U.S. Dollar Lower As Risk Sentiment Improves

December 28 2021 - 4:37AM

RTTF2

The U.S. dollar declined against its major rivals in the

European session on Tuesday, as investors looked past the economic

risks from the Omicron variant.

European stocks rose, undermining the safe-haven dollar, amid

hopes of a limited fallout from the new strain.

The governments in France and Britain resisted imposing

lockdowns despite high infection rates.

U.K. Health Secretary Sajid Javid said that the government will

not impose additional restrictions in England before the New

year.

France announced restrictions on large gatherings and ordered

citizens to work from home for at least three days a week from

January 3.

The greenback touched a fresh 3-week low of 0.9159 against the

franc and near a 6-week low of 1.3460 against the pound, following

its previous highs of 0.9181 and 1.3428, respectively. The currency

is likely to face support around 0.90 against the franc and 1.37

against the pound.

Retreating from its prior highs of 0.7229 against the aussie and

0.6803 against the kiwi, the greenback fell to a new 5-week low of

0.7264 and a 4-day low of 0.6829, respectively. Immediate support

for the dollar is seen near 0.75 against the aussie and 0.70

against the kiwi.

The greenback eased off to 1.1333 against the euro and 114.71

against the yen, falling from its early high of 1.1316 and near a

5-week high of 114.95, respectively. The greenback is seen finding

support around 1.16 against the euro and 112.00 against the

yen.

The greenback was trading at 1.2792 against the loonie, down

from a high of 1.2803 seen at 3:30 am ET. The greenback may seek

support around the 1.26 level.

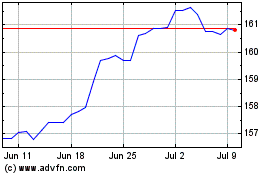

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024