119,124 |

|

|

|

109,666 |

|

| Property and casualty |

|

|

|

|

|

|

|

| Gross earned premiums |

|

15,914 |

|

|

|

14,589 |

|

|

|

58,882 |

|

|

|

58,449 |

|

| Ceded premiums |

|

(1,406 |

) |

|

|

(1,196 |

) |

|

|

(5,075 |

) |

|

|

(4,788 |

) |

| Net earned premiums |

|

14,508 |

|

|

|

13,393 |

|

|

|

53,807 |

|

|

|

53,661 |

|

| |

|

|

|

|

|

|

|

| Insurance premiums,

net |

|

45,327 |

|

|

|

40,331 |

|

|

|

172,931 |

|

|

|

163,327 |

|

| Net investment

income |

|

2,438 |

|

|

|

2,116 |

|

|

|

9,549 |

|

|

|

8,496 |

|

| Realized investment

gains, net |

|

4,357 |

|

|

|

6,350 |

|

|

|

5,154 |

|

|

|

9,168 |

|

| Unrealized losses on

equity securities, net |

|

(2,947 |

) |

|

|

- |

|

|

|

(2,194 |

) |

|

|

- |

|

| Other income |

|

25 |

|

|

|

28 |

|

|

|

113 |

|

|

|

123 |

|

| |

|

|

|

|

|

|

|

| Total

revenue |

|

49,200 |

|

|

|

48,825 |

|

|

|

185,553 |

|

|

|

181,114 |

|

| |

|

|

|

|

|

|

|

| Insurance benefits and

losses incurred |

|

|

|

|

|

|

|

| Life and health |

|

23,887 |

|

|

|

21,462 |

|

|

|

93,821 |

|

|

|

83,029 |

|

| Property and casualty |

|

10,285 |

|

|

|

8,607 |

|

|

|

38,829 |

|

|

|

34,486 |

|

| Commissions and

underwriting expenses |

|

10,586 |

|

|

|

11,646 |

|

|

|

39,042 |

|

|

|

43,446 |

|

| Interest expense |

|

540 |

|

|

|

450 |

|

|

|

2,037 |

|

|

|

1,723 |

|

| Other expense |

|

3,627 |

|

|

|

3,773 |

|

|

|

12,795 |

|

|

|

13,074 |

|

| |

|

|

|

|

|

|

|

| Total benefits and expenses |

|

48,925 |

|

|

|

45,938 |

|

|

|

186,524 |

|

|

|

175,758 |

|

| |

|

|

|

|

|

|

|

| Income (loss) before

income taxes |

|

275 |

|

|

|

2,887 |

|

|

|

(971 |

) |

|

|

5,356 |

|

| Income tax expense

(benefit) |

|

74 |

|

|

|

345 |

|

|

|

(267 |

) |

|

|

828 |

|

| |

|

|

|

|

|

|

|

| Net income

(loss) |

$ |

201 |

|

|

$ |

2,542 |

|

|

$ |

(704 |

) |

|

$ |

4,528 |

|

| |

|

|

|

|

|

|

|

| Earnings (loss)

per common share (basic and diluted) |

$ |

0.01 |

|

|

$ |

0.12 |

|

|

$ |

(0.05 |

) |

|

$ |

0.20 |

|

| |

|

|

|

|

|

|

|

| Reconciliation

of Non-GAAP Financial Measure |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

201 |

|

|

$ |

2,542 |

|

|

$ |

(704 |

) |

|

$ |

4,528 |

|

| Income tax expense

(benefit) |

|

74 |

|

|

|

345 |

|

|

|

(267 |

) |

|

|

828 |

|

| Realized investment

gains, net |

|

(4,357 |

) |

|

|

(6,350 |

) |

|

|

(5,154 |

) |

|

|

(9,168 |

) |

| Unrealized losses on

equity securities, net |

|

2,947 |

|

|

|

- |

|

|

|

2,194 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

| Non-GAAP

operating loss |

$ |

(1,135 |

) |

|

$ |

(3,463 |

) |

|

$ |

(3,931 |

) |

|

$ |

(3,812 |

) |

| |

|

|

|

|

|

|

December 31, |

|

December 31, |

|

| Selected

Balance Sheet Data |

2018 |

|

2017 |

|

| |

|

|

|

|

| Total cash and

investments |

$ |

254,559 |

|

|

$ |

272,058 |

|

|

| Insurance subsidiaries |

|

235,796 |

|

|

|

244,754 |

|

|

| Parent and other |

|

18,763 |

|

|

|

27,304 |

|

|

| Total assets |

|

344,274 |

|

|

|

343,239 |

|

|

| Insurance reserves and

policyholder funds |

|

189,048 |

|

|

|

173,583 |

|

|

| Debt |

|

33,738 |

|

|

|

33,738 |

|

|

| Total shareholders'

equity |

|

101,372 |

|

|

|

112,983 |

|

|

| Book value per common

share |

|

4.75 |

|

|

|

5.26 |

|

|

| Statutory capital and

surplus |

|

|

|

|

| Life and health |

|

34,214 |

|

|

|

34,135 |

|

|

| Property and casualty |

|

43,467 |

|

|

|

43,348 |

|

|

| |

|

|

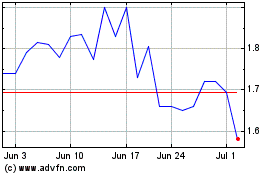

Atlantic American (NASDAQ:AAME)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atlantic American (NASDAQ:AAME)

Historical Stock Chart

From Apr 2023 to Apr 2024