By Sarah Nassauer and Emily Glazer

American businesses are poised to benefit from twin victories in

the $1.9 trillion Covid-19 relief package, which gives consumers

more money to spend but doesn't force companies to raise workers'

wages.

The legislation, expected to be signed into law by President

Biden on Friday, includes $1,400 checks to many Americans and an

extension of a $300 weekly unemployment-aid supplement. It doesn't

include a proposed increase in the minimum wage to $15 over four

years, meaning retailers, restaurants and others don't have to

worry about higher payrolls for now.

Executives and economists said that unlike the last round of

stimulus payments, which came in the midst of lockdowns and

heightened economic uncertainty, these checks are more likely to

flow into the economy as families face fewer financial constraints,

more people are vaccinated and restrictions on travel, dining and

other activity are lifted.

"All this money is coming in, and a lot of it is going to get

spent," said Jeff Aronson, co-founder and managing principal of

investment firm Centerbridge Partners. "Obviously that has huge

implications" that are good for the economy, businesses and

consumers, he said.

The bill passed the House on Wednesday, largely along party

lines with Democratic support. No Republicans voted for it, with

some saying that the economy was poised for a strong recovery

without it and that many of its measures are bloated or unnecessary

and unrelated to the crisis.

Some business leaders echoed GOP concerns even as they embraced

key elements of it.

The Business Roundtable, which counts the chief executive

officers of dozens of the biggest U.S. companies as members, said

Wednesday, "While we advocated for a more targeted approach,

enactment of this package will help deliver urgent resources to

strengthen the public health response and provide assistance for

individuals and small businesses hardest hit by the pandemic."

The U.S. Chamber of Commerce also said it would have preferred a

narrower bill. Economic data already points to building strength,

the Chamber said in a statement last week, while the current bill

"means less money for other priorities, including infrastructure

and education."

During a virtual gathering of dozens of large-company CEOs

hosted by the Yale School of Management on Wednesday morning,

nearly two-thirds, or 64%, said in a snap poll that the relief

package went too far. When asked if they support or oppose the

relief package, 34% said they strongly support it, 37% said they

somewhat support it, 14% said they somewhat oppose it and 15% said

they strongly oppose it, according to the poll.

"If you ask a bunch of CEOs, 'Could you have done it with less?'

you're always going to get into probably could've done it with

less," Doug Parker, chief executive of American Airlines Group

Inc., said during the virtual event. "But that's not the bigger

point. The bigger point is you know there's broad public support

for this bill. That's certainly true of those of us that are

running airlines."

In addition to the stimulus checks and extension of unemployment

benefits, the bill includes funds for coronavirus-related

public-health measures such as testing and vaccine distribution, a

one-year extension of the child tax credit and funds for schools,

state and local governments and small restaurants, among other

measures. (See what is in the stimulus package.)

Companies that have been hurt by the pandemic or rely directly

on robust consumer spending for sales, such as small restaurants

and retailers, cheered the bill's passage. The National Retail

Federation, Consumer Brands Association, National Restaurant

Association and Independent Restaurant Coalition supported the

bill.

"Ensuring that the American people are given the opportunity to

quickly and safely get vaccinated against Covid-19 is the most

critical component of the legislation passed," the retail

federation said last week as the bill moved through the Senate.

Danny Meyer, chief executive of Union Square Hospitality Group,

which owns several New York City restaurants, said: "This will

provide many with a fighting chance to emerge from a deep financial

hole. Positive as this news is, this should have and could have

happened last fall or winter." It "may be too late for many

independent restaurants including a couple of ours," he said.

The bill includes $28.6 billion in potential grants to small

restaurant companies that lost business because of Covid-19. Rep.

Earl Blumenauer, an Oregon Democrat who sponsored a $120 billion

restaurant stimulus bill last year that wasn't enacted, said he

believes grants will begin flowing in weeks, not months. He expects

the funding to run out given the need among restaurants and

bars.

Grants are awarded based on revenue losses from last year

compared with 2019, after deducting for past funds allocated to a

business through the federal Paycheck Protection Program. Small

restaurants will have $5 billion in dedicated funds, and those

owned by women and minorities will get to apply first.

"The PPP definitely helped us, but this will help get us to the

finish line," said Ari Weinzweig, co-founding partner of

Zingerman's Community of Businesses, an organization of food

businesses and restaurants in Ann Arbor, Mich. It lost around $15

million in sales over the course of the pandemic, despite a big

increase in mail-order sales, Mr. Weinzweig said. The organization

dropped to about 550 employees from 700, he said.

Past pandemic stimulus packages have led to higher spending,

boosting retailers and other companies.

"We have seen a lift in the past from stimulus checks--sometimes

as clear as customers receiving the money in their bank account on

a Saturday morning and then seeing a pop in our business by that

afternoon, " said Lee Bird, chief executive of home décor retailer

At Home Group Inc. "We would expect that dynamic to continue to

play out."

Visa Inc. Chief Financial Officer Vasant Prabhu said Wednesday

at an investor meeting that "when stimulus checks hit, you

immediately get the impact." In January, the checks led to a big

surge "in our debit business in the first couple of weeks," he

said.

Heather Haddon contributed to this article.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Emily

Glazer at emily.glazer@wsj.com

(END) Dow Jones Newswires

March 11, 2021 07:14 ET (12:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

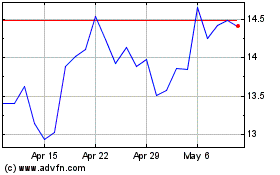

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

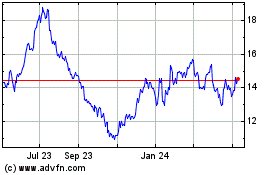

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024