Current Report Filing (8-k)

February 03 2021 - 5:16PM

Edgar (US Regulatory)

0000006201false0000004515false00000062012021-02-032021-02-030000006201srt:SubsidiariesMember2021-02-032021-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 3, 2021

AMERICAN AIRLINES GROUP INC.

AMERICAN AIRLINES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

1-8400

|

|

75-1825172

|

|

Delaware

|

|

1-2691

|

|

13-1502798

|

|

(State or other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Skyview Drive,

|

Fort Worth,

|

Texas

|

|

|

76155

|

|

1 Skyview Drive,

|

Fort Worth,

|

Texas

|

|

|

76155

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(817) 963-1234

(817) 963-1234

|

|

|

|

|

|

|

|

|

|

|

N/A

|

|

(Former name or former address if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.01 par value per share

|

|

AAL

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

|

|

ITEM 2.05.

|

COSTS ASSOCIATED WITH EXIT OR DISPOSAL ACTIVITIES.

|

On February 3, 2021, American Airlines, Inc. (“American”), a wholly owned subsidiary of American Airlines Group Inc. (the “Company”), informed its employees that on February 5, 2021, it will begin to send Worker Adjustment and Retraining Notification (“WARN”) notices to approximately 13,000 U.S.-based employees. These WARN notices, which may be required by law in advance of potential furloughs in certain locations, are part of American’s response to the impacts of the COVID-19 pandemic on its business. As of the date hereof and based on current facts, American expects that any job impact will take effect on or after April 1, 2021.

At this time, the Company is unable to make a good faith determination of an estimate or range of estimates required by paragraphs (b), (c) and (d) of Item 2.05 of Form 8-K with respect to workforce reduction actions in the remainder of 2021. The Company will file an amendment to this report or provide an update in a Quarterly Report on Form 10-Q after it makes a determination of such estimate or range of estimates, if any.

|

|

|

|

|

|

|

|

ITEM 7.01.

|

REGULATION FD DISCLOSURE.

|

As discussed above, on February 3, 2021, American distributed a letter to employees regarding the possibility of a workforce reduction at certain locations. This internal communication is furnished herewith as Exhibit 99.1 and is incorporated by reference into this Item 7.01.

The information in Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

|

|

|

|

|

|

|

|

ITEM 9.01.

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

|

|

|

|

|

|

|

|

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

|

|

|

|

|

104.1

|

|

Cover page interactive data file (embedded within the Inline XBRL document).

|

Cautionary Statement Regarding Forward-Looking Statements

Certain of the statements contained in this report should be considered forward-looking statements within the meaning of the Securities Act, the Exchange Act, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the Company’s plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors), and other risks and uncertainties listed from time to time in the Company’s other filings with the Securities and Exchange Commission. There may be other factors of which the Company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. In particular, the consequences of the coronavirus outbreak to economic conditions and the travel industry in general and the financial position and operating results of the Company in particular have been material, are changing rapidly, and cannot be predicted. The Company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines Group Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN AIRLINES GROUP INC.

|

|

|

|

|

|

Date: February 3, 2021

|

By:

|

|

/s/ Derek J. Kerr

|

|

|

|

|

Derek J. Kerr

|

|

|

|

|

Executive Vice President and

Chief Financial Officer

|

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMERICAN AIRLINES, INC.

|

|

|

|

|

|

Date: February 3, 2021

|

By:

|

|

/s/ Derek J. Kerr

|

|

|

|

|

Derek J. Kerr

|

|

|

|

|

Executive Vice President and

Chief Financial Officer

|

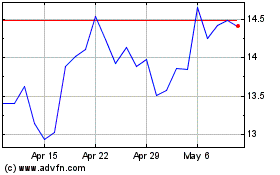

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

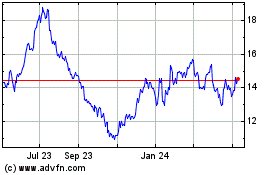

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024