U.S. Treasury Reaches Loan Agreements With Five Major Airlines -- 2nd Update

July 02 2020 - 12:12PM

Dow Jones News

By Alison Sider and Kate Davidson

The U.S. Treasury Department has agreed to terms for loans to

American Airlines Group Inc. and four smaller airlines as part of

an aid program to help the industry weather the coronavirus

pandemic.

The Treasury said that in addition to American, Frontier

Airlines, Hawaiian Airlines, SkyWest Airlines and Spirit Airlines

Inc. had agreed to loan terms and signed letters of intent.

Air travel fell sharply this spring as government restrictions

on travel and fears of infection kept passengers from flying. While

air travel has started to rise, demand remains a fraction of what

it was a year ago and airline executives have said they expect a

full recovery will likely take years.

These are the first airlines to accept government loans from a

$25 billion pool Congress earmarked under the Cares Act, the $2.2

trillion economic stimulus package passed in March. Major carriers

have also received another $25 billion in federal aid to pay

workers through the end of September to avoid mass layoffs they

said would have been inevitable otherwise. The payroll funds are

largely made up of grants that don't need to be paid back.

American expects to complete the $4.75 billion loan in the third

quarter, Chief Executive Doug Parker and President Robert Isom

wrote in a letter to employees Thursday. The airline has previously

said it was seeking to pledge its frequent-flier program as

collateral.

Even with the infusion of government funds, airlines face a dire

outlook. American is burning through $35 million in cash per day,

Mr. Parker and Mr. Isom wrote, and likely has more than 20,000 more

employees than it needs to operate the shrunken schedule it

anticipates this fall.

"To be clear, this doesn't mean 20,000 of our team members will

be furloughed in October, it simply means we still have work to do

to right-size our team for the airline we will operate," the

executives wrote.

Airlines have been scrambling to raise as much cash as they can

as travel bookings have fallen sharply, and American executives

have said that the government loans were likely the most efficient

form of financing available. The airline last week raised another

$4.5 billion to bolster liquidity, including $2.5 billion in senior

notes at an interest rate of 11.75%.

Other carriers such as Delta Air Lines Inc., United Airlines

Holdings Inc. and Southwest Airlines Co. have previously said they

have applied for government loans but hadn't decided whether to tap

them. Airlines have through the end of September to draw the

funds.

The Treasury didn't detail the amounts of the loans or the

terms, but said the borrowers would have to provide warrants,

equity stakes, or senior debt instruments. The Treasury said it is

continuing discussions with other carriers that are eligible for

loans.

Hawaiian Airlines has previously said it would be eligible for

$364 million in government loans. Spirit has said it would be

eligible for $741 million, and SkyWest has said it would be

eligible for $497 million. A spokeswoman for Frontier Airlines

declined to comment.

Write to Alison Sider at alison.sider@wsj.com and Kate Davidson

at kate.davidson@wsj.com

(END) Dow Jones Newswires

July 02, 2020 11:57 ET (15:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

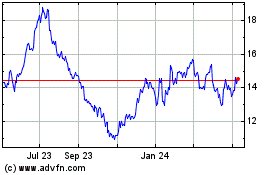

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

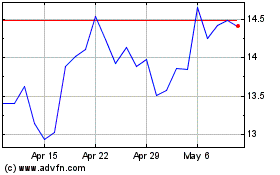

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024