By Doug Cameron and Alison Sider

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 23, 2019).

The prolonged grounding of Boeing Co.'s 737 MAX aircraft is

rippling through the U.S. economy, hurting the nation's trade

balance and clouding the outlook for airlines, suppliers and their

tens of thousands of workers.

Companies ranging from American Airlines Group Inc., to engine

maker General Electric Co. and smaller parts suppliers have cited

the grounding and halt in deliveries of the jetliner for financial

damage or the suspension of profit guidance. Several U.S. and

foreign airlines are cutting back on routes and capacity growth or

delaying pilot hiring and promotions because of the MAX.

Boeing continues to make the MAX and other versions of the 737

at a rate of 42 a month, after cutting monthly output from 52 in

April. Economists say the production cuts likely weighed on U.S.

gross domestic product in the second quarter, and warn the negative

impact could intensify as long as the plane maker is unable to

resume deliveries.

Boeing is the largest U.S. manufacturing exporter and one of the

nation's top private employers. The MAX is its best-selling plane,

and jets worth more than $30 billion sit idle since global

regulators grounded the aircraft following a second fatal crash in

March.

The company hopes to resume deliveries in the fourth quarter,

but some airlines and officials expect the MAX to stay out of

service until next year. That would further dent U.S. exports and

durable-goods orders at a time when some manufacturers are

experiencing higher costs and lowering their output due to tariffs

and trade tensions.

"It has already been a significant part of the slowdown story,"

said Ward McCarthy, chief financial economist at Jefferies LLC.

U.S. durable-goods orders in May fell 1.3% from the prior month,

including a $2 billion drop in sales of civilian aircraft and

spares, the Commerce Department said last month. U.S. exports of

commercial aircraft were down 12% in the first five months of 2019

compared with a year earlier.

The U.S. economy is still growing, with analysts surveyed by The

Wall Street Journal pegging expansion in the second quarter at an

annualized rate of 2%. Michael Feroli, chief U.S. economist at J.P.

Morgan Chase, estimates Boeing's production cuts shaved roughly a

tenth of a percentage point off his forecast.

"The economy is big. It's moving along quite well even in spite

of the issues that Boeing is having," Mr. Feroli said. Economists

say that the impact would be more pronounced if Boeing cuts

production further, as some analysts have said it might need

to.

Boeing has reduced output to limit the number of planes piling

up at its factories, and that has pressured thousands of suppliers

that invested heavily in operations to feed MAX production.

Uncertainty over the return of the MAX and Boeing's production

plans have made it tougher for those suppliers to make hiring and

investment decisions.

"We probably modeled four, five scenarios literally a week as to

when are they going to get back in the air," said GE Aviation

President David Joyce at the Paris Airshow last month.

GE, the sole engine provider for the MAX through its joint

venture with France's Safran SA, expects the MAX slowdown to cost

it as much as $300 million in the second quarter. The partners have

trimmed MAX engine output by 5% but are keeping their own suppliers

working at a higher clip in anticipation of Boeing boosting output

again next year.

Boeing last week said that it expects to pay up to $5.6 billion

in compensation to affected airlines over several years. That is in

addition to $2.7 billion in charges for the expected higher cost of

producing the planes. The company is due to report its

second-quarter earnings on July 24.

Boeing hasn't cut any staff because of the MAX crisis, though

some employees have said they worry layoffs could be coming. Boeing

has trimmed from its ranks of contractors recently as it tries to

be prudent with its cash. A spokesman said that pruning wasn't

related to the MAX grounding.

Boeing said last week it plans to boost 737 production from the

current rate of 42 planes a month to 57 sometime next year while

also delivering the backlog piling up at its factories. Analysts

estimate there could be as many as 300 undelivered jets by the end

of the year.

Many of Boeing's 13,000 domestic suppliers have said they

continue to produce at a rate of 52 planes a month. Boeing's recent

commitment to avoid further cuts and ramp up production when the

MAX is cleared to fly have buoyed some big suppliers.

Boeing remains the largest component of the Dow Jones Industrial

index, accounting for 9.4% of the benchmark, This year the stock is

up almost 16% -- off its all-time high but tracking gains in the

broader aerospace sector based on big order backlogs.

Spirit AeroSystems Holdings Inc., which makes the MAX fuselage

and engine parts, suspended financial guidance this year after the

plane was grounded. Spirit's shares gained 7.1% on Friday after

Boeing laid out its bullish production target. Stocks of other

suppliers such as Triumph Group Inc. and Allegheny Technologies

Inc. climbed more than 2% and 3%, respectively. Boeing closed up

4.5%, though lost some ground in Monday trading.

Airlines have also been buffeted by the changing outlook for the

MAX's return. United Airlines Holdings Inc. said last week that the

grounding has cut into its planned capacity growth this year.

American Airlines said earlier this month that it canceled 7,800

flights in the second quarter due to the grounding, resulting in a

$185 million hit to pretax profits.

Southwest Airlines Co., the biggest carrier of domestic

passengers and the world's largest U.S. MAX operator, had hired at

a rapid clip in anticipation of adding over 40 more of the jets

this year to the 34 already in its fleet. Now Southwest is tapping

the brakes. It has postponed initial training for about 50 new

pilots and put promotions on hold for another 50 seeking to advance

from co-pilot to captain.

Some pilots said the MAX suspension has cut into flying they

count on for additional cash.

One Southwest pilot said there has been about a 25% reduction in

the extra flying he would typically take on at this time of year.

"You make hay when the sun shines, but this summer, the sun's not

shining," he said.

A majority of the roughly 400 Air Canada pilots who were flying

the carrier's 24 MAX planes before the grounding are now on leave

and receiving partial pay, two people familiar with the company's

operations said.

Air Canada declined to comment on the matter.

--Kim Mackrael contributed to this article.

Write to Doug Cameron at doug.cameron@wsj.com and Alison Sider

at alison.sider@wsj.com

(END) Dow Jones Newswires

July 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

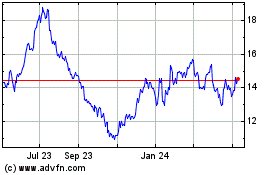

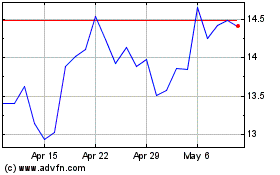

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024