American Airlines Announces Proposed Offering of Senior Secured Notes and New Term Loan by American and Its AAdvantage Subsid...

March 08 2021 - 7:15AM

American Airlines Group Inc. (NASDAQ: AAL) (the “Company”) today

announced that the Company’s subsidiary, American Airlines, Inc.

(“American”), and AAdvantage Loyalty IP Ltd., a newly formed Cayman

Islands exempted company incorporated with limited liability and an

indirect wholly owned subsidiary of the Company and American,

intend to commence a private offering to eligible purchasers of

$2,500,000,000 senior secured notes due 2026 and $2,500,000,000

senior secured notes due 2029 (collectively, the “Notes”) and to

enter into a $2,500,000,000 senior secured term loan credit

facility (the “New AAdvantage Term Loan Facility”) concurrent with

the closing of the offering of the Notes. American and AAdvantage

Loyalty IP Ltd. will be co-issuers of the Notes and co-borrowers

under the New AAdvantage Term Loan Facility. The Notes and the New

AAdvantage Term Loan Facility will be guaranteed by the Company and

certain of the Company’s subsidiaries. The offering of the Notes is

not conditioned upon the closing of the New AAdvantage Term Loan

Facility, and the closing of the New AAdvantage Term Loan Facility

is not conditioned upon the closing of the offering of the Notes.

The final terms and amounts of the Notes and the New AAdvantage

Term Loan Facility are subject to market and other conditions and

may be materially different than expectations.

The Notes and New AAdvantage Term Loan Facility

will be secured on a pari passu senior basis by a first-priority

security interest in American’s AAdvantage program, including

American’s rights under certain related agreements, intellectual

property and other collateral related to the AAdvantage

program.

AAdvantage Loyalty IP Ltd. intends to lend the

net proceeds from the offering of the Notes and the New AAdvantage

Term Loan Facility to American, after depositing a portion of the

proceeds in certain reserve accounts. American intends to use the

proceeds from this intercompany loan from AAdvantage Loyalty IP

Ltd. to repay all amounts outstanding under the term loan facility

with the U.S. Department of the Treasury that is currently secured

by collateral that will secure, in part, the Notes and the New

AAdvantage Term Loan Facility and to use the remainder for general

corporate purposes, which may include the repayment of other

indebtedness.

The Notes will be offered and sold only to

persons reasonably believed to be qualified institutional buyers,

as defined in, and in reliance on Rule 144A under the Securities

Act of 1933, as amended (the “Securities Act”) and to non-U.S.

persons in offshore transactions outside the United States in

reliance on Regulation S under the Securities Act. The Notes will

not be registered under the Securities Act or any other securities

laws of any jurisdiction and will not have the benefit of any

exchange offer or other registration rights. The Notes may not be

offered or sold in the United States absent registration or an

applicable exemption from registration requirements.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy any of the Notes nor

shall there be any sale of the Notes in any jurisdiction in which

such offer, solicitation or sale would be unlawful. This press

release is being issued pursuant to and in accordance with Rule

135c under the Securities Act.

Cautionary Statement Regarding

Forward-Looking StatementsCertain of the statements

contained or referred to herein, including those regarding the

proposed offering of the Notes and New AAdvantage Term Loan

Facility, should be considered forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements may be identified by words

such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,”

“estimate,” “plan,” “project,” “could,” “should,” “would,”

“continue,” “seek,” “target,” “guidance,” “outlook,” “if current

trends continue,” “optimistic,” “forecast” and other similar words.

Such statements include, but are not limited to, statements about

the Company’s plans, objectives, expectations, intentions,

estimates and strategies for the future, and other statements that

are not historical facts. These forward-looking statements are

based on the Company’s current objectives, beliefs and

expectations, and they are subject to significant risks and

uncertainties that may cause actual results and financial position

and timing of certain events to differ materially from the

information in the forward-looking statements. These risks and

uncertainties include, but are not limited to, those set forth

herein as well as in American Airlines Group Inc.’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2020

(especially in Part I, Item 1A. Risk Factors and Part II, Item 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations), and other risks and uncertainties listed

from time to time in the Company’s other filings with the

Securities and Exchange Commission. In particular, the consequences

of the coronavirus outbreak to economic conditions and the travel

industry in general and the financial position and operating

results of the Company in particular have been material, are

changing rapidly, and cannot be predicted. Additionally, there may

be other factors of which the Company is not currently aware that

may affect matters discussed in the forward-looking statements and

may also cause actual results to differ materially from those

discussed. The Company does not assume any obligation to publicly

update or supplement any forward-looking statement to reflect

actual results, changes in assumptions or changes in other factors

affecting these forward-looking statements other than as required

by law. Any forward-looking statements speak only as of the date

hereof or as of the dates indicated in the statement.

Investor

Relationsinvestor.relations@aa.com

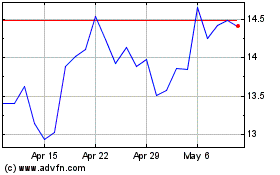

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

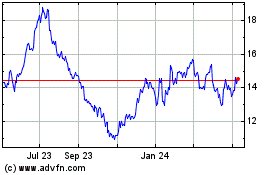

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024