Airlines Seek $50 Billion in Government Aid Amid Coronavirus Crisis -- Update

March 16 2020 - 2:38PM

Dow Jones News

By Alison Sider in Chicago and Ted Mann in Washington

U.S. airlines are in talks with the government to obtain at

least $50 billion in financial assistance -- more than three times

the size of the industry's bailout after the Sept. 11 attacks --

according to people briefed on the discussions.

The exact form and amount of aid carriers are seeking is under

discussion, and could include government-backed loans, cash grants

or other measures including relief from taxes and fees, according

to some of the people and a proposal released by an airline trade

group Monday.

Airlines have been stunned by the rapid plunge in their bookings

as the novel coronavirus has spread around the world. As the

worst-case scenarios they envisioned just days or weeks ago have

come to pass, carriers have scrambled to make ever deeper cuts to

their schedules.

United Airlines Holdings Inc. said Sunday night it would cut its

planned flying in half in April and May and is in talks with its

unions about steps that could include furloughs, pay cuts or other

measures to reduce payroll expenses.

Delta Air Lines Inc. and American Airlines Group Inc. have also

announced severe cuts in flying, hiring freezes and voluntary

unpaid leave for employees. All three carriers have disclosed that

they are in talks with the government, but the amount of assistance

being discussed hasn't been previously reported.

Airlines for America, the industry trade group, issued a

proposal Monday for $50 billion in aid that it had circulated

privately in recent days.

The trade group argued that half of the assistance should come

in the form of direct grants to airlines.

The proposal also outlines a $25 billion program in which the

Federal Reserve would purchase financial instruments from, or

provide interest-free loans or loan guarantees to, passenger and

cargo carriers.

It also includes provisions for rebates of excise taxes --

including those on tickets, cargo and fuel -- that airlines paid in

the first quarter and a repeal of those taxes through at least Dec.

31 2021.

But some lobbying on behalf of the airlines believe that figure

might not be enough, given the likelihood that the disruption to

air travel will last for months, leaving carriers with huge debt

loads and depressed cash flows.

"They might be shooting too low," one person involved in the

talks said.

The Trump administration is using the post-Sept. 11 bailout

passed by Congress in 2001 as a template for the talks with

carriers, people involved in the discussions said.

Lawmakers in 2001 made $5 billion in direct payments to airlines

after the terrorist attacks that prompted a three-day closure of

North American airspace. They also earmarked up to $10 billion to

support U.S. airlines through a loan program, though only $1.56

billion in guarantees were authorized, including to carriers that

ended up failing.

"We don't see the airlines failing, but if they get into a cash

crunch we're going to try to help them," National Economic Council

Director Larry Kudlow told reporters at the White House on Monday.

Mr. Kudlow said "lots" of airlines had reached out seeking

assistance.

"We're in touch about their balance sheets and their cash flow,"

he said.

--Andrew Tangel and Doug Cameron contributed to this

article.

Write to Alison Sider at alison.sider@wsj.com and Ted Mann at

ted.mann@wsj.com

(END) Dow Jones Newswires

March 16, 2020 14:23 ET (18:23 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

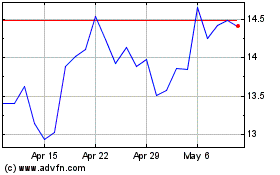

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

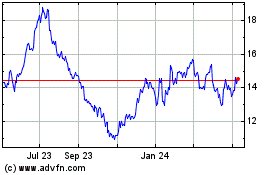

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024