Delta, American to Trim Capacity, Southwest CEO to Take Pay Cut--2nd Update

March 10 2020 - 10:03AM

Dow Jones News

By Alison Sider

Airlines on Tuesday detailed the growing impact of the

coronavirus by cutting more flights in domestic and international

markets, parking planes, freezing hiring and reducing executive

pay.

American Airlines Group Inc. and Delta Air Lines Inc. both said

they planned to reduce the number of flights across their networks

and Southwest Airlines Co. CEO Gary Kelly told employees that he

will take a 10% pay cut as the airline faces the most severe

downturn in decades because of the spread of the coronavirus.

The moves come as bookings have dropped off amid growing

passenger fears about traveling, and concerns that recovery could

take months, rather than the quick bounceback many had initially

anticipated when the virus first started to affect travel early

this year.

American said it plans to cut domestic flying by 7.5% by

decreasing frequencies in markets where it operates many flights.

It will reduce international flying by 10% for the summer peak

travel season.

Delta said Tuesday that it will park some planes and reduce

capacity across its network, cutting international capacity as much

as 25%, and domestic capacity as much as 15%. Delta also said it

would freeze hiring and offer voluntary leave options, in addition

to deferring $500 million in capital expenditures and suspending

share buybacks. The carrier said it would consider retiring some

planes early.

Delta CEO Ed Bastian said: "We have made the difficult but

necessary decision to immediately reduce capacity and are

implementing cost reductions and cash-flow initiatives across the

organization."

Overseas, the European Commission is close to approving a

suspension of airport-slot rules that will allow airlines to cut

back capacity without risking the loss of lucrative takeoff and

landing rights, according to people familiar with the matter.

The move, which could be signed off as early as Tuesday

afternoon, would provide significant relief for domestic and

international carriers operating in Europe. Some have been

operating near-empty flights in and out of congested hubs, like

London's Heathrow, to retain the slots.

Under the so-called "use-it-or-lose-it" airport slot rules,

airlines must use a takeoff or landing slot at a level of at least

80%, to keep the flying rights for the next season.

Southwest's Mr. Kelly told employees that the virus has created

a challenge more serious than any the industry has faced since

9/11, "and it may be worse."

"The velocity and the severity of the decline is breathtaking,"

Mr. Kelly said in a video message Monday that was viewed by The

Wall Street Journal. Southwest had previously said the reduced

bookings could result inasmuch as $300 million in lost revenue in

March alone.

The virus is testing airlines' ability to weather the kind of

economic crisis they have promised investors they could withstand

following a decadelong run of industry profits. While a sharp drop

in fuel prices is likely to relieve some pressure, carriers are

facing a global-demand shock that looks to be more severe than

anything they have encountered since 9/11.

American's reduction in domestic flights will include

cancellation of routes where customers can be easily rerouted. Some

domestic routes will get a boost, though, with bigger planes that

would have been used for international flying. Internationally, it

will trim service to destinations including Paris and Madrid. Latin

America, which had been the one relative haven for U.S. airlines'

international operations, will also see cuts, including American's

flights to Chile and Uruguay.

Top airline executives, including United President Scott Kirby,

American CEO Doug Parker, and Southwest's Mr. Kelly, are slated to

speak at JPMorgan's Aviation, Transportation, & Industrials

Conference Tuesday. The event, usually held in New York, will now

be held via teleconference.

All three airlines said fuel savings could be a silver lining

because of the oil price rout. American pegged the cost reduction

at as much as $3 billion in a presentation prepared for the

conference.

Benjamin Katz contributed to this article.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

March 10, 2020 09:48 ET (13:48 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

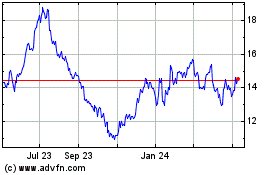

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

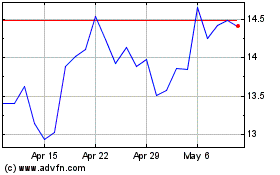

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024